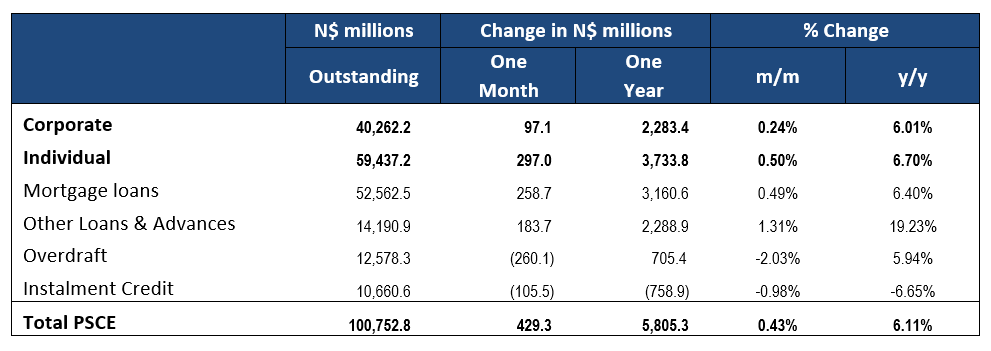

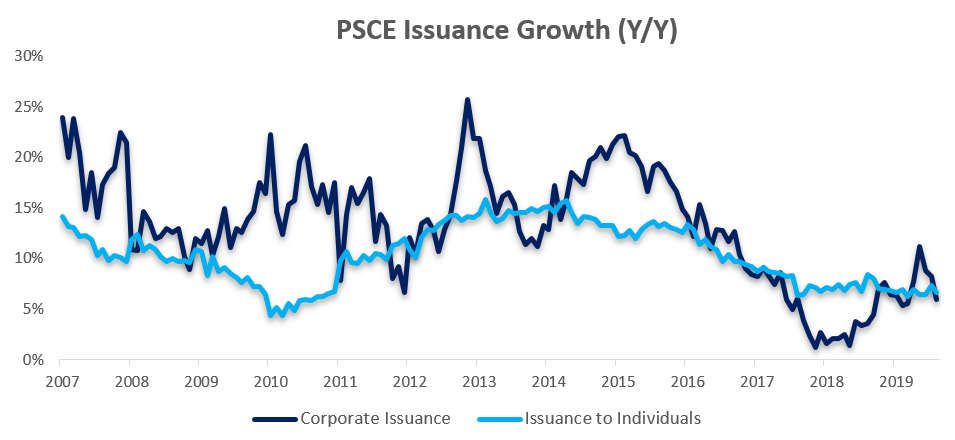

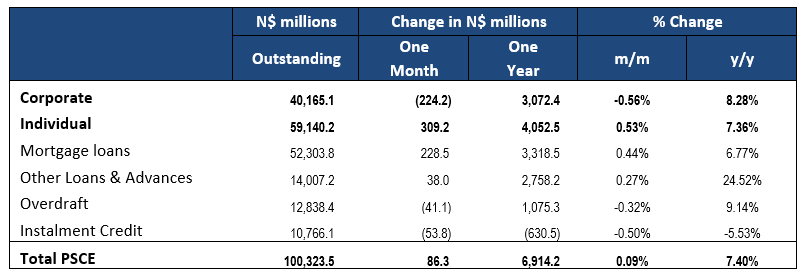

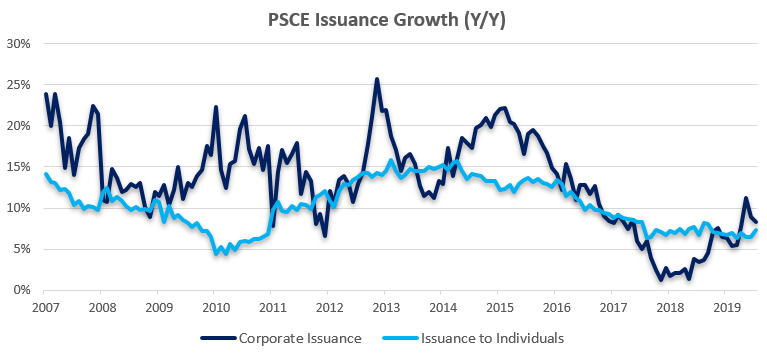

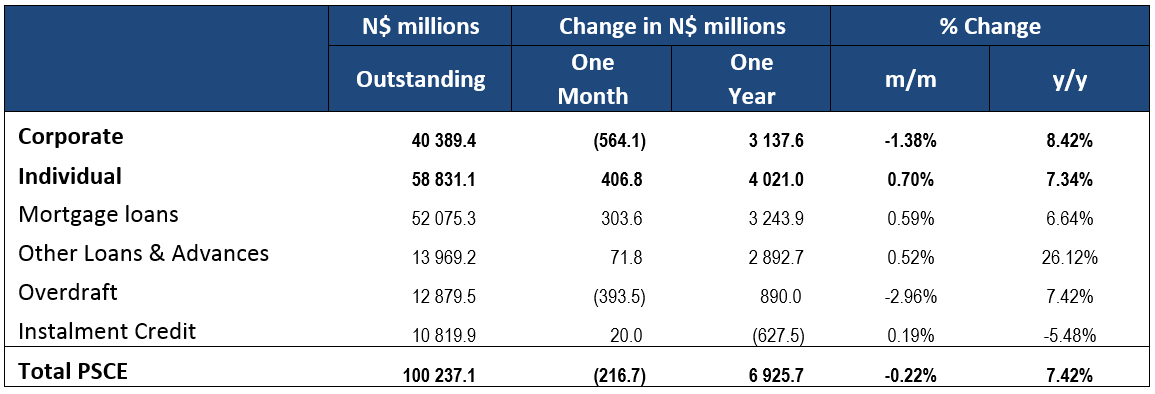

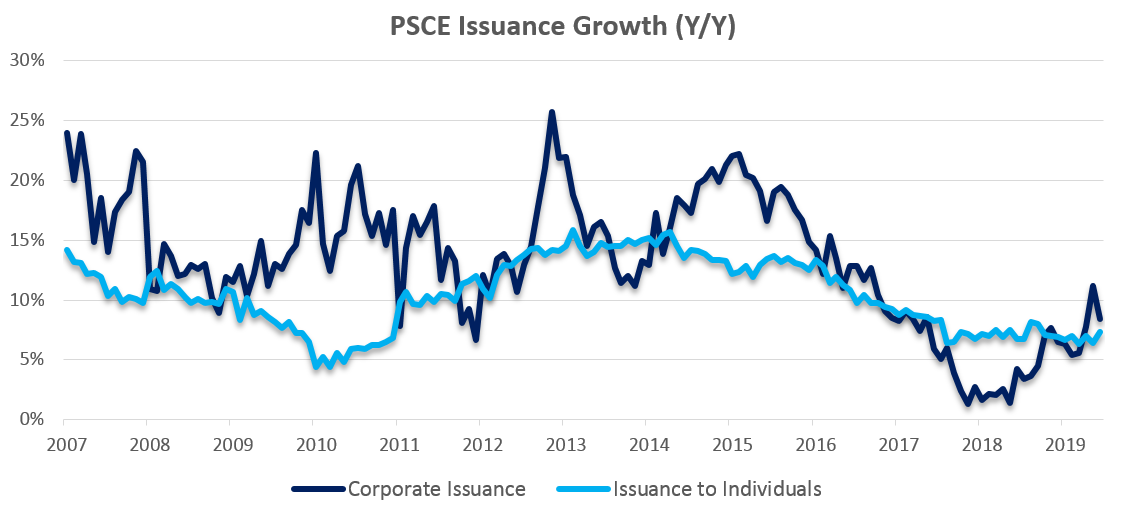

Private sector credit extension (PSCE) increased by N$429.3 million or 0.43% m/m in August, bringing the cumulative credit outstanding to N$100.8 billion. On a year-on-year basis, private sector credit extension increased by 6.1% in August, a slowdown from the 7.4% recorded in July. On a rolling 12-month basis, N$5.8 billion worth of credit was extended to the private sector, with individuals taking up N$3.7 billion while N$2.3 billion was extended to corporates, and the non-resident private sector has decreased their borrowings by N$211.9 million.

Credit Extension to Individuals

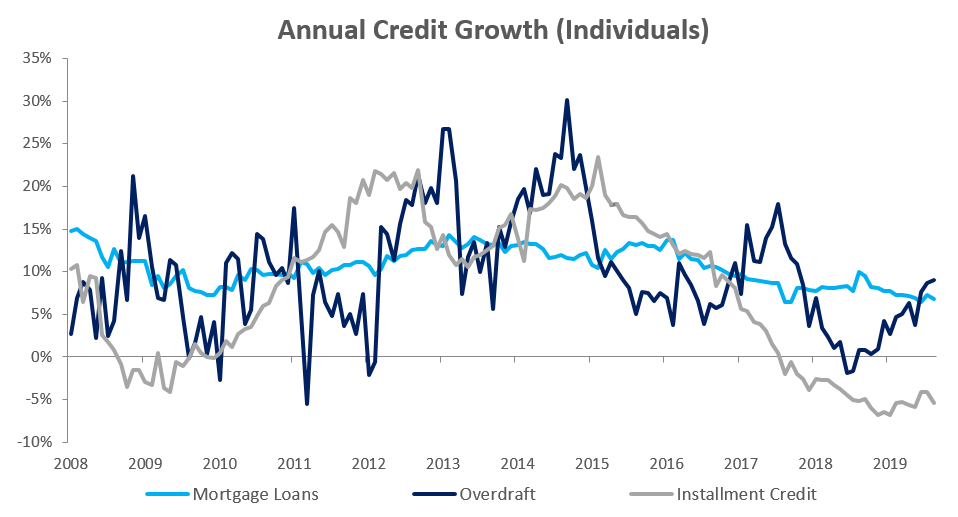

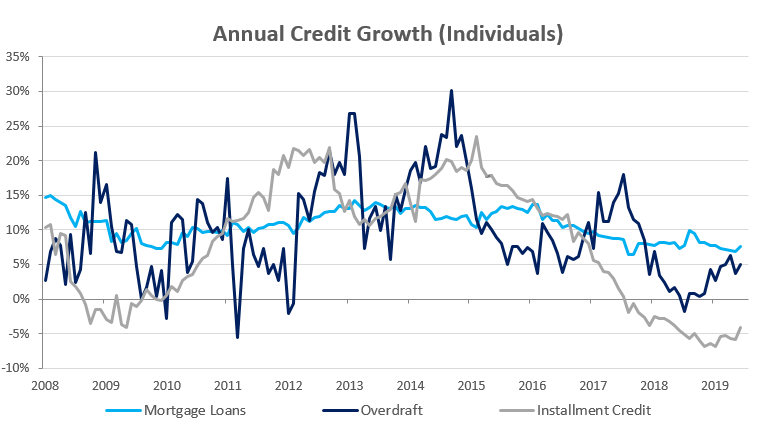

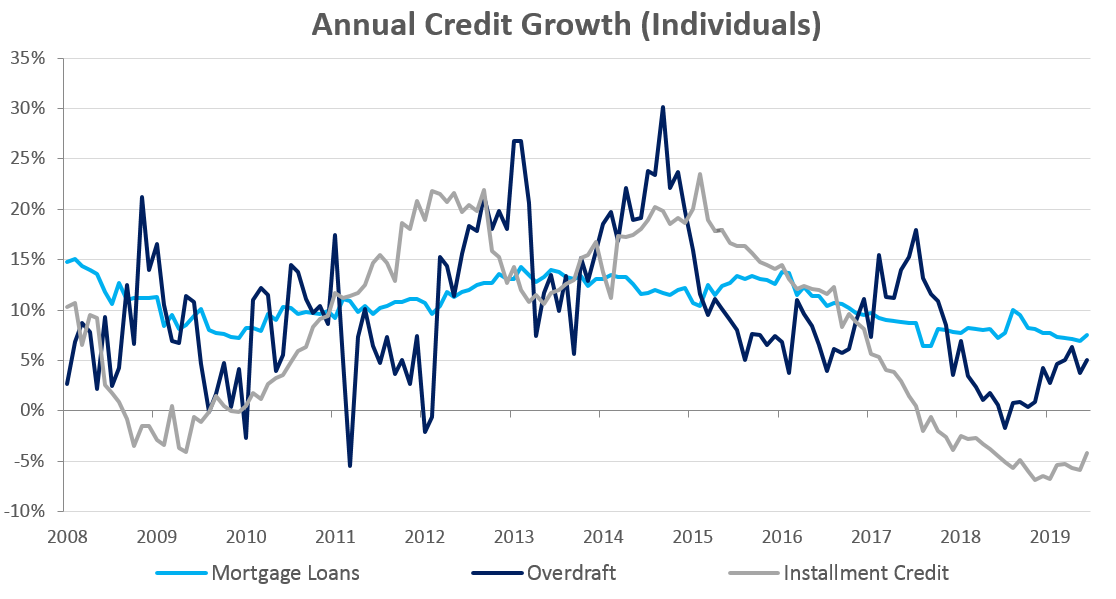

Growth in credit extension to individuals increased to 0.5% m/m and 6.7% y/y compared to 0.5% m/m and 7.4% y/y growth recorded in July. Mortgage loans to individuals grew by 0.7% m/m and 6.8% y/y, and still showing some resiliency to the economic slowdown.

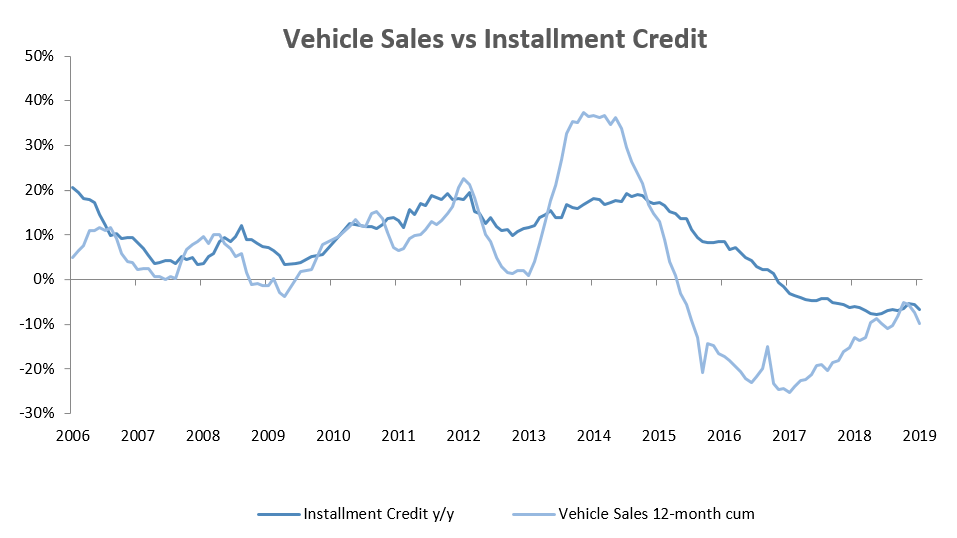

Other loans and advances (which is made up of credit card debt, personal and term loans) grew by 1.6% m/m and 21.6% y/y in August, while overdraft facilities extended to individuals have increased by 9.0% y/y the highest since November 2017, indicating that the uptake of short-term debt by households continues unabated. The increase in the uptake of short-term debt remains of concern as there is little appetite for more productive loans and consumers remain subject to higher interest terms. Installment credit, which consists largely of vehicle financing, contracted by 1.4% m/m and 5.4% y/y, as result of the continued decline new vehicle sales.

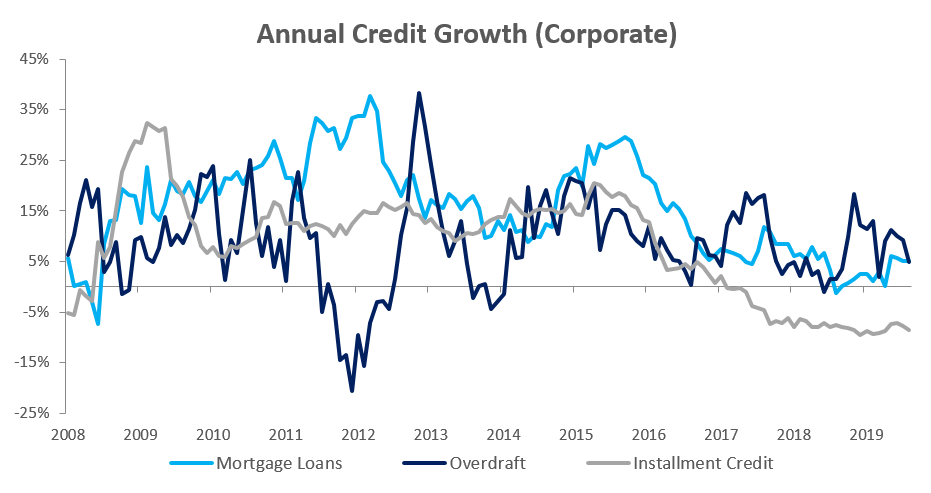

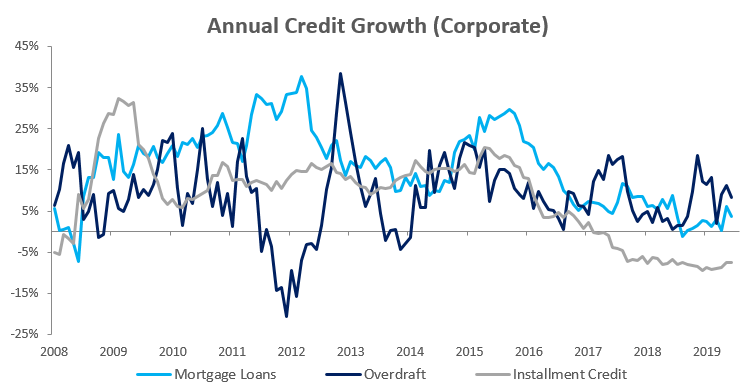

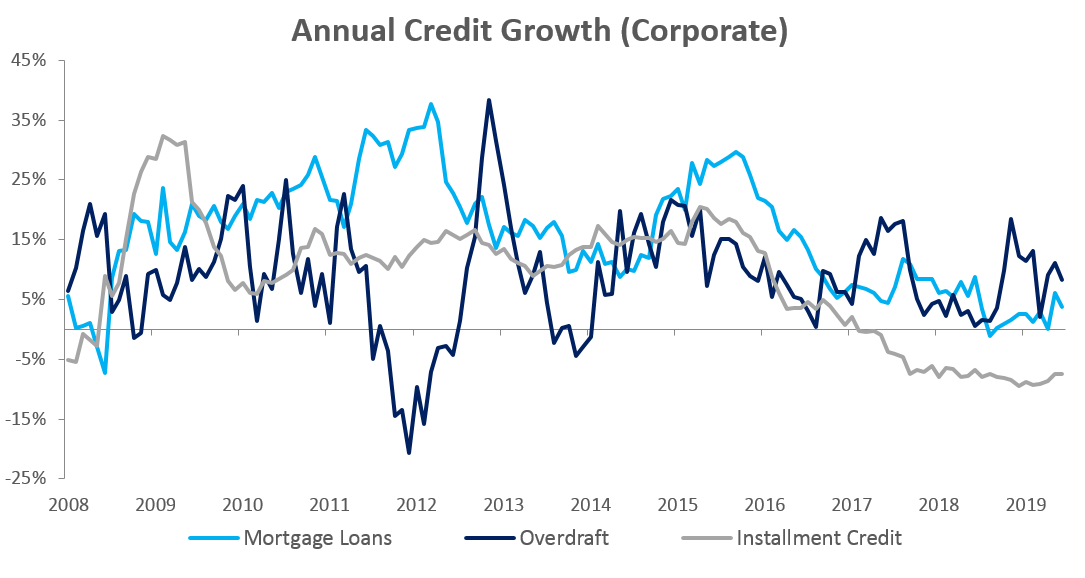

Credit Extension to Corporates

Credit extension to corporates increased to 0.2% m/m compared to the 0.6% m/m contraction recorded in July. On an annual basis, however, credit extension to corporates slowed down to 6.0% y/y in August, compared to the 8.3% y/y growth registered in July. Overdraft facilities extended to corporates contracted further by 3.0% m/m but rose 4.9% y/y. Mortgage loans to corporates contracted by 0.2% m/m but increased 5.0% y/y. Installment credit extended to corporates, which has been contracting since February 2017 on an annual basis, remains depressed, contracting by 0.3% m/m and 8.5% y/y in August.

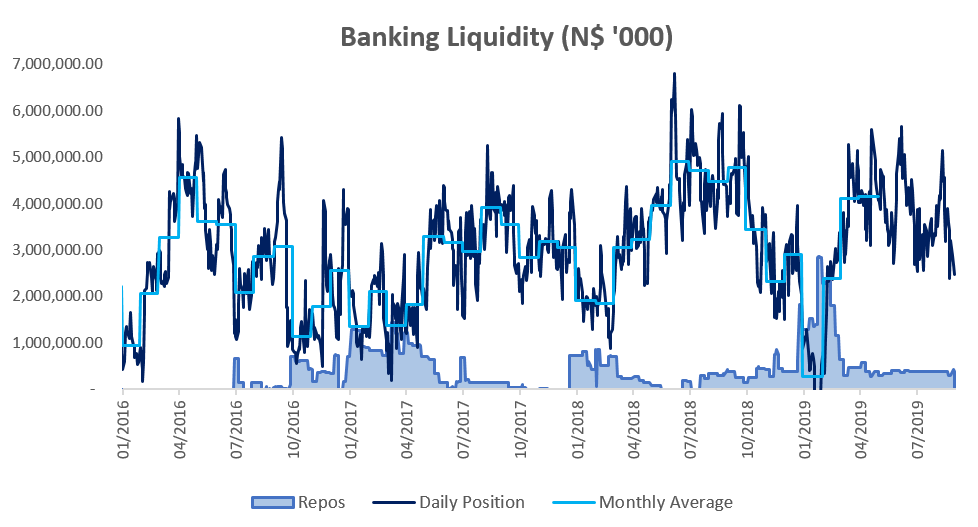

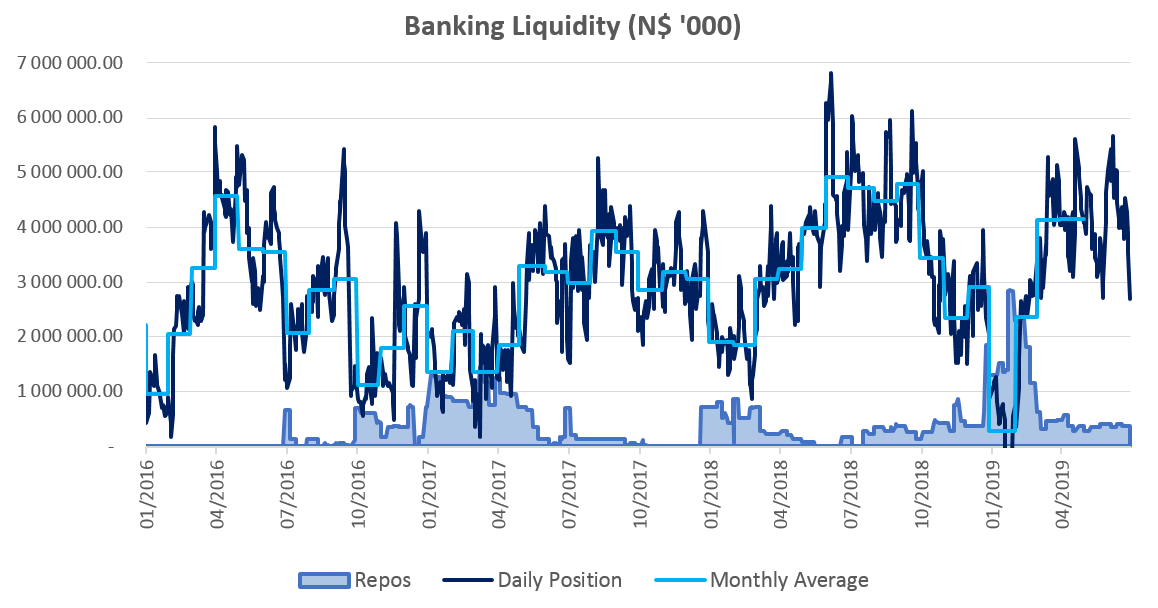

Banking Sector Liquidity

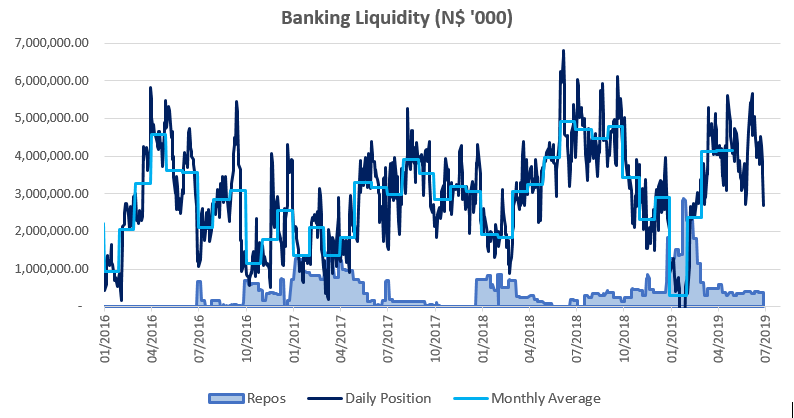

The overall liquidity position of commercial banks improved in August, increasing by N$409.1 million to reach an average of N$3.66 billion. The higher liquidity resulted in a decrease in use of the BoN’s repo facility by commercial banks, with the outstanding balance of repo’s decreasing by N$5 million to N$386.5 million by month end.

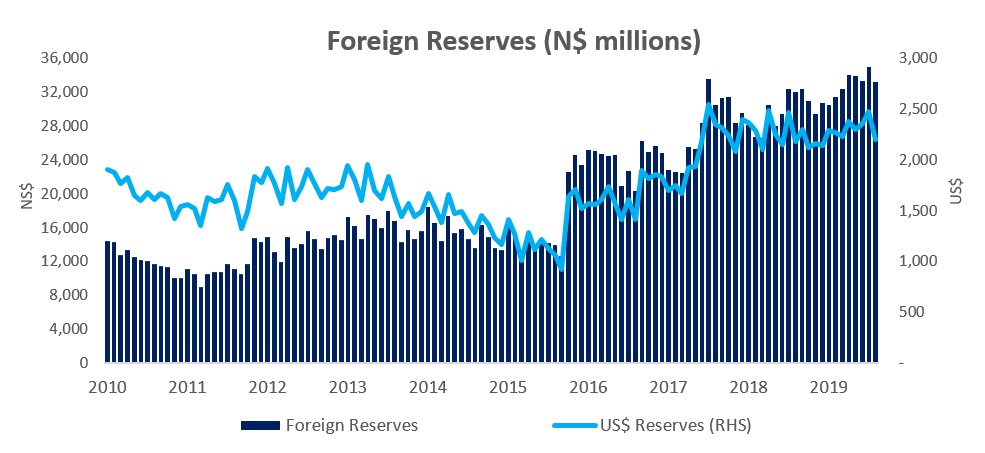

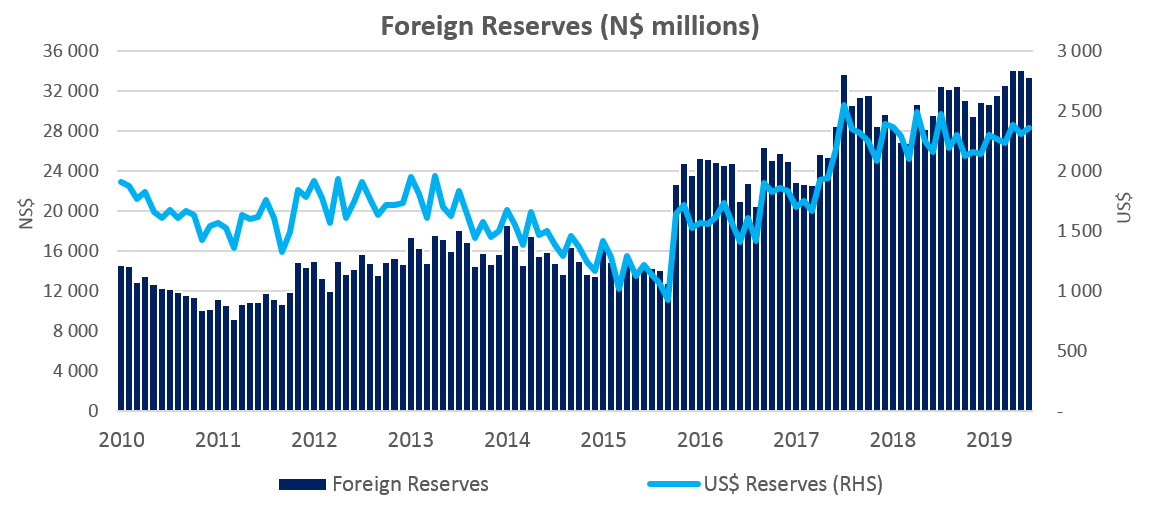

Reserves and Money Supply

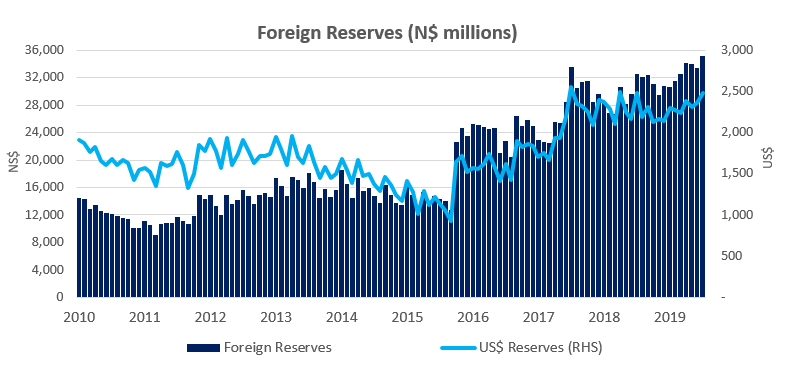

As per the BoN’s latest money statistics release, broad money supply rose by N$8.32 billion or 8.0% y/y in August, following a 6.6% y/y increase in July. Foreign reserve balances rose by N$1.75 billion to N$33.4 billion in August from N$35.2 billion in July.

Private sector credit extension growth increased by 6.11% y/y during August. From a 12-month rolling perspective, credit issuance down by 10.6% from the N$6.42 billion issuance observed over the preceding twelve-month period, with individuals taking up most (64.3%) of the credit extended.

The increase in the uptake of short-term debt and overdraft facilities by households to fund consumption needs, demonstrates the pressure consumers are under. This is of concern as consumers continue to live above their means. According to Bank of Namibia Financial Stability Report, the level of household indebtedness rose and stands at 95.5% in 2018 compared to 2017. Furthermore, demand is expected to be remain subdued as key sectors recorded declining growth rates. Our expectation is for private sector credit extension to remain under pressure as both consumer and business confidence remains low.

BoN took the decision to cut the Repo rate by 25 basis points at its August MPC meeting, this has brought heavily indebted consumers and corporates some relief. However, interest rates remain accommodative by historical standards and further rate cuts are unlikely to result in a meaningful increase in the uptake of credit.