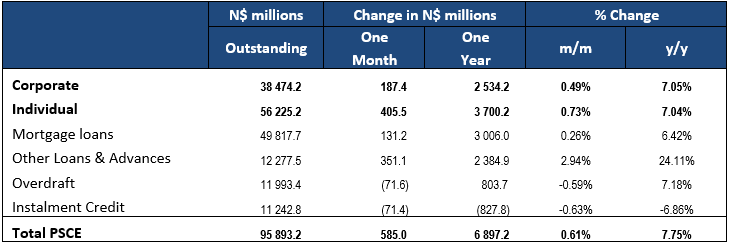

Overall

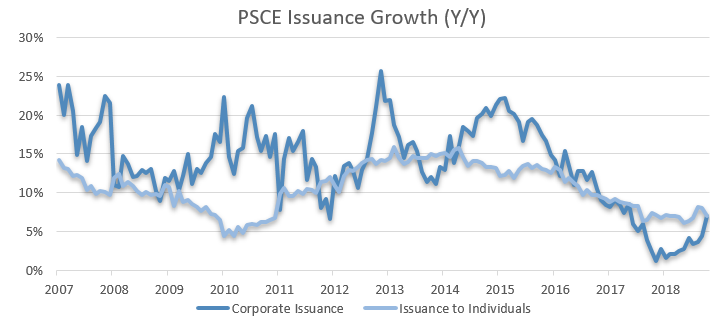

Private sector credit extension (PSCE) rose by N$585 million or 0.6% m/m in October, compared to the N$524 million or 0.6% m/m increase recorded in September. Year-on-Year, PSCE growth edged up to 7.8% in October compared to 7.3% y/y in September. Cumulative private sector credit outstanding as at the end of October amounted to N$95.893 billion. On an annual basis household appetite for credit continues to outweigh that of businesses. However, the gap between credit extended to households and to corporates has narrowed slightly, owing to an increase in the uptake of credit by corporates observed over the past three months. On a rolling 12-month basis N$6.897 billion worth of credit was extended to the private sector with N$3.7 billion being taken up by households. Corporations took up N$2.53 billion worth of credit over the last 12-months, and claims on non-residents totaled N$662.7 million.

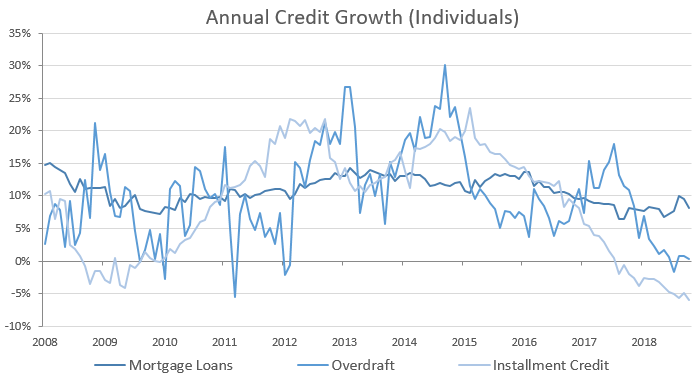

Credit extension to individuals

Credit extended to individuals increased by 7.0% y/y in October, growing at a slightly slower pace than the 8.0% y/y increase recorded in September. On a monthly basis household credit increased by 0.7%, marginally quicker than the 0.5% m/m growth registered in September. The monthly increase in household credit extension was driven by increases in the mortgage loans and other loans and advances categories which increased by 0.8% and 1.3%, respectively. Compared to October 2017, mortgage loans increased by 8.2% y/y while other loans and advances rose by 18.7% y/y. The effects of the amendments to the national credit act have proven to be long-lasting and have resulted in installment credit realizing negative growth rates since August 2017. Household installment credit contracted by 6.0% y/y in October following a 4.9% y/y contraction in September.

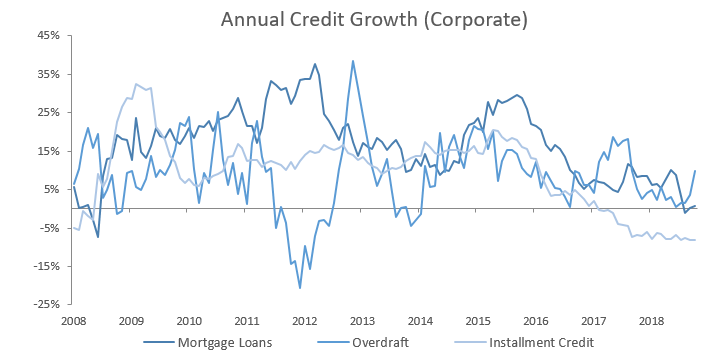

Credit extension to corporates

Credit extension to corporates increased at a quicker pace in October than in September, increasing by 7.1% y/y compared to September’s 4.5% y/y increase. The year-on-year uptick in overall credit extended to corporates has been due to an increase in the use of short-term credit facilities, in particular other loans and advances, picking up from low growth rates in the corresponding period a year ago. Other loans and advances extended to businesses increased by 30.1% y/y and 4.6% m/m. Overdrafts recorded the second highest increase in credit extension to corporates, increasing by 9.8% y/y due to base effects. On a month-on-month basis overdraft credit declined by 0.8% as businesses repaid outstanding overdrawn accounts on net.

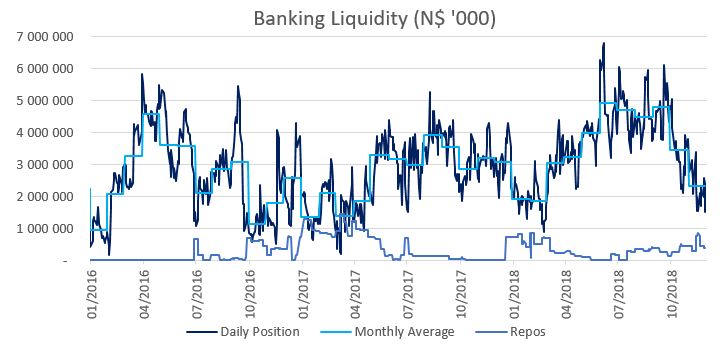

Banking Sector Liquidity

The overall liquidity position of commercial banks experienced a substantial decline of N$1.3 billion to reach an average of N$3.4 billion during October from N$4.7 billion in September. Bank of Namibia attributes the decline in liquidity to investors withdrawing idle funds in search of higher yielding assets as well as for facilitating cross-border payments. During the month of October, overall short-term money market rates in SA have trended higher than those in Namibia, which explains the Namibian exodus to some extent. Furthermore, there has been an increase in use of BoN’s repo facility by commercial banks, with the outstanding balance of repo’s increasing from N$147 million at the start of October to N$434 million by month end.

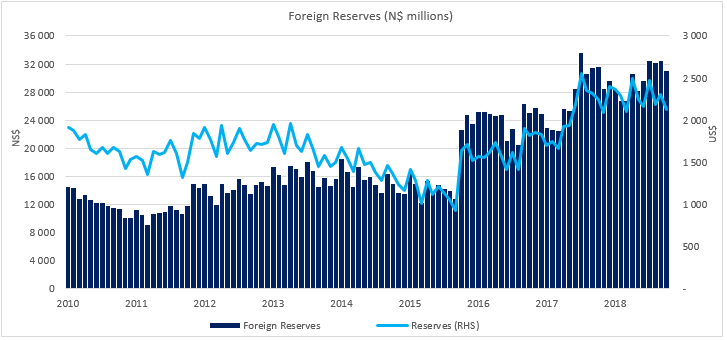

Reserves and money supply

As per BoN latest money statistics release, broad money supply rose by N$13.32 billion or 14.2% y/y in October following a 12.5% y/y increase in September. Foreign reserve balances declined by N$1.41 billion to N$31.1 billion in October from N$32.5 billion in September, representing a 4.3% m/m fall in reserves. BoN attributes the decrease in reserves to commercial banks facilitating foreign currency payments which resulted in net capital outflows, in addition to an interest payment for the US$750 million Eurobond. The governor noted, during the MPC press briefing, that BoN has observed further declines in reserves for the month of November. The governor pointed out that businesses are busy stockpiling in a bid to ensure they meet the seasonal uptick in demand expected around year-end. Foreign balances are likely to pick up over the next couple of months with the pending release of the delayed N$3 billion disbursement due from the African Development Bank’s loan facility.

Outlook

PSCE ticked up for a third consecutive month, reaching a 17-month high growth rate of 7.3% on a year-on-year basis. PSCE has failed to increase by double digit figures for the past two years. The last time it did so was in October 2017 when PSCE increased by 10.2% y/y. Corporate demand for credit has been ticking up modestly. However, for the majority of 2018 household demand for credit has been driving PSCE growth. Household driven PSCE growth is unsustainable in the long-run, especially when borrowing has been used for consumptive purposes. Growth is likely to become constricted in an environment where the consumer is heavily indebted and the refinancing, and approval of new loans becomes more difficult due to eligibility. The recent increase in credit extended to corporates has been a welcome sight. However, the current economic downturn has led to corporates taking on more short-term credit which does point to businesses borrowing simply to stay afloat.

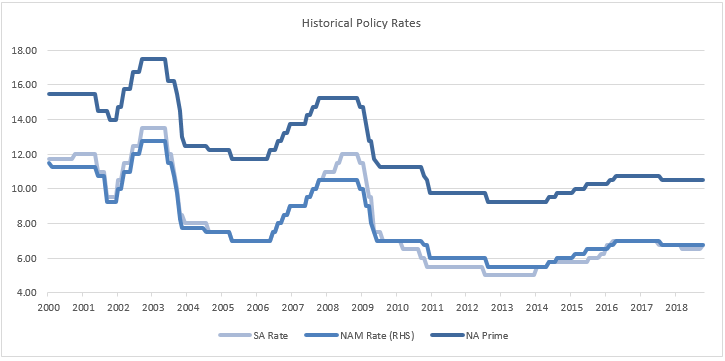

The near-term outlook for PSCE will hinge very much on how quickly, or slowly, consumer and business confidence recovers, and to a larger extent the impact monetary policy will have. Consumer confidence feeds through to business confidence. Increased consumer demand triggers more business production that must meet this demand, thus incentivising businesses to borrow in order to fund capital projects. Borrowing has been predominantly short-term however, and short-term borrowing satisfies short-term needs which is unlikely to drive much meaningful expansion of productive capacity.

Indebted consumers got some form of relief when the BoN left the repo rate unchanged at 6.75% during its December MPC meeting. A decision the MPC deemed appropriate to maintain the one-to-one link between the Namibian dollar and the SA rand. This follows a month after the South African Reserve Bank (SARB) raised its repo rate by 25bps. BoN chose a more accommodative response, having kept a 25bp buffer between its rate and that of the SARB since March 2018. The current interest rate environment is relatively more relaxed compared to historical rates observed over the last eighteen years. Our expectations are for interest rates to remain accommodative in the near-term. However, BoN will be mindful of possible increases in SA rates and move to adjust local rates accordingly. Higher interest rates in SA will very likely lead to capital outflows from Namibia, which in turn jeopardises foreign reserve levels, and therefore the currency peg.