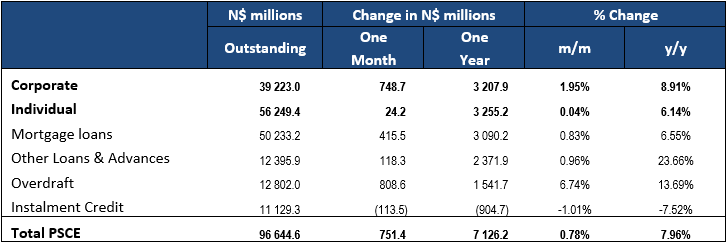

Overall

Private sector credit extension (PSCE) rose by N$751 million or 0.8% m/m in November, compared to the N$585 million or 0.6% m/m increase recorded in October. Year-on-Year, PSCE grew by almost 8.0% in November compared to 7.8% y/y in October. November has also been the fourth consecutive month in which PSCE growth has kept rising on a year-on-year basis. Cumulative private sector credit outstanding as at the end of November amounted to N$96.645 billion. On an annual basis, households were taking up much of the credit extended to the private sector in 2018, accounting for almost two-thirds of the uptake. However, that wide disproportion between credit extended to households and corporations began to narrow in August. On a rolling 12-month basis N$7.126 billion worth of credit was extended to the private sector with N$3.26 billion being taken up by households. Corporations very nearly equaled that which was extended to households by taking up N$3.21 billion worth of the credit over the last 12-months, while claims on non-residents totaled N$663.2 million.

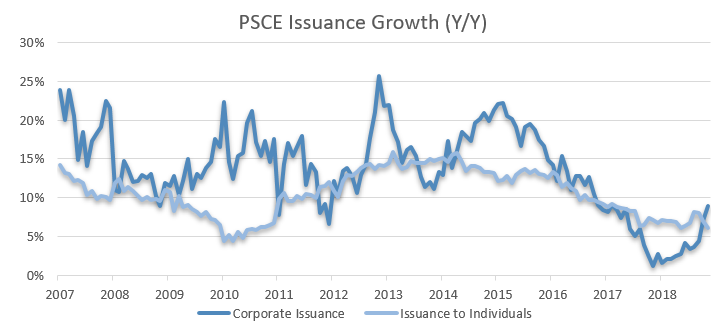

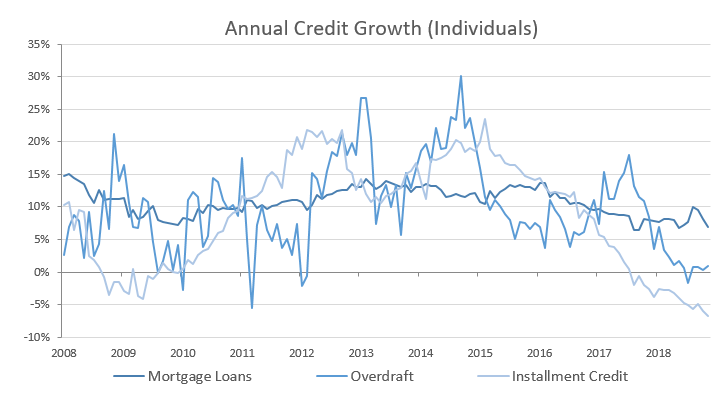

Credit extension to individuals

Credit extended to individuals increased by 6.1% y/y in November, moderating from the 7.0% y/y increase recorded in October. The year-on-year slowdown in household credit extension was due to moderating growth in mortgages, overdrafts, installment credit and other claims. Mortgage loans increased by 6.9% compared to 8.0% a year ago, while overdrafts increased by just 0.9% versus 8.5% in the prior year. Installment credit contracted by 6.8%, worse than the 2.6% contraction registered during the corresponding period in 2017. On a monthly basis, household credit growth printed flat following a modest increase of 0.7% m/m recorded in October. Mortgage credit contracted by 0.3% m/m along with a 0.9% contraction in installment credit. Other loans and advances increased by 2.1% m/m followed by a 0.4% m/m increase in overdrafts. Leasing transactions increased the most in the household’s category, 14% m/m, although significantly slower than the 70.3% m/m growth registered in October.

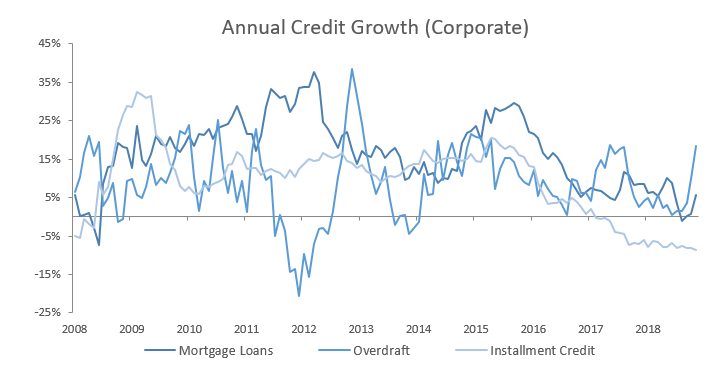

Credit extension to corporates

Credit extension to corporates increased by 8.9% y/y compared to October’s 7.1% y/y increase. The November increase in corporate credit has been the highest since March 2017 and the fifth consecutive month in which corporate credit has been increasing at a faster pace on a year-on-year basis. Shorter-term credit facilities continue to be driving the increase in corporate credit extension. Other loans and advances increased by 28.2% y/y and overdrafts increased by 18.5% y/y. Mortgage loans to businesses increased by 5.6% y/y in November, slowing from the 8.5% y/y increased recorded the corresponding period in 2017. On a monthly basis credit extended to businesses was the main reason for the overall increase in PSCE. Corporates made use of overdraft facilities in November, increasing overdraft loans by 8.9% m/m, followed by corporate mortgage lending which increased by 4.9% m/m.

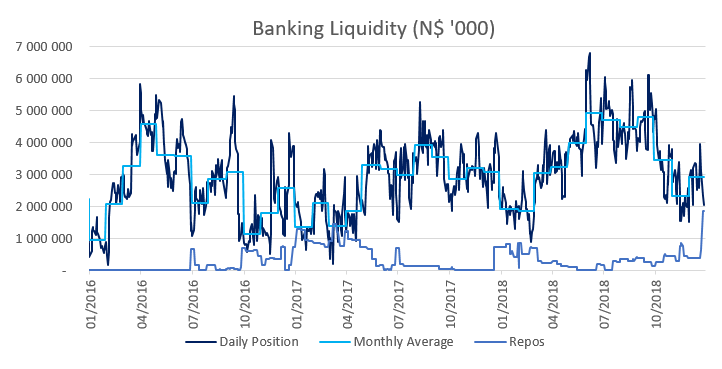

Banking Sector Liquidity

The overall liquidity position of commercial banks declined by N$1.1 billion to reach an average of N$2.3 billion during November from N$3.4 billion in October. Bank of Namibia attributes the decline in liquidity to foreign currency outflows as a result of trade-related payments.

Reserves and money supply

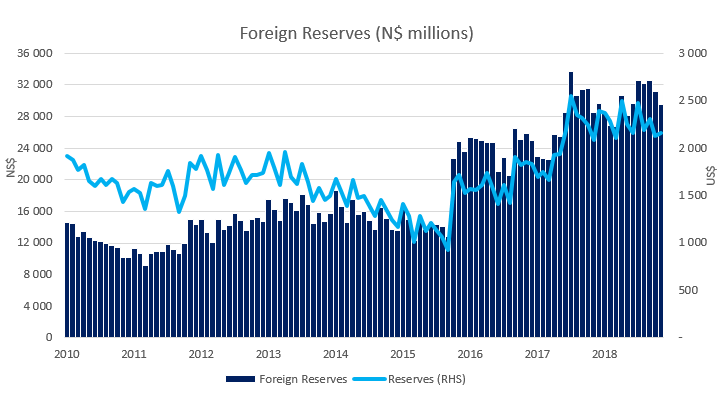

As per BoN latest money statistics release, broad money supply increased by N$7.24 billion or 7.4% y/y in November but decreasing 1.7% m/m by N$1.87 billion. Foreign reserve balances declined by N$1.56 billion to N$29.5 billion in November from N$31.1 billion in October, representing a 5.0% m/m fall in reserves. BoN attributes the decline in reserves to net capital outflows from commercial banks to fund foreign currency purchases, in addition to an interest payment for the US$500 million Eurobond. A stronger Namibian dollar versus the US dollar during the period under review further contributed to the decline in foreign reserves.

Outlook

Overall PSCE growth in November maintained its upward momentum on a year-on-year basis for a fourth consecutive month, increasing by 7.96% y/y. The highest rate of growth in the last 18 months. The year 2018, with the omission of pending December PSCE data, has seen very little deleveraging from both consumers and businesses. In the midst of recessionary economic growth short-term and unsecured loans have grown at a quicker rate than that of mortgage and instalment credit. From a 12-month rolling perspective household demand for credit underpinned growth in PSCE and only until recently have businesses started borrowing more. The increase in corporate credit, however, has been more profound in short-term borrowings.

The Bank of Namibia (BoN) has been accommodative in terms of monetary policy by keeping the repo rate steady at 6.75% since cutting by 25bps in August 2017. How long BoN manages to keep interest rates steady will depend largely on developments in South Africa. The SARB will closely monitor inflation, which ticked up to 5.2% y/y and is expected to moderate on the back of falling oil prices and moderating transport inflation. Furthermore, the SA economy broke out of a recession and the outlook for possible rate hikes is now pushed towards the latter part of 2019. Domestically, BoN will be weary of worsening economic conditions, projecting weaker growth in its December Economic Update. BoN expects the Namibia economy to contract by 0.2% in 2018 followed by growth of 1.5% in 2019, a downward revision from its 1.9% estimation in July 2018 and more than half of the 3.1% it estimated in December 2017.