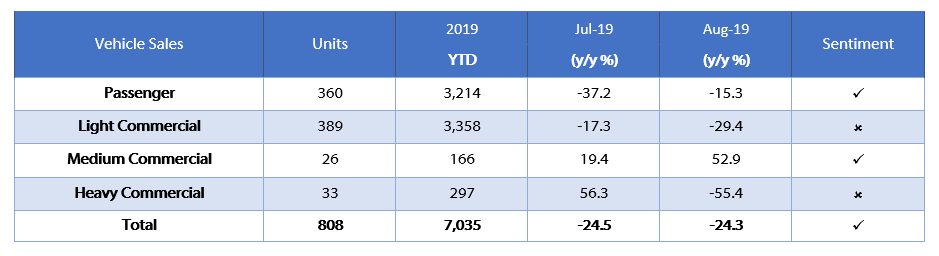

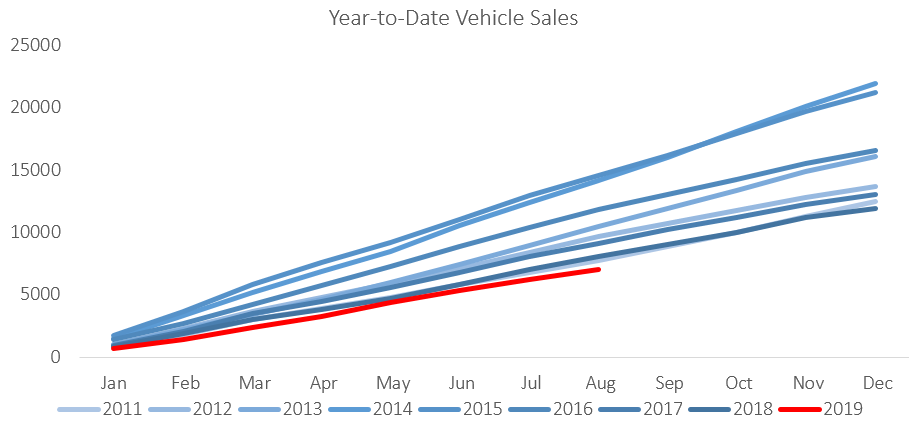

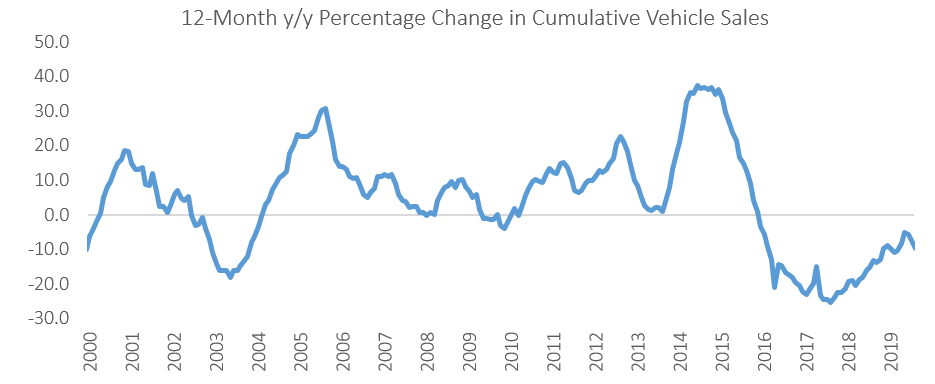

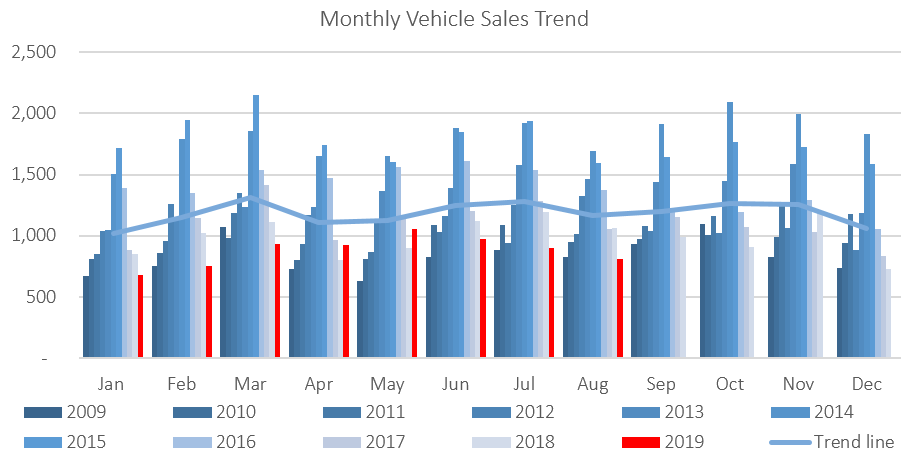

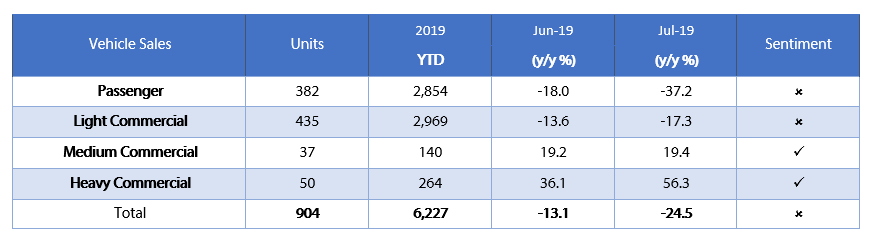

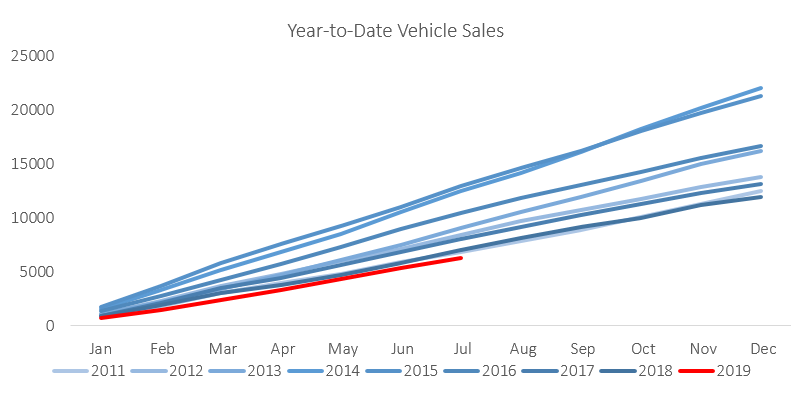

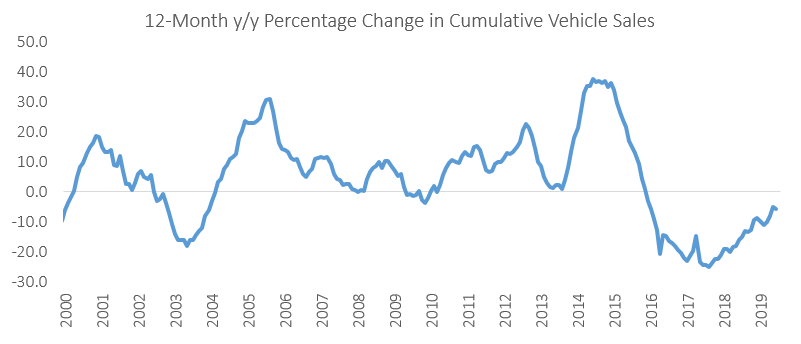

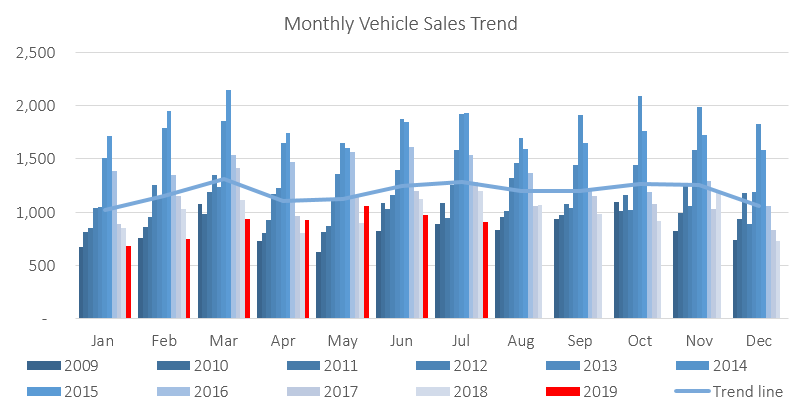

A total of 806 new vehicles were sold in September, representing a 0.2% m/m decrease from the 808 vehicles sold in August. Year-to-date, 7,841 vehicles have been sold of which 3,534 were passenger vehicles, 3,763 were light commercial vehicles, and 544 were medium and heavy commercial vehicles. This is the lowest year-to-date sales witnessed since 2009. On a twelve-month cumulative basis, new vehicle sales continued its downward trend. 10,680 new vehicles were sold over the last twelve months, a 10.2% contraction from the previous twelve months and also the lowest level since 2009.

320 new passenger vehicles were sold in September, contracting by 11.1% m/m and 5.9% y/y. Year-to-date passenger vehicle sales rose to 3,534 units, down 11.1% when compared to the year-to-date figure recorded in September 2018. On an annual basis, twelve-month cumulative passenger vehicle sales fell 9.7% y/y as the number of passenger vehicles sold continued to decline.

A total of 486 new commercial vehicles were sold in September, increasing of 8.5% m/m but contracted by 24.8% y/y. Of the 486 commercial vehicles sold in September, 405 were classified as light commercial vehicles, 25 as medium commercial vehicles and 56 as heavy or extra heavy commercial vehicles. On a twelve-month cumulative basis, light commercial vehicle sales dropped 12.7% y/y, while medium commercial vehicle sales and heavy commercial vehicles rose 0.41% y/y and 12.3% y/y, respectively. There has been an increase in the sale of heavy commercial vehicles on a year-to-year basis, from the 6.9% recorded in the preceding month. This illustrates a slight increase in the demand for durable goods by businesses.

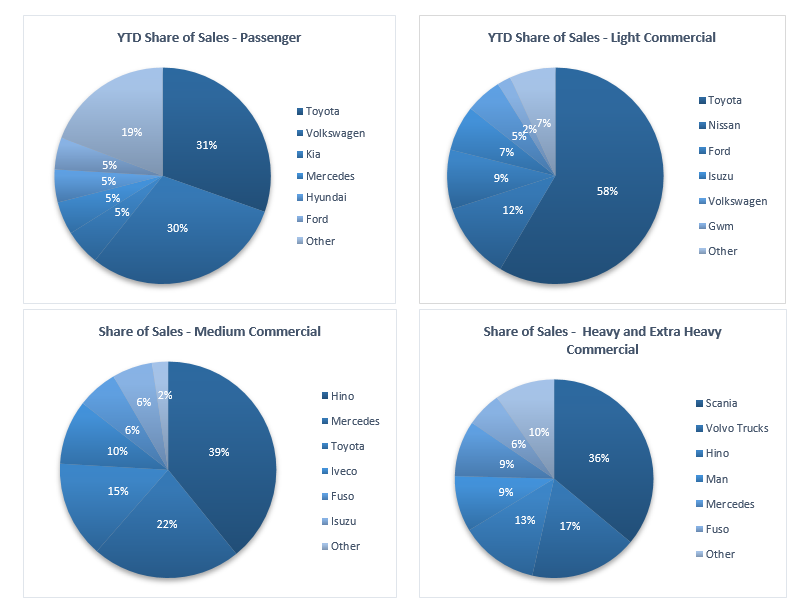

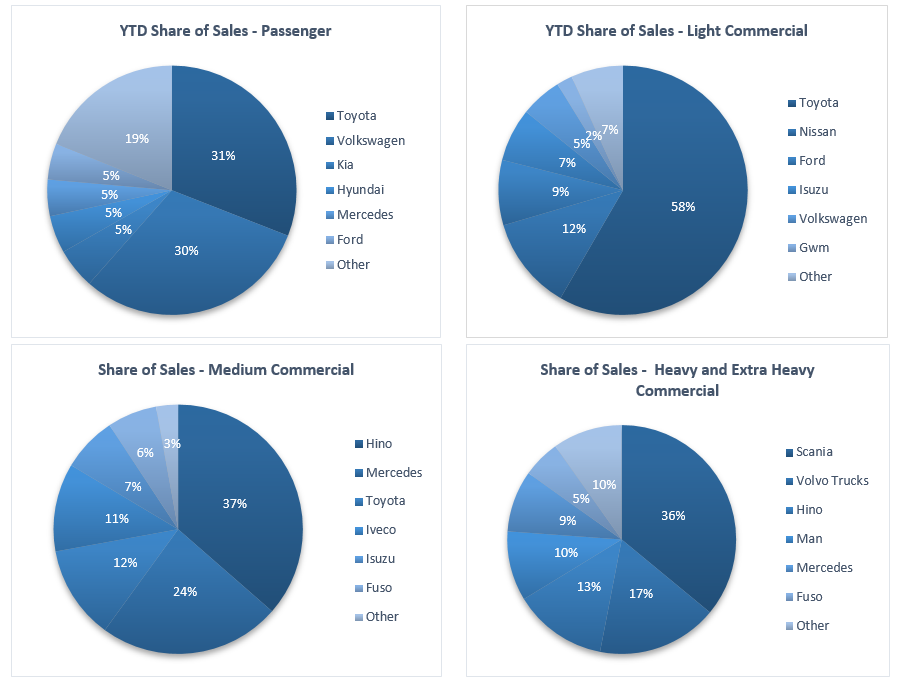

Volkswagen leads the passenger vehicle sales segment with 30.4% of the segment sales year-to-date. Toyota in second place with 29.7% of the market-share as at the end of September. Kia, Mercedes, Hyundai and Ford each command around 5.0% of the market in the passenger vehicles segment, leaving the remaining 19.4% of the market to other brands.

Toyota retains a strong year-to-date market share of 58.5% and remains the market leader in the light commercial vehicle segment. Nissan remains in second position in the segment with 11.7% of the market, while Ford makes up third place with 9.3% of the year-to-date sales. Hino leads the medium commercial vehicle segment with 37.2% of sales year-to-date, while Scania was number one in the heavy- and extra-heavy commercial vehicle segment with 34.8% of the market share year-to-date.

The Bottom Line

Vehicle sales remain under pressure, with the year-to-date new vehicle sales in 2019 currently below 2010 levels, and the total new vehicle sales for the last 12 months down 10.2% from the same period in 2018. The number of vehicle sales recorded continues to decrease and any prospects of growth in the short-term remains dim. Latest data from the Namibia Statistics Agency recorded 2.6% contraction in the Namibian economy. As a result, we expect demand to remain subdued due to low consumer and business confidence.