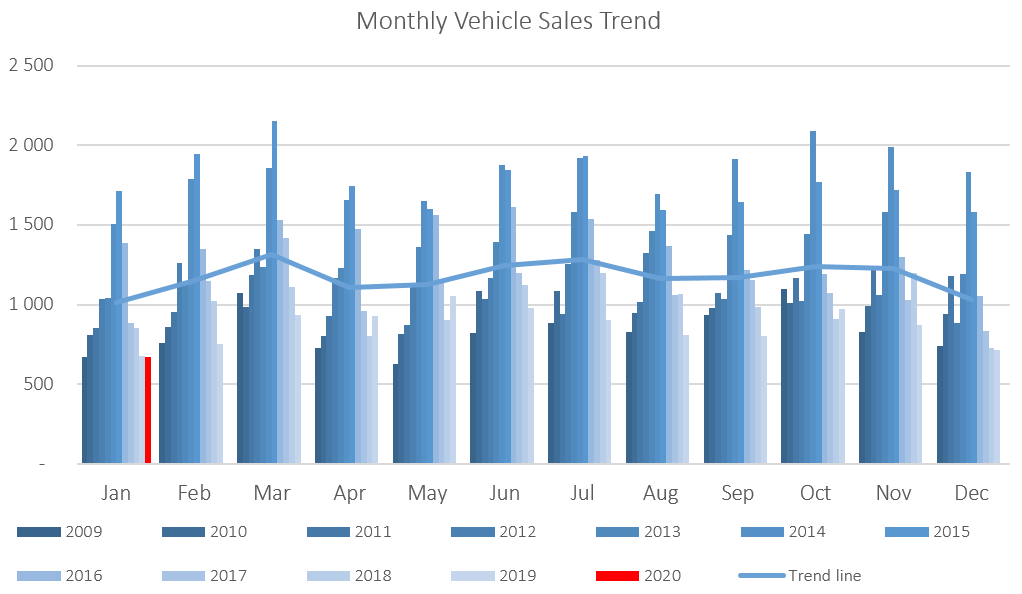

A total of 759 new vehicles were sold in March, representing a 5.0% m/m decrease from the 799 vehicles sold in February, and a 18.9% y/y decrease from the 936 new vehicles sold in March 2019. Year-to-date, 2,229 vehicles have been sold of which 956 were passenger vehicles, 1,110 light commercial vehicles, and 163 medium and heavy commercial vehicles. This is a 5.8% decline in the total number of new vehicles sold during the first quarter of 2020 when compared to 2019. On a twelve-month cumulative basis, vehicle sales continued to wane with a total of 10,265 new vehicles sold as at March 2020, down 9.0% from the 11,285 sold over the comparable period a year ago, and the lowest since April 2010.

318 New passenger vehicles were sold during March, declining by 8.4% m/m. On a year-on-year basis new passenger vehicle sales were 24.6% lower than the 422 units sold in March 2019. Year-to-date passenger vehicle sales rose to 956, reflecting lower annual sales than the preceding 15 years, and a 14.5% decline from the first quarter of 2019.

A total of 441 new commercial vehicles were sold in March, representing a contraction of 2.4% m/m and 14.2% y/y. Of the 441 commercial vehicles sold in March 389 were classified as light, 23 as medium and 29 as heavy. On an annual basis, light commercial sales fell by 19.5% y/y, medium commercial sales climbed 53.3% y/y and heavy commercial vehicle sales increased by 81.3% y/y. The increases in medium and heavy commercial sales are however from a low base. On a twelve-month cumulative basis light commercial vehicle sales have declined 13.0% y/y, medium commercial vehicles rose by 17.1% y/y, and heavy commercial vehicles rose 25.6% y/y. These high growth figures are again from a very low base.

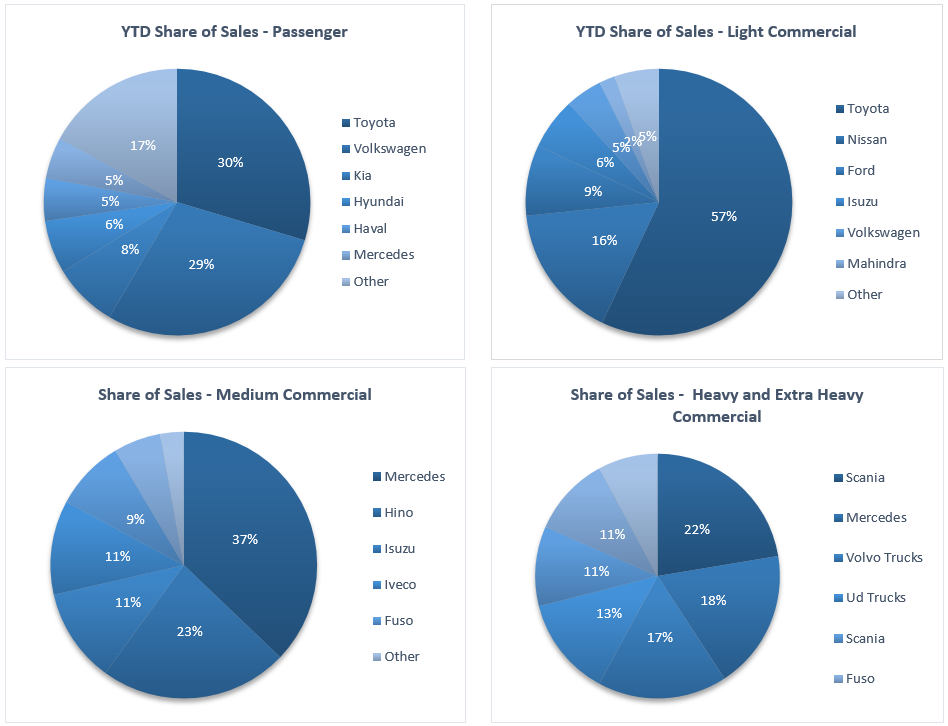

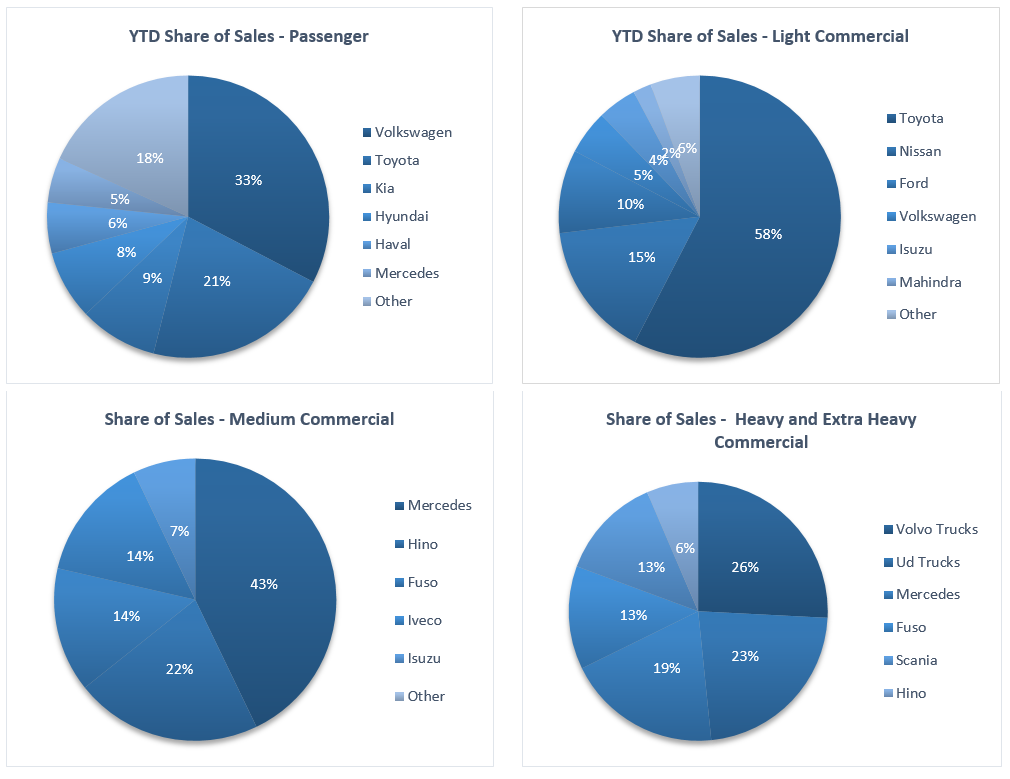

Toyota continued to lead the market for new passenger vehicle sales in March, claiming 30.9% of the market, followed closely by Volkswagen with a 29.0% share. They were followed by Kia and Hyundai at 7.2% and 5.8% of the market respectively, while the rest of the passenger vehicle market was shared by several other competitors.

Toyota also remained the leader in the light commercial vehicle space with a 57.6% market share, with Nissan in second place with a 16.3% market share. Ford and Isuzu claimed 8.7% and 5.6%, respectively, of the number of light commercial vehicles sold thus far in 2020. Mercedes leads the medium commercial vehicle segment with 31.0% of sales year-to-date. Mercedes was also number one in the heavy and extra-heavy commercial vehicle segment with 21.9% of the market share year-to-date.

The Bottom Line

March new vehicle sales generally have a seasonal effect of being slightly higher due to it being the end of the tax year. This was however not the case in 2020 with new vehicle sales were depressed in March, declining by 9.0% y/y on a twelve-month cumulative basis, to to 10,265 vehicles. It should be noted that the data precedes the 21-day lockdown of the two most economically significant regions and as a result, vehicle sales are expected to be significantly lower in April. Used vehicle sales will similarly be affected by this. Both consumers and businesses are expected to be under considerable financial stress in the short- to medium term as a result of the lockdown, and we thus expect vehicle sales to remain at lower levels in the months to come.