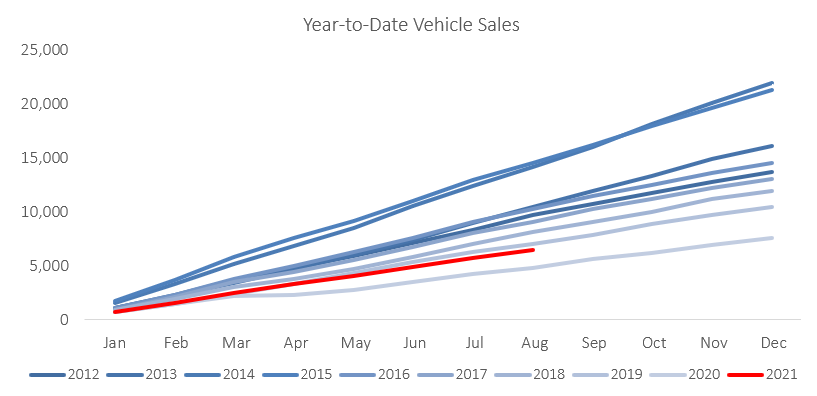

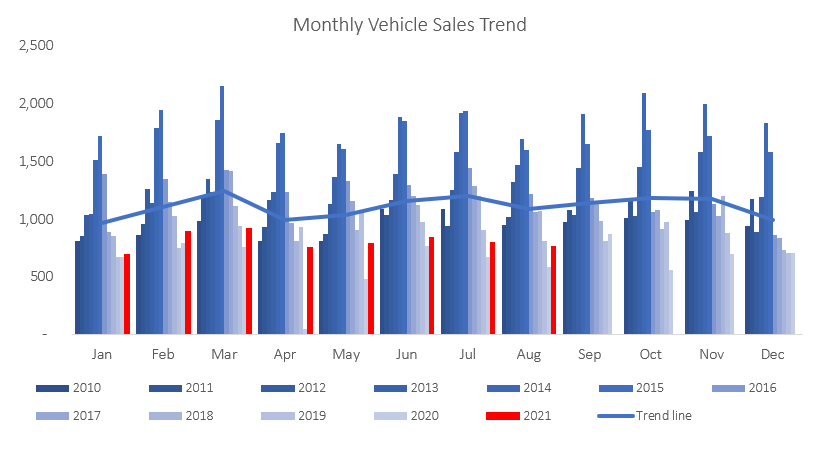

In August 764 new vehicles were sold, a 4.5% m/m decrease from the 800 sold in July, bringing the total number of vehicle sales in 2021 to 6,457. Total new vehicle sales have declined for the second month running. On a 12-month cumulative basis, vehicle sales have grown by 14.1% y/y to 9,296. However, it is the historically low base of 2020’s new vehicle sales, rather than exceptional sales growth in 2021, that explains the relatively high 12-month cumulative sales increase. On a year-on-year basis, new vehicle sales rose 30.4% in August. All told, 2021 remains on track to be the second worst year for new vehicle sales in the past decade.

340 new passenger vehicles were sold in August, a 12.6% m/m decrease from the 389 sold in July. Year-on-year passenger vehicle sales increased by 70.9%. Year-to-date vehicle sales have increased by 53.4%. On a 12-month cumulative basis, the number of passenger vehicles sold increased by 28.8% in August to 4,257. However, the equivalent 2019 figure is 4,678, meaning that while new passenger vehicle sales have ticked up from 2020 lows, the 2019 benchmark is yet to be reached.

Commercial vehicle sales increased by 3.2% m/m to 424 in August. New commercial vehicle sales increased by 9.3% y/y. 354 light and 16 medium commercial vehicles were sold in August, a 5.9% m/m decrease and 23.1% m/m increase respectively. 54 heavy commercial vehicles were sold, more than double the amount sold in July. On a 12-month cumulative basis, light commercial vehicle sales increased by 2.8% y/y, medium commercial vehicles fell by 15.2% y/y, and heavy commercial vehicles increased by 27.7% y/y.

Volkswagen and Toyota now have an all but equal split of the market for passenger vehicles in 2021, with Volkswagen taking 29% and Toyota 28%. Kia solidified its position as the next largest player in the market, marginally upping its share to 9%. Hyundai and Suzuki round off the top 5 with 6% and 5% passenger vehicle market share respectively.

On a year-to-date basis, Toyota remains the biggest seller of light commercial vehicles with a 55% share of the market. Ford comes in second at 13%. Mercedes has taken 33% of the market for medium commercial vehicles, followed closely by Hino with 31%. The heavy and extra heavy commercial vehicle market is the most competitive of the vehicle markets. Scania currently has a 22% market share and Volvo has 19%.

August was another sluggish month for vehicle sales in Namibia. Despite a marginal increase in the number of commercial vehicles sold compared to June and July’s figures, a dip in passenger vehicle sales cancelled out any overall vehicle sales gains that might have been made. Global automotive production remains under significant strain as variable demand and a well-documented shortage of semiconductors slow production. The extent to which these supplier-facing costs are passed down to the Namibian consumer is an open question. So long as the automotive market remains sufficiently competitive prices of new vehicles should not increase drastically.