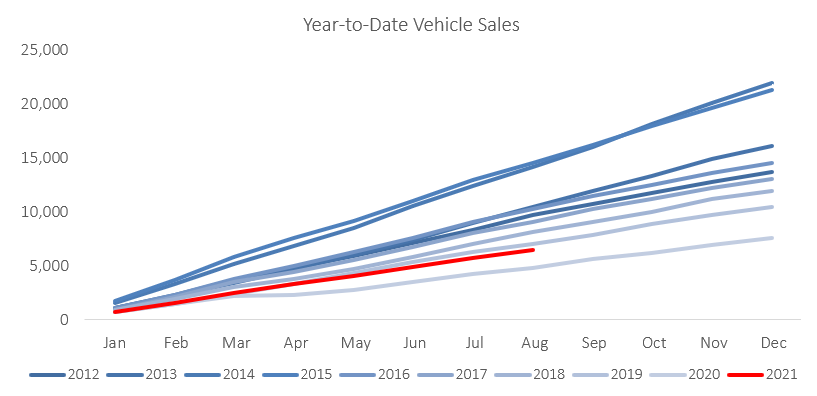

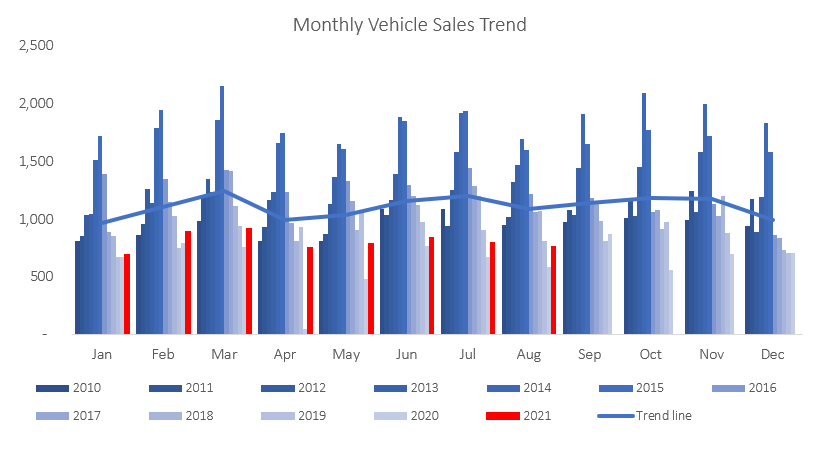

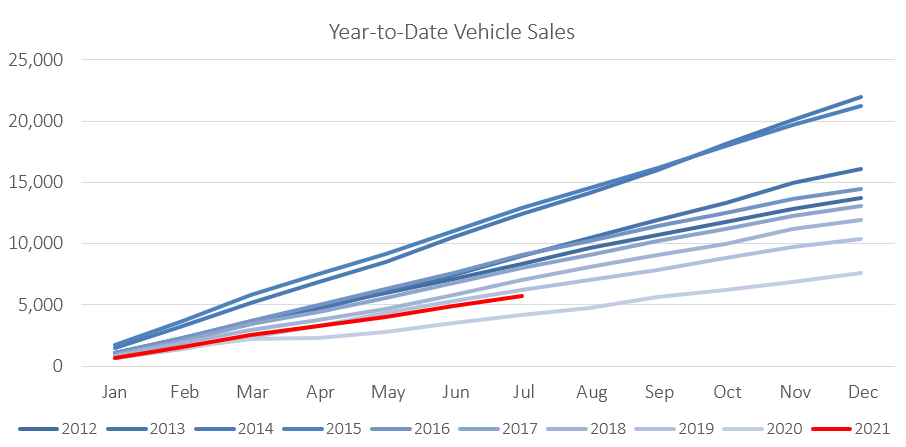

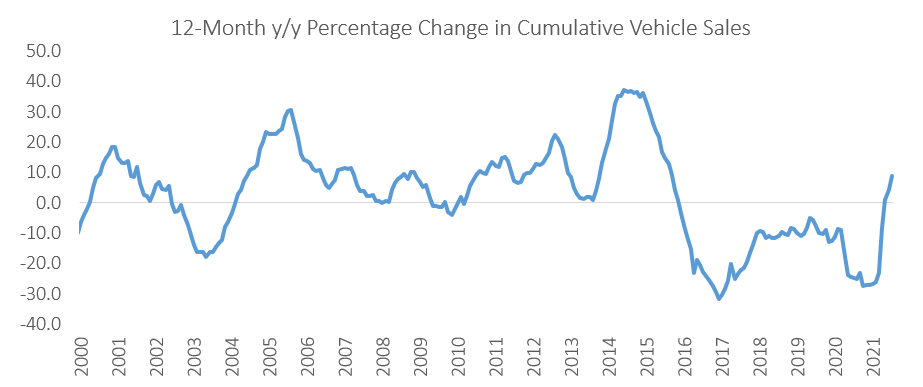

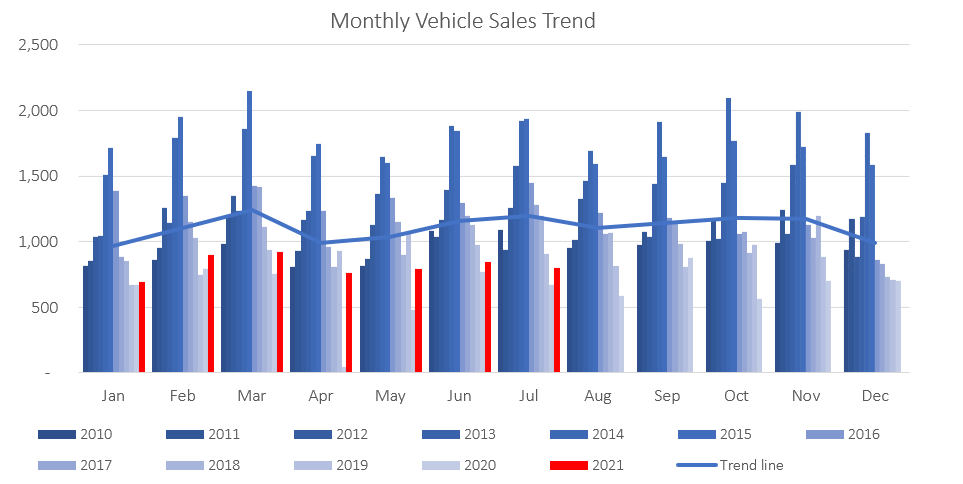

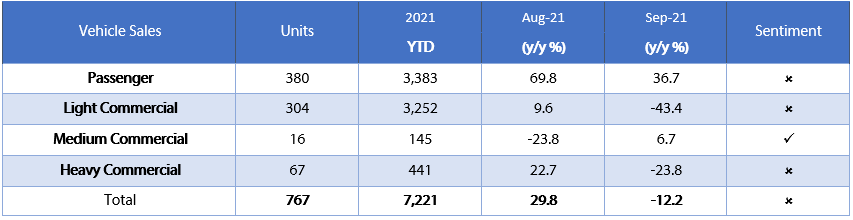

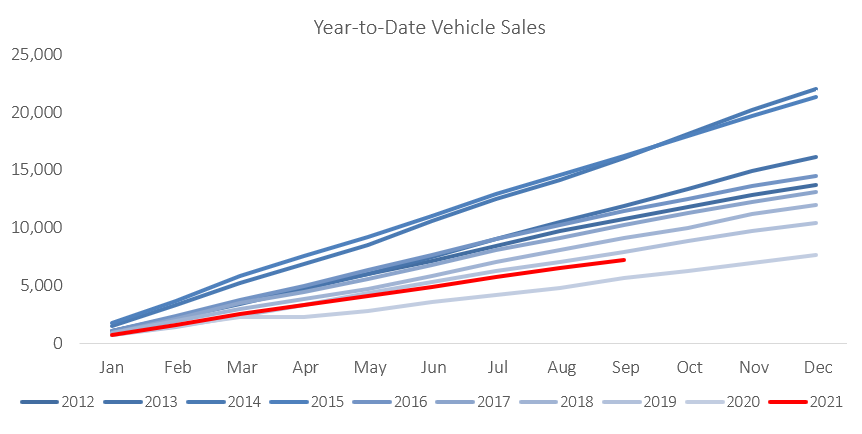

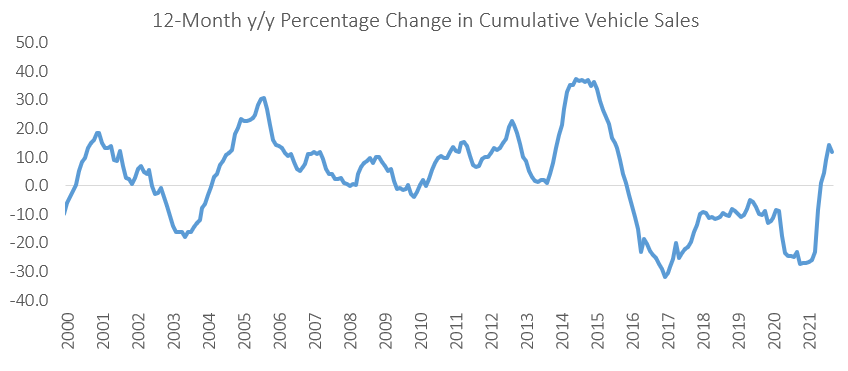

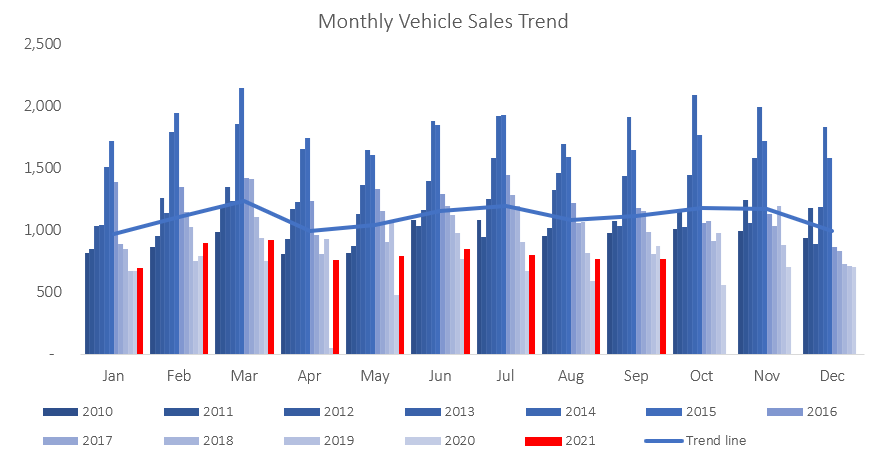

767 new vehicles were sold in September, a near identical number to the 762 sold in August. This brings the total number of new vehicle sales in 2021 to 7,221. On a year-on-year basis, new vehicle sales declined by 12.2%. On a 12-month cumulative basis, vehicle sales have grown by 11.8% to 9,186. September is usually a better month for new vehicle purchases. In fact, 767 represents the smallest number of new cars sold in the month of September over the past decade, lower even than 2020’s September figure. As such, 2021 remains on track to be the second worst year for car sales in the past decade.

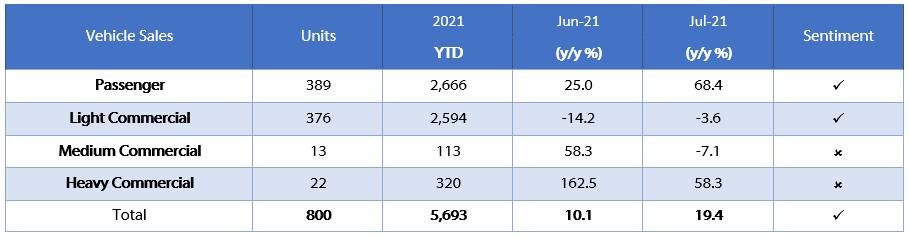

380 new passenger vehicles were sold in September, a 12.4% increase from the 338 sold in August and a 36.7% increase from this time last year. Year-to-date, the sale of new passenger vehicles increased by 51.2% y/y. On a 12-month cumulative basis, sales have increased by 33.6% y/y to 4,356. There is a distinct upward trend in the 12-month cumulative sales figures as it starts to shed the historically low sales numbers from 2020. If this modest upward trend continues there is a good chance that we will see 12-month cumulative sales figure reach late 2019 values by the end of 2021.

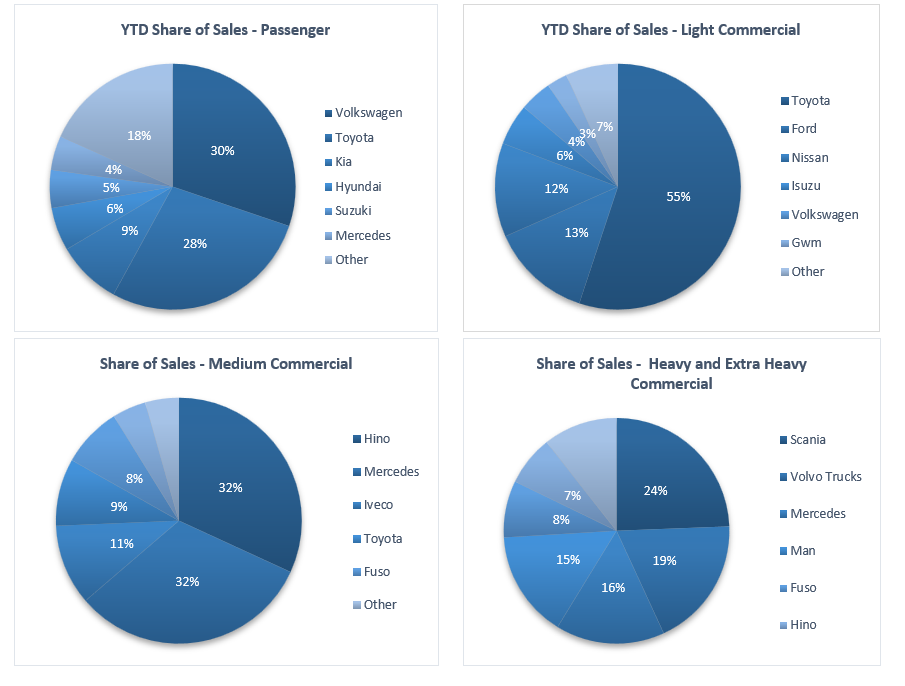

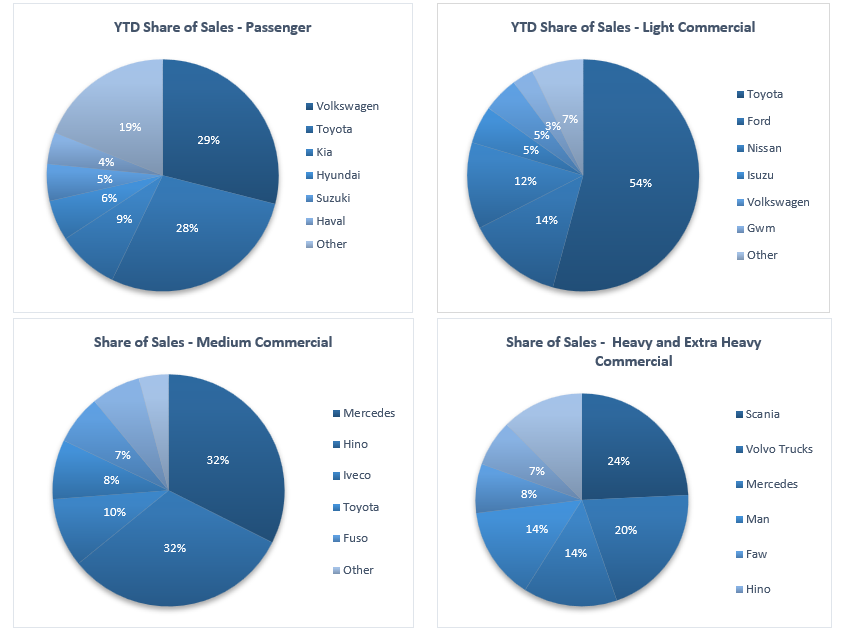

Volkswagen and Toyota continue to dominate the market for passenger vehicles, with each maintaining about a 30% share of the market in 2021. Given the ingrained popularity of these two brands it is unlikely that another car maker will be able to displace them in the short- to medium-term. Kia, Hyundai and Suzuki have market shares of 9%, 6% and 5% respectively.

On a year-to-date basis, Toyota is the biggest seller of light commercial vehicles. They have a 54% share of the market so far in 2021. Mercedes is the main player in the medium commercial vehicles market with a market share of 32%. The German carmaker also has a 14% market share in the heavy and extra heavy commercial vehicle market. Scania has the largest market share in the heavy and extra-heavy commercial vehicle market with 24%.

In the context of 2021 September was an average month for vehicle sales in Namibia. The sale of passenger vehicles increased month-on-month and sales of commercial vehicles decreased, all but balancing each other out. While new vehicle sales remain generally sluggish, Namibia’s situation is not unique. Car sales are down in Europe and the US as the global shortage of semiconductors rolls on. However, Namibia’s declines are best explained by consumers not being able to afford new vehicles and corporates not replacing their fleets.