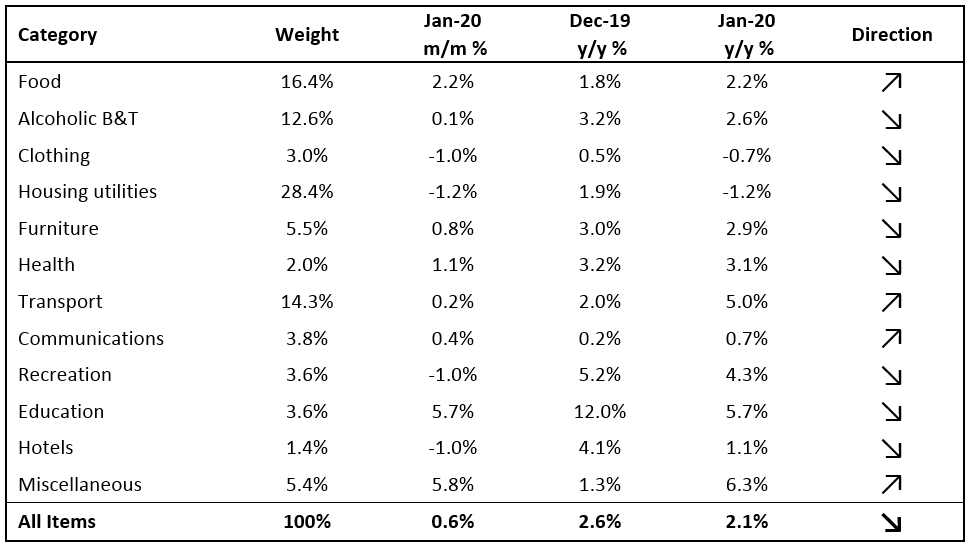

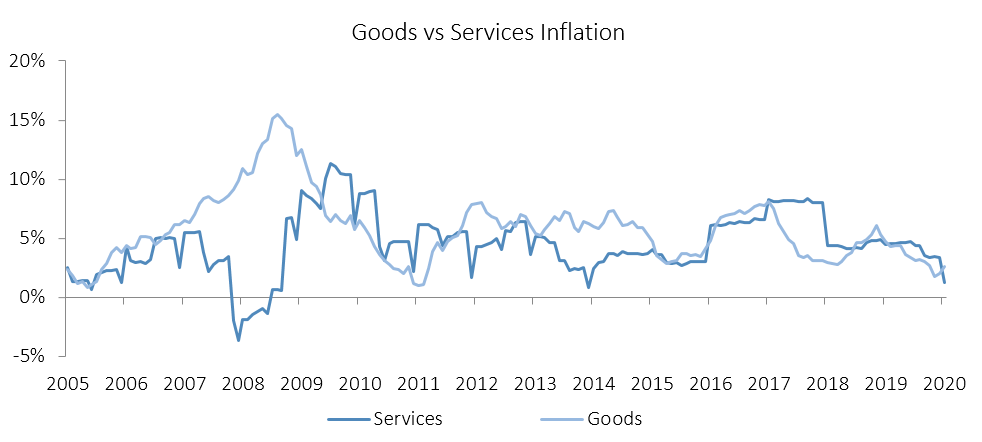

The Namibian annual inflation rate slowed considerably to 2.1% in January, following the 2.6% y/y increase in prices recorded in December. Prices in the overall NCPI basket increased 0.6% m/m. On a year-on-year basis, overall prices in four of the twelve basket categories rose at a quicker rate in January than in December, while the other eight recorded slower rates of inflation. Prices for goods increased by 2.6% y/y while prices for services increased by 1.3% y/y.

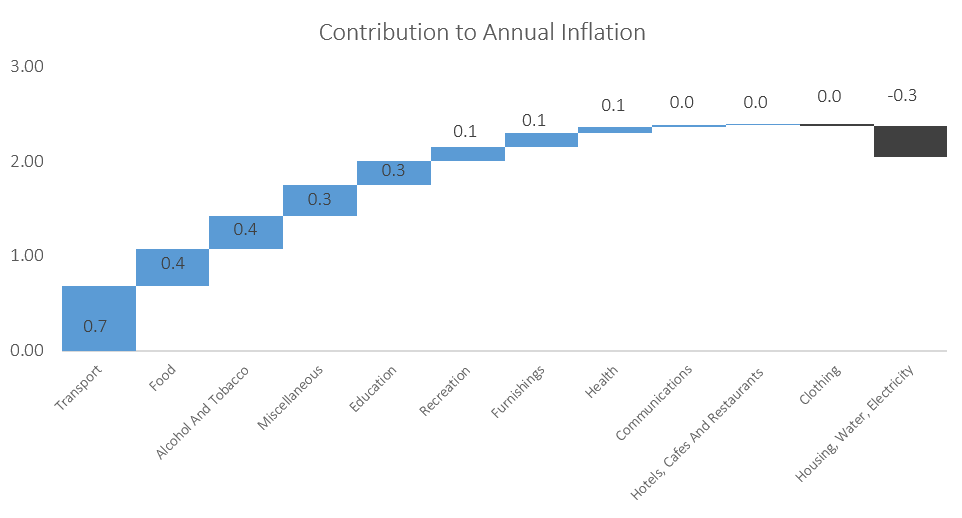

Transport, the third largest basket item, was the largest contributor to annual inflation, accounting for 0.7 percentage points of the total 2.1% annual inflation rate. Transport costs increased by 0.2% m/m and 5.0% y/y. The purchase of vehicles subcategory saw price increases of 4.6% y/y, while the operation of personal transport equipment subcategory recorded price increases of 6.1% y/y. Fears of the global economic impact of the coronavirus has pushed the price of Brent crude oil down 11.9% in January to around US$58 a barrel. Although it is unlikely for the oil price to remain at current levels in the long run, the lower oil price does at least mean that the likelihood for transport inflation to increase substantially in the short term is low.

Food & non-alcoholic beverages, the second largest basket item in weighting, accounted for 0.4 percentage points of the total inflation figure. Food and non-alcoholic beverage prices increased by 2.1% y/y, ticking up from inflation of 1.7% y/y recorded in December. Prices in twelve of the thirteen sub-categories recorded increases on an annual basis. The largest increases were observed in the prices of fruits which increased by 13.8% y/y and vegetables which increased by 8.4% y/y. The meat sub-category meanwhile saw a marginal price decrease of 0.5% y/y in January. Rainfall figures have so far been mixed, with the northern and eastern regions receiving normal- to above-normal amounts of rain, and the central and southern regions receiving below-normal amounts of rain. Should these regions continue to experience poor rainfall for the rest of the rainy season, local food production will be affected which could lead to higher food price inflation.

Alcoholic beverages and tobacco prices, making up approximately 12.6% of the overall inflation basket, was the third highest contributor to the annual inflation rate in January, with prices of the basket item increasing 0.1% m/m and 2.6% y/y. The main driver in this basket category was alcohol prices which increased by 4.4% y/y while tobacco prices were down 5.1% y/y.

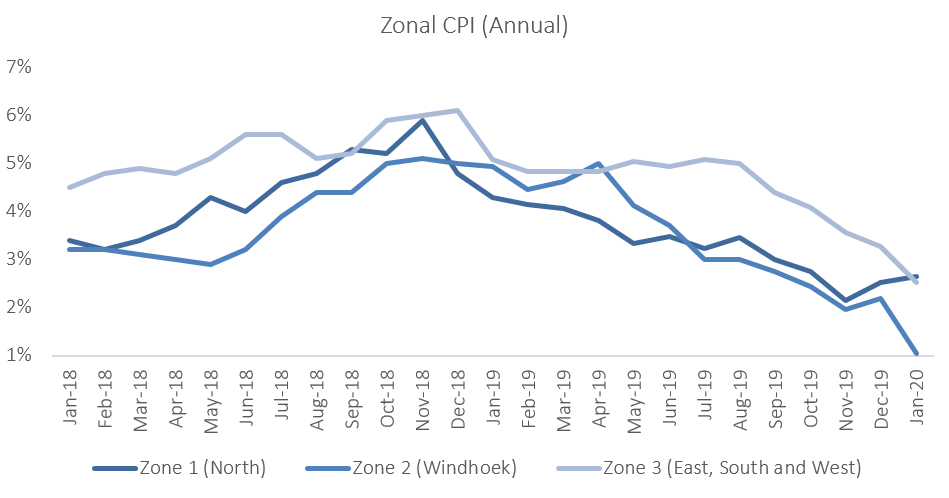

According to the zonal data, the northern regions of the country recorded the highest rate of inflation in January at 1.2% m/m and 2.6% y/y. The central region recorded the lowest inflation rate at 0.2% m/m and 1.0% y/y, while the mixed zone 3 covering the south, east and west of the country recorded inflation of 0.5% m/m and 2.5% y/y.

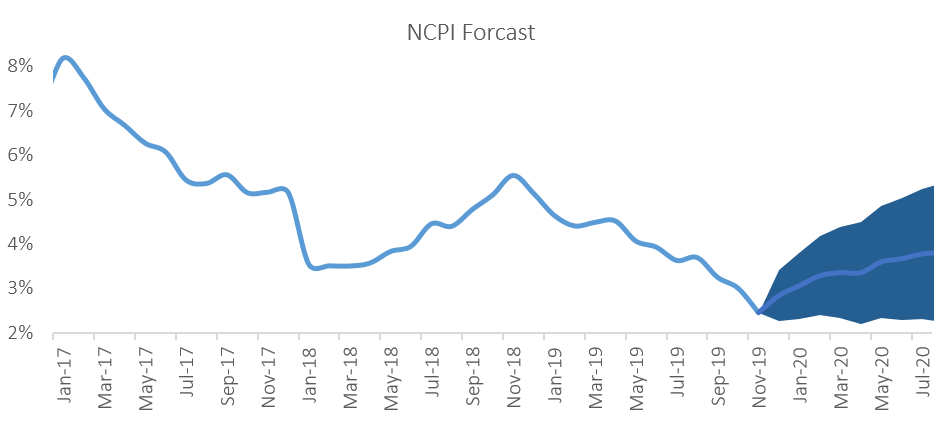

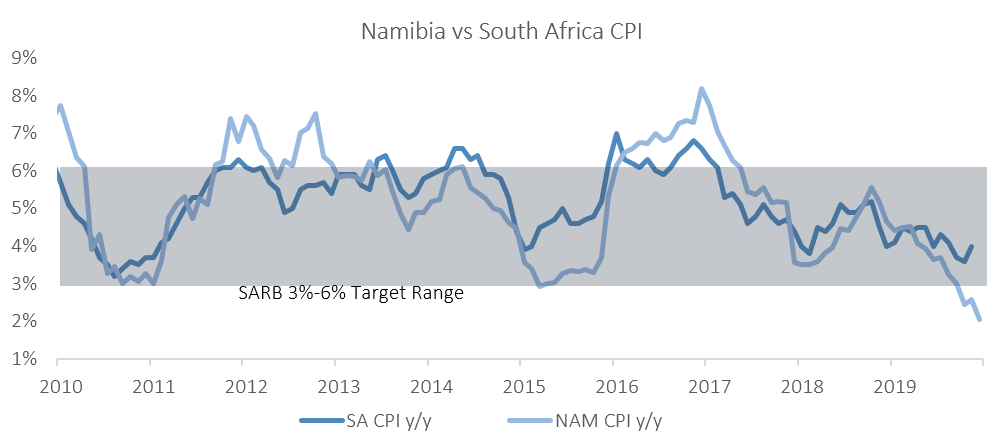

As the graph above depicts, Namibian annual inflation has been slowing almost consistently since November 2018, and is currently trending at levels last seen in 2005. January’s figure of 2.1% y/y is particularly low as a result of annual rental adjustments being put through. According to the NSA, the prices for the rental payments for dwellings sub-category declined by 1.5% y/y in January. As the tough economic conditions persist, it is ever more difficult for landlords to push up rental prices. As rental payments make up a large portion of the CPI basket, the deflationary adjustment means that Namibian annual inflation in 2020 is likely to be well below Namibia’s long run average. IJG’s inflation model forecasts an average inflation rate of 3.3% y/y in 2020. Lower expected inflation, coupled with low economic growth forecasts means that there is a lot of leeway for the Bank of Namibia’s MPC to cut the repo rate at its February meeting.