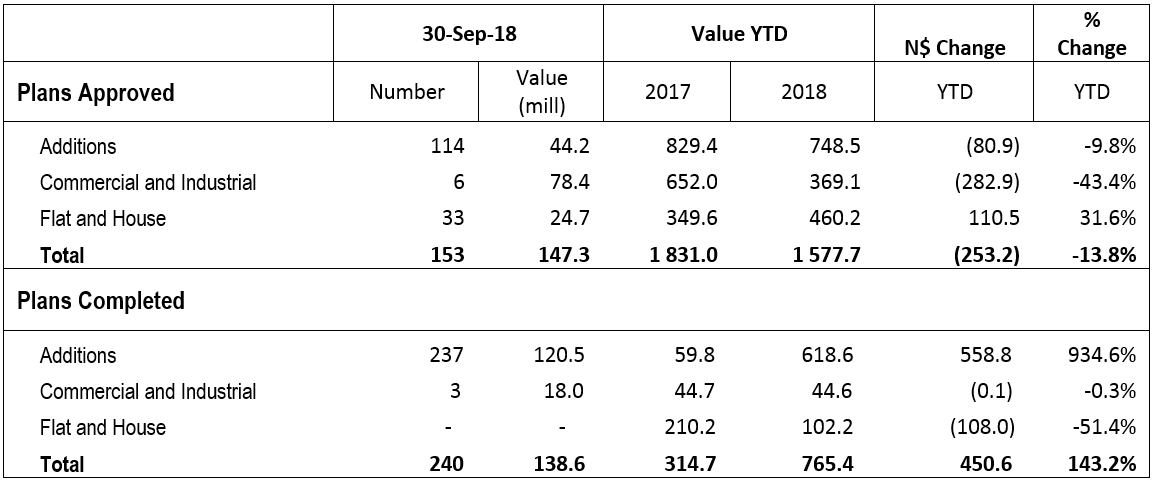

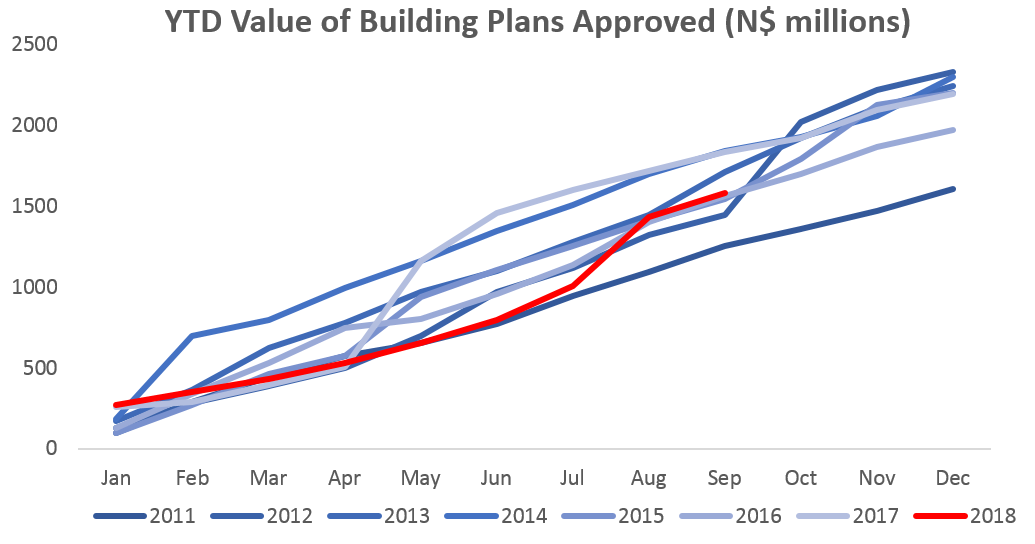

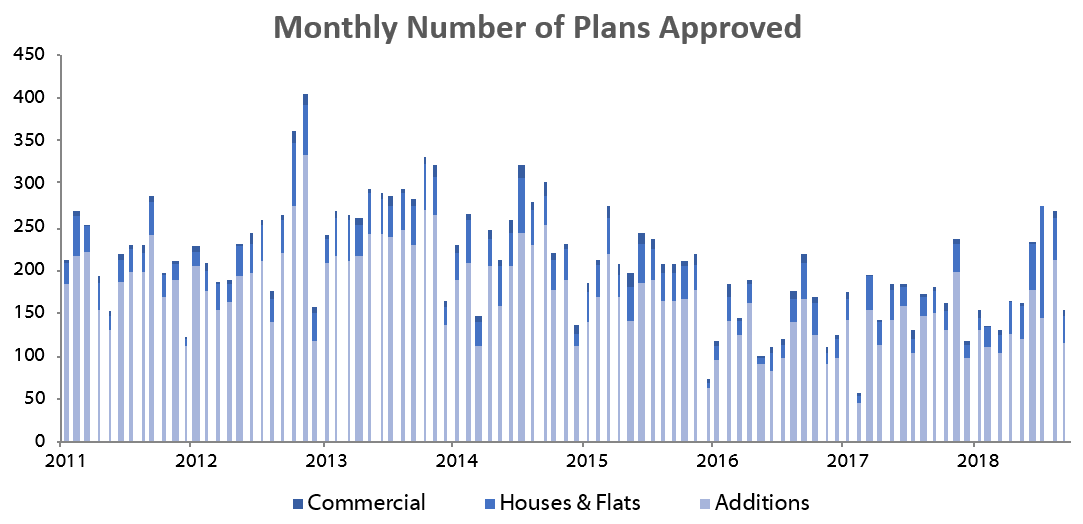

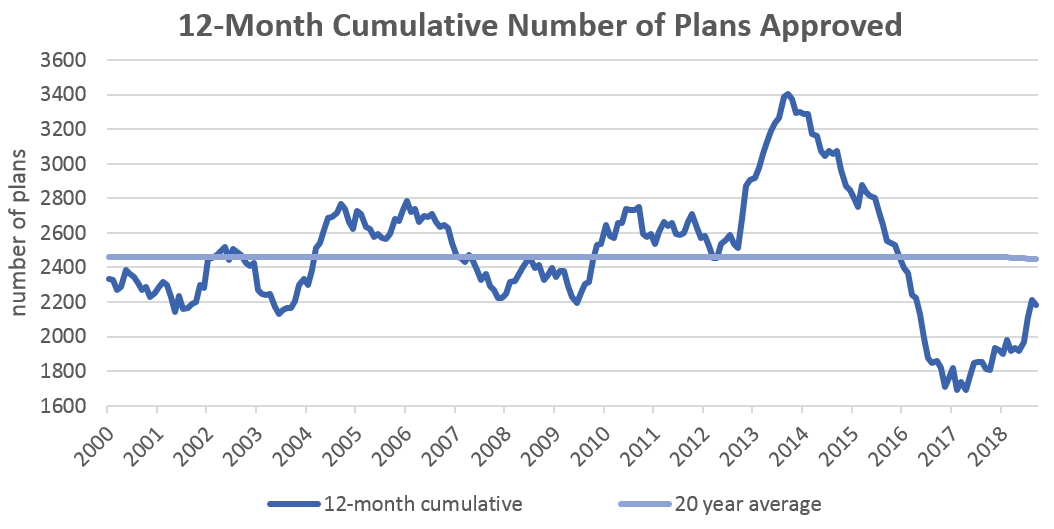

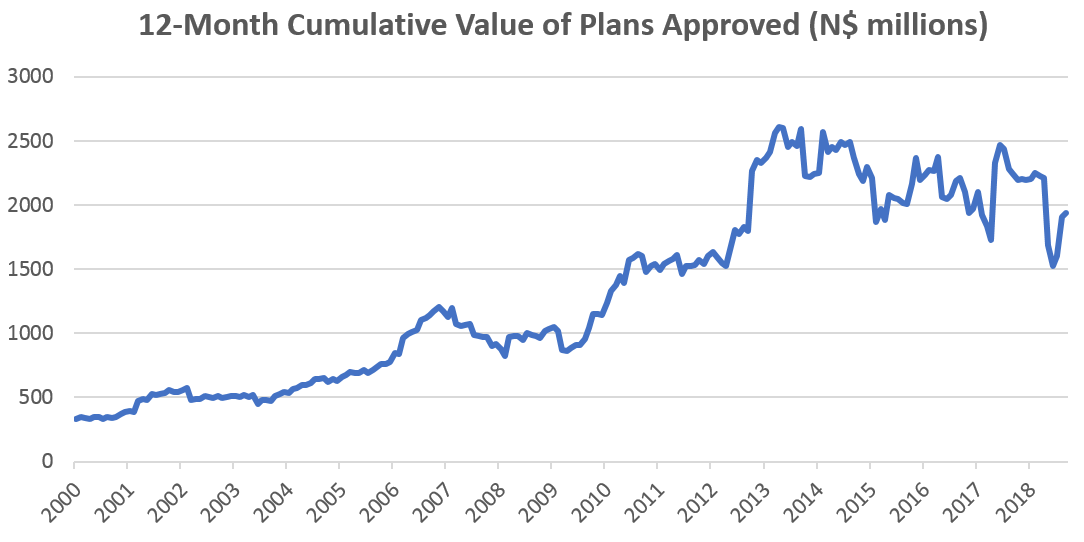

A total of 153 building plans were approved by the City of Windhoek in September, decreasing by 43.1% m/m and 15.5% y/y. In value terms, approvals decreased by N$276.2 million to N$147.3 million, representing a 65.2% m/m decline, but a 26.0% y/y increase. The number of completions for the month of September stood at 240, valued at N$138.6 million. The year-to-date value of approved building plans reached N$1.6 billion, 13.8% lower than the corresponding period in 2017. On a twelve-month cumulative basis, 2,184 building plans were approved, an increase of 20.4% y/y, worth approximately N$1.94 billion, a decrease of 13.6% in value terms over the prior 12-month period.

Additions to properties made up 114 out of the total 153 approved building plans recorded in September. This is a 46.5% m/m decrease in additions from the 213 additions recorded in August. Year-to-date 1,242 additions to properties have been approved with a value of N$748.5 million, declining 9.8% y/y in terms of value.

New residential units were the second largest contributor to building plans approved, with 33 approvals registered in September, a m/m decrease of 29.8% compared to the 47 residential units approved in August. Year-to-date, 397 new residential units have been approved, 78.0% more than during the corresponding period in 2017. In value terms, N$24.7 million worth of residential units were approved in September, 73.3% less than the N$92.5 million worth of residential approvals in August. The year-to-date value of residential approvals reached N$460.2 million, 31.6% higher than during the first three quarters of 2017.

Commercial and industrial building plans approved amounted to 6 units, worth N$78.4 million for September. Year-to-date, 34 plans for commercial and industrial purposes have been approved which is two more than in the corresponding period in 2017. On a rolling 12-month perspective the number of commercial and industrial approvals have increased to 52 units worth N$414.4 million as at September, compared to the 46 approved units worth N$711.6 million over the corresponding period a year ago.

On a 12-month cumulative basis, 2,184 building plans were approved by September, an increase of 20.4% y/y. In value terms however, approvals are down 13.6% y/y over the same period. The latest private sector credit extension data showed that mortgage loans extended to corporates contracted remained flat m/m in August, but rose by 1.1% m/m for individuals.

The outlook for short to medium term growth in the construction sector remains bleak. If implemented, the proposed changes to the income tax legislation is very likely to have a negative impact on economic growth. Increasing tax rates on businesses, coupled with continued fiscal consolidation by government, means that no substantial growth in capital expenditure on expansionary projects can be expected.