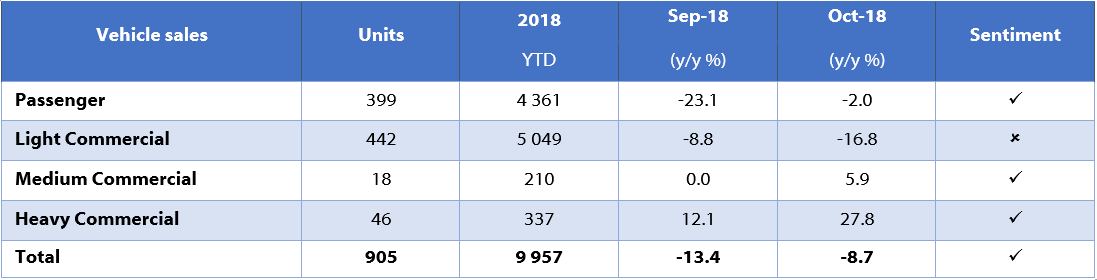

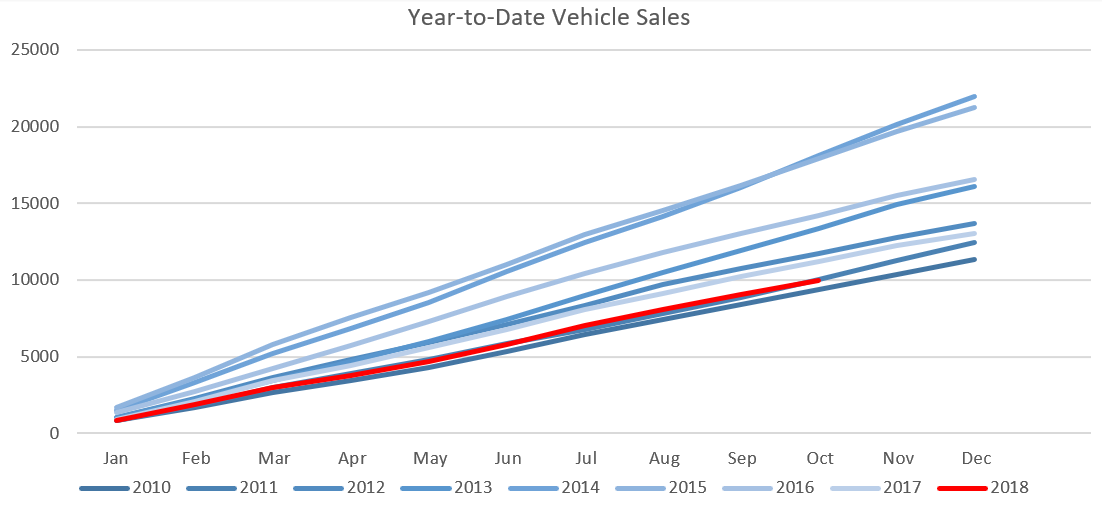

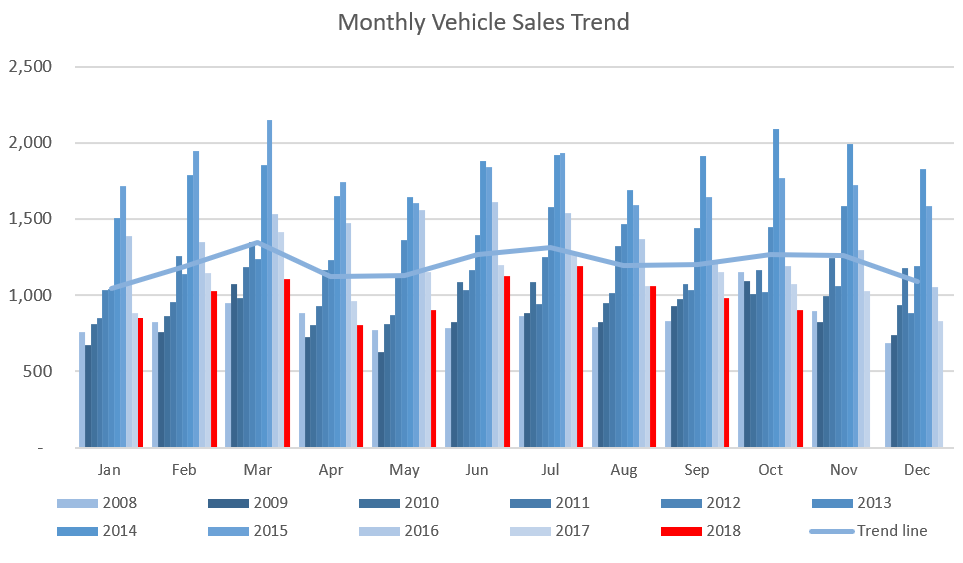

905 New vehicles were sold in October, representing a 7.8% decrease from the 982 vehicles sold in September, and an 8.7% decrease from October 2017 when 991 new vehicles were sold. Year-to-date 9,957 vehicles have been sold of which 4,361 were passenger vehicles, 5,049 light commercial vehicles, and 547 medium and heavy commercial vehicles. On a twelve-month cumulative basis, a total of 11,793 new vehicles were sold as at 31 October 2018, which represents a contraction of 13.1% from the 13,565 sold over the comparable period a year ago. New vehicle sales are thus still in decline despite the low base set in 2016 and 2017.

A total of 399 new passenger vehicles were sold during October, increasing by 19.8% m/m but declining by 2.0% y/y. Year-to-date passenger vehicle sales rose to 4,361, down 8.3% y/y. On a rolling 12-month basis new passenger vehicle sales were down 47.8% from the peak in April 2015.

Commercial vehicle sales reflect a similar picture, declining by 13.4% year-to-date and 15.4% y/y on a rolling 12-month basis. A total of 506 new commercial vehicles were sold in October, representing a contraction of 22.0% m/m and 13.4% y/y. 442 Light commercial vehicles, 18 medium commercial vehicles, and 46 heavy commercial vehicles were sold during the month. Light commercial vehicle sales have dropped 16.8% y/y, while medium commercial sales rose 5.9% y/y, and heavy and extra heavy sales rose by 27.8% y/y. On a twelve-month cumulative basis, light commercial vehicle sales dropped 16.9% y/y, while medium commercial vehicle sales rose 0.83% y/y, and heavy commercial vehicle sales rose 0.2% y/y. This is the first month since November 2015 that medium commercial sales have showed positive growth on a twelve-month cumulative basis, and the first month since February 2016 that heavy commercial sales have showed positive growth on a twelve-month cumulative basis. The positive growth is negligible at this point but it is possible that a floor in medium and heavy commercial vehicle sales has been found as companies that have been sweating assets start to replace those vehicles.

Toyota continues to lead the market for new passenger vehicle sales in 2018 based on the number of new vehicles sold, claiming 34.2% of the market, followed by Volkswagen with a 28.2% share. They were followed by Hyundai and Kia at 5.8% and 4.8% respectively, while the rest of the passenger vehicle market was shared by several competitors.

Toyota also remained the leader in the light commercial vehicle space with a 57.8% market share, with Nissan in second place with a 17.3% share. Ford and Isuzu claimed 8.5% and 5.0%, respectively, of the number of light commercial vehicles sold thus far in 2018. Hino leads the medium commercial vehicle category with 42.4% of sales while Scania remains number one in the heavy and extra-heavy commercial vehicle segment with 36.8% of the market share year-to-date.

The Bottom Line

The cumulative number of new vehicle sales continued to contract on a 12-month basis, amounting to 11,793 at the end of October. Government’s continued commitment to fiscal consolidation does have a direct effect on the demand for new vehicles. Government vehicle expenditure has fallen from N$1.02 billion in the 2014/15 fiscal year to N$22.2 million in 2017/18. In his Mid-Term Budget Review Speech last month, finance minister Calle Schlettwein left the revised vehicle budget unchanged at N$11.9 million from the budget tabled in March. N$1.4 million is allocated to the Auditor General’s office for vehicles, N$10.0 million to Health and Social Services and N$500,000 to the Justice ministry. For the 2019/20 year, N$10.0 million is allocated to Health and Social Services for vehicles. These figures dim the prospects for new vehicle sales in the short- to medium-term.