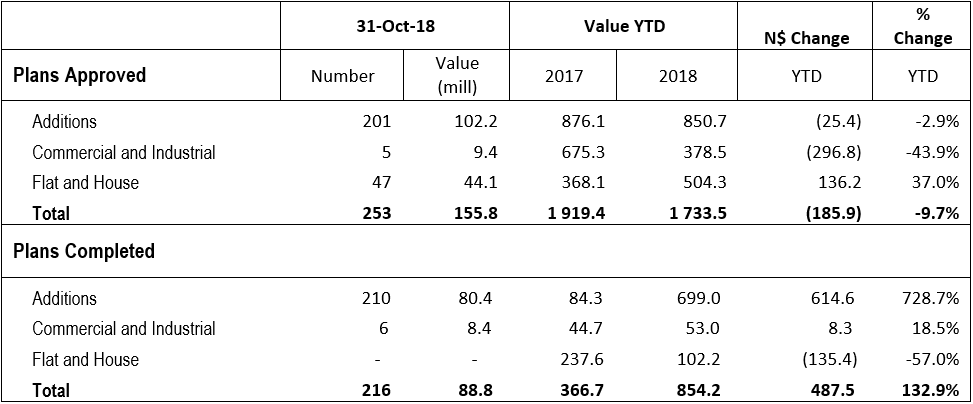

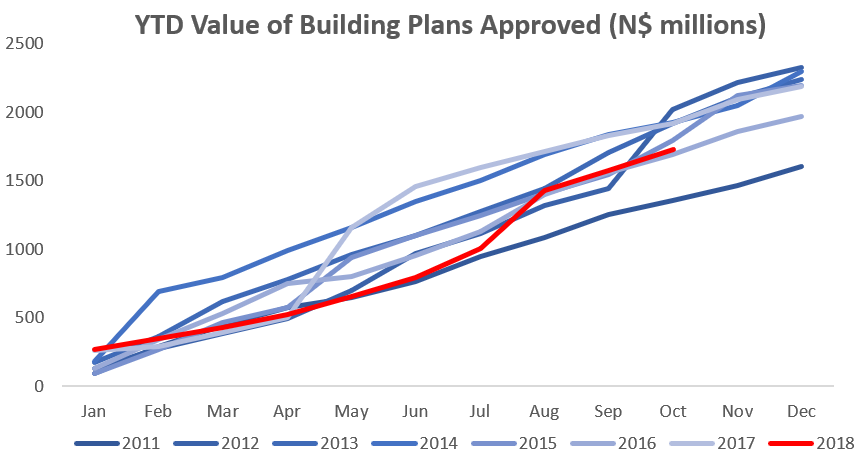

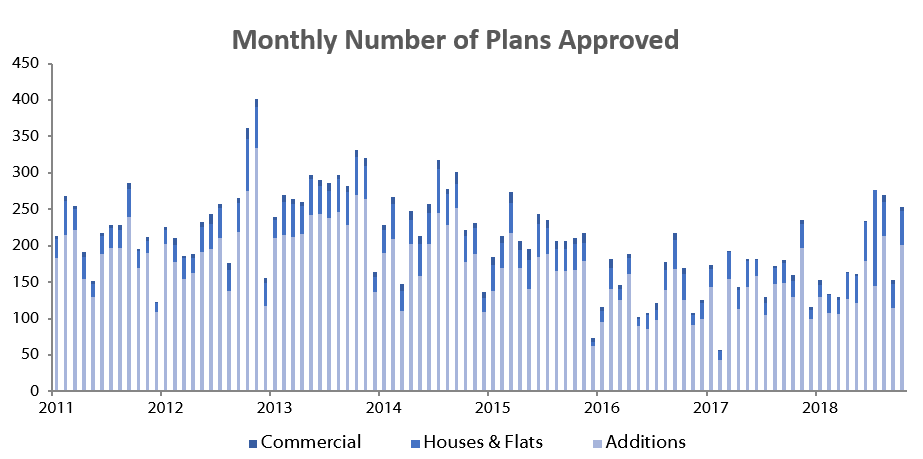

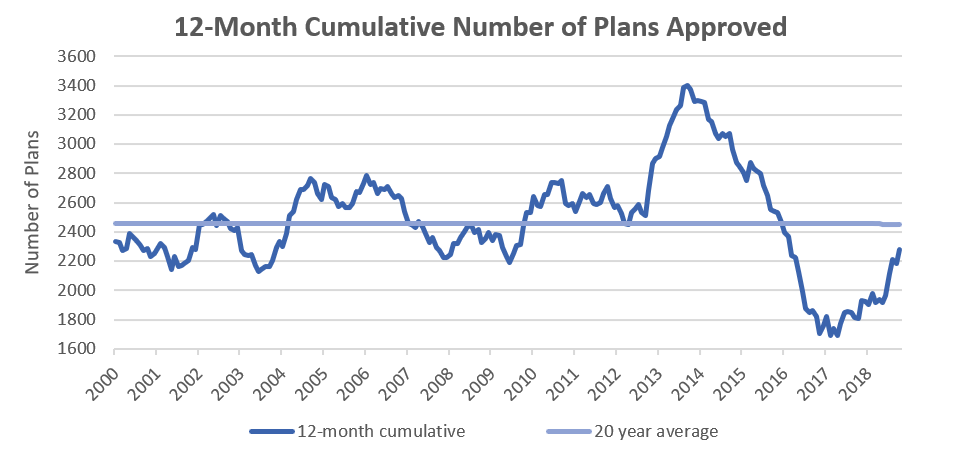

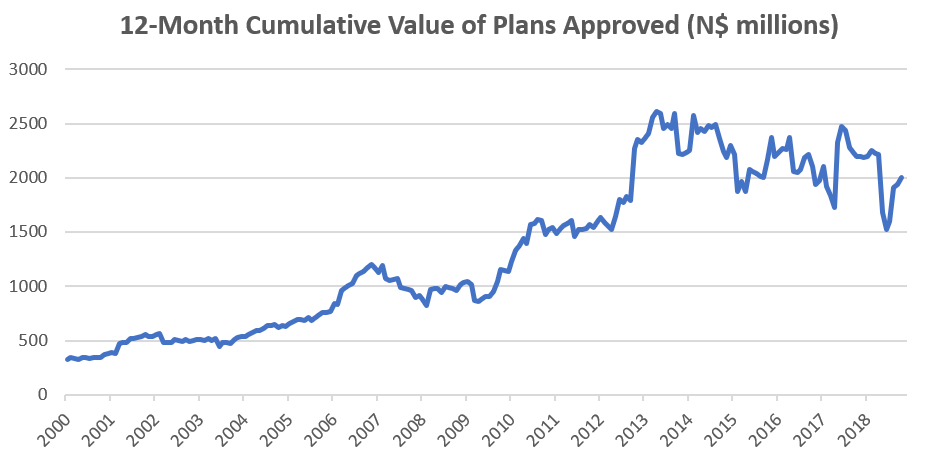

A total of 253 building plans were approved by the City of Windhoek in October, which is 100 more than in September. The value of building plans approved in October was N$155.8 million, an increase of 5.8% from the N$147.3 million worth of approvals in September. A total of 216 buildings with a total value of N$88.8 million were completed during October. On a year-to-date basis, 1,926 plans have been approved, 354 more than over the same period last year. The year-to-date value of approved building plans currently stands at N$1.73 billion, which is 9.7% lower than during the corresponding period in 2017. On a twelve-month cumulative basis, 2,277 building plans were approved worth approximately N$2.01 billion, 8.6% lower in value terms than this time last year.

The largest portion of building plan approvals was once again made up of additions to properties, from both a number and value perspective. 201 additions were approved in October, a 54.6% m/m increase over September and almost matching the number of additions approved in August. Year-to-date 1,443 additions to properties have been approved with a cumulative value of N$850.7 million, a decline of 2.9% y/y in terms of value.

New residential units were the second largest contributor to building plans approved, with 47 approvals registered in October, 14 more than in September. 444 new residential units have been approved year-to-date, 200 more than during the corresponding period in 2017. In dollar terms, N$504.3 million worth of residential plans have been approved year-to-date, an increase of 37.0% when compared to the same period last year.

5 Commercial and industrial building plans were approved in October, worth N$9.4 million. This is one fewer than in the prior month, and a decrease of 88.0% m/m and 59.5% y/y in value terms. The number of new commercial units approved thus far in 2018 stands at 39 with a total value of N$378.5 million. This compares to 41 units valued at N$675.3 million approved over the same period in 2017. On a 12-month cumulative basis, the number of commercial and industrial approvals has increased by 2.1% y/y in October to 48 units, worth approximately N$400.6 million, a decrease of 44.3% in value terms over the prior 12-month period.

On a rolling 12-month basis, the number of building plan approvals have been ticking up since the end of last year. The majority of these approvals are additions to properties which are of low relative value, meaning that in value terms there is still stagnation in the amount of overall investment into the property market. Additions to properties are generally attributable to individuals and the increase in number and value of additions over the last year signals a return of some consumer confidence, although still fragile. We expect consumer confidence to lead business confidence, which, according to the building plans data, still seems to be depressed.

We suspect that Namibia is reaching the bottom of the economic downturn with a number of high frequency indicators such as PSCE pointing to a bottoming out. We expect consumer confidence to translate to business confidence as demand picks up but signs of a widespread upswing in economic activity are still missing at present and global headwinds do pose an increased threat to recovery in the Namibian economy. The outlook for Namibia remains fragile as a result, but barring any external shocks, or poor policy decisions, the country should start emerging from recession in 2019, although at a sedate pace.