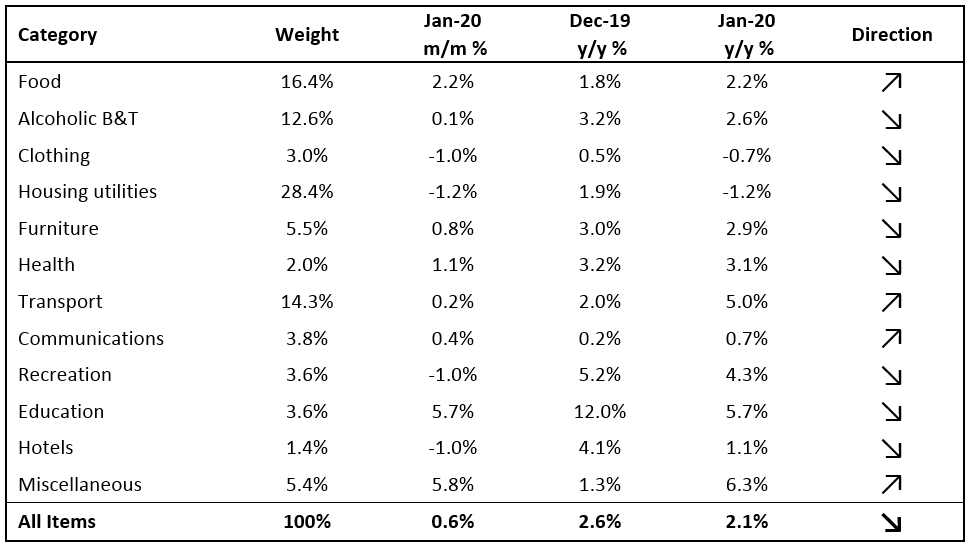

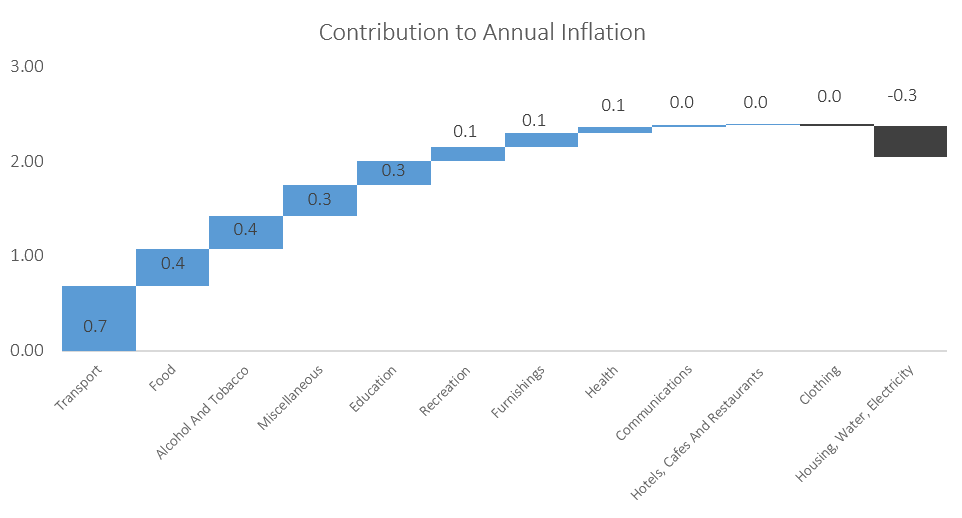

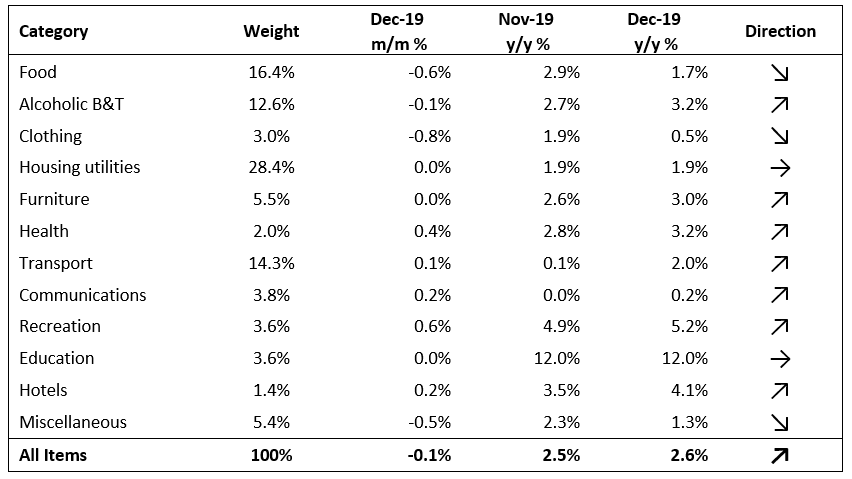

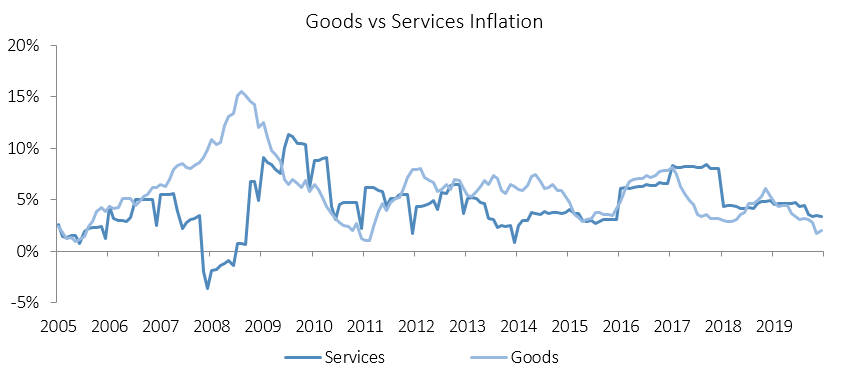

The Namibian annual inflation rate ticked up slightly to 2.5% y/y in February, following the 2.1% y/y increase in prices recorded in January. Prices in the overall NCPI basket increased by 0.3% m/m. Overall, prices in eight of the twelve basket categories rose at a faster annual rate than in January, while four categories rose at a slower annual rate. Prices for goods increased by 3.5% y/y and 1.1% y/y.

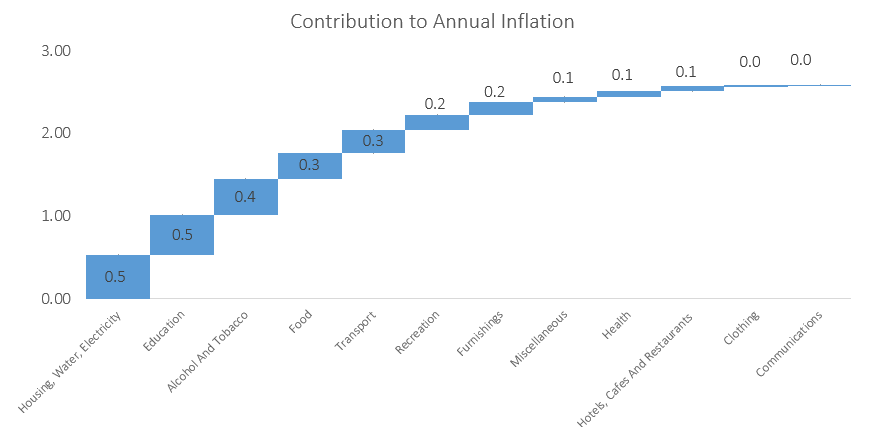

Transport, the third largest basket item by weighting, was once again the largest contributor to annual inflation, accounting for 0.6 percentage points of the total 2.5% annual inflation rate. The basket category recorded price increases of 0.2% m/m and 4.4% y/y. The purchase of vehicles subcategory saw price increases of 3.8% y/y, while the operation of personal transport equipment subcategory recorded price increases of 5.9% y/y.

The price of Brent crude has plummeted this week after Saudi Arabia and Russia triggered an oil production war, combined with fears of the global economic impact of the fast-spreading coronavirus. The price of Brent crude fell 28.0% to US$33.0 per barrel this week as both the Saudis and Russians have committed to flood the market with record amounts of oil, we expect the oil price to remain low for the next few months. We thus expect the Ministry of Mines and Energy to cut fuel prices over the next few months, which will lead to lower transport inflation in the coming months.

Food & non-alcoholic beverages prices increased by 1.0% m/m and 2.8% y/y in February, ticking op from inflation of 2.2% y/y recorded in January. Despite this relatively subdued rate of inflation, this basket category made up the second largest portion of annual inflation. Prices in all thirteen of the sub-categories recorded increases on an annual basis. The largest increases were observed in the prices of fruits which increased by 15.0% y/y and fish which increased by 8.2% y/y. We expect muted inflation in this category after most parts of the country received good rainfall during February which is likely to have a positive impact on local food production.

Alcoholic beverages and tobacco prices, was the third largest contributor to the annual inflation rate in February, with prices in the basket increasing by 0.4% m/m and 2.7% y/y. Tobacco prices recorded an increase of 0.4% m/m, but a decrease of 4.4% y/y, while prices for alcoholic beverages recorded an increase of 0.4% m/m and 4.4% y/y.

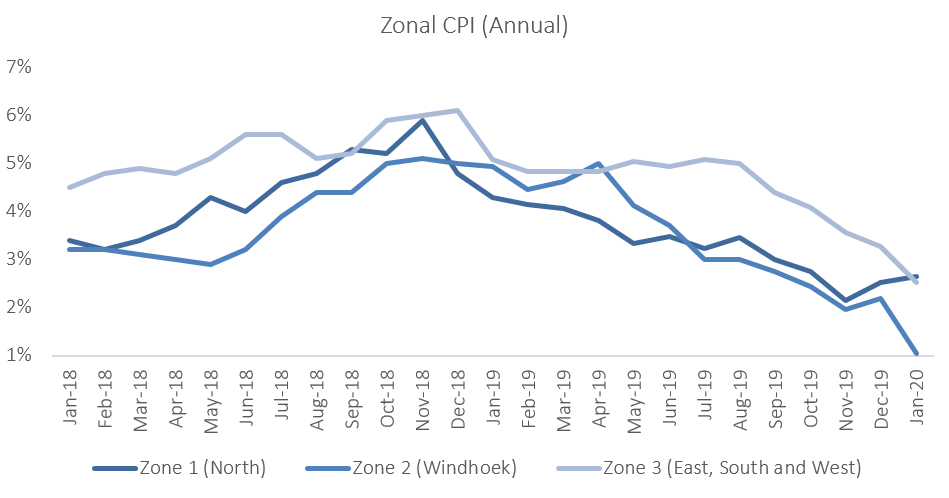

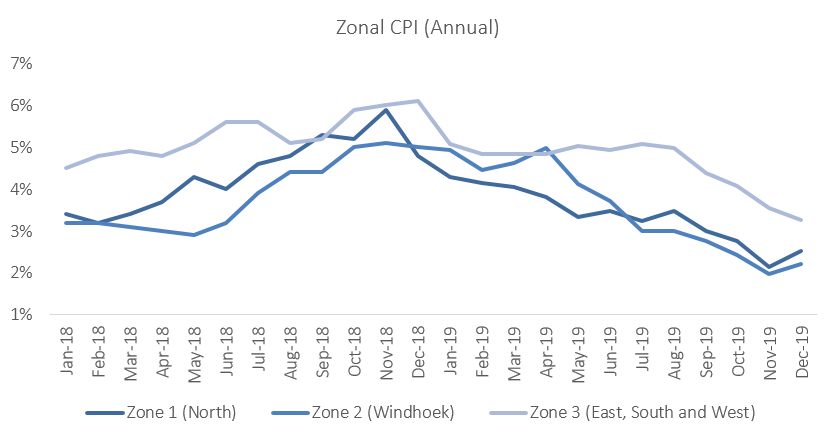

The zonal data shows that on a monthly basis, prices declined by 0.1% in the northern zone 1 while rising elsewhere in the country. On an annual basis the Windhoek and surrounding area, in zone 2, recorded the lowest inflation rate at 2.1% y/y in July, with the northern region recording the highest rate of annual inflation at 2.8% y/y. Inflation in zone 3 (Eastern, Southern and Western Regions) remained unchanged at 2.5% y/y.

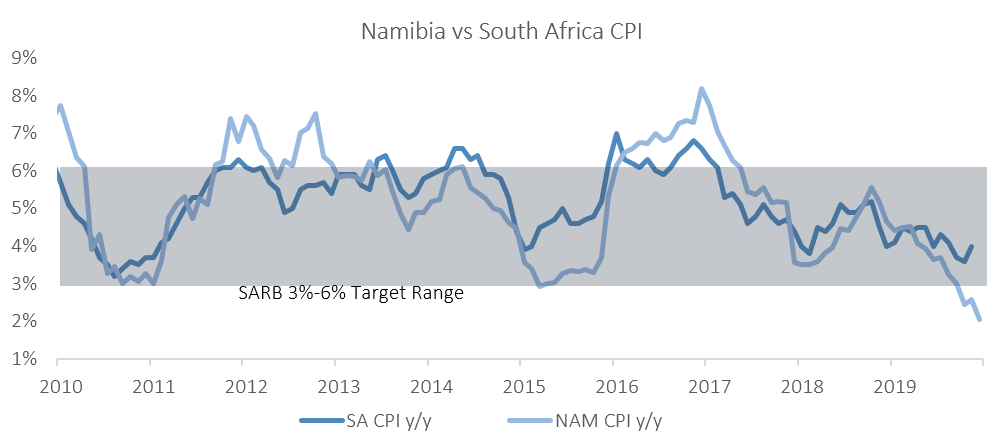

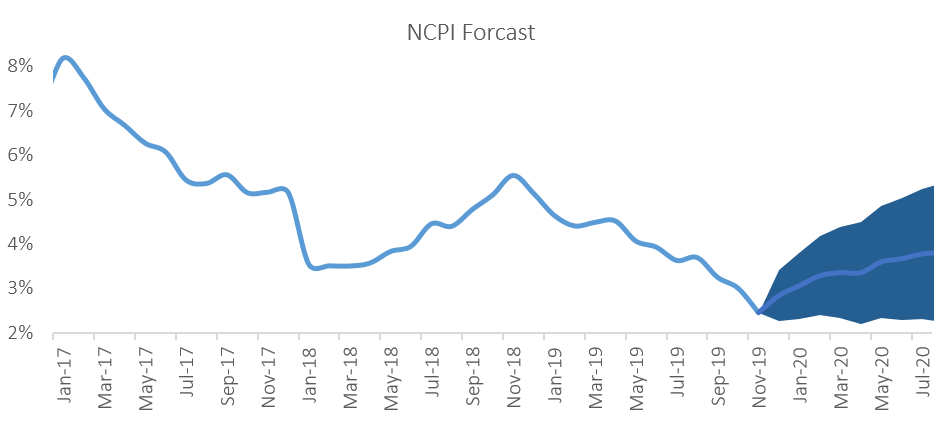

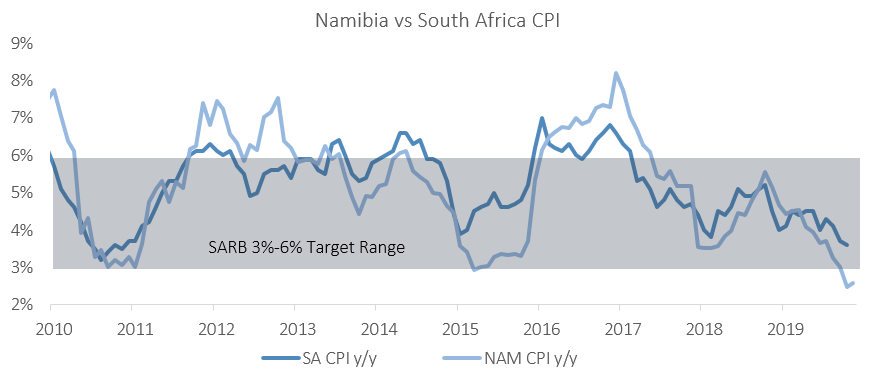

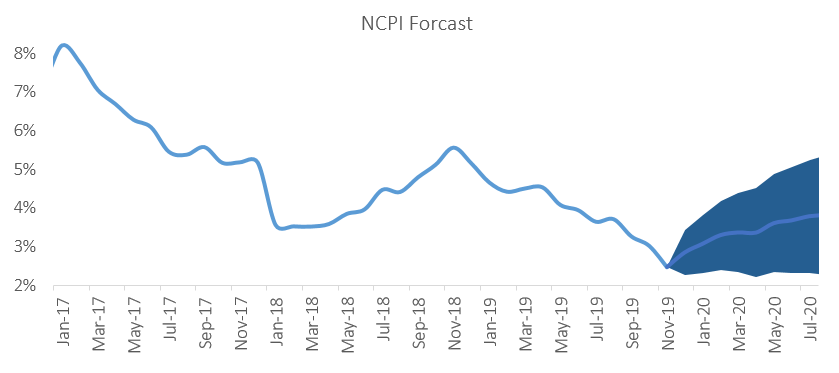

While the Namibian annual inflation print for February at 2.5% has ticked up from the 2.1% figure recorded in January, inflation remains at historically low levels. With low inflationary pressure due to adequate rainfall in most parts of the country, an oil-price war and a lack of domestic demand, we expect inflation to remain subdued in the coming months. IJG’s inflation model forecasts an average inflation rate of 2.8% y/y in 2020. This lower expected inflation and low economic growth forecasts means that there is still some leeway for both the South African Reserve Bank and the Bank of Namibia to cut repo rates at their next MPC meetings.