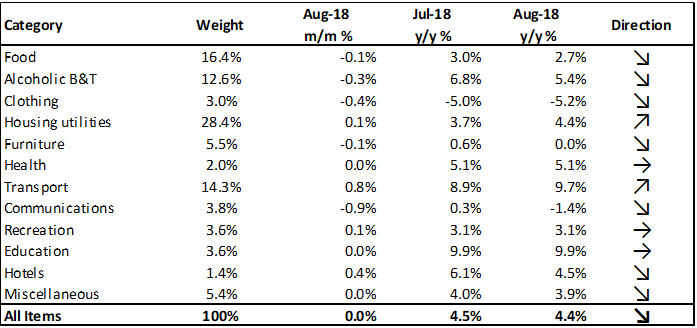

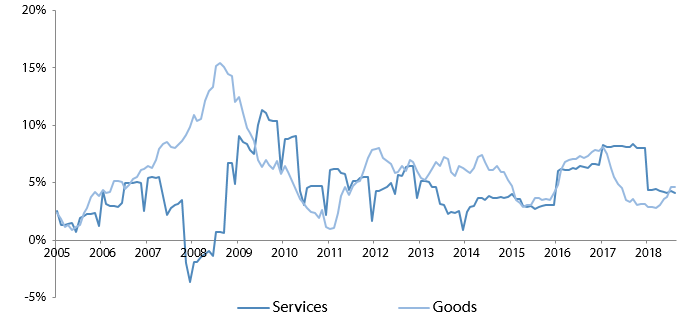

The Namibian annual inflation rate decreased to 4.4% in August, a slightly slower pace than the 4.5% y/y rate of increase in prices recorded in July. The overall NCPI basket registered no price increases on a month-on-month basis in August, following inflation of 0.5% m/m in July. On an annual basis prices in just two of the twelve basket categories rose at a quicker rate in August than in July. Slower rates of inflation in six categories largely contributed to the overall slower rate of increases recorded in August. The rate of inflation in three of the twelve categories remained unchanged. Prices for goods increased at a rate of 4.6% y/y in August, consistent with the July rate. Prices for services increased at a rate of 4.1% y/y following a 4.3% y/y increase in July.

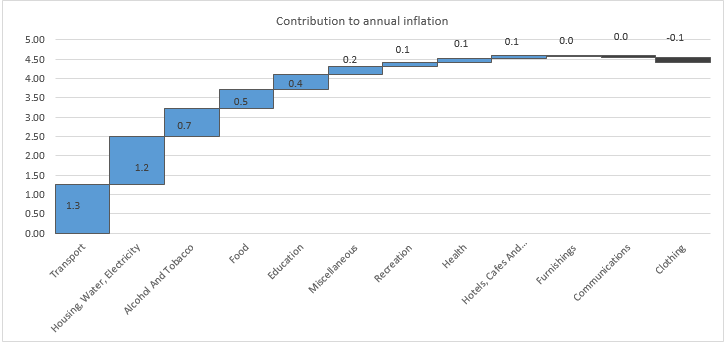

Just as it was in July, transport was the largest contributor to annual inflation in August, accounting for 1.3% of the total 4.4% annual inflation rate. On a monthly basis, transport prices increased at a rate of 0.8% in August, rising faster than the 0.6% m/m increase recorded in July. On an annual basis, transport prices increased by 9.7%, faster than the 8.9% y/y increase recorded in July. August has also been the third consecutive month in which transport prices have been increasing at a quicker annual pace. Prices in the three subcategories all recorded increases on a year-on-year basis. Prices relating to the purchase of vehicles increased at a rate of 7.9% y/y, while prices relating to the operation of personal transport equipment increased by 12.6% y/y. A 20% increase in taxi fares was approved in August and so will only reflect in the public transportation services subcategory from next month. This was the only subcategory that registered a slower pace of increase in August of 1.7% compared to 1.8% in July.

The transport category has been under pressure following consecutive months of fuel price hikes, with hikes in September being the latest. The price of Brent Crude oil has rallied since the start of August, following a drop in price for much of July. Currency weakness observed in August coupled with the increase in the price of Brent Crude oil drove the increase in fuel prices. As long as these pressures and under-recoveries remain, we expect that the ministry of mines and energy will continue hiking fuel pump prices.

The Housing and utilities category was the second largest contributor to annual inflation, due to its large weighting in the basket. Prices for this category increased by a rate of 0.8% m/m and 4.4% y/y. The electricity, gas and other fuels subcategory recorded the largest increase in prices at 13.2% y/y, faster than inflation of 8.4% y/y recorded in July. Month-on-month, prices in this subcategory increased by 0.5%. The water supply, sewerage service and refuse collection subcategory prices remained unchained on a monthly basis, while the regular maintenance and repair of dwellings subcategory showed prices decreasing at a rate of 0.4% m/m.

Prices for the alcoholic beverages and tobacco category increased at a rate of 5.4% y/y, but declined 0.3% m/m. Prices of alcoholic beverages increased at a rate of 5.8% y/y while tobacco prices increased at a rate of 3.8% y/y.

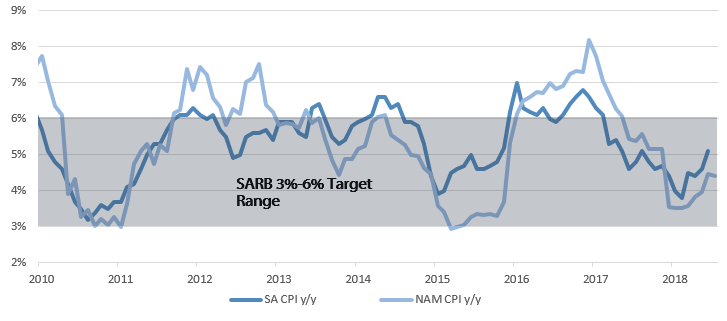

The Namibian annual inflation rate of 4.4% remains quite low seven months into 2018. It is also trending lower than that of neighbouring South Africa (July: 5.1% y/y). The factors putting upward pressure on inflation at present are currency weakness and the volatility in the price of Brent Crude oil. Tropical storms in the US (Hurricane Florence) is pilling doubt on US production, with expectations for limited supply, which is driving the oil price upward. Fears of Turkish and Argentinian troubles spreading further afield have resulted in prolonged emerging market bond and equity sell-offs. The EM risk-off sentiment has seen the rand weakening by over 17% from the start of August to a peak of R15.60/US$ during the first week in September. Effects of a weaker rand are passed through to Namibia by way of the currency peg. The uncertainty of how long this currency weakness will persist directly feeds into the SARB’s inflation forecast at a time when SA inflation is trending towards the SARB’s 6% upper boundary for annual inflation. If the SARB believes that inflation could break through its 6% target it is likely to hike interest rates in an attempt to rein in escalating inflation. Should the SARB hike rates we believe that the Bank of Namibia is likely to follow suit in order to maintain the reserve position. Higher interest rates will be a further drag on the already struggling Namibian economy.