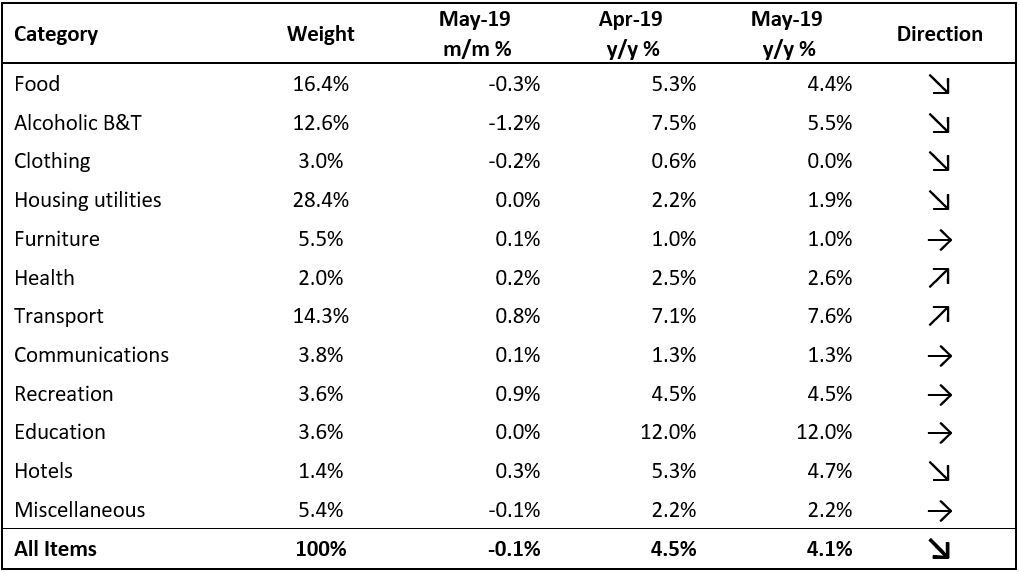

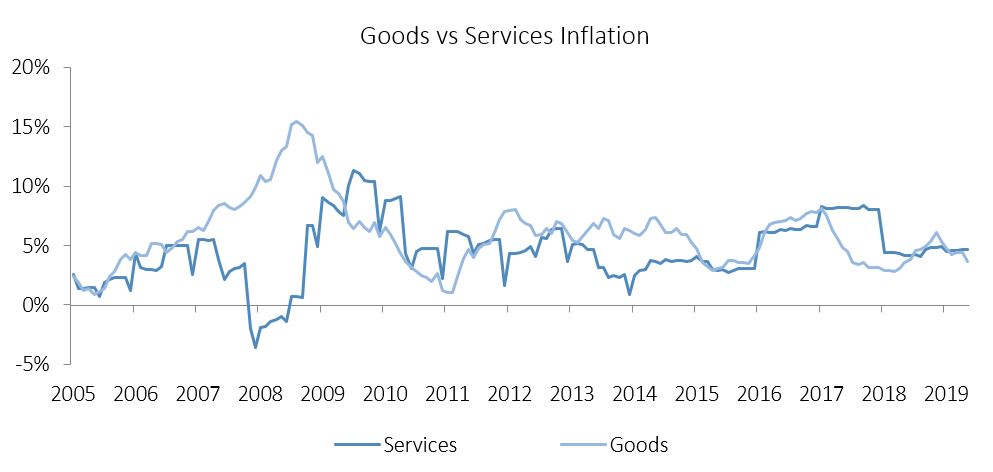

The Namibian annual inflation rate slowed to 4.1% y/y in April, from 4.5% in March. On a month-on-month basis prices decreased by 0.1%, following the 0.4% m/m increase in April. Overall, prices in only two of the basket categories rose at a faster annual rate than in April, price in five categories rose at a slower annual rate and five categories recorded steady inflation rates. Prices for goods rose by 3.7% y/y in May, while prices for services grew by 4.6% y/y.

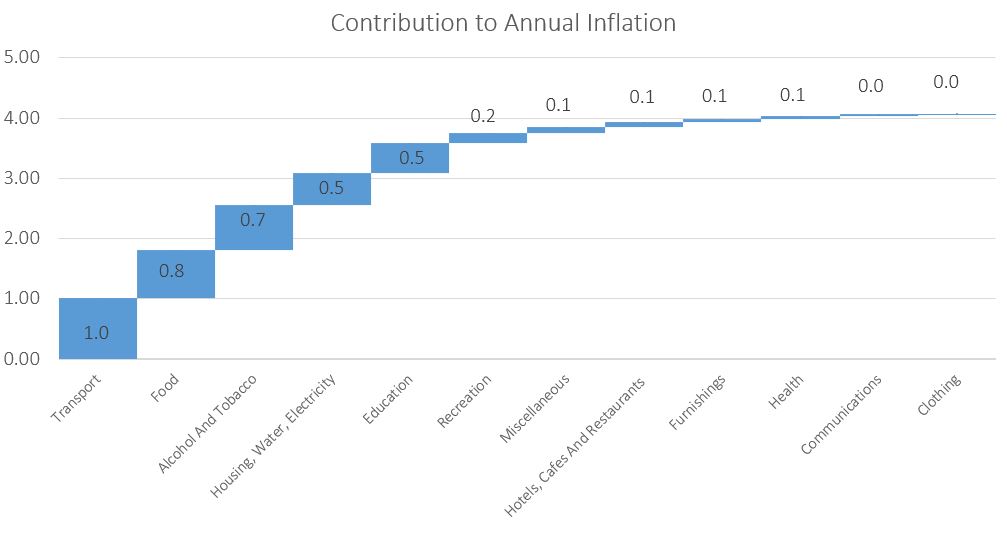

The transport basket was the largest contributor to annual inflation in May. Prices in the transport basket rose 0.8% m/m and 7.6% y/y during the month, reflecting the increase in fuel prices and taxi fares respectively. The cost of purchasing motor vehicles dropped by 1.0% m/m in May, with annual growth in vehicle prices recorded subdued growth of 4.1%. The cost of public transportation services has risen by 20.0% when compared to May last year, due to the increase in taxi fares in September. The operation of personal transport equipment, largely made up of fuel expenses, costs 1.9% more than in April, and 5.7% more than in May 2018.

Food and non-alcoholic beverages prices decreased by 0.3% m/m, although this basket of goods costs 4.4% more than it did last year. Despite this relatively subdued rate of annual inflation and contraction on a monthly basis, this basket category made up the second largest portion of annual inflation. The meat prices subcategory recorded price decreases of 1.7% m/m and 0.4% y/y, meaning that meat is cheaper on average than it was last month and in May last year. The decline in meat prices is not expected to last however, as it is largely driven by high supply of animals as farmers slaughter more during the drought. Restocking farms in the future will likely lead to upward pressure on meat prices. Fish prices saw even larger decrease in May, recording deflation of 5.0% m/m and 1.4% y/y.

Alcohol and tobacco prices decreased by 1.2% in May with annual price inflation in this basket category slowing to 5.5% from 7.5% in April. Tobacco prices recorded a decrease of 7.8% m/m and 3.4% y/y and thereby caused the slowdown in inflation in the overall category. This is very puzzling and no explanation for this decrease in prices is given by the NSA in its bulletin. Market dynamics have seen above average increases in the prices of tobacco products in recent years in order to maintain revenues as cigarette use declines. Prices for alcoholic beverages continued their upward trend in May, recording inflation of 0.3% m/m and 7.6% y/y.

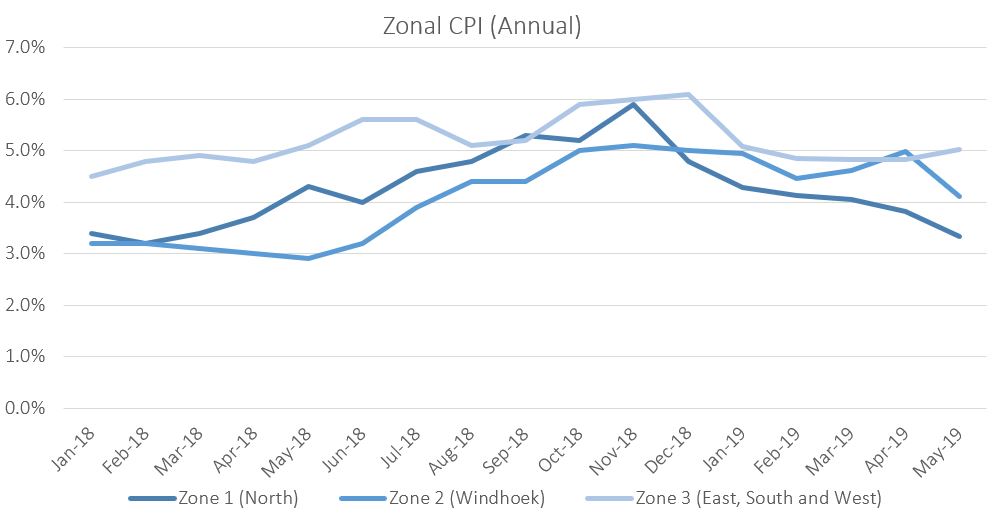

The Namibia Statistics Agency (NSA) released regional CPI data for Namibia for the first time in April, grouping the country into three zones, based on the then Central Bureau of Statistics’ (CBS) 2005 grouping. Zone 1 consists of regions in the northern part of the country, namely Kavango East, Kavango West, Kunene, Ohangwena, Omusati, Oshana, Oshikoto, Otjozondjupa and Zambezi. Zone 2 covers the Khomas region and Zone 3 covers the remaining //Karas, Erongo, Hardap, and Omaheke regions. This zonal data shows that on a monthly basis prices decreased in the central zone 2 while rising elsewhere in the country. On an annual basis the northern regions, in zone 1, recorded the lowest inflation rate at 3.3%, with the mixed zone 3 covering the east and west of the country recording the highest rate of inflation at 5.0%. Prices in zone 2 (Windhoek and surrounds) increased by 4.1% y/y.

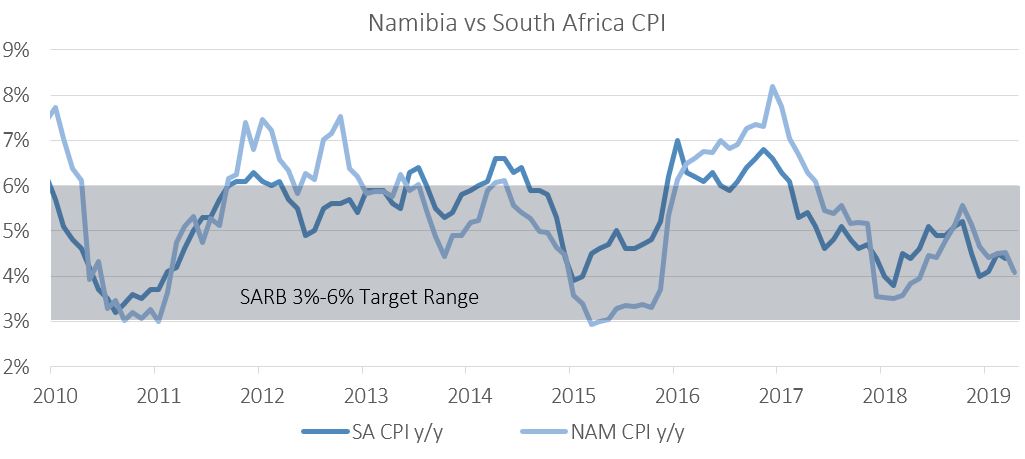

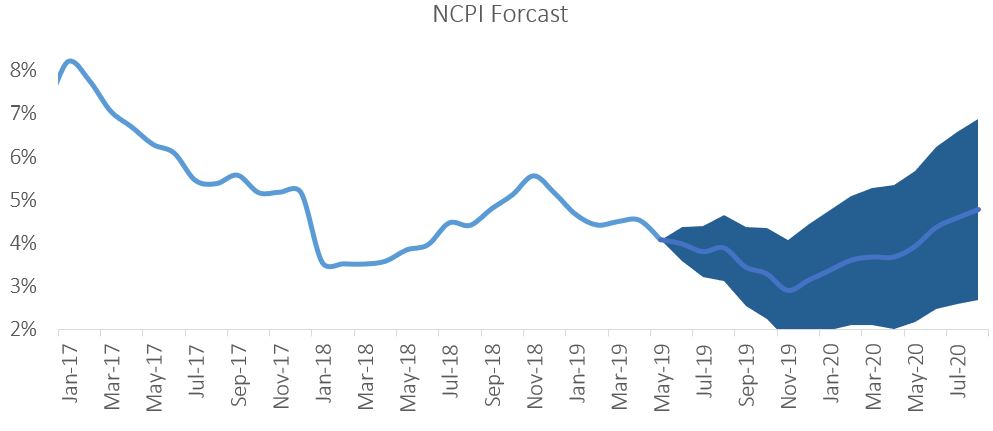

Low food price inflation and subdued housing and related inflation rates have contributed greatly to the low overall inflation figure in May. The moderate food price inflation comes as some relief to struggling households in the current economic climate. Aggregate demand in the Namibian economy remains depressed despite accommodative interest rates. Low aggregate demand is indeed responsible for much of the low price inflation experienced at present. Generally, depressed aggregate demand this is countered with monetary policy through interest rate cuts. This is however not an option for the Bank of Namibia (BoN) at present as decreasing rates to below those in neighbouring South Africa may put pressure on the reserve position and by extension the currency peg. As such monetary policy is currently restricted to what the South African Reserve Bank (SARB) implements across the border.

The SARB, expected to keep rates on hold for 2019 at the beginning of the year, is taking an ever more dovish tone as the year progresses. The last SARB monetary policy committee (MPC) decision was split 3:2 between members wanting to keep rates on hold and those calling for a cut, respectively. The market now expects two rate cuts of 25 basis points in South Africa in 2019. Should the SARB cut rates we believe that BoN will follow, bringing some relief to Namibian borrowers.

We do however not believe that a 50 basis point decrease in interest rates in Namibia will be enough to drive meaningful economic growth in the current policy environment. The policy uncertainty created over the last three years, combined with impending tax amendments, make the business climate in Namibia less conducive to growth and employment creation. In this environment monetary policy is likely to be less effective than during a growth slowdown free of these impediments to growth. Policy clarity thus remains the strongest tool available to government to turn around the Namibian economy.