Twitter Timeline

Twitter feed is not available at the moment.Categories

- Calculators (1)

- Company Research (281)

- Capricorn Investment Group (48)

- FirstRand Namibia (51)

- Letshego Holdings Namibia (23)

- Mobile Telecommunications Limited (6)

- NamAsset (3)

- Namibia Breweries (45)

- Oryx Properties (55)

- Paratus Namibia Holdings (5)

- SBN Holdings Limited (15)

- Economic Research (558)

- BoN MPC Meetings (4)

- Budget (19)

- Building Plans (119)

- Inflation (121)

- Other (27)

- Outlook (17)

- Presentations (2)

- Private Sector Credit Extension (119)

- Tourism (4)

- Trade Statistics (2)

- Vehicle Sales (122)

- Media (25)

- Print Media (15)

- TV Interviews (9)

- Regular Research (1,359)

- Business Climate Monitor (75)

- IJG Daily (1,169)

- IJG Elephant Book (12)

- IJG Monthly (101)

- Team Commentary (239)

- Danie van Wyk (60)

- Dylan van Wyk (27)

- Eric van Zyl (16)

- Hugo van den Heever (1)

- Leon Maloney (11)

- Top of Mind (4)

- Zane Feris (2)

- Uncategorized (2)

- Valuation (3,234)

- Asset Performance (94)

- IJG All Bond Index (1,409)

- IJG Daily Valuation (1,339)

- Weekly Yield Curve (391)

Meta

Category Archives: Vehicle Sales

New Vehicle Sales – May 2023

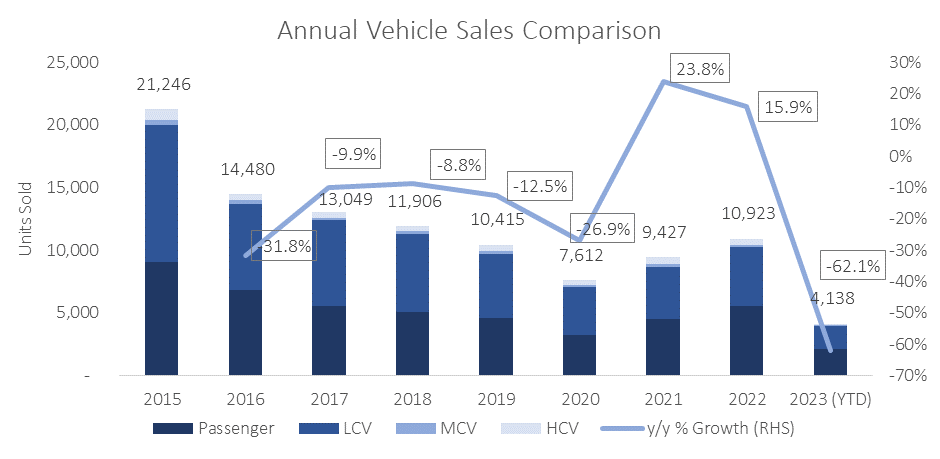

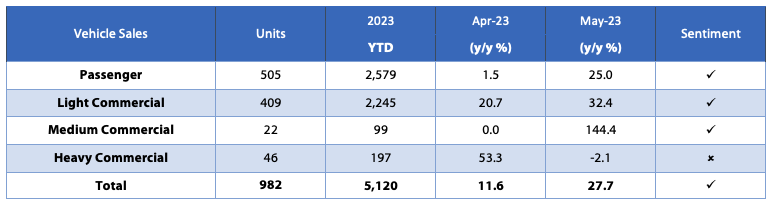

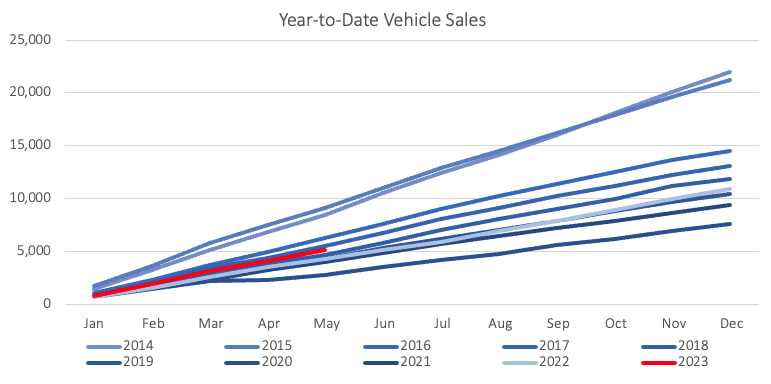

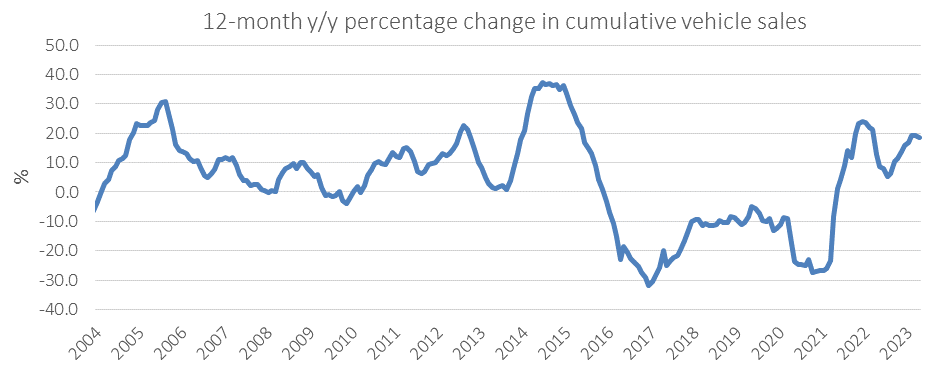

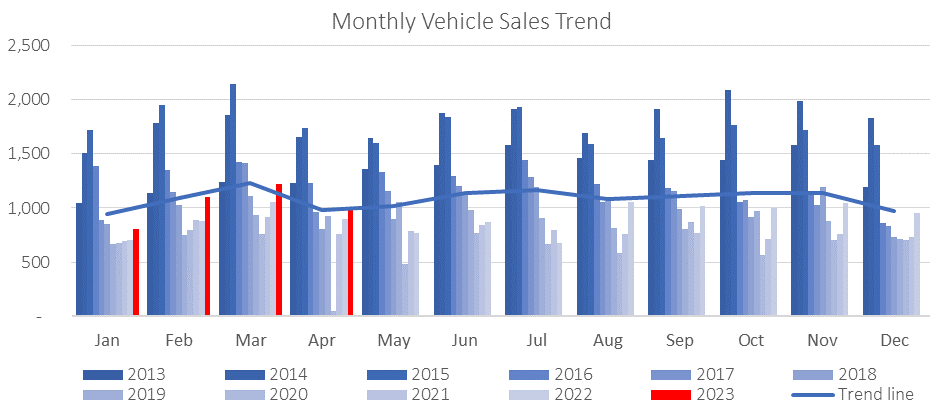

982 New vehicles were sold in May, down 2.2% m/m from the 1,004 vehicles sold in April, but 27.7% more than in May 2022. Year-to-date 5,120 new vehicles have been sold, of which 2,579 were passenger vehicles, 2,245 light commercial vehicles, and 296 medium- and heavy commercial vehicles. In comparison, 4,314 new vehicles were sold during the first 5 months of 2022, and 4,050 in 2021. On a twelve-month cumulative basis, a total of 11,729 new vehicles were sold at the end of May, representing a 21.0% y/y increase from the 9,691 sold over the comparable period a year ago.

During the month, 505 new passenger vehicles were sold, surpassing the 493 monthly average over the last twelve months. Passenger vehicle sales rose by 7.9% m/m and 25.0% y/y. Of the 17 manufacturers who sold new passenger vehicles in May, 10 recorded a higher number of sales than in April. Year-to-date, 2,579 new passenger vehicles have been sold, 15.1% more than at the same point last year. On a twelve-month cumulative basis, new passenger vehicle sales rose to 5,913, up 21.2% y/y from the 4,877 vehicles sold over the corresponding period a year ago, and the highest 12-month cumulative figure since July 2017.

A total of 477 new commercial vehicles were sold in May, a decline of 11.0% m/m but 30.7% more than in May 2022. This was the second consecutive month we saw commercial vehicle sales decline, with May’s figure coming in below the monthly average of 485 vehicles observed over the last twelve months. The 12-month cumulative commercial vehicle sales figure however continues to tick up, reaching 5,816 in May, an increase of 20.8% y/y, and the highest since March 2020. Light commercial vehicles continue to make up the bulk of the new commercial vehicle sales with 409 sold in May, followed by 46 heavy and extra heavy commercial vehicles and 22 medium commercial vehicles sold during the month.

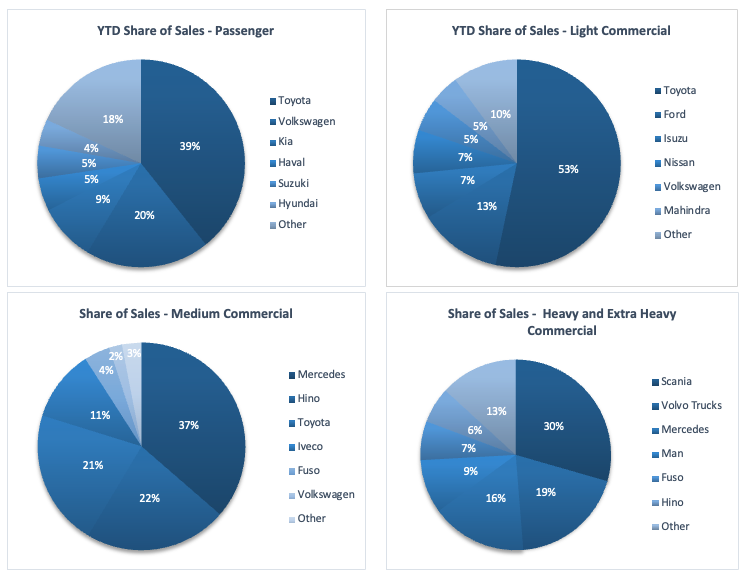

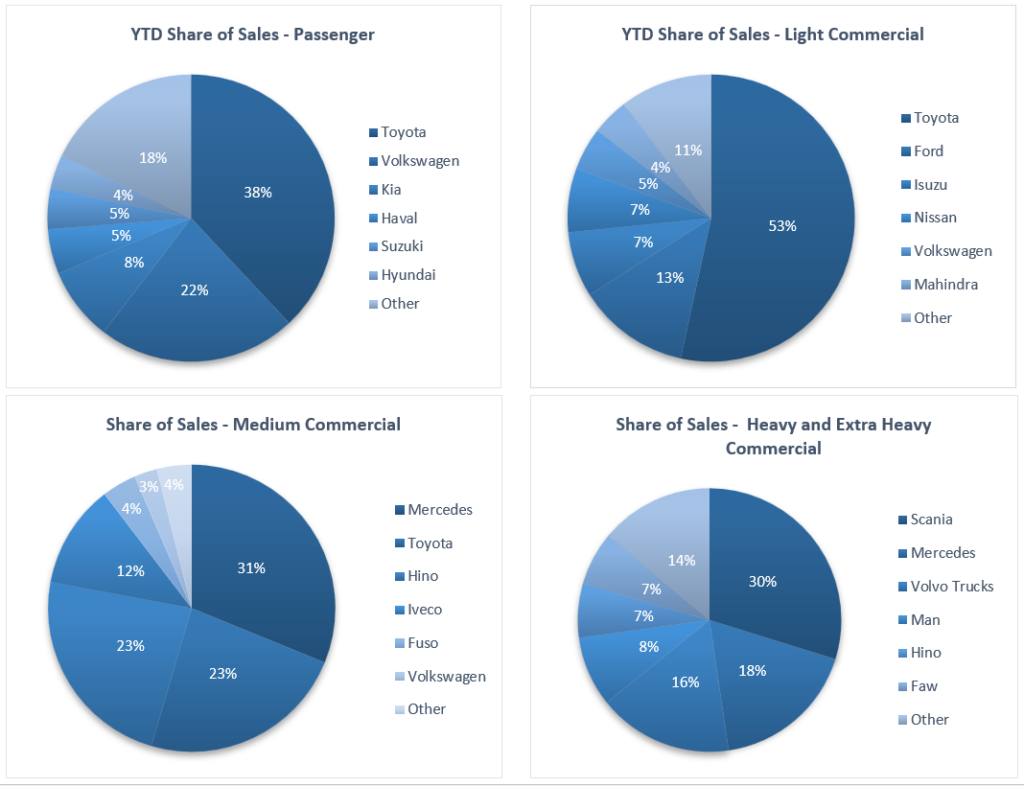

Toyota remains dominant in the new passenger vehicle sales segment with 39.3% of the segment sales year-to-date. The manufacturer has sold just over double the number of new passenger vehicles year-to-date than its closest competitor, Volkswagen. Volkswagen, which is sitting at 19.3% of segment sales year-to-date, is followed by Kia at 8.9%, and Haval and Suzuki, at 5.1% each.

Toyota also maintained its stronghold in the light commercial vehicle segment, claiming 53.3% of the sales year-to-date. Ford is next in line with 13.0% of the market share. Mercedes leads the medium commercial vehicle segment with 36.4% of the market share, while Scania remains on top in the heavy- and extra heavy commercial segment with 29.4% of the segment sales year-to-date

The Bottom Line

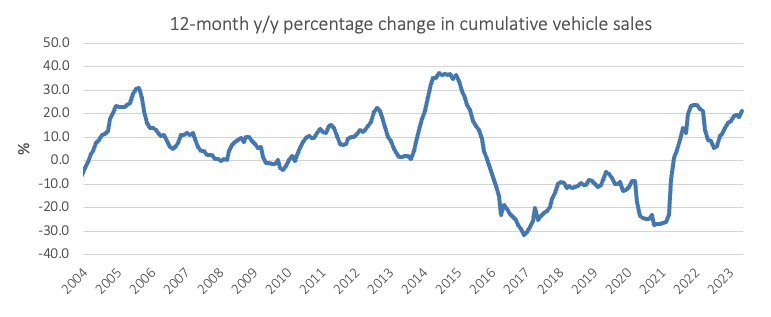

Despite coming in somewhat softer in May, new vehicle sales remain relatively strong, evidenced by the 12-month cumulative figure continuing to tick up month after month and trending around early 2019 levels. Both passenger and commercial vehicle segments have been recording positive year-on-year growth for 10 consecutive months, with rising interest rates seemingly doing little to dampen demand.

New Vehicle Sales – April 2023

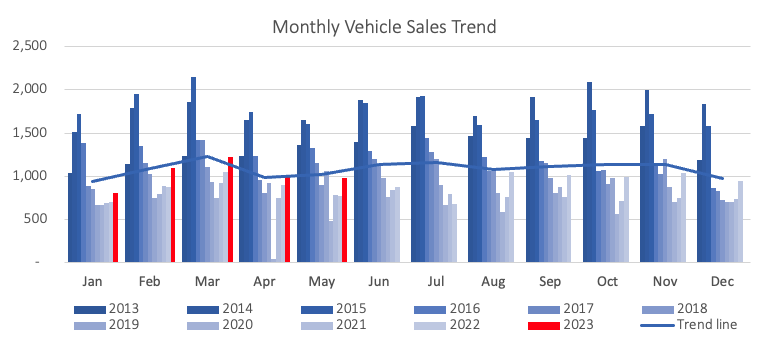

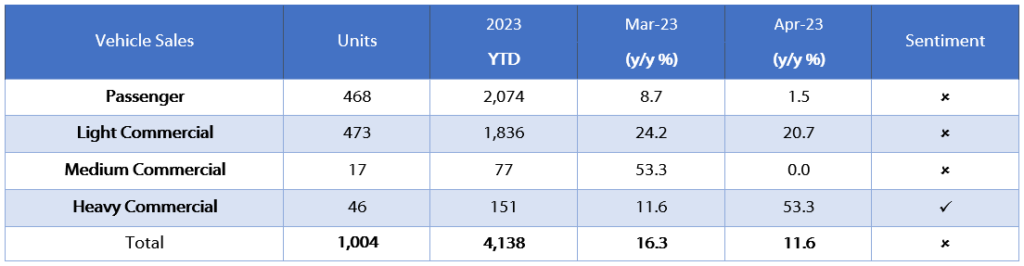

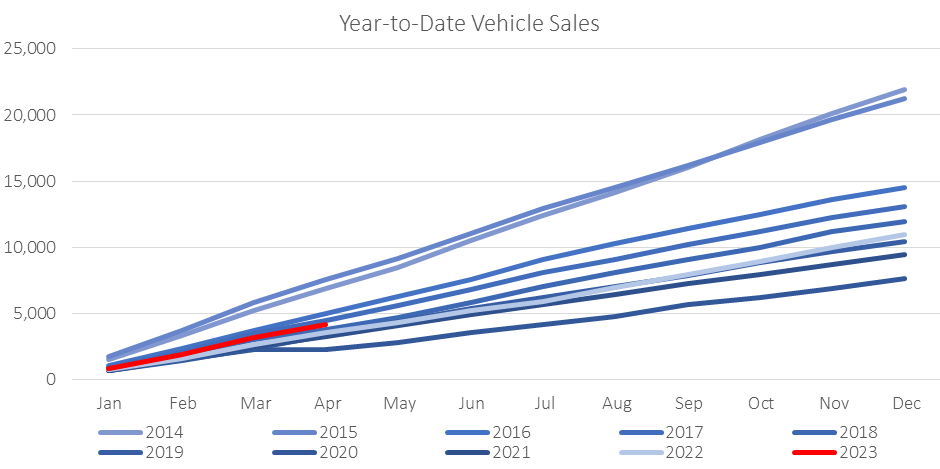

A total of 1,004 new vehicles were sold in April, down 18.11% m/m from the 1,226 vehicles sold in March, but 11.6% more than in April 2022. Year-to-date, 4,138 new vehicles have been sold, of which 2,074 were passenger vehicles, 1,836 light commercial vehicles, and 228 medium- and heavy commercial vehicles. On a 12-month cumulative basis, a total of 11,516 new vehicles have been sold at the end of April, representing an increase of 18.6% y/y from the 9,712 sold over the comparable period a year ago.

April saw 468 new passenger vehicles sold in total, an 18.6% m/m decline, but marginally higher (1.5%) than in the same month a year ago. Year-to-date, new passenger vehicle sales grew to 2,074, an increase of 13.0% compared to the 1,836 vehicles sold over the same period in 2022. On a 12-month cumulative basis, new passenger vehicle sales increased to 5,812, up 20.3% y/y from the 4,831 vehicles sold over the corresponding period a year earlier.

536 new commercial vehicle units were sold in April, representing a 17.7% m/m drop from the 651 units sold in March, but 22.1% more than in April 2022. Light commercial vehicles accounted for 473 of the total commercial vehicles sales in April, medium commercial vehicles sales came in at 17 units, and heavy and extra heavy commercial vehicles sales amounted to 46 units. All three categories witnessed fewer sales in April than in March. On an annual basis, light commercial vehicles sales grew by 20.7% y/y, heavy and extra heavy commercial vehicles sales increased by 53.3% y/y while sales in the medium commercial vehicle category remained steady. Year-to-date, 2,064 commercial vehicles have been sold, of which 1,836 were light commercial vehicles, 77 medium commercial vehicles and 151 heavy and extra heavy commercial vehicles. On a twelve-month cumulative basis, light commercial vehicle sales increased by 20.0% y/y to 4,983 units, medium commercial vehicle sales rose by 23.7% y/y to 235 units while heavy commercial vehicle sales came in at 486 units, representing a contraction of 9.7% y/y.

Toyota continues to show its dominance in the new passenger vehicle sales segment, after taking 38.0% of the market share year-to-date, followed by Volkswagen with 22.4% of the sales year-to-date. Kia and Haval are the best of the rest with 8.3% and 5.1% of the market share, respectively.

Toyota also asserted its dominance in the light commercial vehicle segment after claiming 53.4% of the sales year-to-date. Ford trailed in second place, taking up 12.6% of the market share. Mercedes continues to lead the medium commercial vehicle segment with 31.2% of the market share, while Scania remains on top in the heavy- and extra heavy commercial segment with 29.8% of the market share.

Demand for new vehicles remained relatively strong in April with the 1,004 new vehicles sold being the highest number of units sold in the month of April since 2016. The drop in April’s sales figure from the recent high of last month was somewhat expected as data from recent years suggest a tapering in monthly vehicle sales after peaking in March of each year. The 12-month new vehicle sales cumulative figure has climbed to its highest levels since May 2019 with annual growth in the 12-month cumulative sales showing signs of slowing as the graph above depicts. On a year-to-date basis, vehicle sales continue to trend just above 2018 levels.