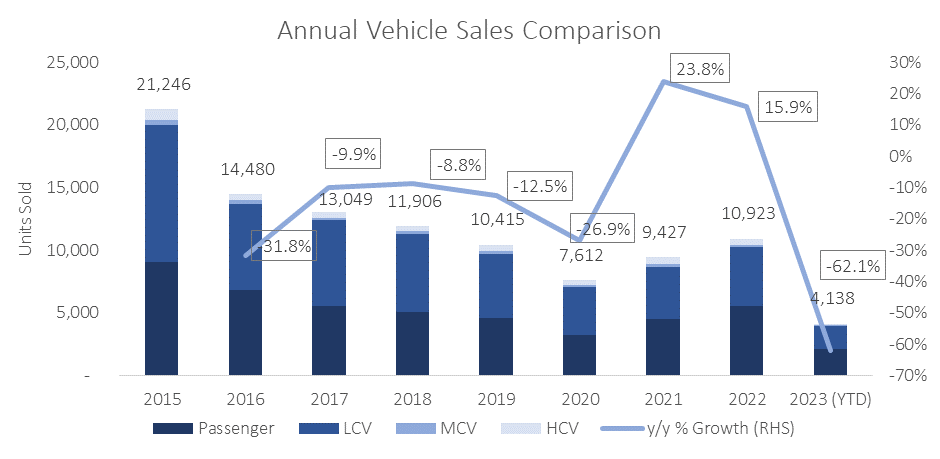

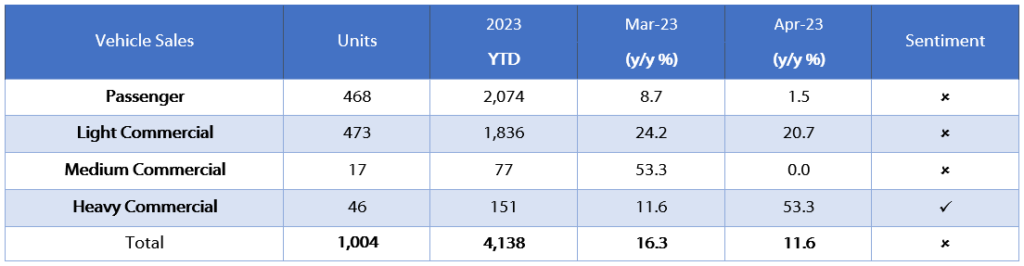

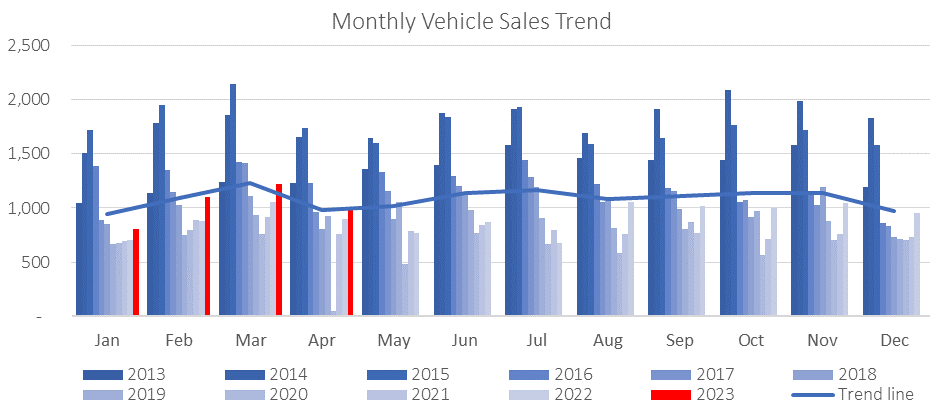

A total of 1,004 new vehicles were sold in April, down 18.11% m/m from the 1,226 vehicles sold in March, but 11.6% more than in April 2022. Year-to-date, 4,138 new vehicles have been sold, of which 2,074 were passenger vehicles, 1,836 light commercial vehicles, and 228 medium- and heavy commercial vehicles. On a 12-month cumulative basis, a total of 11,516 new vehicles have been sold at the end of April, representing an increase of 18.6% y/y from the 9,712 sold over the comparable period a year ago.

April saw 468 new passenger vehicles sold in total, an 18.6% m/m decline, but marginally higher (1.5%) than in the same month a year ago. Year-to-date, new passenger vehicle sales grew to 2,074, an increase of 13.0% compared to the 1,836 vehicles sold over the same period in 2022. On a 12-month cumulative basis, new passenger vehicle sales increased to 5,812, up 20.3% y/y from the 4,831 vehicles sold over the corresponding period a year earlier.

536 new commercial vehicle units were sold in April, representing a 17.7% m/m drop from the 651 units sold in March, but 22.1% more than in April 2022. Light commercial vehicles accounted for 473 of the total commercial vehicles sales in April, medium commercial vehicles sales came in at 17 units, and heavy and extra heavy commercial vehicles sales amounted to 46 units. All three categories witnessed fewer sales in April than in March. On an annual basis, light commercial vehicles sales grew by 20.7% y/y, heavy and extra heavy commercial vehicles sales increased by 53.3% y/y while sales in the medium commercial vehicle category remained steady. Year-to-date, 2,064 commercial vehicles have been sold, of which 1,836 were light commercial vehicles, 77 medium commercial vehicles and 151 heavy and extra heavy commercial vehicles. On a twelve-month cumulative basis, light commercial vehicle sales increased by 20.0% y/y to 4,983 units, medium commercial vehicle sales rose by 23.7% y/y to 235 units while heavy commercial vehicle sales came in at 486 units, representing a contraction of 9.7% y/y.

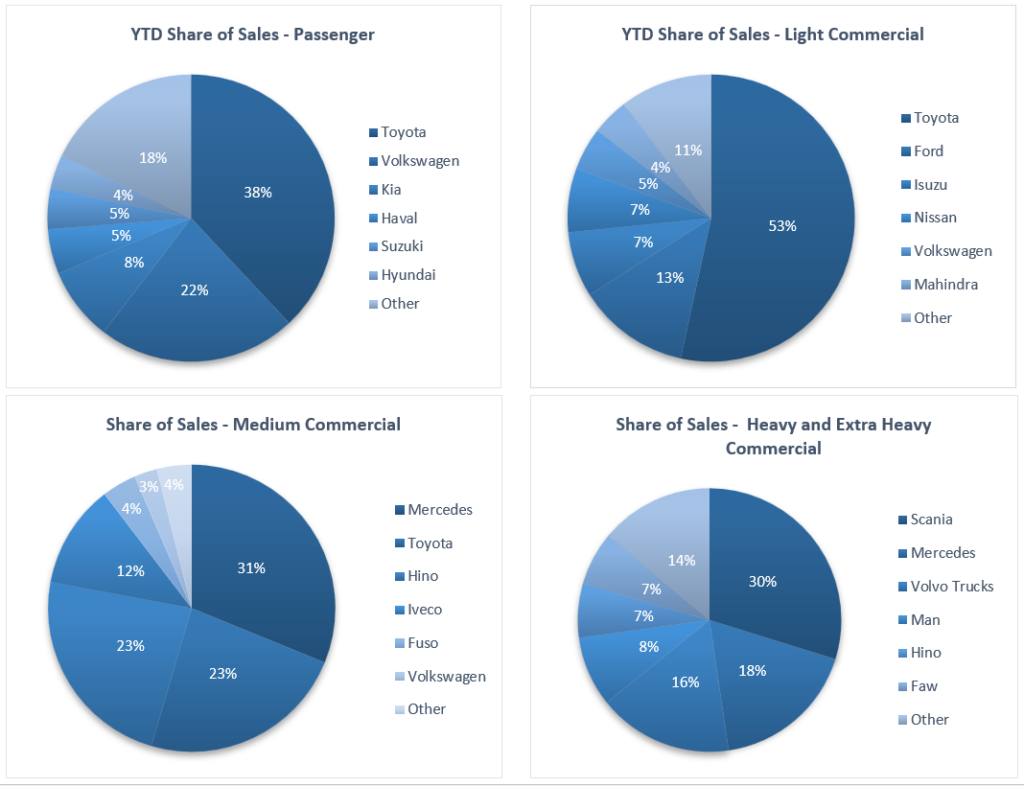

Toyota continues to show its dominance in the new passenger vehicle sales segment, after taking 38.0% of the market share year-to-date, followed by Volkswagen with 22.4% of the sales year-to-date. Kia and Haval are the best of the rest with 8.3% and 5.1% of the market share, respectively.

Toyota also asserted its dominance in the light commercial vehicle segment after claiming 53.4% of the sales year-to-date. Ford trailed in second place, taking up 12.6% of the market share. Mercedes continues to lead the medium commercial vehicle segment with 31.2% of the market share, while Scania remains on top in the heavy- and extra heavy commercial segment with 29.8% of the market share.

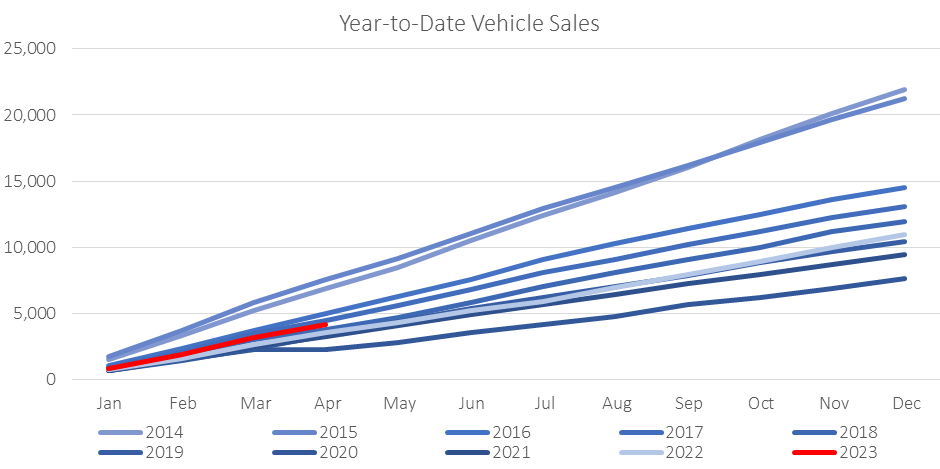

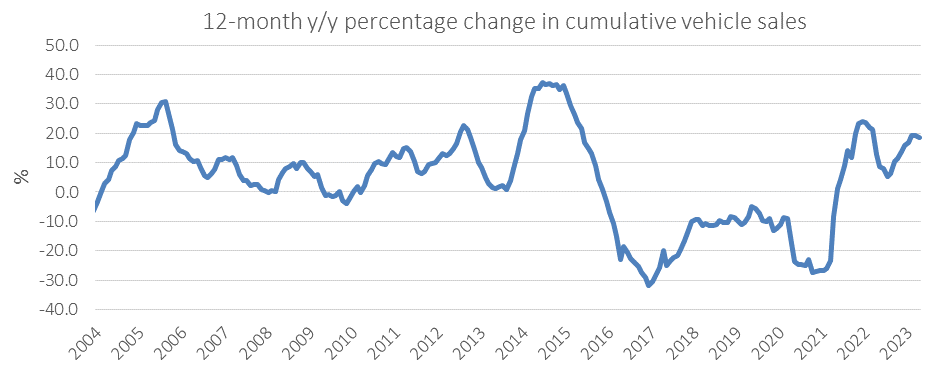

Demand for new vehicles remained relatively strong in April with the 1,004 new vehicles sold being the highest number of units sold in the month of April since 2016. The drop in April’s sales figure from the recent high of last month was somewhat expected as data from recent years suggest a tapering in monthly vehicle sales after peaking in March of each year. The 12-month new vehicle sales cumulative figure has climbed to its highest levels since May 2019 with annual growth in the 12-month cumulative sales showing signs of slowing as the graph above depicts. On a year-to-date basis, vehicle sales continue to trend just above 2018 levels.