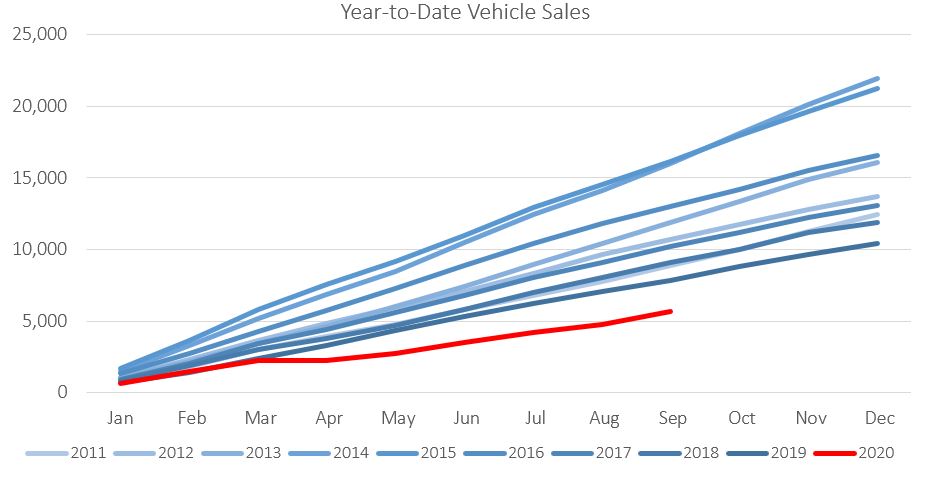

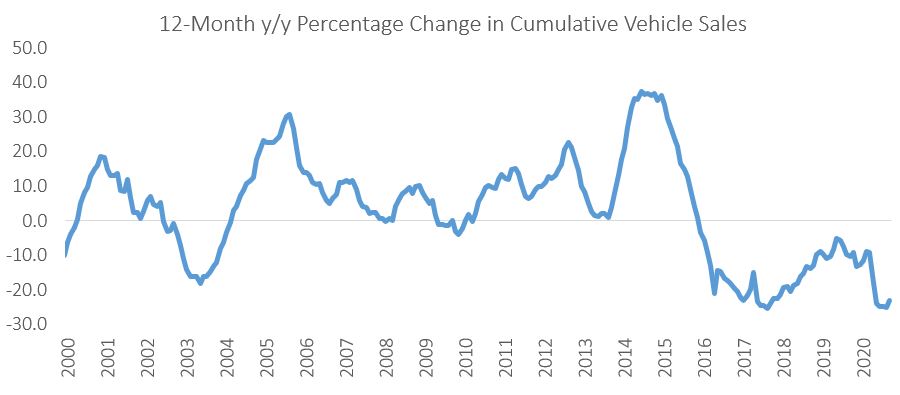

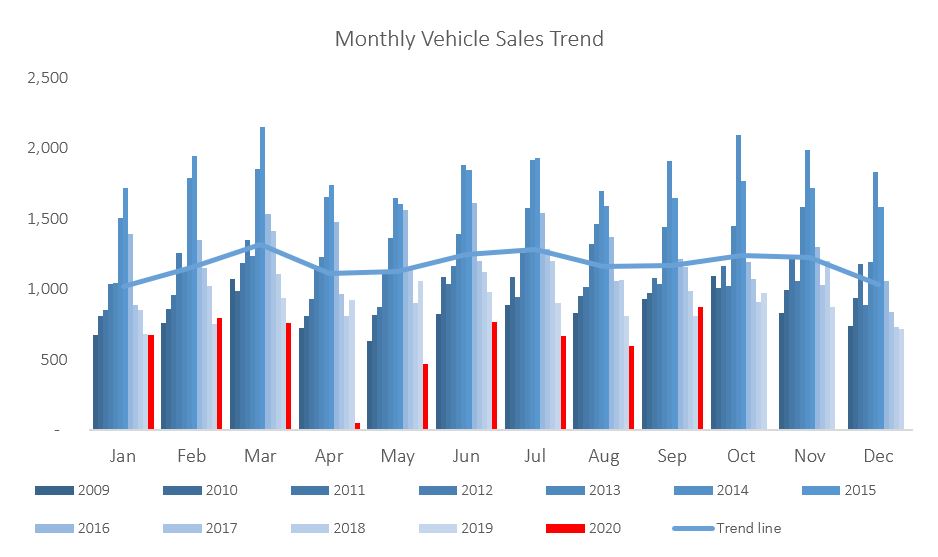

874 New vehicles were sold in September, an increase of 46.9% m/m from the 595 vehicles sold in August, and an 8.4% y/y increase from the 806 new vehicles sold in September 2019. September is only the second month this year where new vehicle sales topped sales in 2019 on a year-on-year basis. Year-to-date 5,655 vehicles have been sold of which 2,245 were passenger vehicles, 3,016 were light commercial vehicles, and 394 were medium and heavy commercial vehicles. On an annual basis, twelve-month cumulative new vehicle sales continued to trend downward with 8,215 new vehicles sold over the last twelve months, a 23.1% y/y contraction from the corresponding period last year.

A total of 278 new passenger vehicles were sold during September, representing a 34.3% m/m increase but a 13.1% y/y contraction. Year-to-date passenger vehicle sales rose to 2,245 units, down 36.5% when compared to the year-to-date figure recorded in September 2019. On a rolling 12-month basis passenger vehicle sales are at their lowest level since June 2004 at 3,261 units, highlighting the severity of the slowdown in sales. Consumer confidence has been plagued by poor economic conditions since 2016 and this has been further impacted by job losses and pay cuts this year brought on by Covid related lockdowns.

The best month of 2020 in commercial vehicles sales thus far was recorded in September with 596 units sold. This is a 53.6% m/m, and 22.6% y/y increase. 537 Light commercial vehicles, 15 medium commercial vehicles, and 44 heavy and extra heavy commercial vehicles were sold during the month. On a twelve-month cumulative basis light commercial vehicle are down 18% y/y, medium commercial vehicle sales fell 14.8% y/y, and heavy commercial vehicle sales contracted by 17.1% y/y, all measures remaining on a downward trajectory on an annual basis.

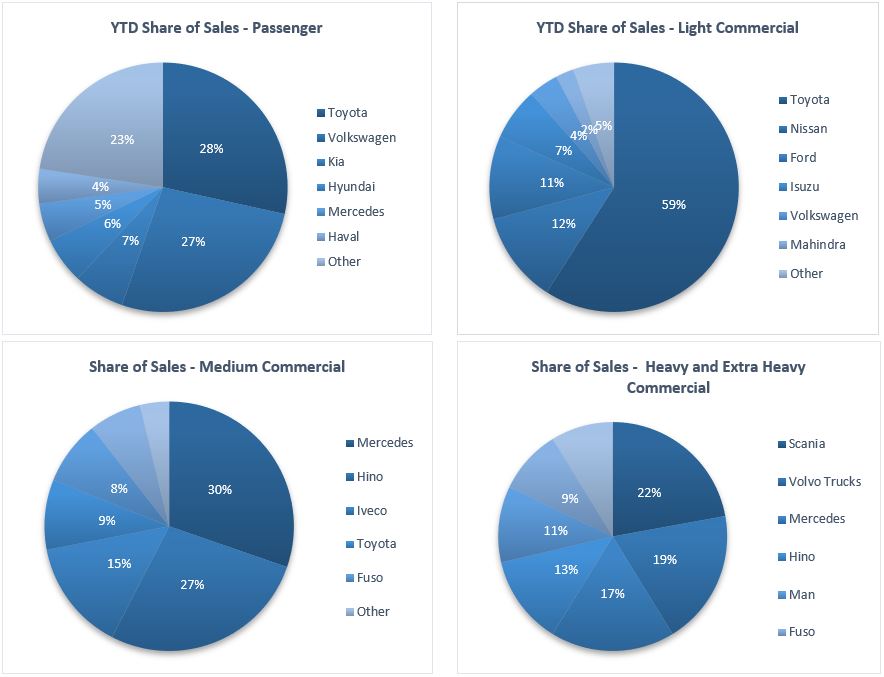

Toyota remains the leader in terms of year-to-date market share of new passenger vehicles sold with 28.4% of the market, followed closely by Volkswagen with 26.9%. The two top brands maintained their large gap over the rest of the market with Kia and Hyundai following with 6.6% and 6.0% of the market respectively. No other manufacturer managed to breach the 5% market-share mark.

Toyota remained the leader in the light commercial vehicle space with a dominant 59.1% market share. Nissan and Ford were the only other manufacturers to breach the 10% market share level with 11.8% and 10.8% of the market respectively. Mercedes leads the medium commercial vehicle segment with 30.3% of sales year-to-date, closely followed by Hino with 27.3% of the market. Scania remained number one in the competitive heavy and extra-heavy commercial vehicle segment with 22.1% of the market share year-to-date, closely followed by Volvo Trucks and Mercedes with 19.1% and 17.6% of the market respectively.

The Bottom Line

September marks only the second month of 2020 where monthly new vehicle sales topped sales from the corresponding month in 2019, the other being February. The general trend in new vehicle sales remains negative as can be expected in an economy performing poorly. Consumers have been under pressure for a number of years now as the economy started to cool in 2015 after five years of rapid growth between 2010 and 2015. A slowdown in government spending in real terms, coupled with a halt in foreign direct investment brought on by poor policy guidance have resulted in a stagnant economy and as a result erosion of consumer and business confidence. This stagnation has been further exacerbated by lockdown measures aimed at slowing the spread of Covid 19.

A multitude of obstacles thus weigh on a return to growth for the Namibian economy, not least of which is the poor policy overhang. We thus expect the Namibian economy to remain fragile for the foreseeable future, and we expect this to be reflected in vehicle sales, building plan approvals as well as PSCE and other high frequency indicators.