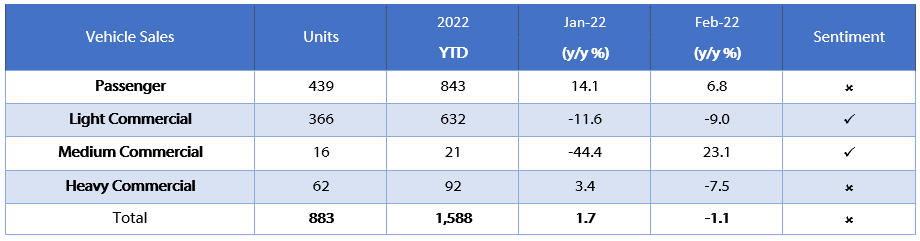

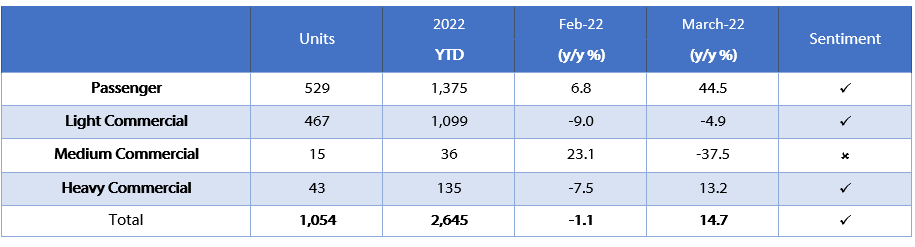

1,054 new vehicles were sold in March, which is 175 more than were sold in February and represents a 14.7% y/y increase from the 919 vehicles sold in March 2021. March’s sales figure is the first time since May 2019 that new vehicle sales have surpassed the 1,000 level. 2,645 new vehicles were sold during the first quarter, of which 1,375 were passenger vehicles, 1,099 light commercial vehicles, and 171 medium- and heavy commercial vehicles. By comparison, the first three months of 2021 saw 2,505 new vehicles sold. On a 12-month cumulative basis, a total of 9,568 new vehicles were sold as at March 2022, representing an increase of 21.2% y/y from the 7,896 sold over the comparative period a year ago, although it should be noted that this growth rate has been slowing since December last year.

529 new passenger vehicles were sold during March, an increase of 20.5% m/m from the 439 sold in February, and an increase of 44.5% y/y from the 366 vehicles sold in March 2021. Year-to-date, passenger vehicle sales rose to 1,375 in the first quarter, 21.6% higher than during the same period in 2021 and 45.0% higher than the first quarter of 2020. On a 12-month cumulative basis, new passenger vehicle sales have increased by 39.3% y/y to 4,728.

A total of 525 new commercial vehicles were sold in March, a representing an increase of 18.2% m/m but a decline of 5.1% y/y. The month-on-month increase was driven by a strong increase in light commercial vehicle sales, while both the medium- and heavy commercial vehicle subcategories recorded fewer sales than the preceding month. Light commercial vehicle sales fell 4.9% y/y, medium commercial vehicle sales dropped by 37.5% y/y while heavy commercial vehicle sales rose by 13.2% y/y. On a twelve-month cumulative basis, light commercial vehicle sales have increased by 3.3% y/y to 4,083, medium commercial vehicles rose by 20.6% y/y to 193, and heavy commercial vehicles climbed by 44.6% y/y to 564.

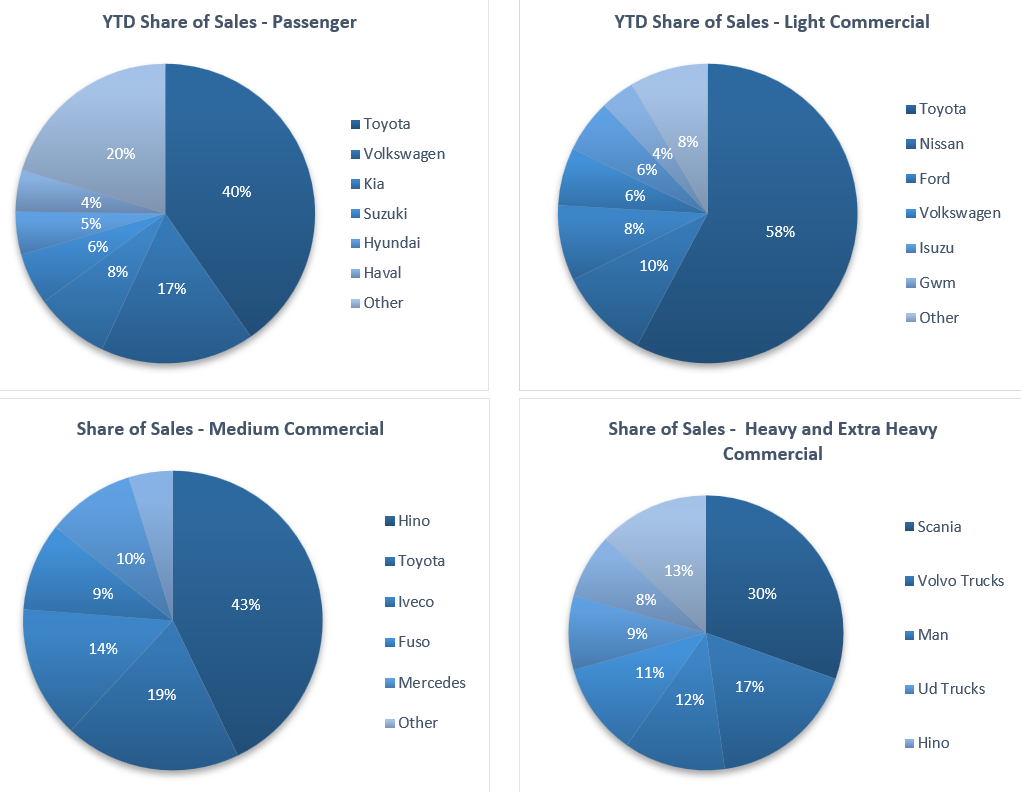

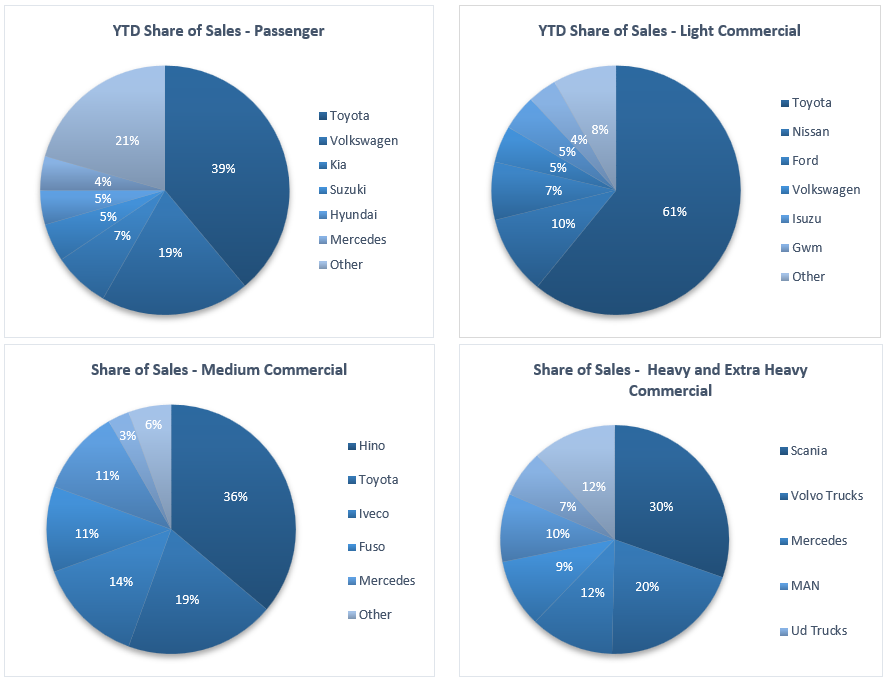

Toyota continue to enjoy a strong lead in the new passenger vehicle sales segment, claiming 38.9% of the on a year-to-date basis, followed by Volkswagen with a 19.3% share and slightly up from the previous month. They were followed by Kia and Suzuki with 7.3% and 4.9% of the market, respectively, leaving the remaining 29.5% of the market to other brands.

On a year-to-date basis, Toyota remained the leader in the light commercial vehicle space with a 60.9% market share and an increase from the previous month. Nissan came in second place claiming a market share of 10.3%, also slightly higher than in the previous month. Hino remain the leader in the medium commercial vehicle space claiming 36.1% of the market share, followed by Toyota with a market share of 19.4%. Scania remained number one in the heavy and extra-heavy commercial vehicle segment with 30.4% of the market share year-to-date.

The Bottom Line

As mentioned earlier, March’s sales figure is the first time since May 2019, that monthly new vehicle sales have surpassed the 1,000 level. It is worth noting that March new vehicle sales generally have a seasonal effect of being slightly higher than the surrounding months. Due to this seasonal effect, we expect to see monthly new vehicle sales to return to the levels witnessed in the last 18 months. On a 12-month cumulative basis, new passenger vehicle sales continued to increase, rising for the 16th consecutive month. On a monthly basis, new commercial vehicle sales encouragingly continued to tick up for a third consecutive month, although the March seasonal effect likely played a role here as well. 12-month cumulative new commercial vehicle sales have remained steady at the 4,100 level since April last year.