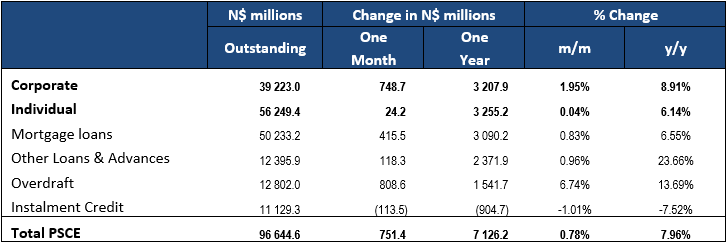

Overall

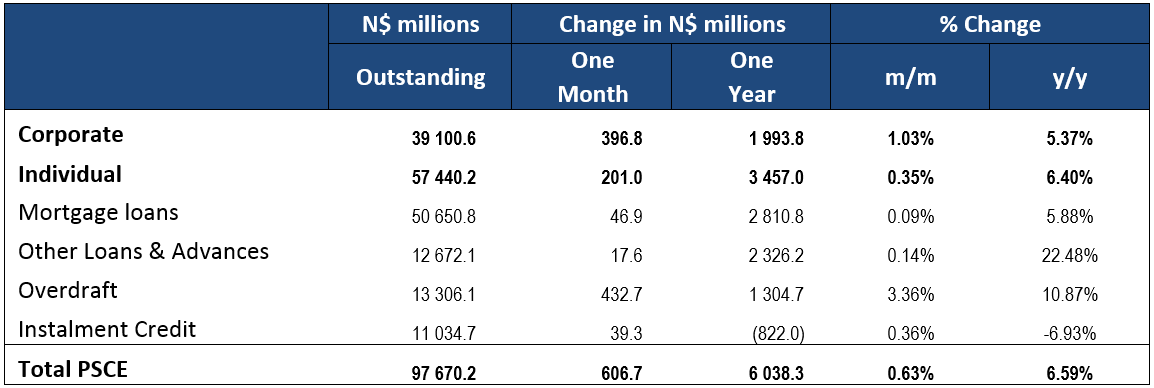

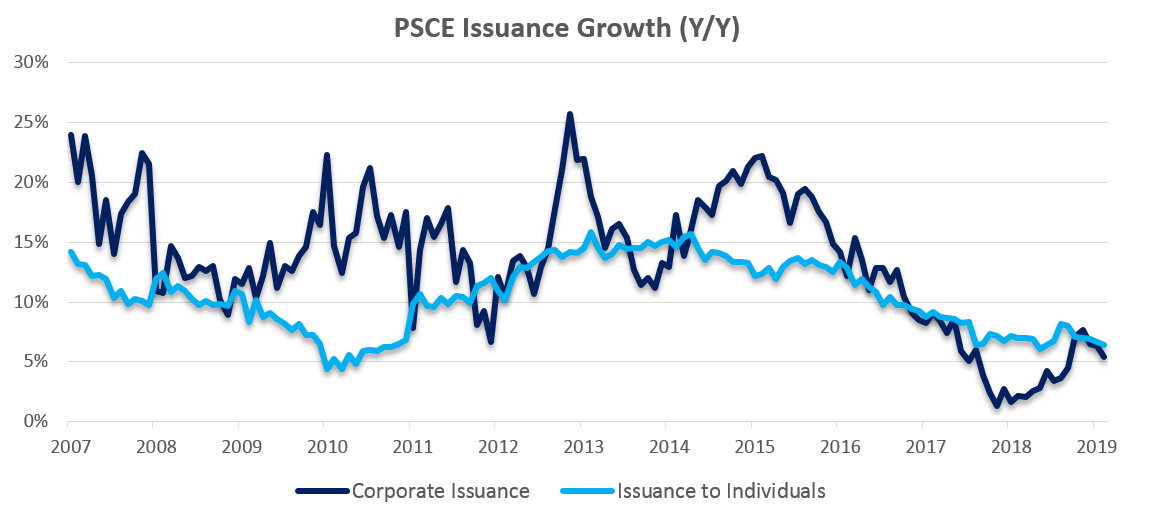

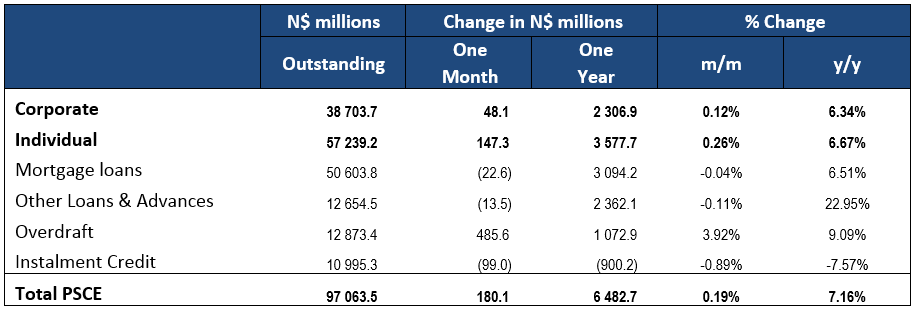

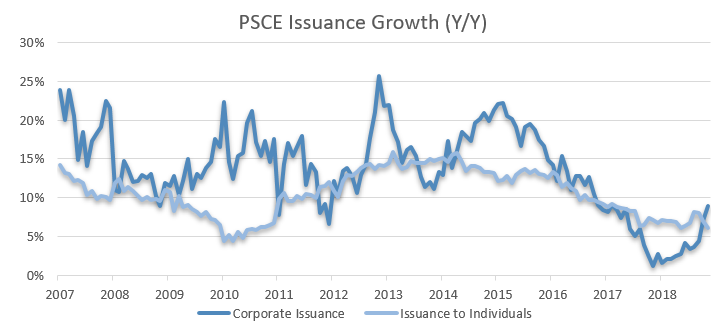

Total credit extended to the private sector (PSCE) increased by N$606.7 million or 0.63% m/m in February, bringing the cumulative credit outstanding to N$97.7 billion. On a year-on-year basis, private sector credit extension increased by 6.59% in February, compared to 7.16% in January. From a rolling 12-month basis, N$6.04 billion worth of credit was extended to the private sector. Of this cumulative issuance, individuals took up credit worth N$3.46 billion, while N$1.99 billion was issued to corporates. Claims on non-resident private sectors totaled N$587.4 million, on a 12-month cumulative basis.

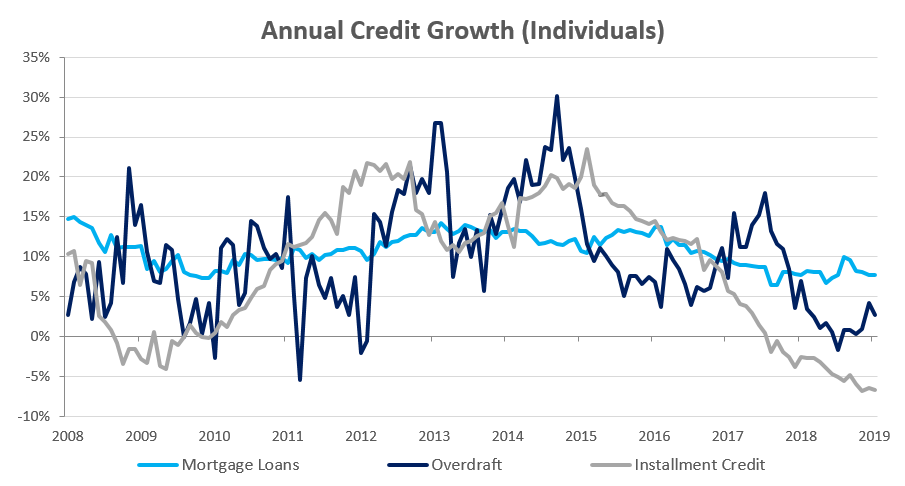

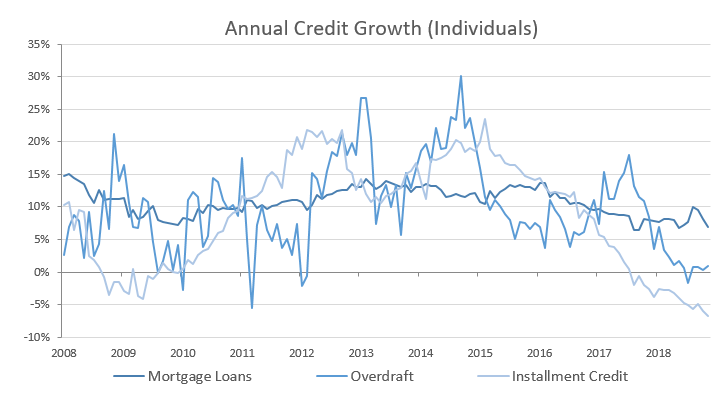

Credit Extension to Individuals

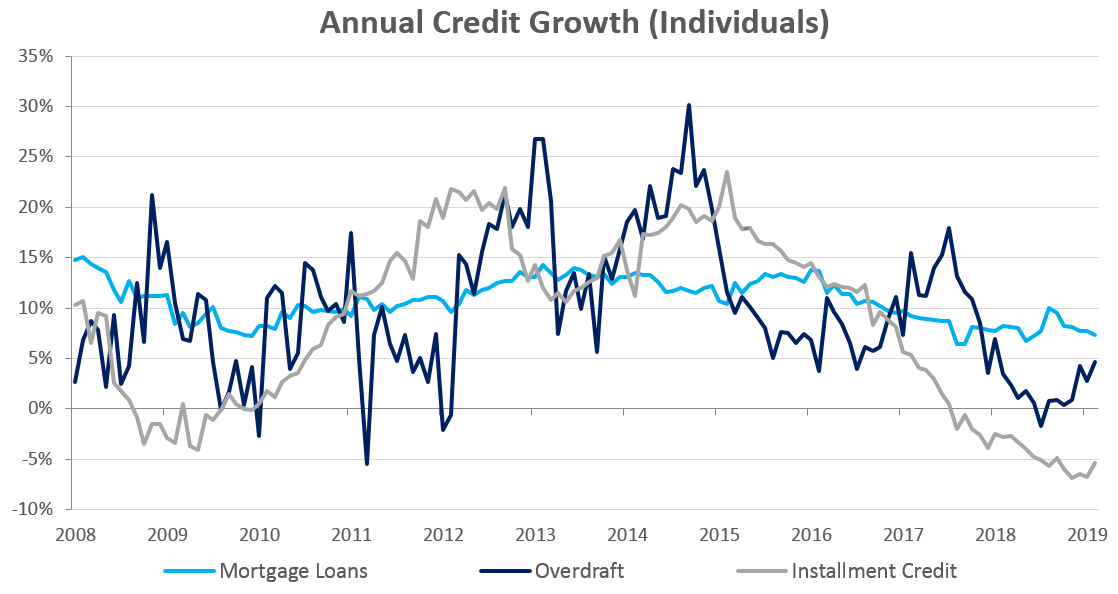

Credit extended to individuals increased by 6.4% y/y in February, growing at a slightly slower pace than the 6.7% y/y increase recorded in January. On a monthly basis, household credit grew by 0.4% following an increase of 0.3% m/m recorded in January. Household demand for overdraft facilities was once again strong in February, increasing by 2.2% m/m and 4.7% y/y, compared to the 2.3% m/m and 2.7% y/y increase seen in January. The value of mortgage loans extended to individuals increased by 0.3% m/m and 7.3% y/y. Installment credit remained depressed, increasing by 1.1% m/m, but contracting by 5.4% y/y.

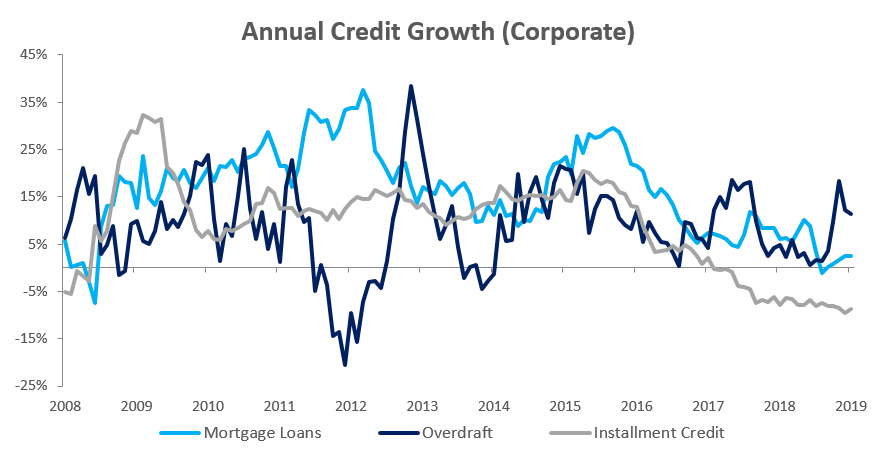

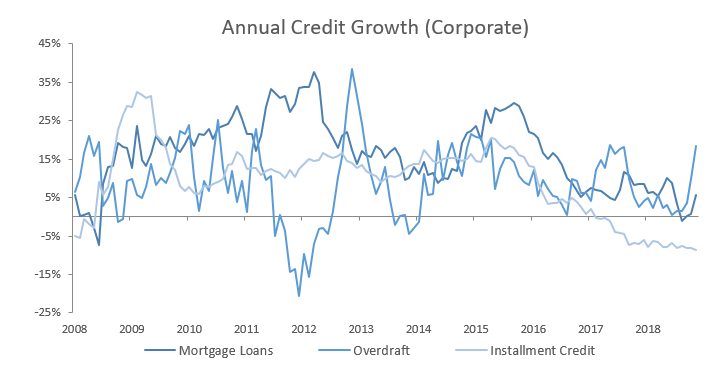

Credit Extension to Corporates

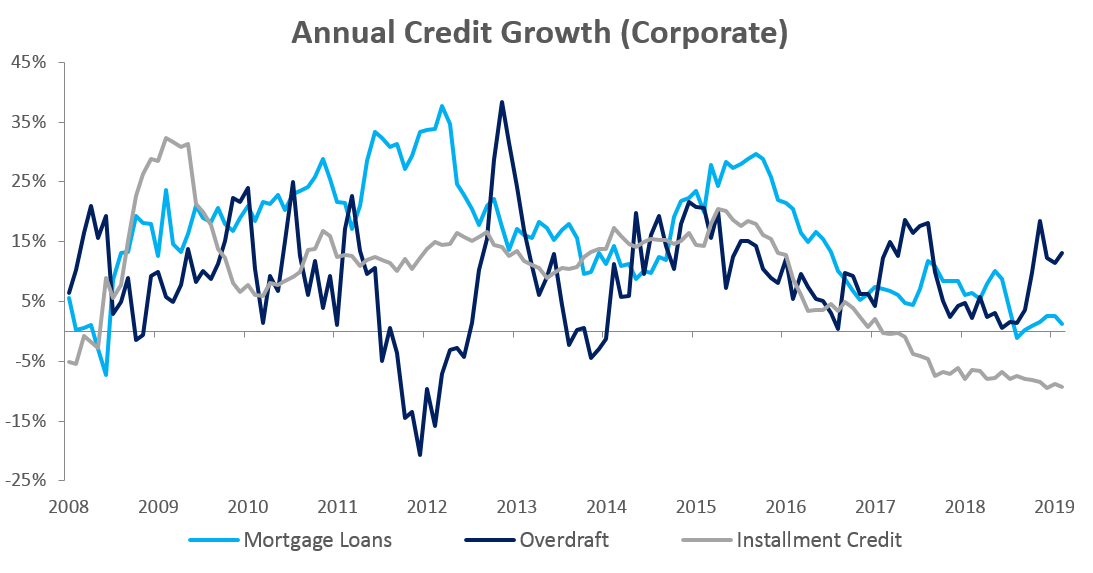

Credit extension to corporates ticked up slightly month-on-month, increasing by 1.0% following a 0.1% increase in January. Year-on-year credit extension to corporates increased by 5.4% in February, increasing at a slower rate than the 6.3% y/y recorded in January. The increase in overall loans to corporates was mostly driven by corporates’ continued use of short-term credit facilities, in particular overdrafts, which increased by 3.7% m/m and 13.1% y/y. Other loans and advances, which consists of credit card debt, personal and term loans, extended to businesses increased by 26.8% y/y, but contracted by 0.2% m/m. Mortgage loans extended to corporates increased by a low 1.2% y/y, but decreased by 0.7% m/m.

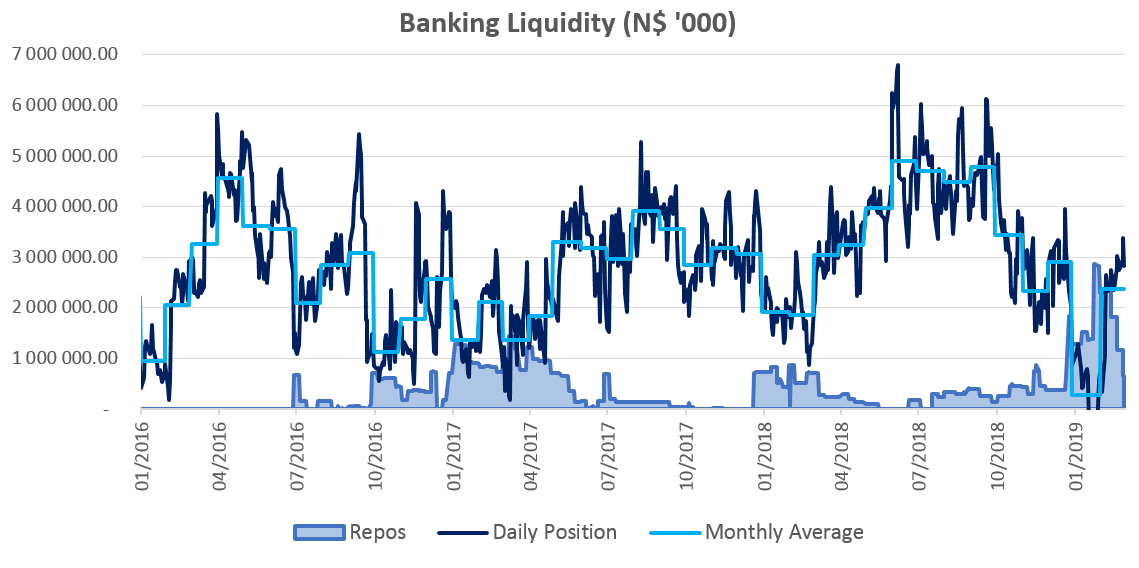

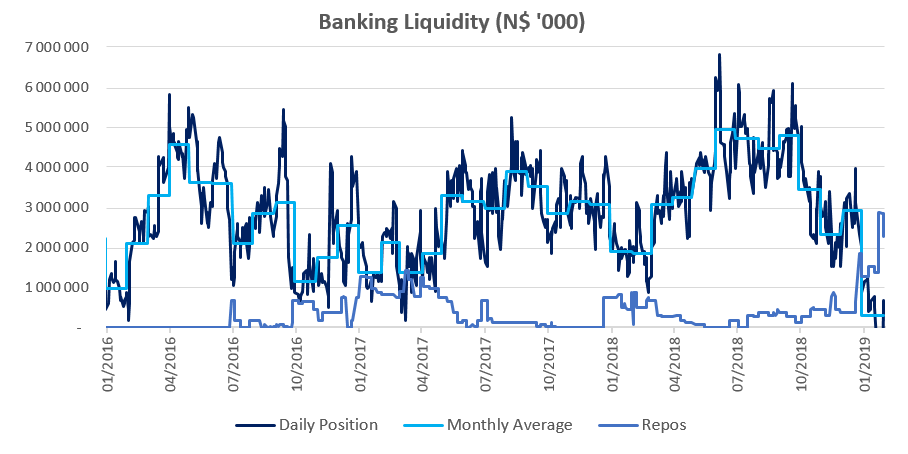

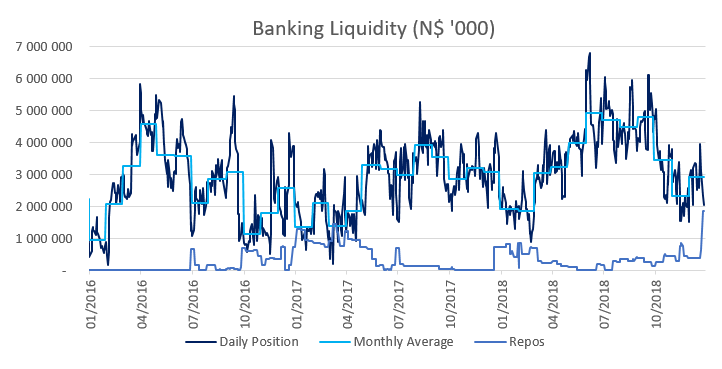

Banking Sector Liquidity

The overall liquidity position of commercial banks improved significantly during February, increasing by N$2.10 billion to reach an average of N$2.38 billion. Bank of Namibia credits this improvement in liquidity to higher government spending as well as higher mineral proceeds during the period. The higher liquidity resulted in a decrease in use of the BoN’s repo facility by commercial banks, with the outstanding balance of repo’s decreasing from N$2.29 billion at the start of February to N$645.7 million by month end.

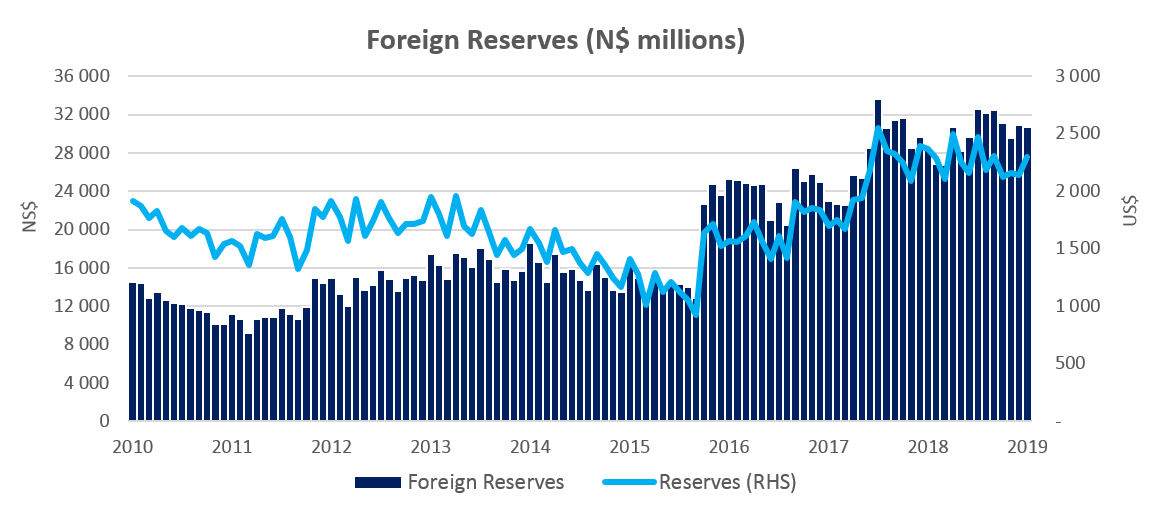

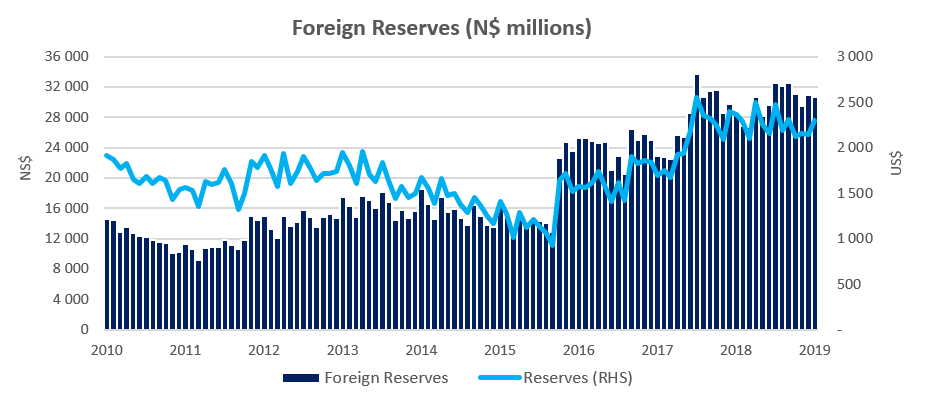

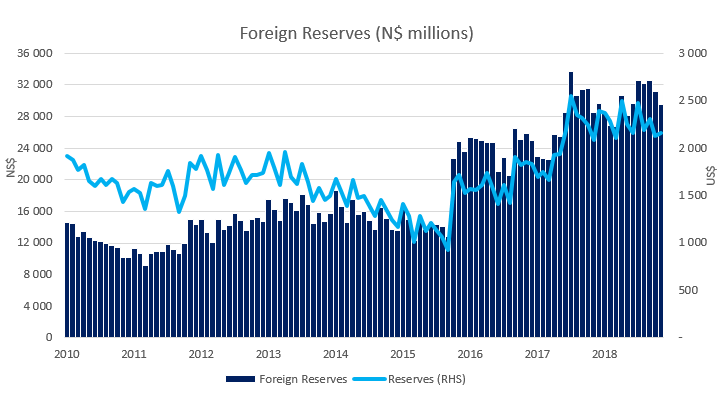

Reserves and Money Supply

Broad money supply rose by N$9.97 billion or 10.5% y/y in February following a 7.6% y/y increase in January, as per the BoN’s latest money statistics release. Foreign reserve balances rose by 3.1% m/m to N$31.6 billion in February. The BoN stated that the increase was mostly due to increased net capital inflows by commercial banks, coupled with exchange rate revaluations.

Outlook

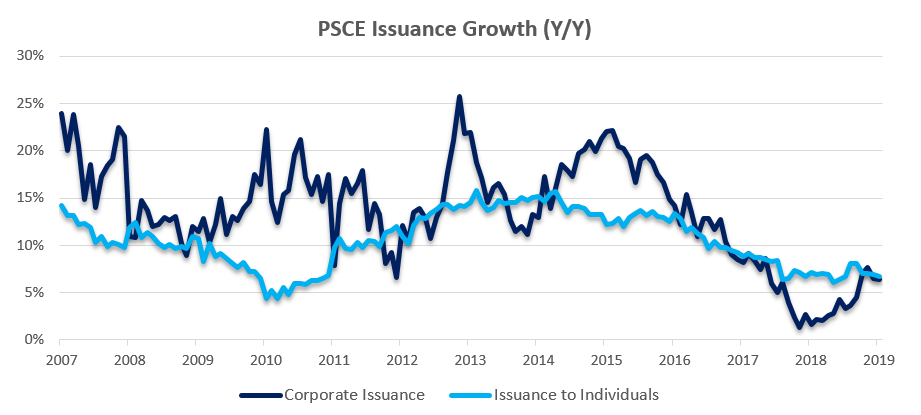

Overall PSCE growth in February moderated for a third consecutive month on a year-on-year basis, increasing by 6.6%. From a 12-month rolling perspective, credit issuance is up 36.6% from the N$4.42 billion issuance observed at the end of February 2018, with individuals taking up most (57.3%) of the credit extended over the past 12 months.

As has been the case for the past few months, most of the growth in PSCE for February has stemmed from shorter-dated debt, which is unlikely to drive meaningful expansion of productive capacity. Instalment credit extended to corporates, remained depressed, contracting by 9.3% y/y in February. The persistent contraction in instalment credit to corporates (since February 2017) is a further indication that businesses are financing fewer and fewer capital goods and as such, are not expanding operations.