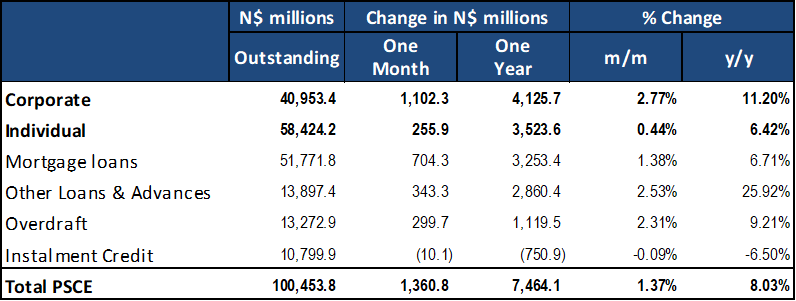

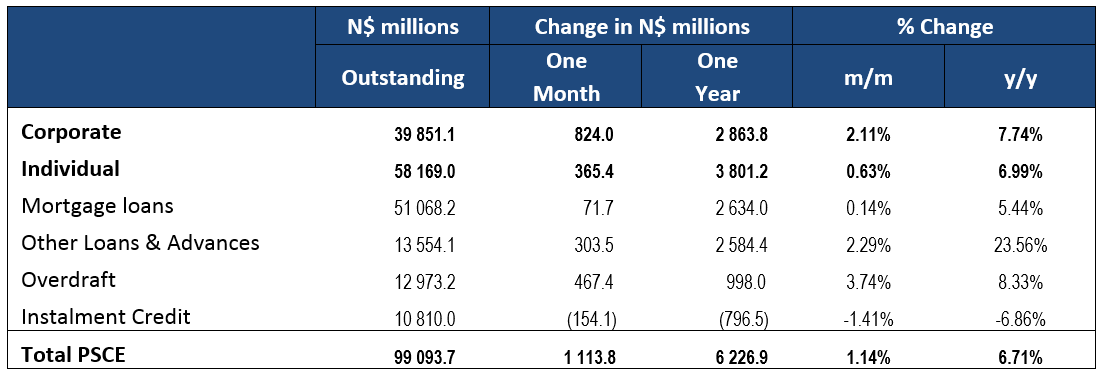

Overall

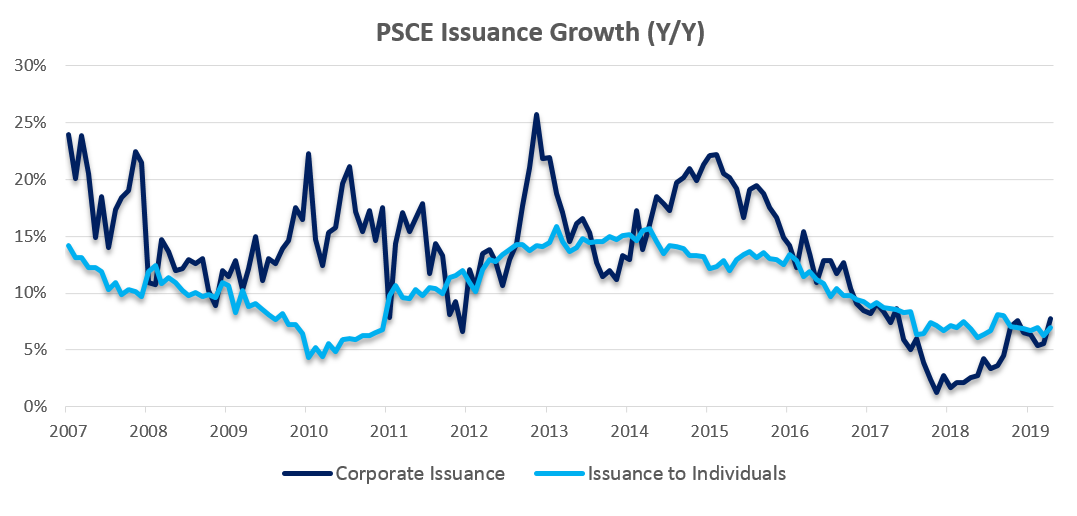

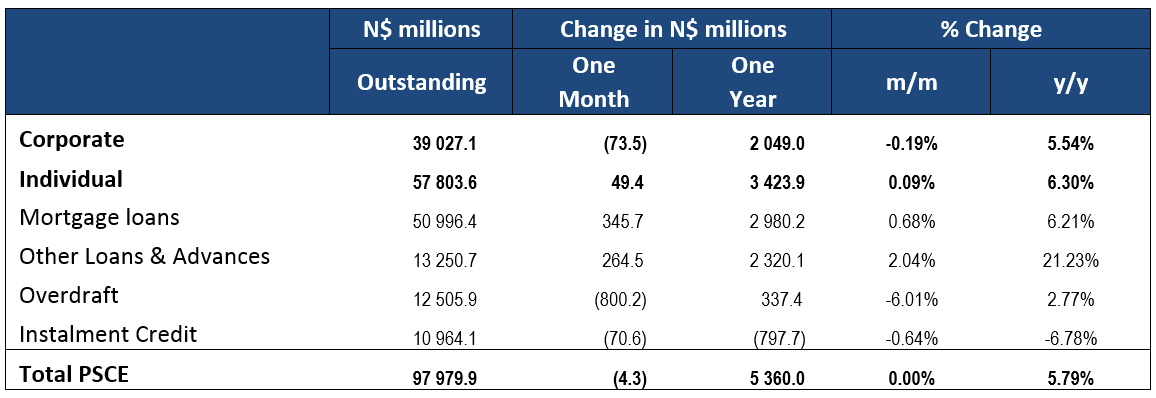

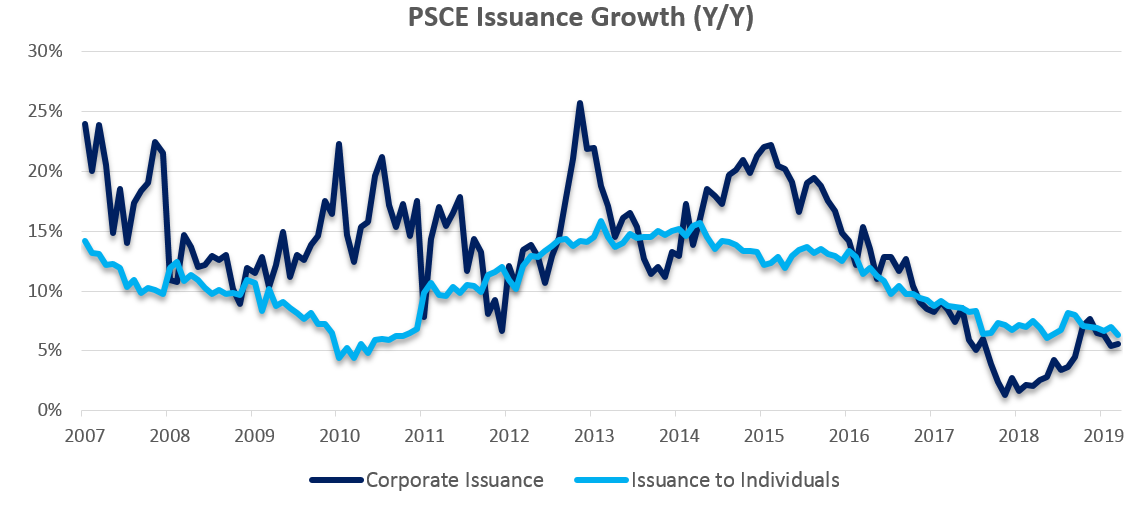

Total credit extended to the private sector (PSCE) increased by N$1.36 billion or 1.37% m/m in May, bringing the cumulative credit outstanding to N$100.45 billion. On a year-on-year basis, private sector credit extension grew by 8.03% in May, compared to 6.71% recorded in March. On a rolling 12-month basis N$7.46 billion worth of credit was extended. N$4.13 billion worth of credit has been extended to corporates and N$3.52 billion to individuals on a 12-month cumulative basis, while the non-resident private sector has decreased their borrowings by N$185.3 million, the third consecutive month in which this has happened.

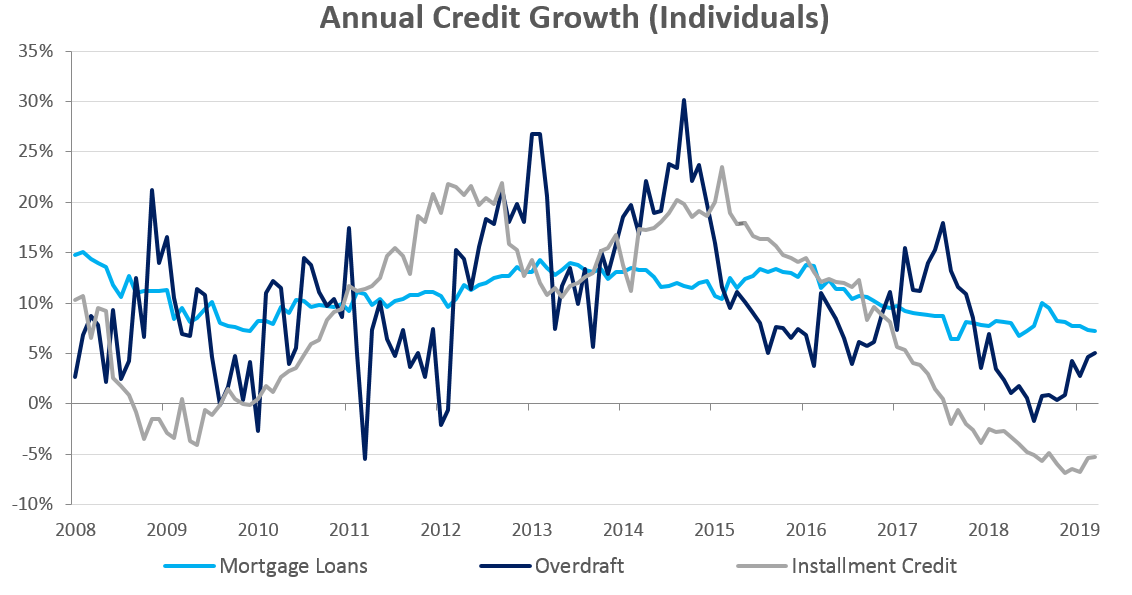

Credit Extension to Individuals

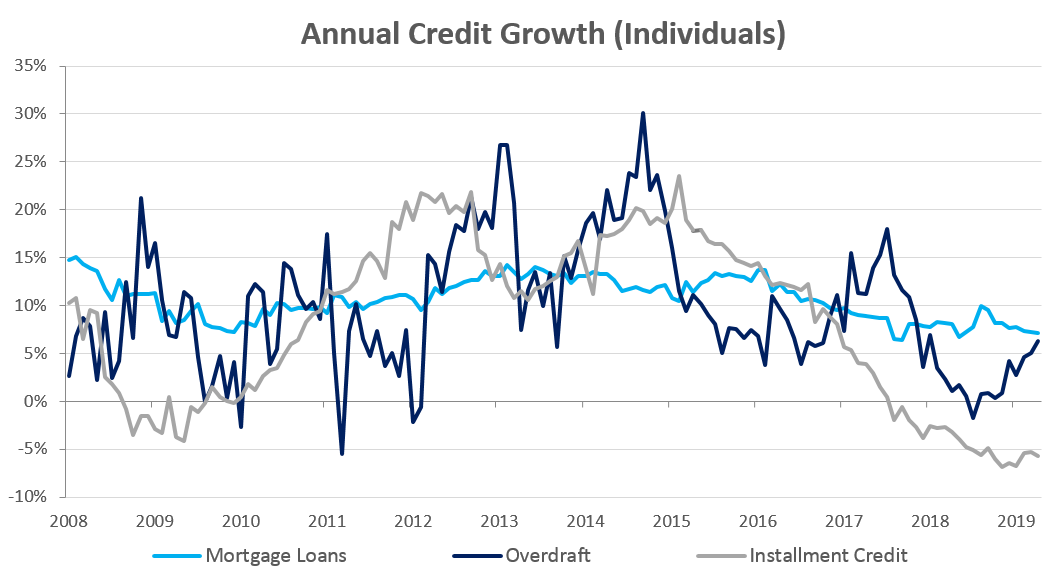

Growth in credit extended to individuals slowed to 6.4% y/y in May, a noticeable decrease from the growth of 7.0% y/y recorded in April. However, the biggest driver of the increase in credit extended to individuals was a 6.9% y/y increase in mortgage loans, followed by other loans and advances increasing by 23.9%. Other loans and advances have increased to N$7.22 billion, growing at a much quicker pace than overdrafts. Overdraft facilities extended to individuals have increased by 0.5% m/m and 3.7% y/y.

Growth in credit extended to households slowed to 0.4% m/m from 0.6% m/m in April. The value of mortgage loans extended to individuals increased by 0.4% m/m and 6.9% y/y. While instalment credit extension remained depressed, contracting by 0.6% m/m and 5.9% y/y.

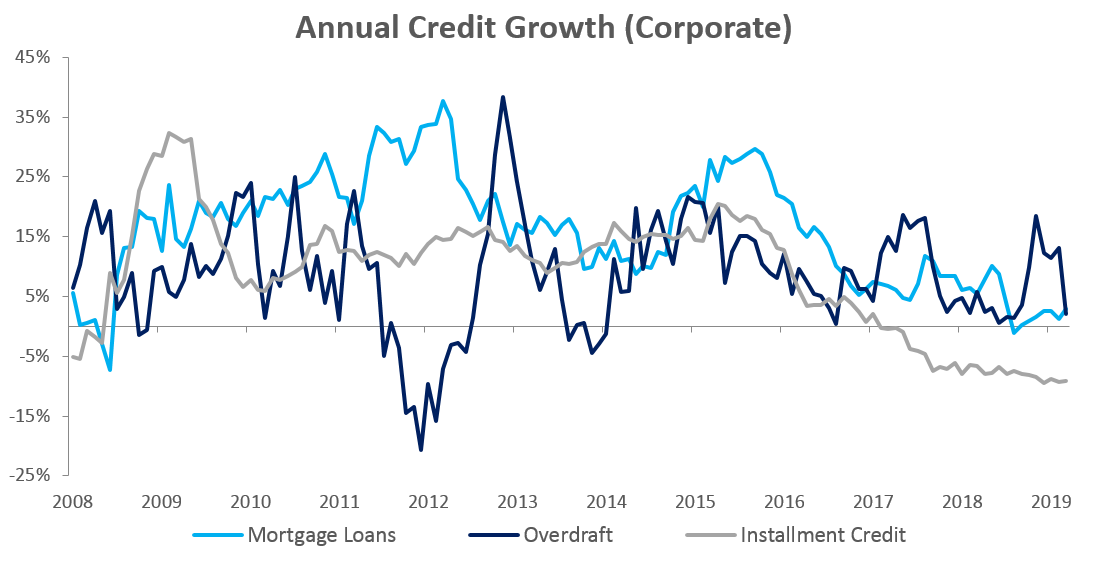

Credit Extension to Corporates

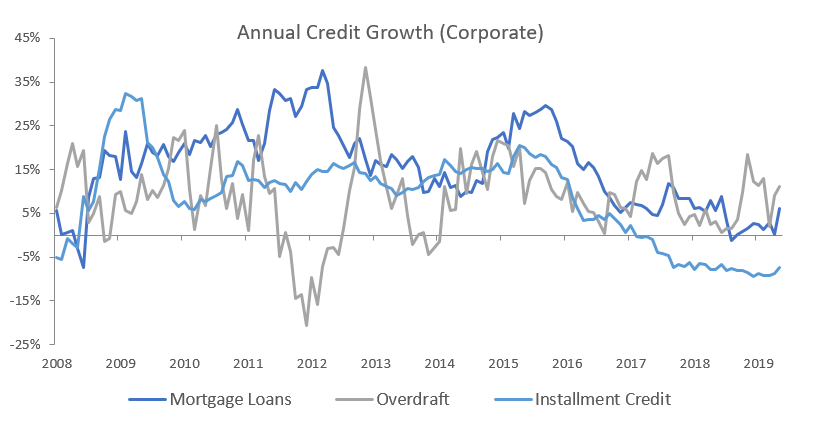

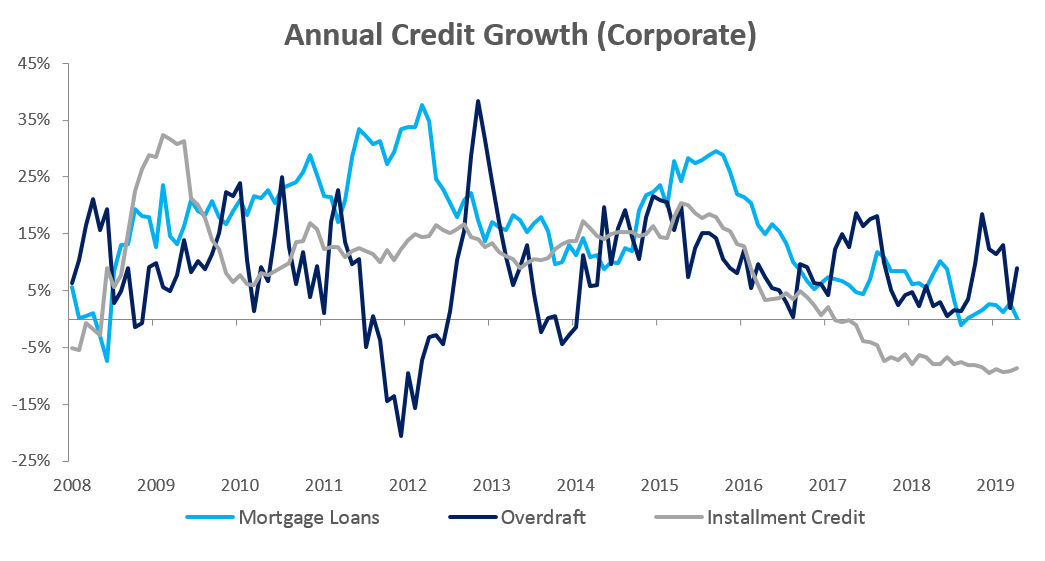

Credit extension to corporates increased by 2.8% m/m and 11.2% y/y in May. On a rolling 12-month basis, N$4.13 billion was extended to corporates as at the end of May compared to the N$2.86 billion as at the end of April. The month-on-month increase was largely driven by mortgage loans extended to corporates which increased by 4.9% m/m and 6.1% y/y. The use of short-term facilities, particularly overdrafts, increased by 2.9% m/m and 11.1% y/y. Other loans and advances, which consists of credit card debt and short-term loans, extended to businesses increased by 3.4% m/m and 28.2% y/y.

Over the last twelve months the use of short-term facilities has increases greatly, pointing to stressed cash flow among corporate borrowers. While a symptom of the lacklustre economic climate, there is a limit to how long businesses can rely on such facilities in the absence of improved economic conditions. The spike in use of short-term facilities is concerning given that expectations are for poor economic conditions to persist in the short-to medium-term.

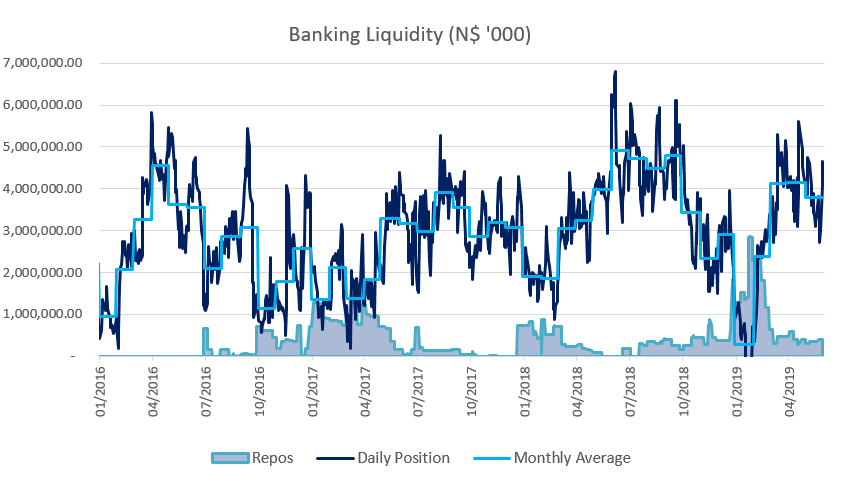

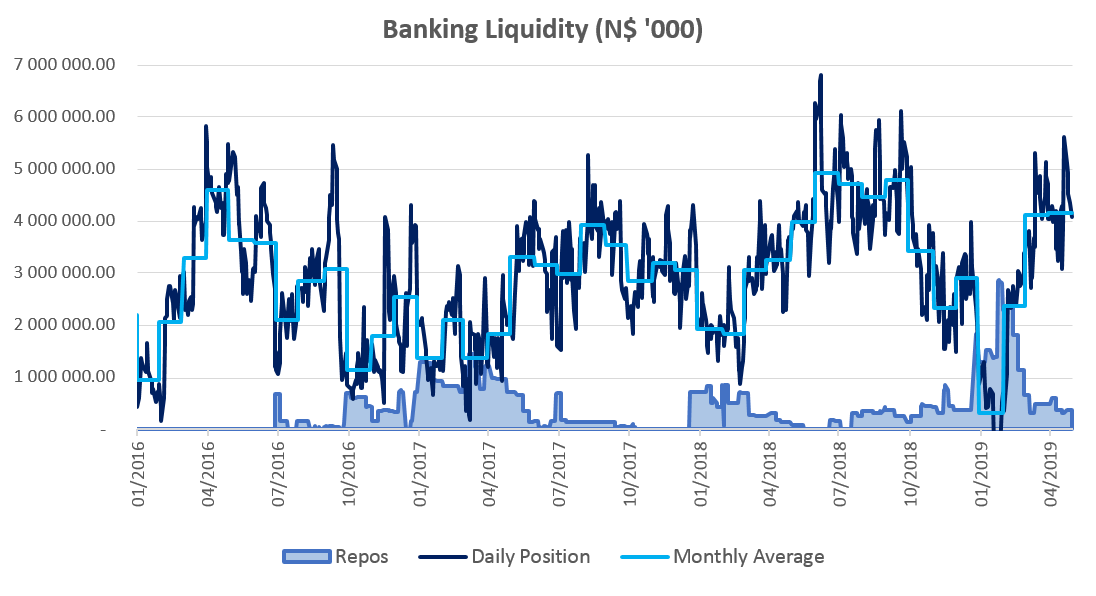

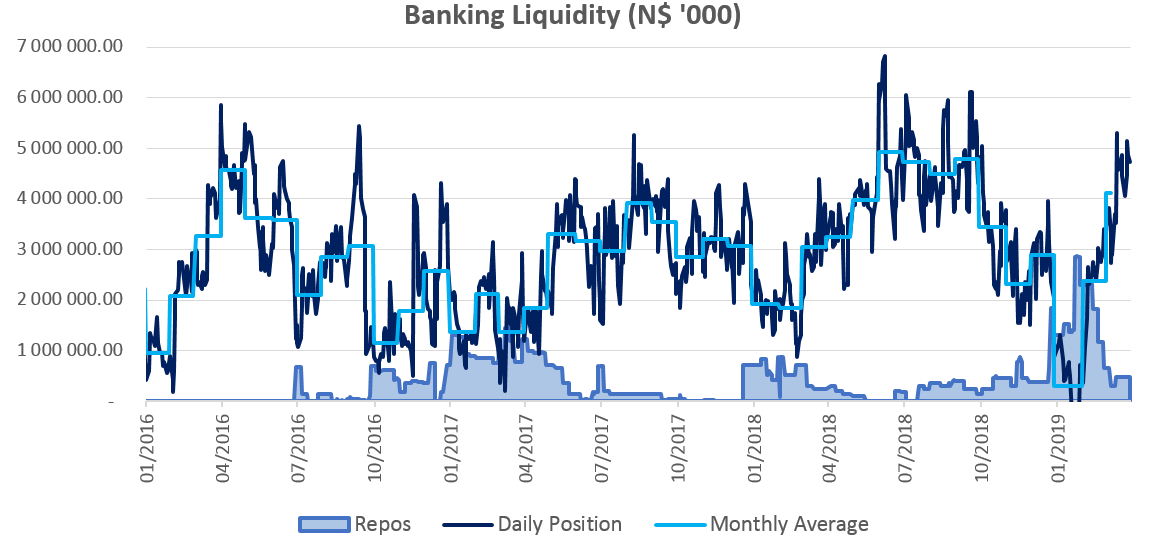

Banking Sector Liquidity

The overall liquidity position of commercial banks decreased by N$361.5 million to an average of N$3.79 billion during May from the N$4.15 billion in April. According to the Bank of Namibia (BoN), the decline in liquidity balances stemmed mainly from increased demand for BoN bills during the period under review. There was an increase in the use of BoN’s repo facility by commercial banks, with the outstanding balance of repo’s increasing from N$290.9 million at the start of May to N$ N$398.1 million by the end.

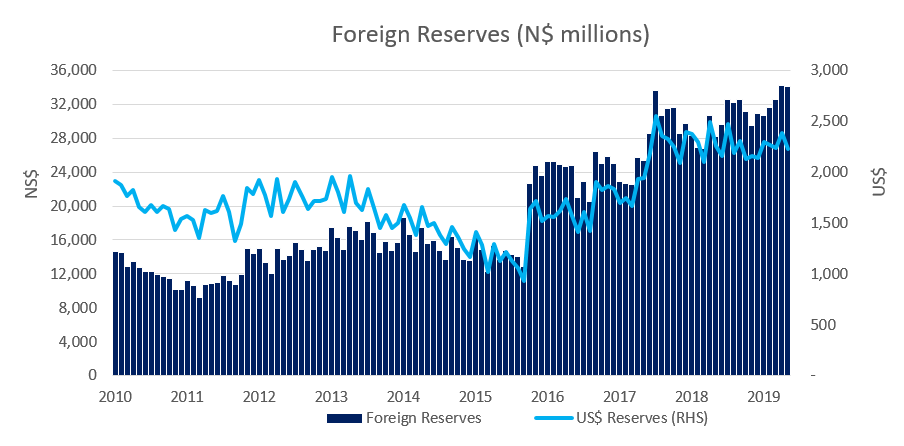

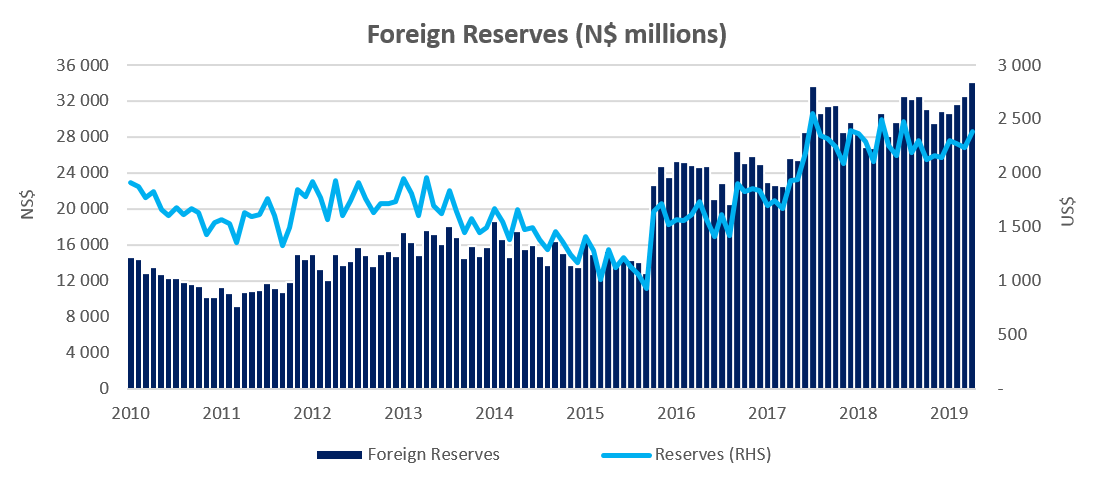

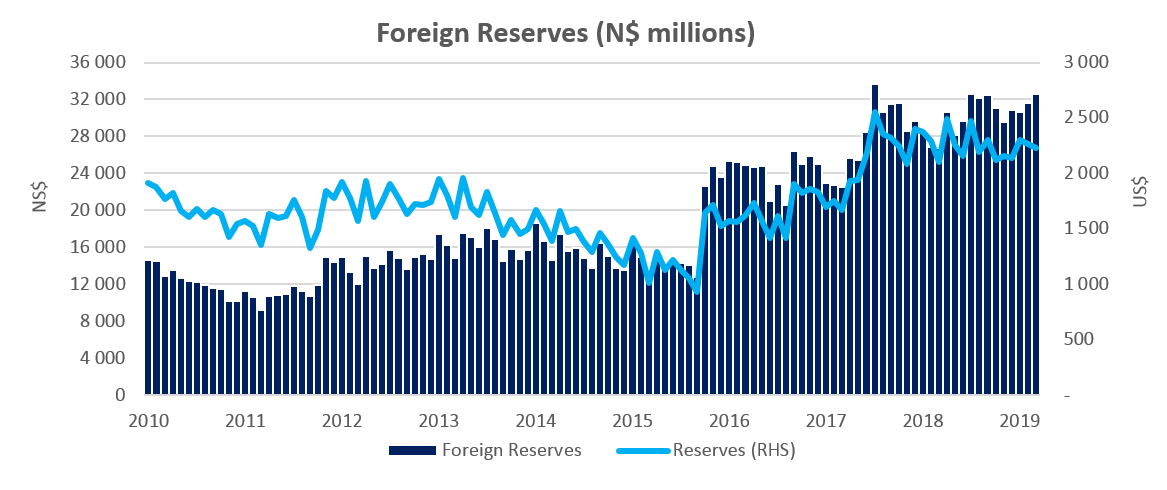

Reserves and Money Supply

Broad money supply rose by N$11.6 billion or 11.7% y/y in May following a 10.2% y/y increase in April, as per the BoN’s latest monetary statistics release. Foreign reserve balance contracted by 0.1% m/m down by N$33.7 million to N$34.1 billion. The BoN stated that the decreased is largely due to net capital outflows of foreign currencies through commercial banks, coupled with net government payments during the month under review.

Outlook

From a 12-month rolling perspective, credit issuance is up 48.0% from the N$5.04 billion issuance observed at the end of May 2018, with corporates taking up 55.3% of the credit extended over the past 12 months. The credit extended to corporates on a cumulative 12-month basis has increased from N$509 million in May 2018 to N$4.13 billion. While credit extended to individuals has been rather stagnant, down 9% on a rolling 12-month basis to N$3.52 billion.

However, PSCE growth in May stemmed from the use of short-term debt as the other loans and advances category grew by 12.4% y/y for corporates and 23.9% y/y for individuals. Due to the nature of debt used, this further questions the utilisation of the credit extended and the probability that such debt is not being used to fund capital expenditures or for long-term productive use.