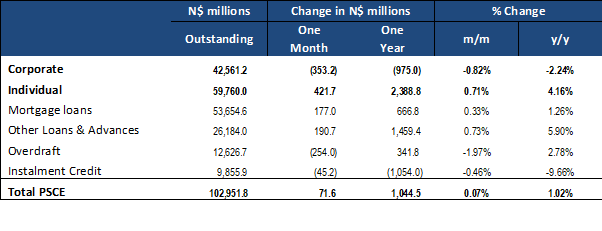

Overall

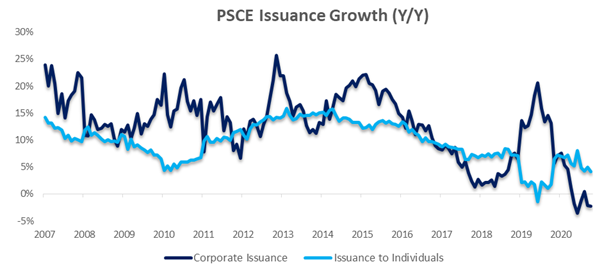

Private sector credit (PSCE) increased by N$1.09 billion or 1.05% m/m in November, bringing the cumulative credit outstanding to N$104.68 billion. On a year-on-year basis, private sector credit increased by 2.31% in November, compared to 1.65% y/y in October. On a rolling 12-month basis, N$2.37 billion worth of credit was extended to the private sector. Of this cumulative issuance, individuals took up N$2.38 billion while corporates took up N$321.6 million. The non-resident private sector decreased their borrowings by N$337.8 million.

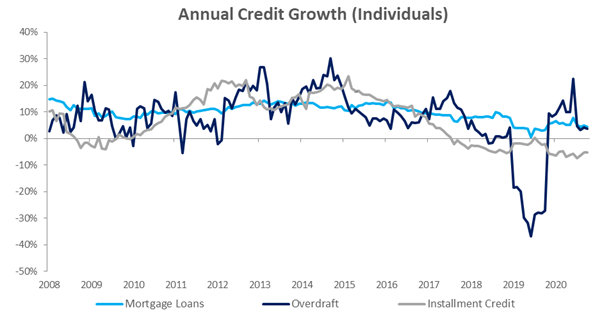

Credit Extension to Individuals

Credit extended to individuals increased by 0.7% m/m and 4.1% y/y in November, growing at a slightly slower pace than the 4.2% y/y increase recorded in October. The month-on-month growth has mostly been driven by an increase in overdrafts which grew by 5.8% m/m and 9.4% y/y indicating continued use of short-term credit by individuals. The uptake of longer-term credit agreements like mortgages and instalment credit by individuals continued to slow. The value of mortgage loans extended to individuals rose by only 0.4% m/m and 4.4% y/y. Instalment credit grew by 0.4% m/m but was down 4.1% y/y as new vehicle sales continue to dwindle.

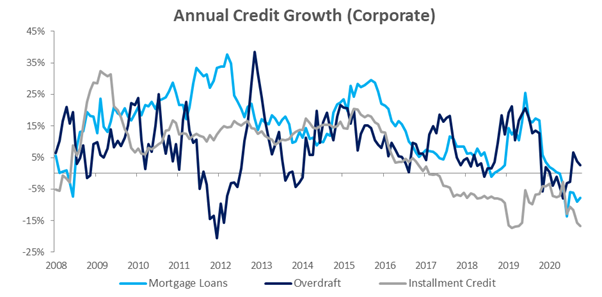

Credit Extension to Corporates

Credit extended to corporates grew by 1.5% m/m after increasing by 0.7% m/m in October. On an annual basis, credit extended to corporates rose by a mere 0.7% y/y. As was the case with credit extension to individuals, the month-on-month growth in corporate credit was primarily driven by increased uptake in overdraft facilities which registered growth of 7.7% m/m and 15.0% y/y. The Bank of Namibia (BoN) attributed this to a rise in demand for overdrafts by businesses operating in the wholesale and retail trade sector as well as the agriculture sector. Mortgage loans to corporates increased by 0.8% m/m but declined by 7.2% y/y. Instalment credit extended to corporates, which has been contracting since February 2017 on an annual basis, remained depressed, contracting by 1.2% m/m and 17.2% y/y in November, the lowest level since early 2019.

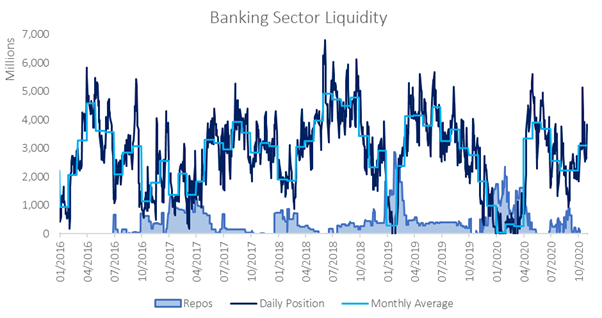

Banking Sector Liquidity

The overall liquidity position of commercial banks deteriorated during November, contracting by N$764.5 million to reach an average of N$2.34 billion during the month. According to the BoN, the decline can mainly be attributed to cross-border transfers, funds mainly designated for investments.

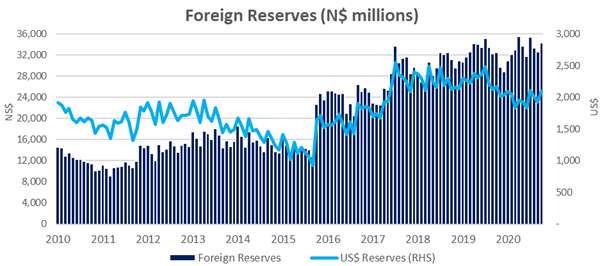

Reserves and Money Supply

As per the BoN’s latest money statistics release, broad money supply rose by N$9.90 billion or 8.5% y/y in November. Foreign reserve balances fell by N$3.84 billion or 11.2% m/m to N$30.52 billion in November. The BoN ascribes the decline to net government payments, foreign currency purchases by commercial banks and exchange rate revaluations during the period.

Outlook

Private sector credit extension growth remained subdued at the end of November. While 12-month cumulative issuance rose to N$2.37 billion in November from N$1.68 billion in October, 12-month issuance is still down 57.3% y/y. With economic conditions unlikely to improve materially in 2021, we expect the trend of reliance on short-term debt by both consumers and businesses to continue. With corporates continuing to repay their longer-term debt and de-levering their balance sheets, we are unlikely to see meaningful growth in private sector credit extension and could even see a contraction on an annual basis in the coming months.