Overall

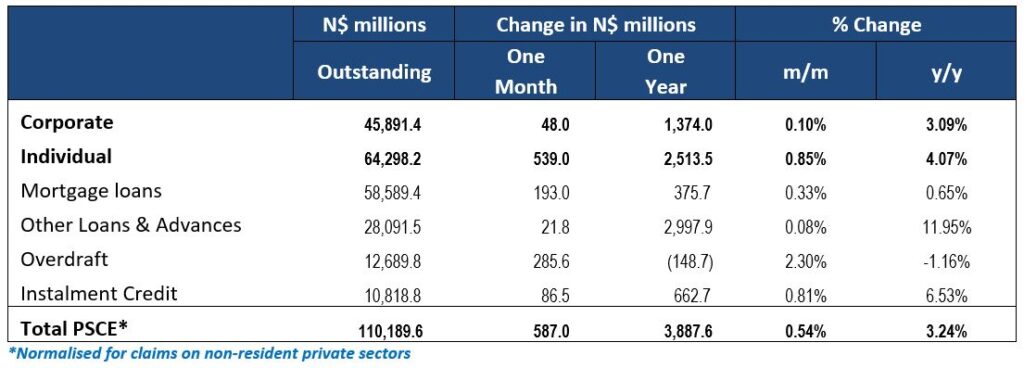

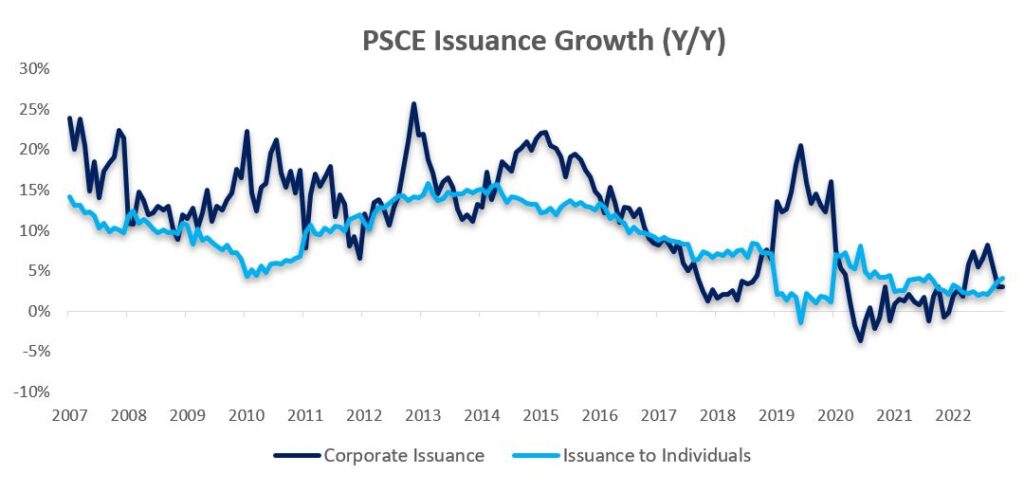

Private sector credit (PSCE) rose by N$587.0 million or 0.5% m/m in November, bringing the cumulative credit outstanding to N$110.2 billion after normalising for interbank swaps accounted in non-resident private sector claims. Year-on-year, private sector credit grew by 3.2% in November, marginally quicker than the 3.0% y/y growth recorded in October. On a 12-month cumulative basis, N$3.46 billion worth of credit was extended to the private sector. Of the cumulative issuance, corporates borrowed N$1.37 billion and individuals took up N$2.52 billion.

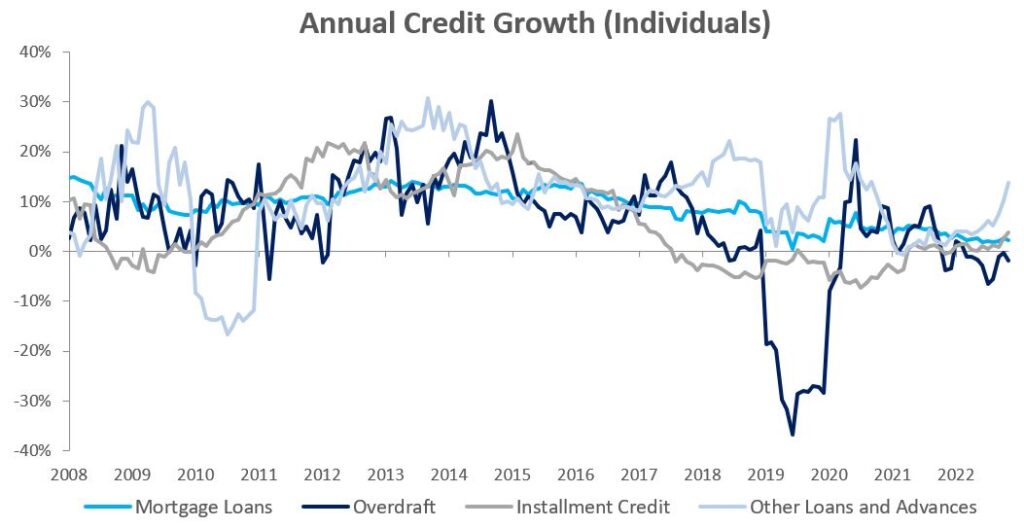

Credit Extension to Individuals

Credit extended to individuals rose by 0.8% m/m and 4.1% y/y in November. Annual growth in all of the credit lines to individuals bar overdraft facilities picked up in November. Overdraft facilities to individuals contracted by 1.5% m/m and 1.9% y/y. Annual growth in this line item has been trending in the negative territory since March 2022. Mortgage loans to individuals recorded growth of 0.3% m/m and 2.2% y/y, albeit marginally slower than in October. Other loans and advances (consisting of credit card, personal, and term loans) grew by 3.5% m/m and 13.8% y/y, naturally picking up pace as the holiday season approached. Instalment credit annual growth also picked up pace as credit extended in this category rose by 0.8% m/m and 3.8% y/y.

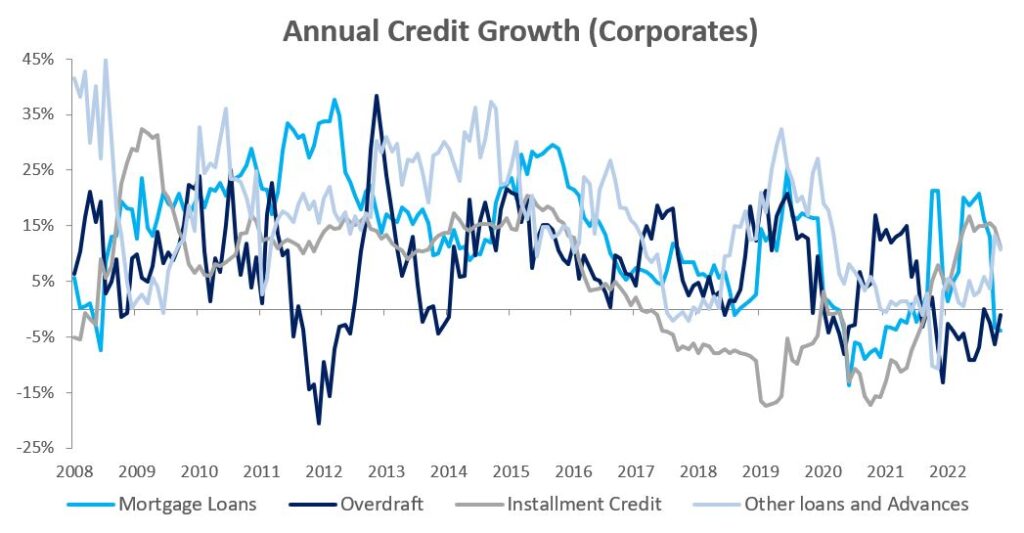

Credit Extension to Corporates

Credit extended to corporates rose by 0.1% m/m and 3.1% y/y in November. The Bank of Namibia (BoN) ascribed the growth to higher demand for short term credit facilities by corporates in the fishing, energy and manufacturing sector during the period under review. The BoN further noted that the improved growth was tempered as a result of deleveraging by corporates in the services and manufacturing sectors. Mortgage loans increased by 0.3% m/m but fell 3.8% y/y. Overdrafts rose by 3.2% m/m but declined 1.0% y/y. Installment credit posted growth of 0.8% m/m and 11.0% y/y while other loans and advances to corporates contracted by 2.1% m/m but grew by 10.7% y/y.

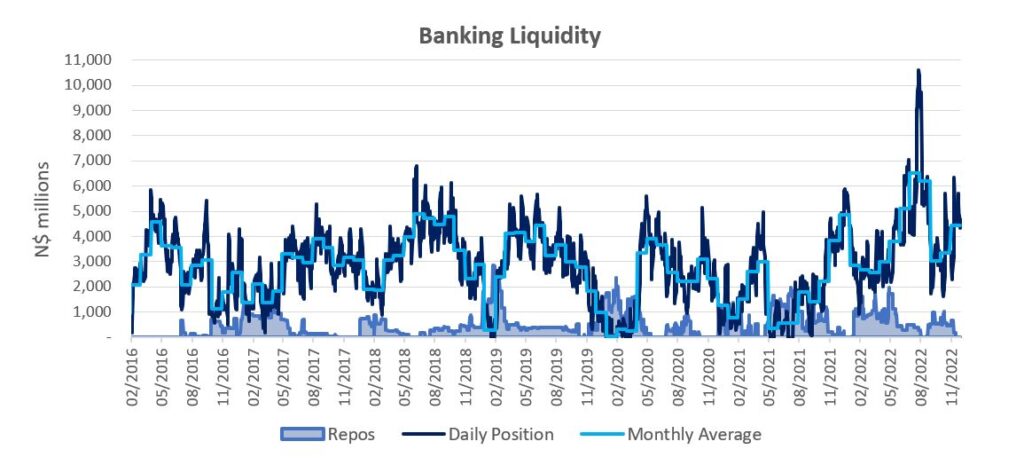

Banking Sector Liquidity

The overall liquidity position of the commercial banks improved in November, growing by N$1.30 billion to an average of N$4.44 billion and ended the month at N$4.70 billion. The BoN attributed the improved liquidity position to inflows from rising diamond sales.

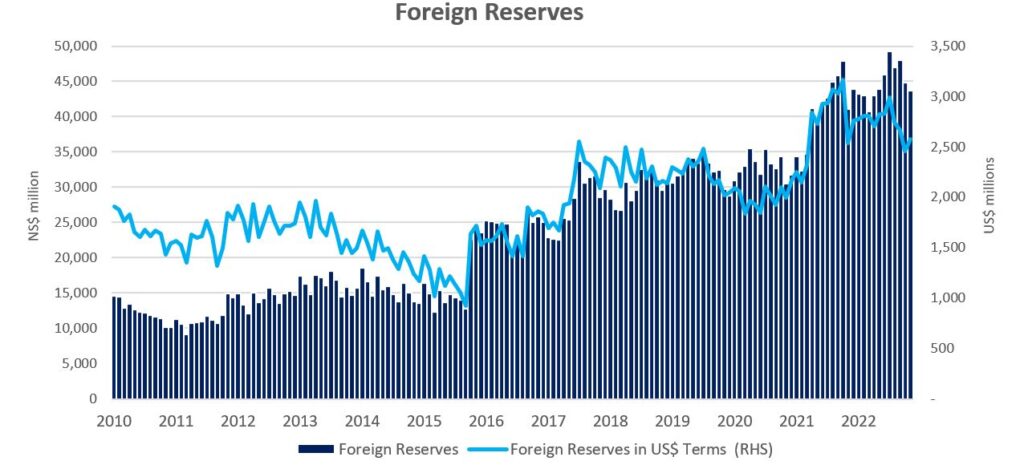

Money Supply and Reserves

Broad money supply (M2) contracted by N$842.3 million or 0.6% y/y to N$129.1 billion. The BoN ascribed the contraction to declining ‘other deposits’ coupled with lower growth in currency outside depository corporations during the review period. Foreign reserve balances fell by 2.3% m/m or N$1.04 billion to N$43.7 billion in November, which according to the BoN, was largely due to the redemption of the ZAR-denominated NAM01 bond during the review period.

Outlook

November saw the annual PSCE growth marginally higher compared to October. The BoN attributed the slightly higher growth in PSCE to increased demand for credit by the household sector and corporations in the fishing, energy, and manufacturing sectors as noted earlier. We expect PSCE growth to remain restrained over the short term and into 2023 due to rising borrowing costs and tepid economic activity dampening demand for new credit. We also see little on the supply side that would ignite demand for credit over this period.