Overall

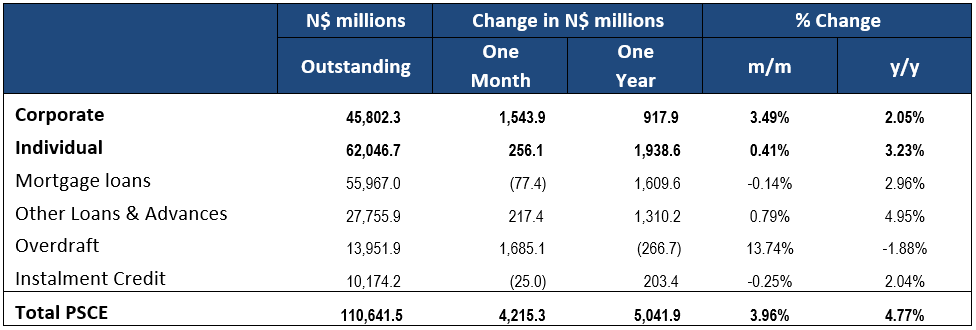

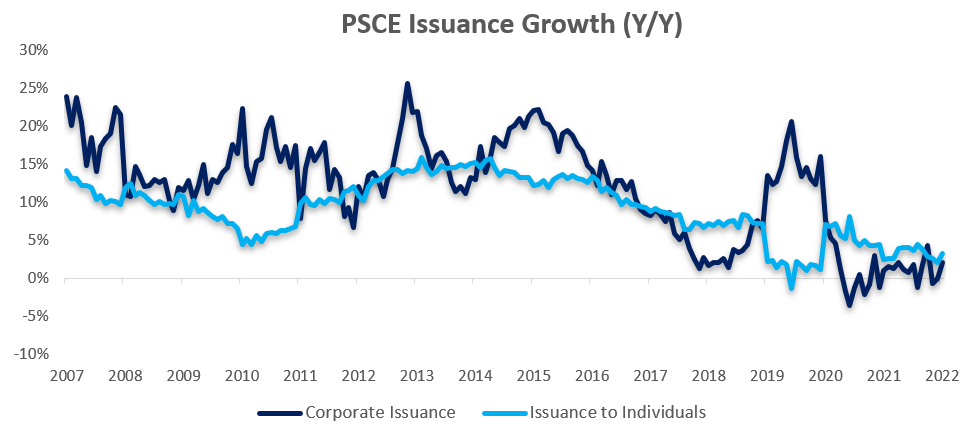

Private sector credit (PSCE) increased by N$4.22 billion or 4.0% m/m in January, the largest month-on-month percentage increased since 2003, bringing the cumulative credit outstanding to N$110.6 billion. On a year-on-year basis, private sector credit grew by 4.8% y/y in January, substantially quicker than the 1.0% growth recorded in December. Cumulative credit extended to the private sector over the last 12 months amounted to N$5.04 billion. N$1.9 billion worth of credit has been extended to individuals on a 12-month cumulative basis, while N$917.9 million was extended to corporates. Claims on non-resident private sectors increased by an immense N$2.4 billion during the month, which drove most of the increase in the overall PSCE figure.

Credit Extension to Individuals

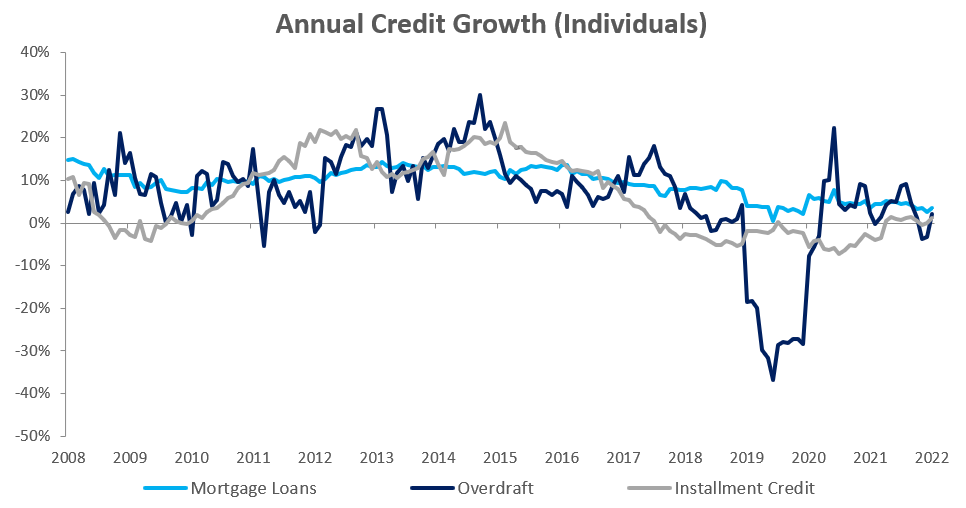

Credit extended to individuals increased by 0.4% m/m and 3.2% y/y in January. Most of the increase was driven by an increase in mortgage loans of 0.3% m/m and 3.4% y/y. Overdraft facilities to individuals also displayed relatively strong growth of 3.7% m/m and 2.0% y/y during the month. Other loans and advances (consisting of credit card debt, personal- and term loans) rose by 0.4% m/m and 4.0% y/y.

Credit Extension to Corporates

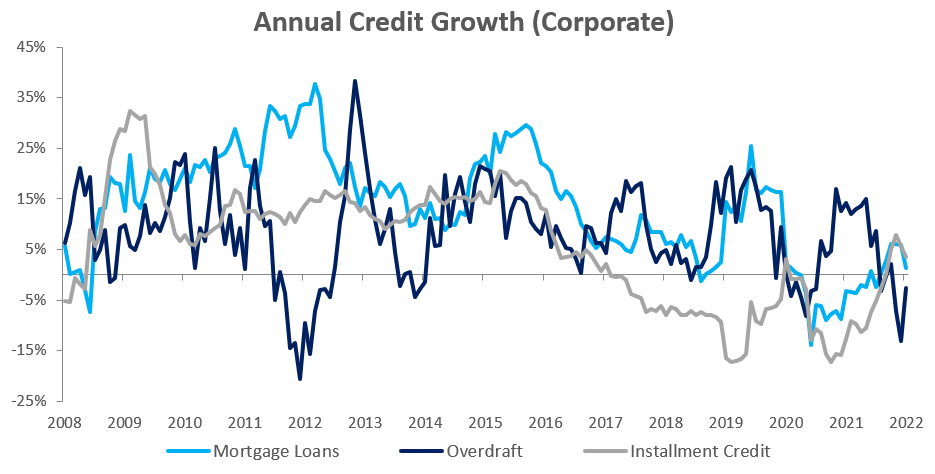

Credit extended to corporates grew by 2.1% y/y in January, following a contraction of 0.1% y/y in December. On a month-on-month basis credit extension to corporates rose 3.5% in January. The month-on-month growth was primarily driven by increased uptake in overdraft facilities which registered growth of 16.1% m/m, but fell 2.7% y/y. Demand for instalment credit by corporates remain low, falling by 0.4% m/m, but increasing 3.6% y/y. Mortgage loans to corporates fell by 1.6% m/m, but rose 1.4% y/y.

Banking Sector Liquidity

The overall liquidity position of the commercial banks deteriorated significantly during January, falling by N$2.00 billion to an average of N$2.85 billion. The BoN ascribed the decline to corporate tax payments at the start of 2022. The decline meant that the repo balance increased from zero at the end of December to N$1.53 billion at the end of the month.

Reserves and Money Supply

Broad money supply (M2) rose by N$2.03 billion or 1.6% y/y to N$128.4 billion, according to the BoN’s latest monetary statistics. Foreign reserve balances fell by 1.3% m/m or N$576.8 million to a total of N$43.3 billion. The contraction was contributed to increased government payments, increased commercial bank purchases of foreign currencies as well as exchange rate revaluations during the period.

Outlook

PSCE started the year off strong with a 4.0% m/m increase. It should however be noted that a significant portion of the increase has been driven by an increased uptake of overdraft facilities, particularly by corporates. Overdraft facilities are typically used to address short-term funding requirements, and not to fund long-term capital investment projects. The N$2.4 billion increase in claims on non-resident private sectors is however encouraging.

As expected, the BoN decided to raise rates by 25 basis points at its February MPC meeting. Inflationary pressure is expected to pick up in the coming months due to the rising oil price and the second-round effects. We continue to forecast both the South African and Namibian central banks to increase rates between 75- and 125-basis points during the year.