Overall

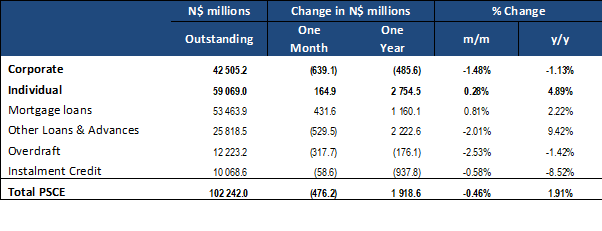

Total credit extended to the private sector (PSCE) decreased by N$106.9 million or 0.1% m/m in September, bringing the cumulative credit outstanding to N$102.88 billion. On a year-on-year basis private sector credit extension increased by only 1.5% y/y in September, compared to 2.2% growth recorded in August. This represents the lowest level of annual growth on our records dating back to 2002. N$2.80 billion worth of credit has been extended to individuals on a 12-month cumulative basis, while corporates and the non-resident private sector decreased their borrowings by N$943.7 million and N$372.3 million, respectively.

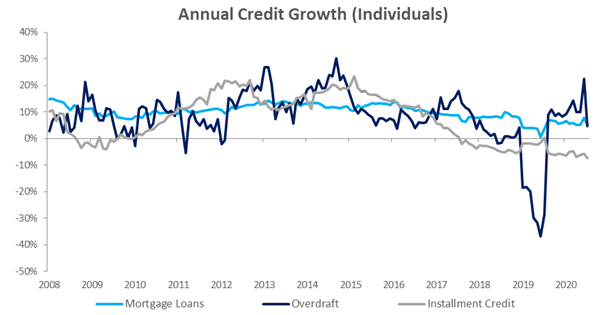

Credit Extension to Individuals

Credit extended to individuals increased by 0.5% m/m and 5.0% y/y in September. The month-on-month growth has mostly been driven by an increase in ‘other loans and advances’ (or OLA, which is made up of credit card debt, personal and term loans) which grew by 1.4% m/m and 14.0% y/y in August, indicating continued reliance on short-term credit by individuals. Overdraft facilities extended to individuals increased by 0.7% m/m and 4.2% y/y. Instalment credit and leasing transactions remained steady m/m, but contracted by 5.2% y/y. The value of mortgage loans extended to individuals grew by 0.3% m/m and 4.8% y/y.

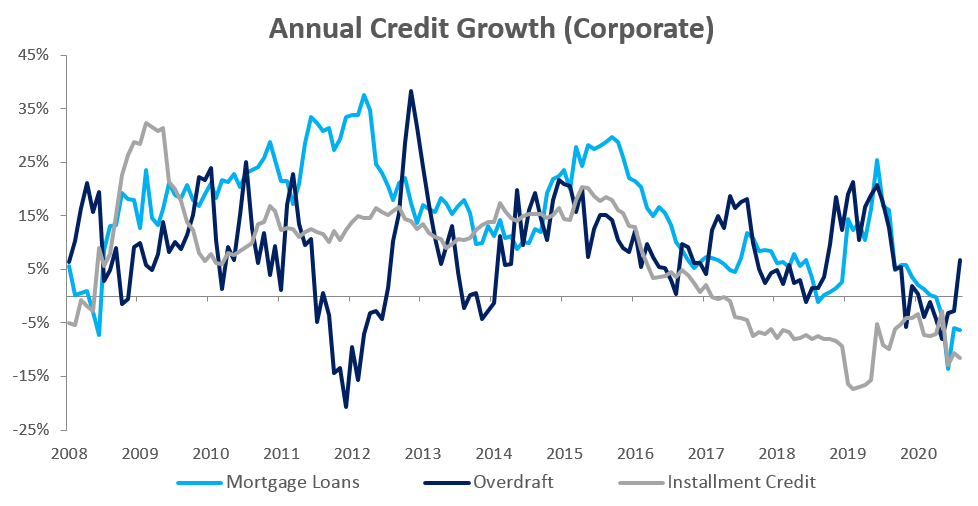

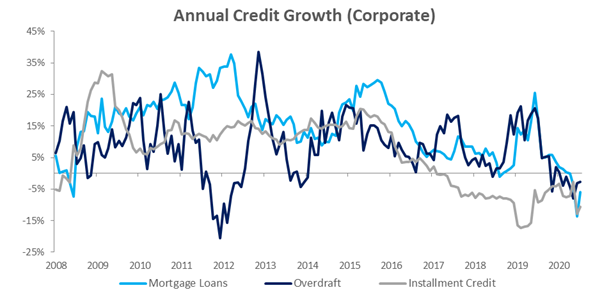

Credit Extension to Corporates

Credit extended to corporates contracted by 0.8% m/m and 2.2% y/y in September, following the low growth of 1.8% m/m and 0.4% y/y in August. Bar overdrafts, all categories recorded declines on a month-on-month basis. Mortgage loans to corporates declined by 1.0% m/m and 8.9% y/y. Instalment credit extended to corporates, which has been contracting since February 2017 on an annual basis, remained depressed, contracting by 2.5% m/m and 15.6% y/y in September. Overdrafts to corporates remained steady m/m, but increased by 3.7% y/y.

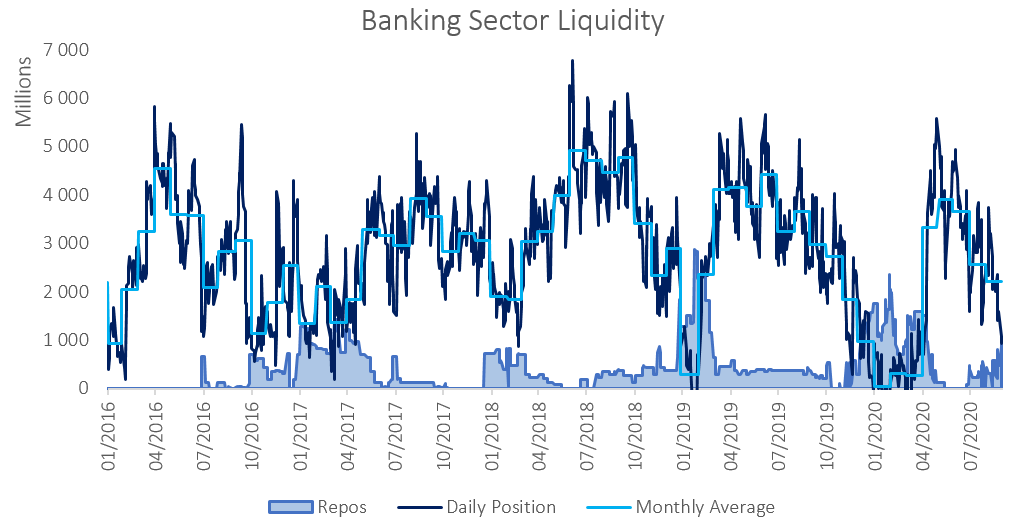

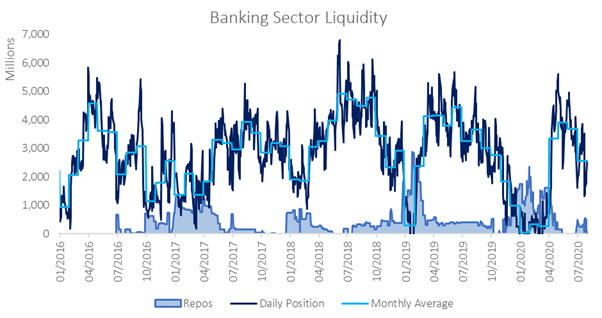

Banking Sector Liquidity

The overall liquidity position of commercial banks remained relatively unchanged, declining by only N$10.1 million to reach an average of N$2.22 billion. The Bank of Namibia states that this is due to two opposing effects of higher Government payments which were partially offset by an increase in South African Rand currency outflows during the month. The outstanding balance of repo’s fell from N$882.8 million at the start of September to N$116.0 million by month end.

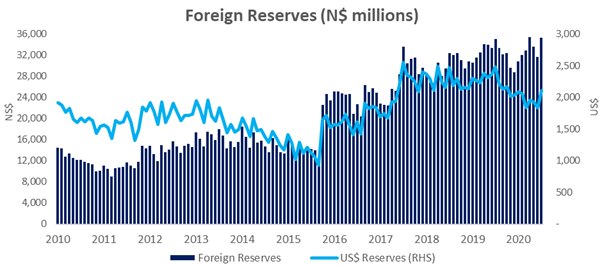

Reserves and Money Supply

Broad money supply rose by N$12.7 billion or 11.2% y/y in September, as per the BoN’s latest monetary statistics release. Foreign reserve balances declined by N$2.01 billion or 2.2% m/m to N$32.7 billion in September. The BoN attributes the decrease to higher government foreign payments, as well as an increase in commercial bank outflows during the month.

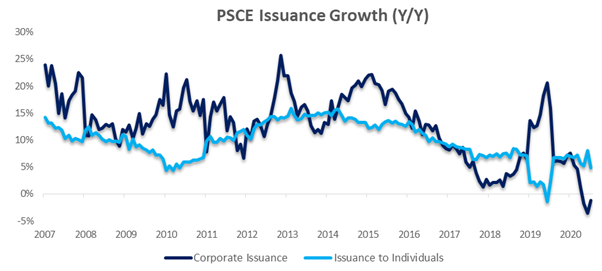

Outlook

Private sector credit extension growth remains subdued at the end of September, slowing from 2.2% y/y to 1.5% y/y in September. Rolling 12-month issuance fell to N$1.48 billion and is down a rather staggering 75.1% from the N$5.95 billion figure as at September 2019.

The data clearly shows that while the various rate cuts by the BoN would have provided relief to those who are heavily indebted, it did not spur on additional credit uptake, as we predicted. The heightened uptake of short-term personal debt and overdrafts is a sign of a stretched consumer, many of whom will have been negatively impacted by the effect of the pandemic and resultant lockdowns. As economic activity is expected to remain depressed for quite some time, we do not expect to see a recovery in credit extension in the short term. Corporates continue to delever, indicating that they are not preparing to invest in capital expansion projects anytime soon, which makes sense given the current economic climate.