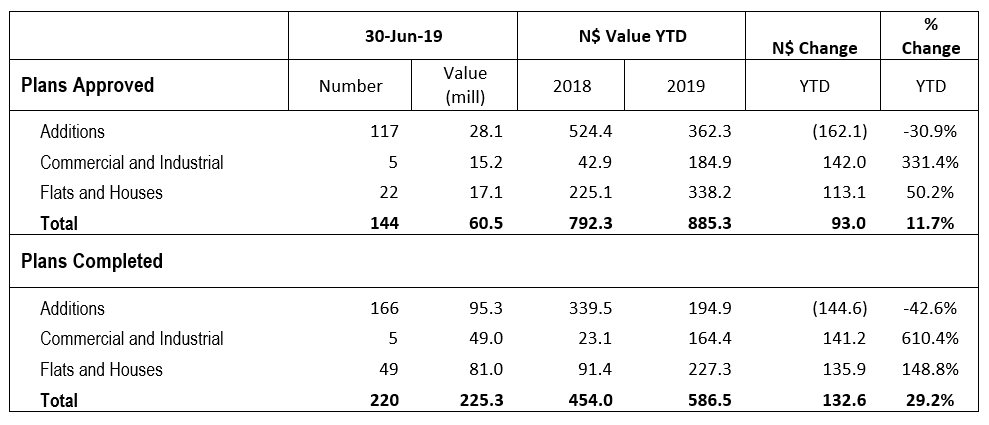

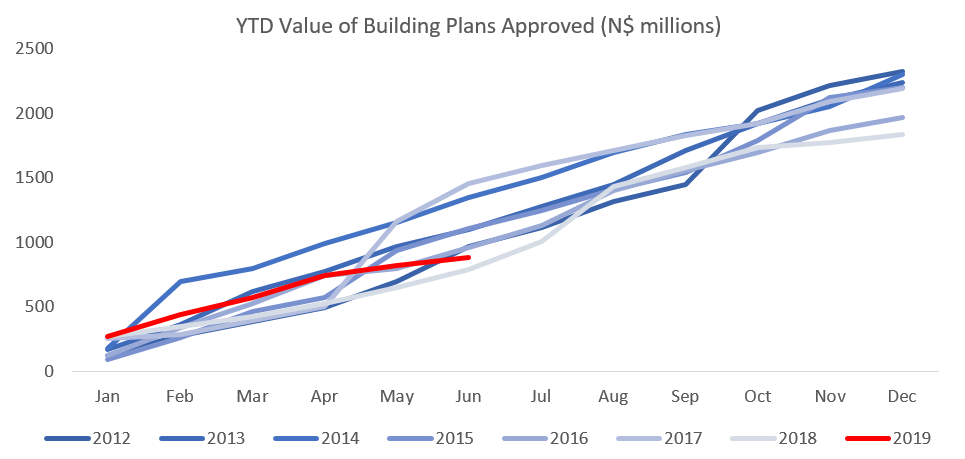

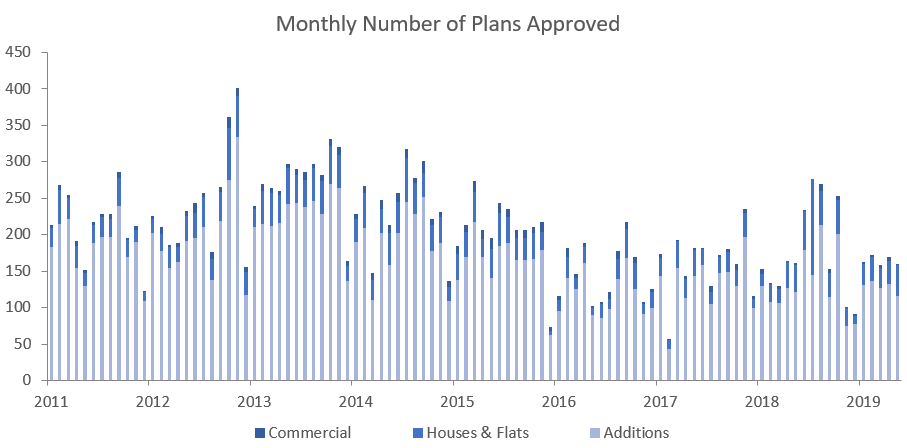

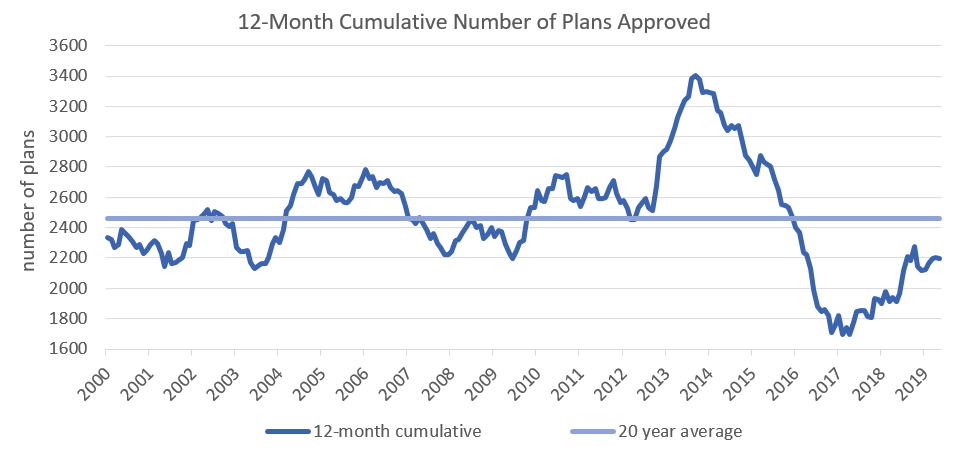

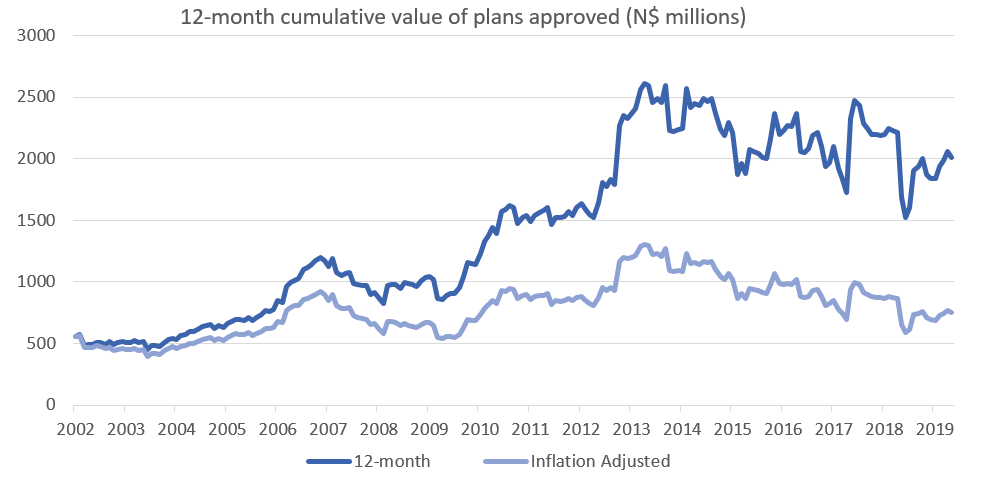

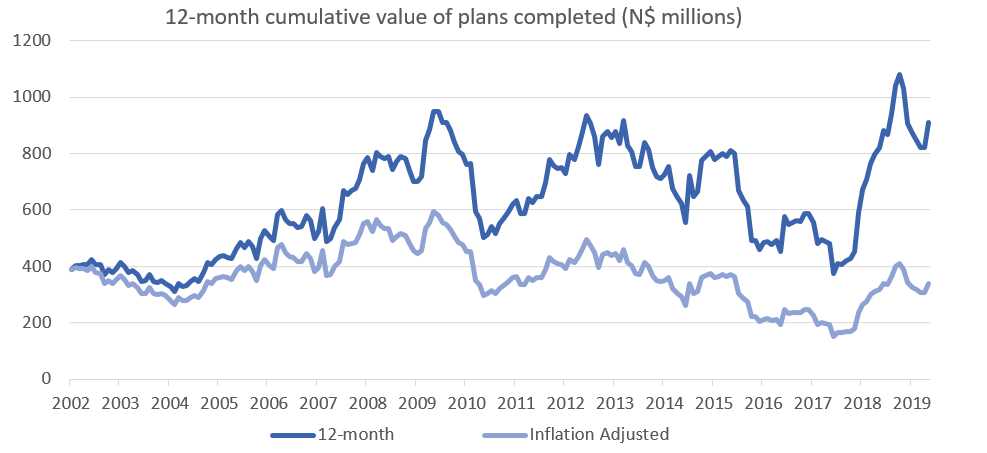

A total of 144 building plans were approved by the City of Windhoek in May, 15 less than in May. N$60.5 million worth of plans were approved in June as opposed to N$81.3 million in May. A total of 220 building plans were completed during the month with a value of N$225.3 million. Year-to-date, N$885.3 million worth of building plans have been approved, 11.7% more than during the corresponding period in 2018. On a twelve-month cumulative basis, 2,108 building plans have been approved worth approximately N$1.93 billion, 26.6% higher in value terms than cumulative approvals in June 2018.

117 additions to properties were approved in June with a value of N$28.1 million, a drop of 17.5% m/m and 63.8% y/y in value. Year-to-date 760 additions to properties have been approved with a total value of N$362.3 million, decreases of 1.3% y/y in number and 30.9% y/y in value terms. On a 12-month cumulative basis the number of additions approved has decreased by 0.8% y/y as well as by 22.2% y/y in value terms. We continue to see more additions to properties being approved but with a lower overall value being added. Year-to-date 341 additions have been completed with a combined value of N$194.9 million, down 68.3% y/y in number and 42.6% y/y in value terms.

New residential units accounted for 22 of the approvals registered in June, decreases of 47.6% m/m and 58.5% y/y. In value terms N$17.2 million worth of residential units were approved in June, contracting by 62.7% m/m and 68.0% y/y. Year-to-date residential unit approvals have decreased by 0.5% y/y in number and are up 50.2% y/y in value. On a 12-month cumulative basis residential unit approvals recorded a 50.6% y/y increase in number of approvals and a 76.9% y/y increase in value.

5 new commercial units valued at N$15.2 million were approved in June, bringing the year-to-date number of commercial and industrial approvals to 20, worth a total of N$184.9 million. This is 5.3% up in number from June last year and 331.4% up in value terms. On a rolling 12-month basis the number of commercial and industrial approvals have risen to 44 units worth N$522.3 million. This is a decrease of 15.4% y/y in number but an increase of 192.0% y/y in value.

In the last 12 months 2,108 building plans have been approved, increasing by 7.1% compared to June 2018. These approvals are valued at N$1.93 billion, an increase of 26.6% y/y. Overall the cumulative plans approved have increased in number and value terms compared to a year ago which points to positive future construction activity in the city.

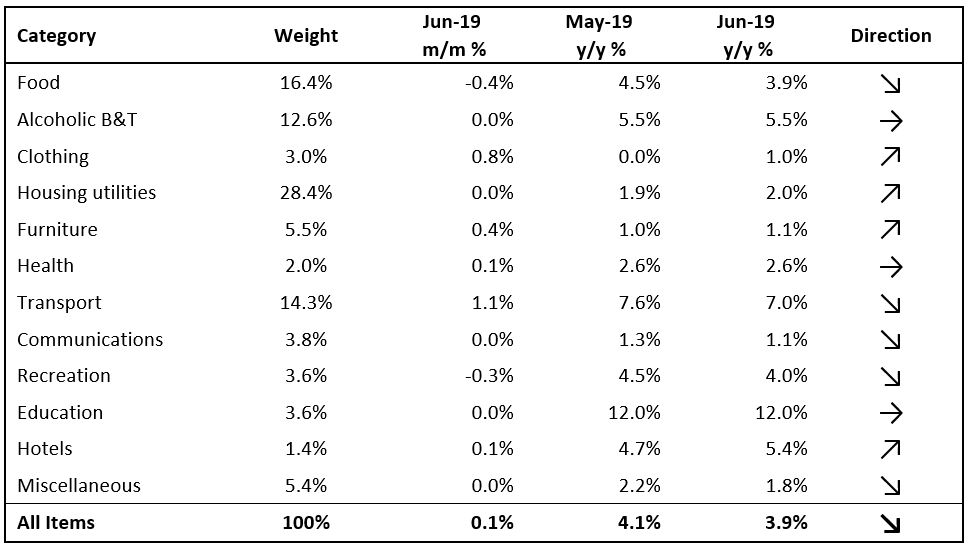

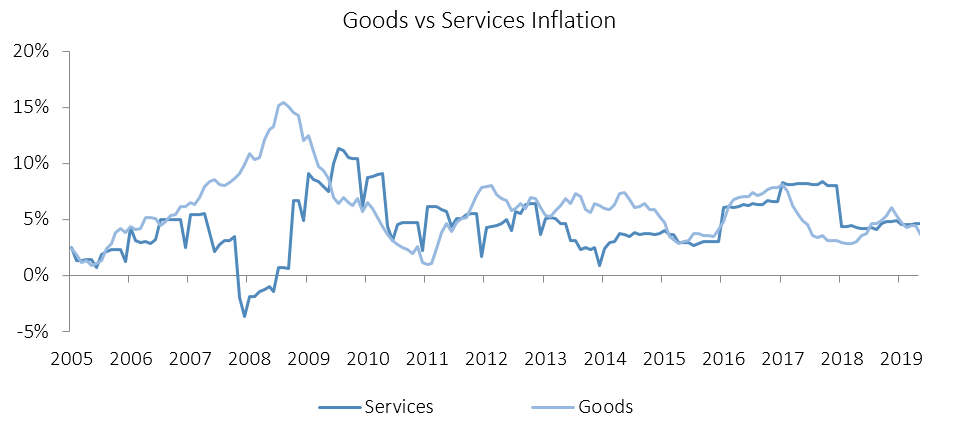

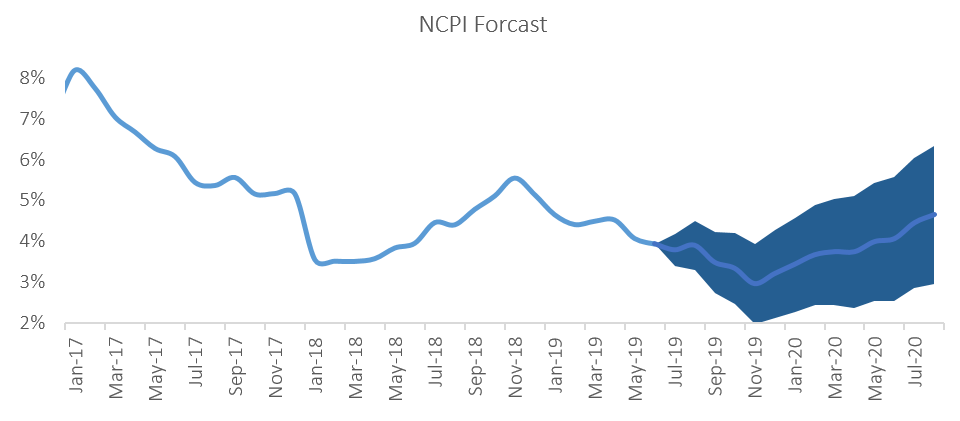

Our expectation is for the Bank of Namibia to follow the SARB’s MPC decision to cut interest rates by 25 bps at next month’s MPC meeting. Consumers and businesses are thus likely to be provided with some slight relief. With the rate cut it will become more attractive for businesses to acquire the debt finance needed to expand and invest in capital projects, but only marginally.

Interest rates are unlikely to be the major barrier to capital projects going forward. The construction industry, along with lenders, have been challenged by sluggish growth in the economy and poor business confidence rather than tight monetary policy. We do not expect the decrease in interest rates to bring about a significant improvement in the approvals and completions data in the short term as business confidence is still lacking.