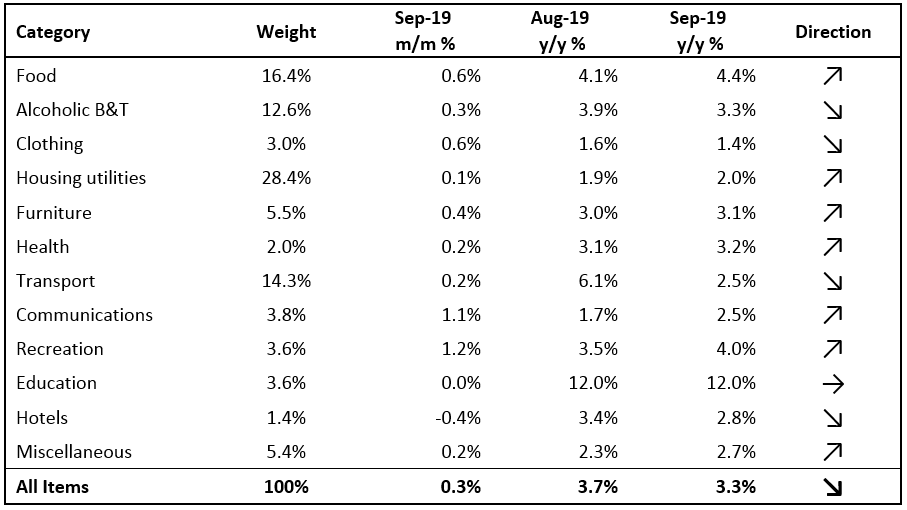

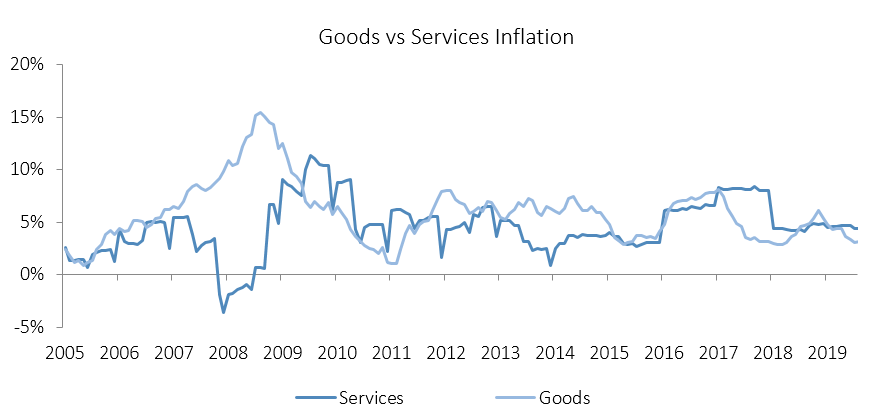

The Namibian annual inflation rate slowed to 3.3% y/y in September, following the 3.7% y/y increase in prices recorded in August. On a month-on-month basis, prices rose 0.3% following a 0.1% price change recorded in August. On an annual basis, prices in seven of the twelve basket categories rose at a quicker rate in September than in August. One category remained unchanged, while the rate of price increases in four categories slowed for the month of September. Prices for goods rose by 3.0% y/y while prices for services increased by 3.5% y/y.

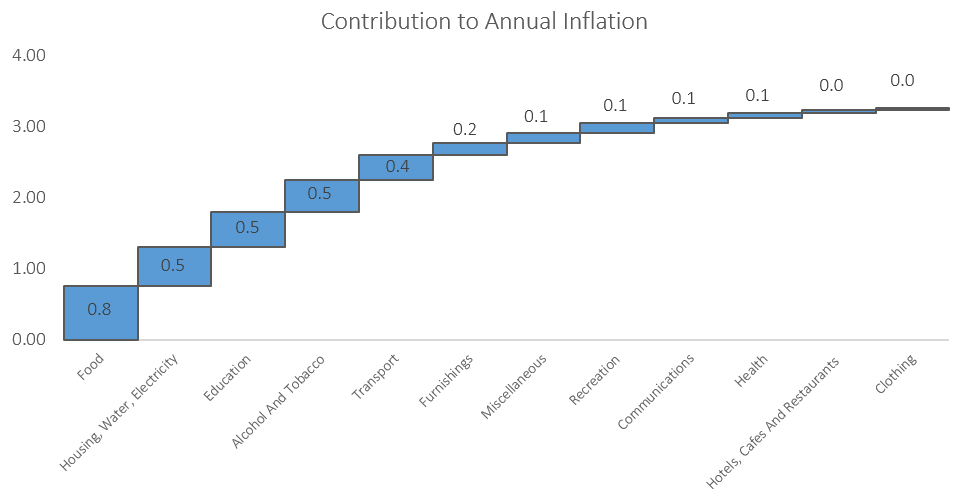

Food & non-alcoholic beverages, the second largest basket item in weighting, accounted for 0.8% of the total annual inflation figure. Prices in this category rose by 4.4% y/y, faster than the 4.1% recorded in August. Most of the sub-categories of food and non-alcoholic beverages showed relatively low monthly increases, while four of the sub-categories showed monthly decreases. The largest increases were observed in the prices of vegetables which increased by 15.1% y/y and fruits which increased by 11.7% y/y. The price of meat saw a price decrease of 0.2% y/y. The decline in meat prices is not expected to last however, as it is largely driven by high supply of animals as farmers slaughter more during the drought. Restocking farms in the future will likely lead to upward pressure on meat prices.

The housing and utilities category was the second largest contributor to annual inflation in September, accounting for 0.5% of the total 3.3% inflation figure. Price inflation for this category came in at 2.0% y/y, but remained relatively flat month-on-month, increasing only 0.1%. Annual inflation for rental payments remained unchanged at 2.3% in September and will likely remain this low for the rest of the year. The regular maintenance and repair of dwellings subcategory recorded an increase in prices of 3.4% y/y, which is a somewhat lower rate of increase than the 3.6% y/y registered the previous month. Month-on-month, prices in this subcategory decreased by 0.3%.

The education basket category recorded inflation of 12.0% y/y, with the cost of pre-primary and primary education growing at a rate of 12.6% y/y, while secondary- and tertiary education recorded price increases of 11.0% y/y and 12.7% y/y, respectively. All three subcategories printed no price increases on a month on month basis.

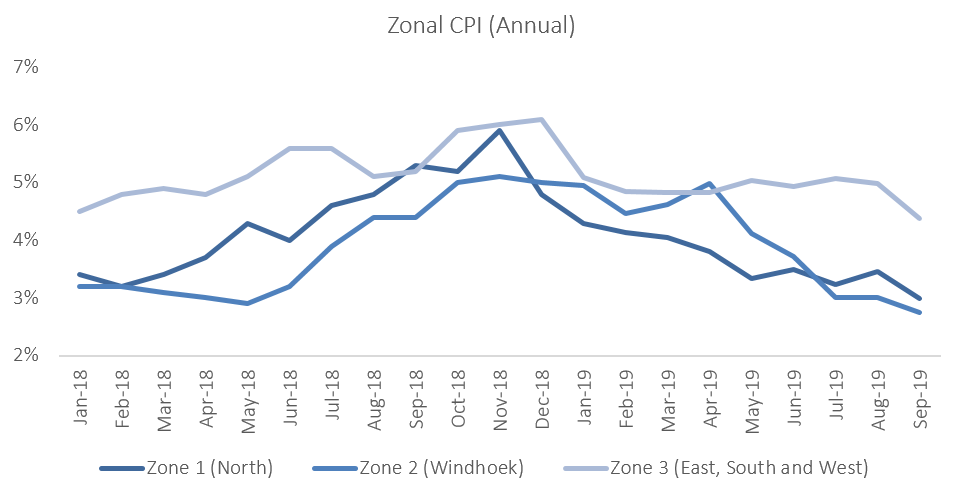

The zonal data shows that on a monthly basis, prices printed flat in the southern, eastern and western parts of the country, while rising elsewhere in the country. On an annual basis, the Windhoek and surrounding area, recorded the lowest inflation rate of 2.7% in September, with the mixed zone 3 covering the south, east and west of the country recording the highest rate of inflation at 4.4% y/y. Inflation in the northern region of the country increased to 3.0% y/y.

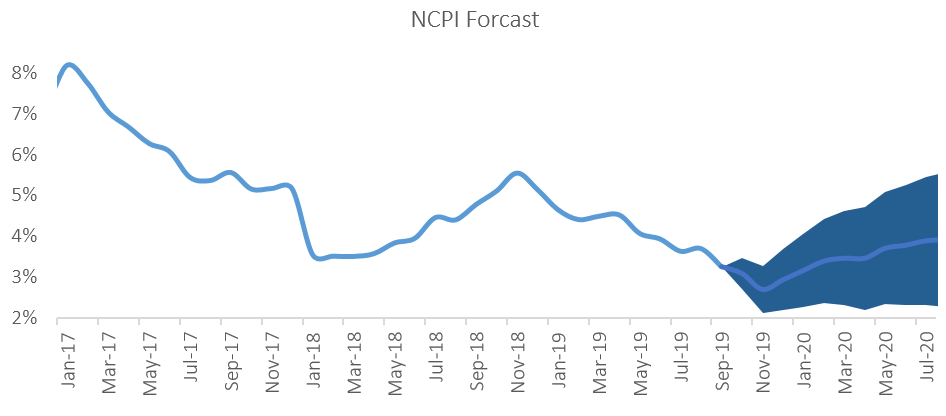

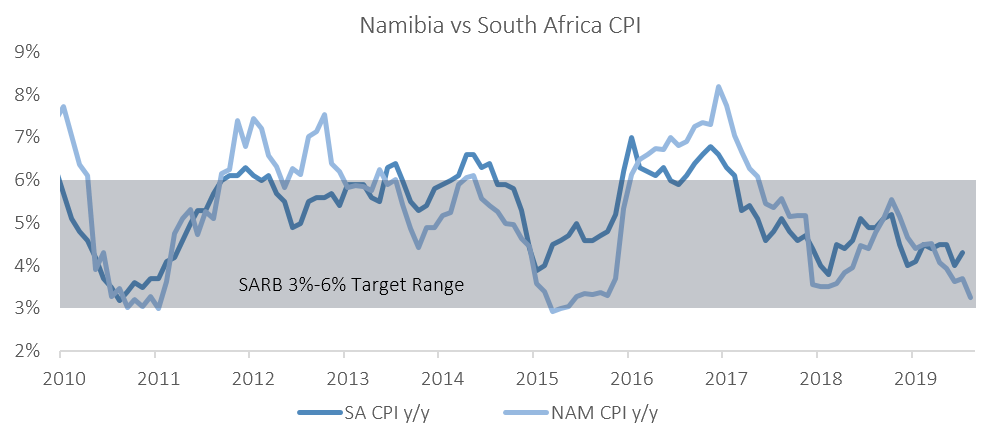

The Namibian annual inflation rate continued to slow, reaching 3.3% in September, and is the lowest annual rate since November 2015. The moderation in September’s annual figure was mostly a result of base effects, as the increase in prices of public transportation services in September 2018 no longer influences the annual inflation figure. The ongoing recession, coupled with low business and consumer confidence, has dampened the demand for goods and services, translating to lower overall inflation. IJG’s inflation model forecasts an average inflation rate of 3.8% y/y in 2019 and 3.9% y/y in 2020. The largest upside risk to this forecast is higher food costs, as the drought affects local food production.