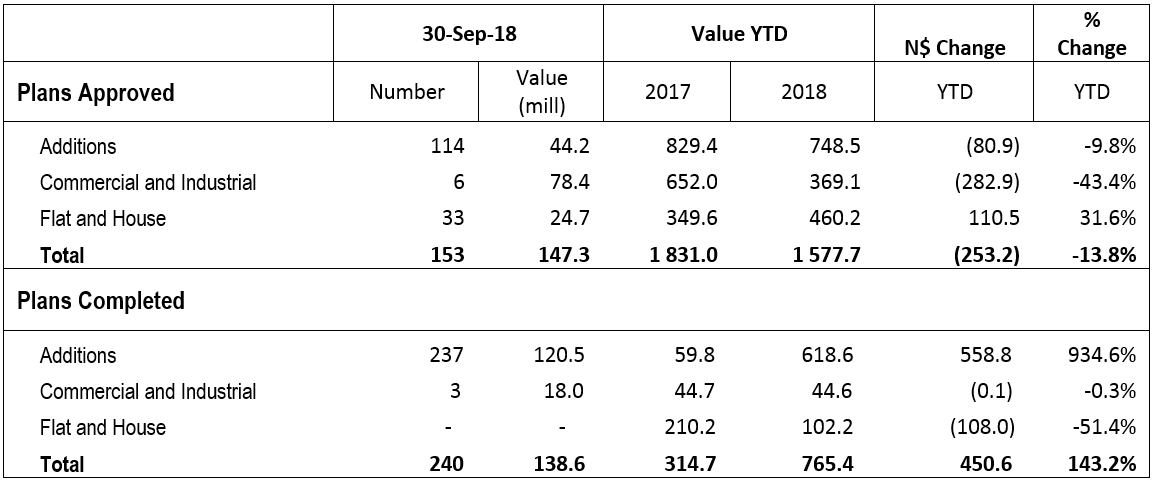

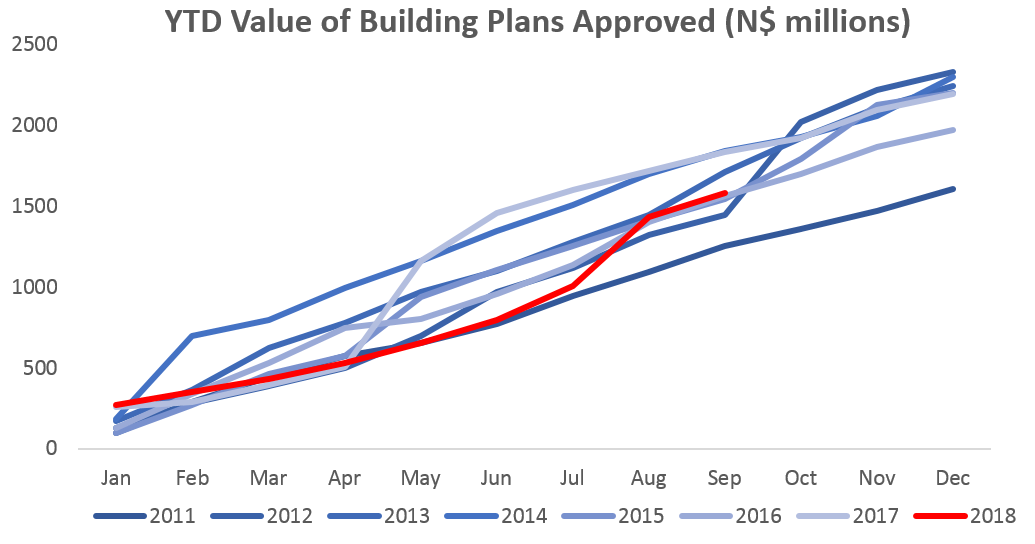

Overall

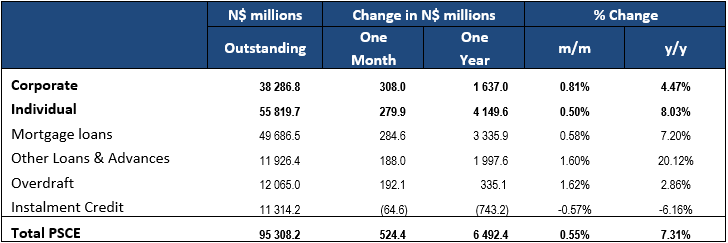

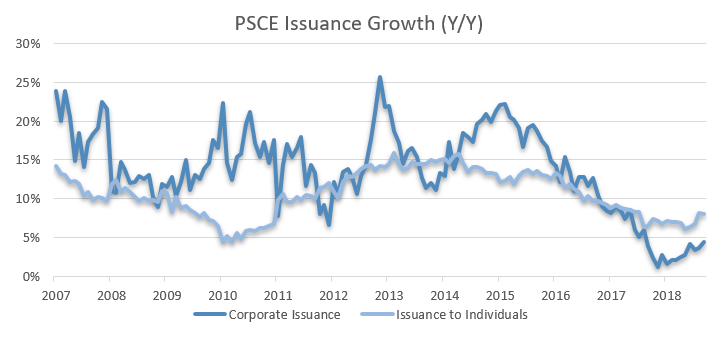

Private sector credit extension (PSCE) rose by N$524.4 million or 0.6% m/m, compared to the N$1.375 billion or 1.5% m/m increase recorded in August. PSCE growth ticked up marginally to 7.3% y/y in September from 7.1% y/y in August. Cumulative credit outstanding currently amounts to N$95.3 billion. Similar to what transpired in August, the monthly increase in PSCE for September was driven by corporates rather than households. On an annual basis PSCE growth was largely driven by household demand for credit. Growth in credit extended to households however, did slow marginally to 8.0% y/y in September compared to 8.1% y/y in August. Credit extended to corporates increased by 4.5% y/y in September following a 3.6% y/y rise in August. On a rolling 12-month basis N$6.49 billion worth of credit was extended to the private sector with N$4.15 billion being taken up by households. Corporations took up N$1.64 billion worth of credit while claims on non-residents totaled N$705.8 million.

Credit extension to individuals

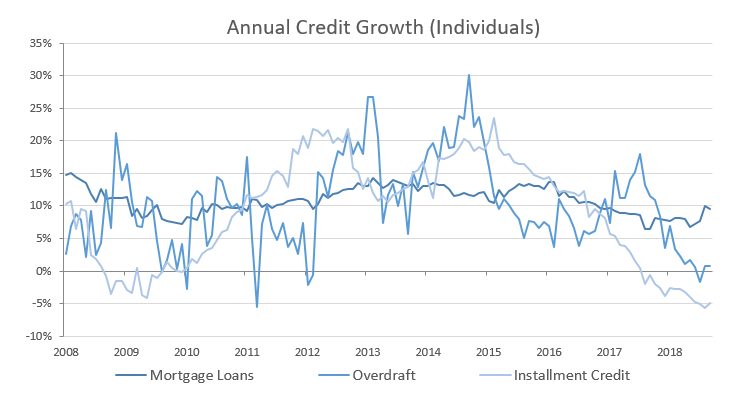

Credit extended to individuals increased by 8.0% y/y in September, almost unchanged from the 8.1% y/y growth recorded in August. Mortgage loans extended to individual increased by 9.5% y/y in September compared to the 10.0% y/y increase recorded in August. Other loans and advances grew by 18.0% y/y and 1.6% m/m in September. Growth in installment credit remained in negative territory, contracting by 4.6% y/y and 0.2% m/m in September. Household demand for overdraft facilities remained subdued in September, increasing by 0.8% y/y and unchanged on a month-on-month basis.

Credit extension to corporates

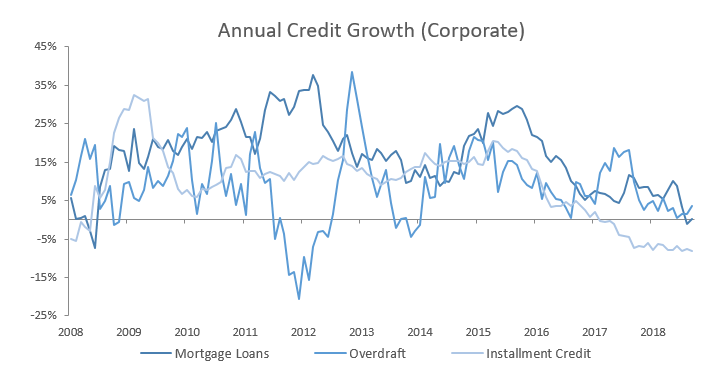

Credit extension to corporates grew by 4.5% y/y and 0.8% m/m in September. On a rolling 12-month basis N$1.64 billion was extended to corporates as at the end of September compared to N$1.34 billion as at the end of August. The uptick in the general demand for credit by corporates does provide for some optimism, possibly showing signs of increased business confidence. However, the biggest driver of the increase in credit extended to corporates was a 22.4% y/y increase in loans and other advances, followed by overdraft facilities increasing by 3.6% y/y. The continued contractions in installment credit and leasing transactions of 8.0% y/y and 1.6% y/y respectively, is a sign of declining capital investment. When viewed in conjunction with in the increased use of short-term credit such as overdraft facilities, this points to businesses borrowing to manage cash flows rather than expanding operations.

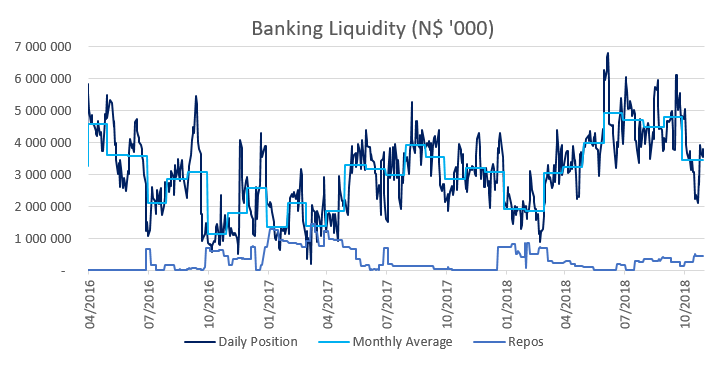

Banking Sector Liquidity

The overall liquidity position of commercial banks increased by N$303.1 million to an average of N$4.8 billion during September from N$4.5 billion in August. Bank of Namibia attributed the strong liquidity in September to an increase in Diamond sales. Furthermore, commercial banks made less use of BoN’s repo facility, with the outstanding balance of repo’s decreasing from N$386 million at the start of September to N$147 million by month end. The balance of BoN bills remained unchanged at N$1.7 billion as at the end of September.

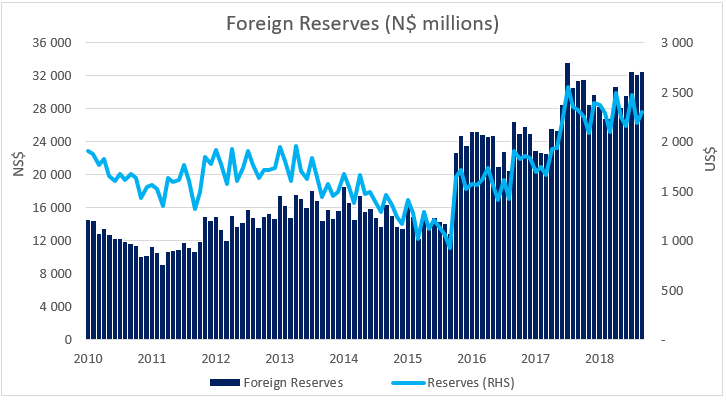

Reserves and money supply

Foreign reserve balances increased by N$321 million to N$32.52 billion in September from N$32.20 billion in August. BoN attributes the increase in reserves to inflows from foreign currency deposits by the commercial banks. A portion of the foreign currency deposits are attributable to diamonds sales which also led to the increased liquidity position as noted above.

Outlook

PSCE accelerated moderately for a second consecutive month, reaching a 16-month high growth rate of 7.3% y/y. Much of the rise in PSCE was household driven over the last year. One would expect for the increase in household demand to translate into an increase in business credit to meet that demand. However, corporates have scaled down in their uptake of mortgage financing and installment credit, which finances capital projects. This becomes concerning when viewed in conjunction with loans, advances and overdrafts that have been on the rise and does point to businesses operating under difficult financial conditions. October and November PSCE releases may record increases in short-term credit extended to corporates, as businesses prepare for the seasonal uptick in retail spending expected over the last two months of the year.

Key monetary policy decisions are scheduled between now and December that will have an impact on PSCE growth in the near-term. The SARB Monetary Policy Committee (MPC) will meet in November to re-evaluate interest rates, with present expectations of a 25bp hike in rates. A SARB rate hike will put SA’s repo rate on par with that of Namibia. BoN’s MPC, scheduled to meet in December, would be likely to seriously consider maintaining the 25bp interest rate spread over South Africa which would see a similar rate hike in Namibia. At present, South African money market rates are marginally higher than those in Namibia, and if BoN keeps its repo rate on par with that of SA, it may lead to an outflow of capital from Namibia. A rate hike by BoN would mitigate the risk of capital outflows and protect foreign reserve levels, but will make debt service costs more expensive for an already indebted consumer.