Twitter Timeline

[custom-twitter-feeds]

Categories

- Calculators (1)

- Company Research (298)

- Capricorn Investment Group (52)

- FirstRand Namibia (54)

- Letshego Holdings Namibia (25)

- Mobile Telecommunications Limited (7)

- NamAsset (3)

- Namibia Breweries (45)

- Oryx Properties (59)

- Paratus Namibia Holdings (6)

- SBN Holdings Limited (17)

- Economic Research (660)

- BoN MPC Meetings (13)

- Budget (19)

- Building Plans (142)

- Inflation (142)

- Other (28)

- Outlook (17)

- Presentations (2)

- Private Sector Credit Extension (141)

- Tourism (7)

- Trade Statistics (4)

- Vehicle Sales (143)

- Media (25)

- Print Media (15)

- TV Interviews (9)

- Regular Research (1,806)

- Business Climate Monitor (75)

- IJG Daily (1,609)

- IJG Elephant Book (12)

- IJG Monthly (108)

- Team Commentary (250)

- Danie van Wyk (61)

- Dylan van Wyk (27)

- Eric van Zyl (16)

- Hugo van den Heever (1)

- Leon Maloney (11)

- Top of Mind (4)

- Zane Feris (12)

- Uncategorized (6)

- Valuation (4,492)

- Asset Performance (116)

- IJG All Bond Index (2,083)

- IJG Daily Valuation (1,807)

- Weekly Yield Curve (485)

Meta

Category Archives: Economic Research

NCPI – September 2019

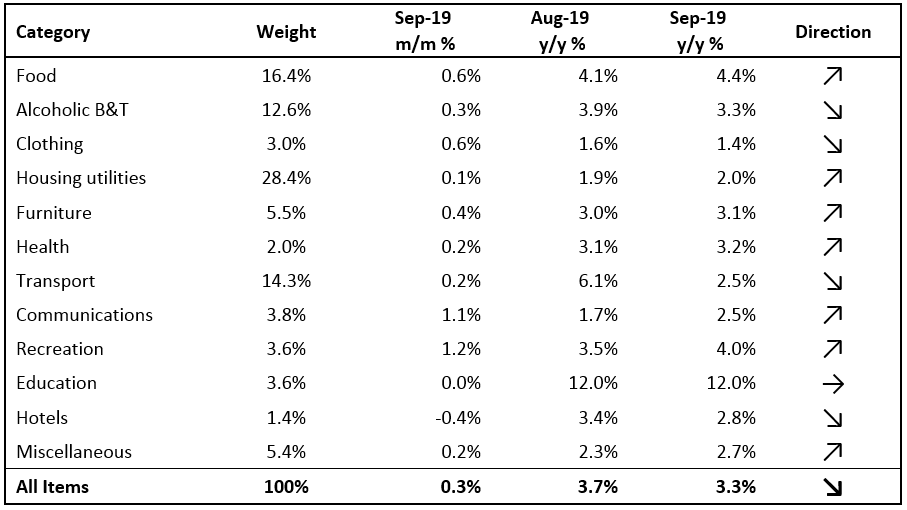

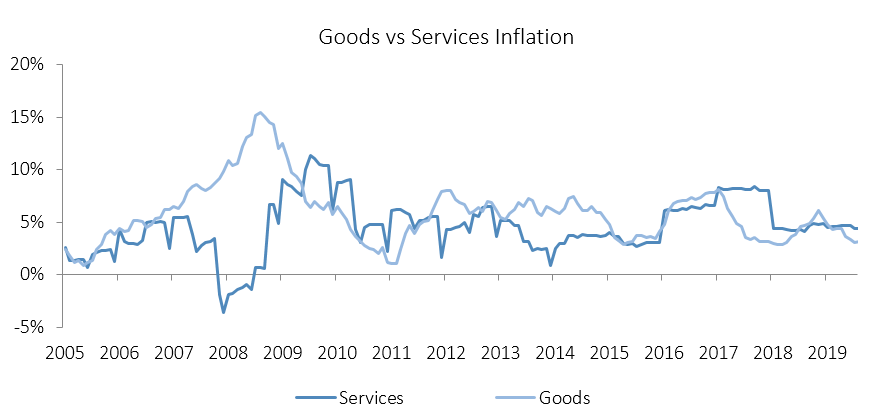

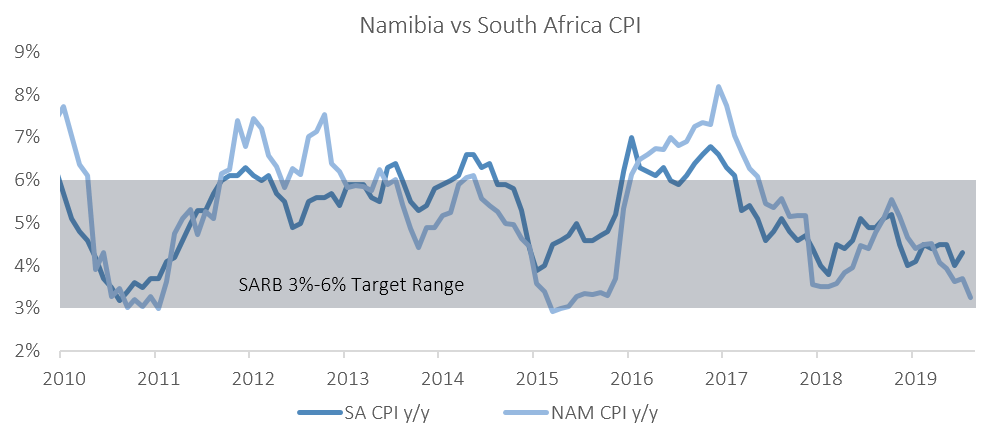

The Namibian annual inflation rate slowed to 3.3% y/y in September, following the 3.7% y/y increase in prices recorded in August. On a month-on-month basis, prices rose 0.3% following a 0.1% price change recorded in August. On an annual basis, prices in seven of the twelve basket categories rose at a quicker rate in September than in August. One category remained unchanged, while the rate of price increases in four categories slowed for the month of September. Prices for goods rose by 3.0% y/y while prices for services increased by 3.5% y/y.

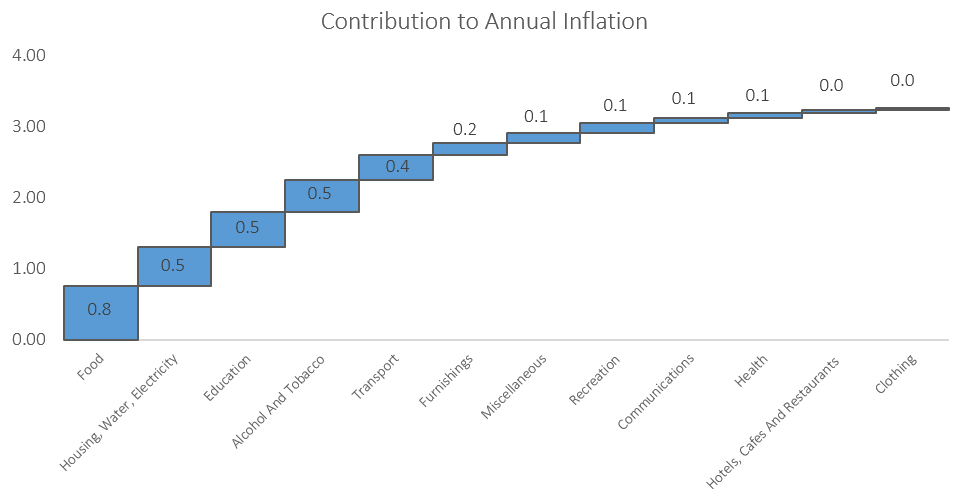

Food & non-alcoholic beverages, the second largest basket item in weighting, accounted for 0.8% of the total annual inflation figure. Prices in this category rose by 4.4% y/y, faster than the 4.1% recorded in August. Most of the sub-categories of food and non-alcoholic beverages showed relatively low monthly increases, while four of the sub-categories showed monthly decreases. The largest increases were observed in the prices of vegetables which increased by 15.1% y/y and fruits which increased by 11.7% y/y. The price of meat saw a price decrease of 0.2% y/y. The decline in meat prices is not expected to last however, as it is largely driven by high supply of animals as farmers slaughter more during the drought. Restocking farms in the future will likely lead to upward pressure on meat prices.

The housing and utilities category was the second largest contributor to annual inflation in September, accounting for 0.5% of the total 3.3% inflation figure. Price inflation for this category came in at 2.0% y/y, but remained relatively flat month-on-month, increasing only 0.1%. Annual inflation for rental payments remained unchanged at 2.3% in September and will likely remain this low for the rest of the year. The regular maintenance and repair of dwellings subcategory recorded an increase in prices of 3.4% y/y, which is a somewhat lower rate of increase than the 3.6% y/y registered the previous month. Month-on-month, prices in this subcategory decreased by 0.3%.

The education basket category recorded inflation of 12.0% y/y, with the cost of pre-primary and primary education growing at a rate of 12.6% y/y, while secondary- and tertiary education recorded price increases of 11.0% y/y and 12.7% y/y, respectively. All three subcategories printed no price increases on a month on month basis.

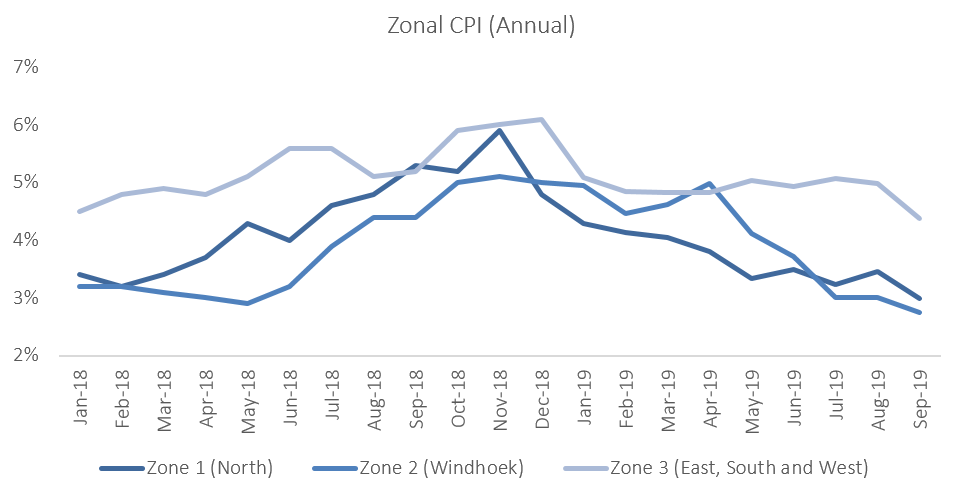

The zonal data shows that on a monthly basis, prices printed flat in the southern, eastern and western parts of the country, while rising elsewhere in the country. On an annual basis, the Windhoek and surrounding area, recorded the lowest inflation rate of 2.7% in September, with the mixed zone 3 covering the south, east and west of the country recording the highest rate of inflation at 4.4% y/y. Inflation in the northern region of the country increased to 3.0% y/y.

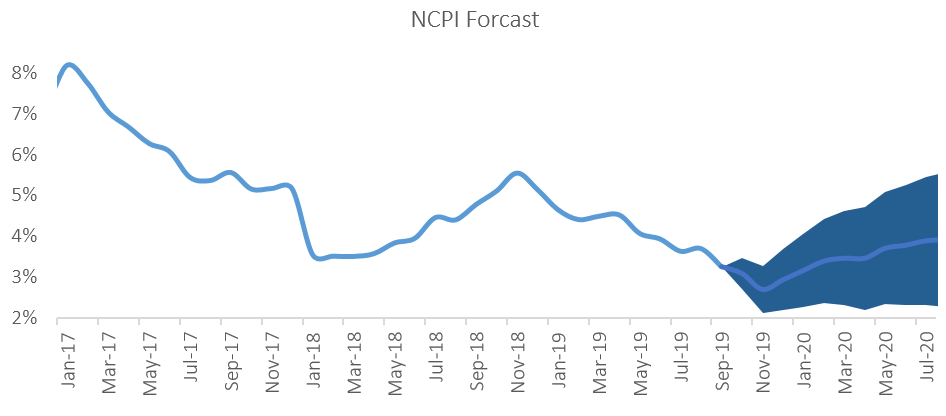

The Namibian annual inflation rate continued to slow, reaching 3.3% in September, and is the lowest annual rate since November 2015. The moderation in September’s annual figure was mostly a result of base effects, as the increase in prices of public transportation services in September 2018 no longer influences the annual inflation figure. The ongoing recession, coupled with low business and consumer confidence, has dampened the demand for goods and services, translating to lower overall inflation. IJG’s inflation model forecasts an average inflation rate of 3.8% y/y in 2019 and 3.9% y/y in 2020. The largest upside risk to this forecast is higher food costs, as the drought affects local food production.

New Vehicle Sales – September 2019

A total of 806 new vehicles were sold in September, representing a 0.2% m/m decrease from the 808 vehicles sold in August. Year-to-date, 7,841 vehicles have been sold of which 3,534 were passenger vehicles, 3,763 were light commercial vehicles, and 544 were medium and heavy commercial vehicles. This is the lowest year-to-date sales witnessed since 2009. On a twelve-month cumulative basis, new vehicle sales continued its downward trend. 10,680 new vehicles were sold over the last twelve months, a 10.2% contraction from the previous twelve months and also the lowest level since 2009.

320 new passenger vehicles were sold in September, contracting by 11.1% m/m and 5.9% y/y. Year-to-date passenger vehicle sales rose to 3,534 units, down 11.1% when compared to the year-to-date figure recorded in September 2018. On an annual basis, twelve-month cumulative passenger vehicle sales fell 9.7% y/y as the number of passenger vehicles sold continued to decline.

A total of 486 new commercial vehicles were sold in September, increasing of 8.5% m/m but contracted by 24.8% y/y. Of the 486 commercial vehicles sold in September, 405 were classified as light commercial vehicles, 25 as medium commercial vehicles and 56 as heavy or extra heavy commercial vehicles. On a twelve-month cumulative basis, light commercial vehicle sales dropped 12.7% y/y, while medium commercial vehicle sales and heavy commercial vehicles rose 0.41% y/y and 12.3% y/y, respectively. There has been an increase in the sale of heavy commercial vehicles on a year-to-year basis, from the 6.9% recorded in the preceding month. This illustrates a slight increase in the demand for durable goods by businesses.

Volkswagen leads the passenger vehicle sales segment with 30.4% of the segment sales year-to-date. Toyota in second place with 29.7% of the market-share as at the end of September. Kia, Mercedes, Hyundai and Ford each command around 5.0% of the market in the passenger vehicles segment, leaving the remaining 19.4% of the market to other brands.

Toyota retains a strong year-to-date market share of 58.5% and remains the market leader in the light commercial vehicle segment. Nissan remains in second position in the segment with 11.7% of the market, while Ford makes up third place with 9.3% of the year-to-date sales. Hino leads the medium commercial vehicle segment with 37.2% of sales year-to-date, while Scania was number one in the heavy- and extra-heavy commercial vehicle segment with 34.8% of the market share year-to-date.

The Bottom Line

Vehicle sales remain under pressure, with the year-to-date new vehicle sales in 2019 currently below 2010 levels, and the total new vehicle sales for the last 12 months down 10.2% from the same period in 2018. The number of vehicle sales recorded continues to decrease and any prospects of growth in the short-term remains dim. Latest data from the Namibia Statistics Agency recorded 2.6% contraction in the Namibian economy. As a result, we expect demand to remain subdued due to low consumer and business confidence.