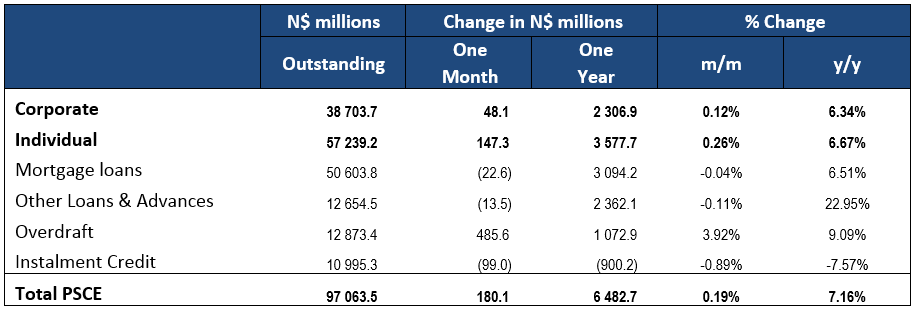

Overall

Total credit extended to the private sector (PSCE) increased by N$180.1 million or 0.19% in January, bringing cumulative credit outstanding to N$97.1 billion. On a year-on-year basis, credit extended grew by 7.16% in January, compared to 7.37% in December. Cumulative credit extended to the private sector over the last 12-months amounted to N$6.48 billion. Individuals took up N$3.58 billion worth of credit over the last 12-month, corporates took up N$2.31 billion, and claims on the non-resident private sector accounted for N$598.1 million.

Credit Extension to Individuals

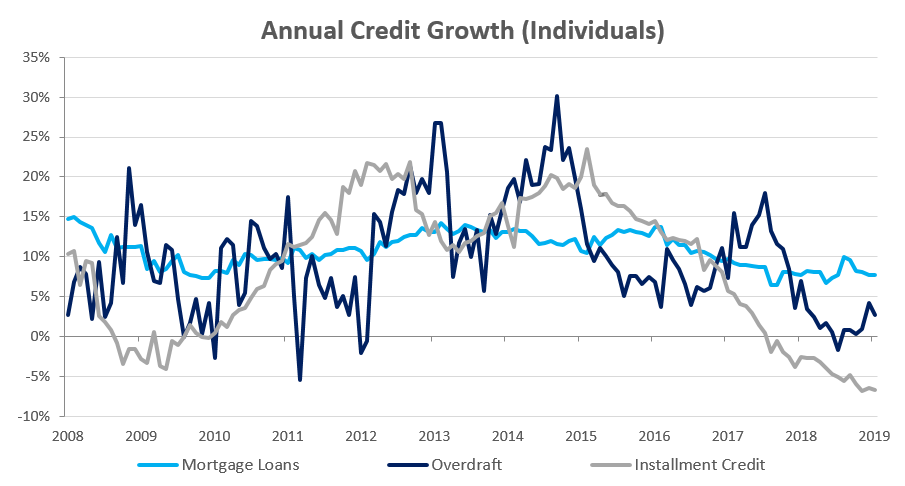

Credit extended to individuals increased by 0.3% m/m and 6.7% y/y in January, versus 0.7% m/m and 6.9% y/y in December. Mortgage loans extended to individuals increased by 7.7% y/y in January, in line with the increase seen in December. Other loans and advances (which is made up of credit card debt, personal and term loans) grew by 0.6% m/m and 18.3% y/y in January. Installment credit, which is quite often used to purchase new vehicles, contracted by 6.8% y/y. Household demand for overdraft facilities was quite strong in January, increasing by 2.3% m/m and 2.7% y/y, compared to the 1.8% m/m and 4.2% y/y increase seen in December.

Credit Extension to Corporates

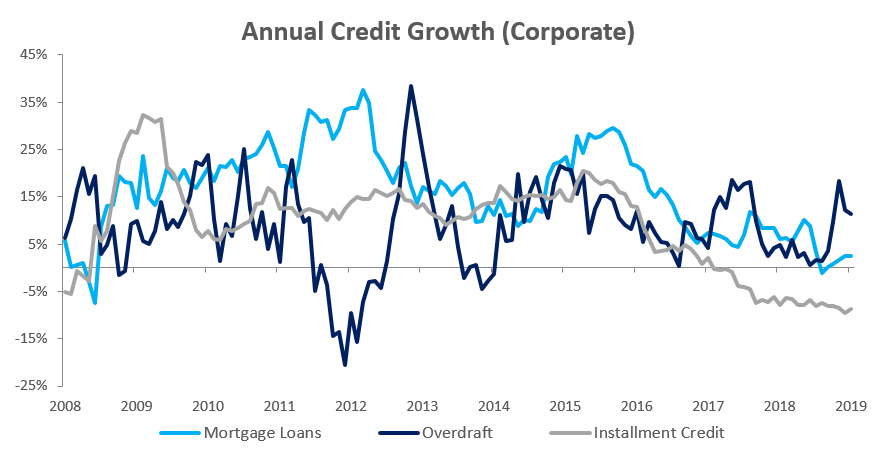

Credit extension to corporates increased by 6.3% y/y in January, moderating slightly from the 6.5% y/y increase recorded in December. On a month-on-month basis, credit extension to corporates rose 0.1% after decreasing by 0.3% in December. Installment credit extended to corporates, which has been contracting since February 2017 on an annual basis remained depressed, contracting by 8.8% y/y in January. Leasing transactions to corporates declined further in January by 20.0% y/y. Overdraft facilities extended to corporates rose by 4.5% m/m and 11.4% y/y. Mortgage loans to corporates rose by 2.5% y/y, while other loans and advances increased by 28.1% y/y.

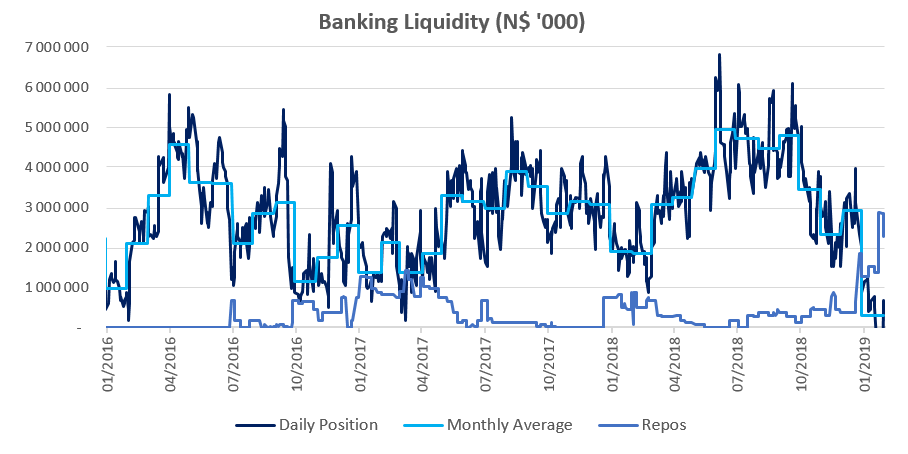

Banking Sector Liquidity

The overall liquidity position of commercial banks fell by a hefty N$2.6 billion to reach an average of N$262.1 million during January from N$2.8 billion in December. According to the Bank of Namibia (BoN), the decline is attributable to corporate tax payments made at the end of December, as well as the usual slow spending from the Government during January each year. There has been an increase in use of the BoN’s repo facility by commercial banks, with the outstanding balance of repo’s increasing from N$1.29 billion at the start of January to N$2.29 billion by month end. The use of the facility is a further sign that some banks are facing challenges in terms of liquidity.

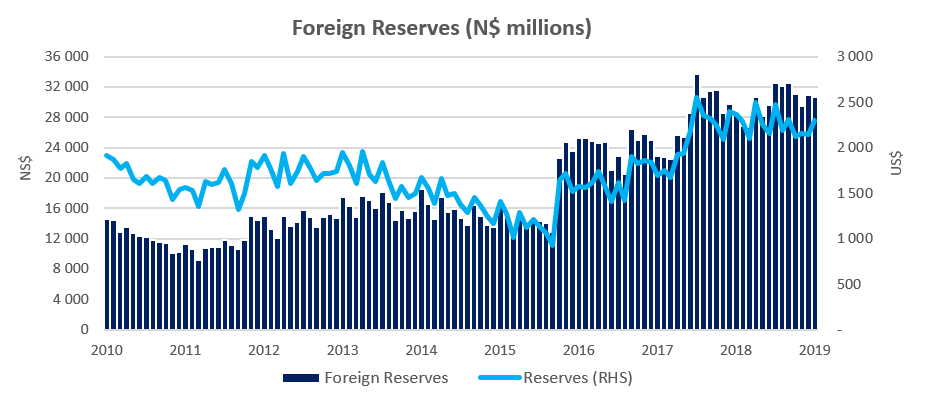

Reserves and Money Supply

As per the BoN’s latest money statistics release, board money supply rose by N$7.3 billion or 7.6% y/y in January, but decreased by N$622.4 million or 0.6% m/m. Foreign reserve balances fell by N$228.6 million to N$30.7 billion in January, representing a 0.7% m/m contraction in reserves. The BoN stated that the decrease in reserves was due to net purchases of the South African rand by commercial banks for investment purposes abroad and import payments.

Outlook

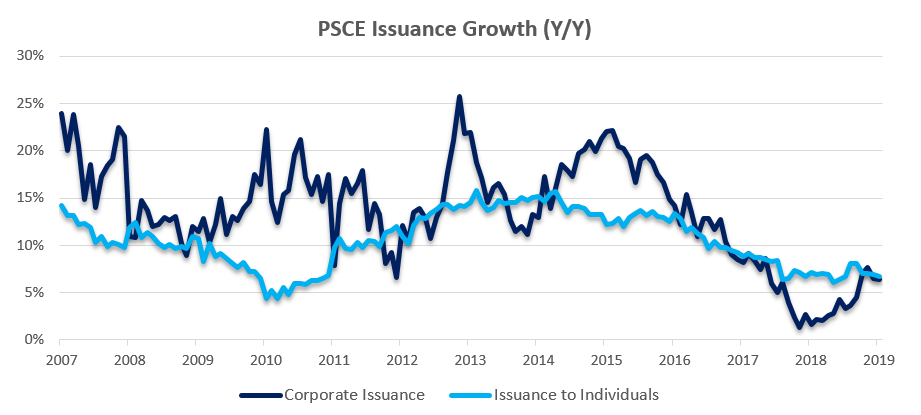

Although growth in PSCE moderated for a second consecutive month, the 7.16% y/y increase was still a faster rate of increase than in most months in 2018. Rolling 12-month private sector credit issuance is up 50.5% from the N$4.31 billion issuance observed at the end of January 2018, with individuals taking up most (55.2%) of the credit extended over the past 12 months.

As a result of the recessionary environment Namibia finds itself in, short-term and unsecured loans continue to grow at a quicker rate than that of mortgage and installment credit, as is evident by the 3.9% m/m increase in overdrafts during the month. Short-term borrowing satisfies short-term needs, and the subdued uptake of productive credit by corporations is a clear indication that business confidence remains depressed. The uptake of short-term credit is unlikely to drive meaningful expansion of productive capacity.