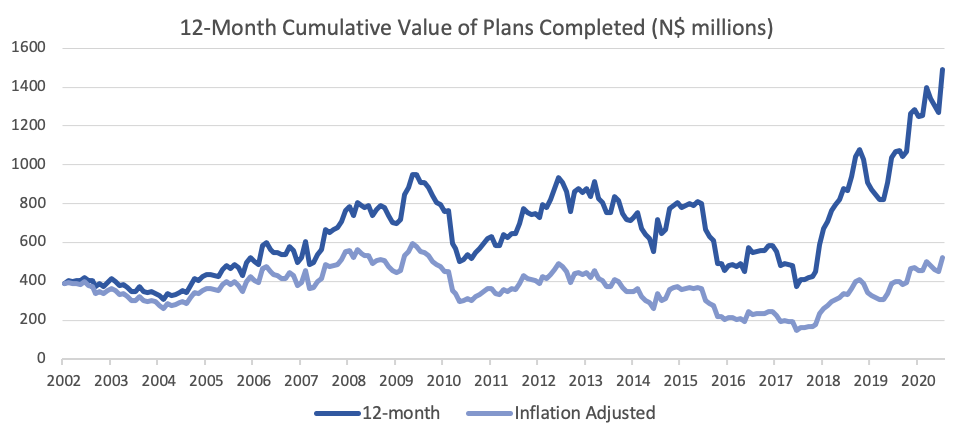

A total of 666 new vehicles were sold in July, representing a 13.2% m/m decrease from the 767 new vehicles sold in June, and a 26.3% y/y decline from the 904 new vehicles sold in July 2019. Year-to-date 4,182 vehicles have been sold of which 1,757 were passenger vehicles, 2,156 were light commercial vehicles, and 270 were medium and heavy commercial vehicles. This is 32.8% lower than the total number of new vehicles sold during the same period last year. On a twelve-month cumulative basis, vehicle sales continued to dwindle with a total of 8,357 new vehicle sold as at July 2020, down 24.8% from the 11,119 sold over the comparable period a year ago, and the lowest since June 2005.

227 New passenger vehicles were sold during July, declining by 34.2% m/m. On a year-on-year basis new passenger vehicle sales were 40.6% lower than the 382 units sold in July 2019. Year-to-date passenger vehicle sales rose to 1,757, down 38.4% when compared to the number sold during the same period last year. Twelve-month cumulative passenger vehicle sales fell 4.3% m/m and 27.1% y/y. The demand for new passenger vehicles thus remains very low on the back of the weak economic climate.

A total of 439 new commercial vehicles were sold in July, representing a 4.0% m/m increase, but a 15.9% y/y contraction. This has been the third consecutive month of increases in new commercial vehicle sales which is somewhat encouraging, although the previous two increases were from a low base and the sales figures are still a far cry from those seen five to six years ago. Of the 439 commercial vehicles sold in July, 390 were classified as light commercial vehicles, 14 as medium commercial vehicles and 35 as heavy or extra heavy commercial vehicles. On a twelve-month cumulative basis, light commercial vehicle sales dropped 24.1% y/y, medium commercial vehicle sales fell 6.3%, and heavy commercial vehicle sales contracted by 19.9% y/y. This is the first time since September 2018 that all three these categories have recorded a decrease on a twelve-month cumulative basis.

Volkswagen continues to narrowly lead the passenger vehicle sales segment with 29.5% of the segment sales year-to-date. Toyota retained second place with 29.2% of the market share as at the end of July. They were followed by Kia and Hyundai with 6.4% and 5.6% of the market respectively, while the rest of the passenger vehicle market was shared by several other competitors.

Toyota remained the leader in the light commercial vehicle space with a dominant 56.4% market share, with Nissan in second place with a 13.4% market share. Ford and Isuzu claimed 10.6% and 7.7%, respectively, of the number of light commercial vehicles sold thus far in 2020. Mercedes leads the medium commercial vehicle segment with 31.3% of sales year-to-date. Mercedes was also number one in the heavy and extra-heavy vehicle segment with 21.3% of the market share year-to-date.

The Bottom Line

As expected, the demand for new vehicles remained sluggish in July with only 666 new vehicles sold during the month. New vehicle sales figures are currently trending at levels last seen in 2005. The figures suggest that that vehicle owners are either holding on to the vehicles they already own or are purchasing second hand and imported vehicles. We expect this to remain the case for the medium term as there is currently little indication that economic conditions will improve any time soon. On a rolling 12-month basis new vehicle sales are down 63.1% from the peak in April 2015, and down 24.8% y/y.