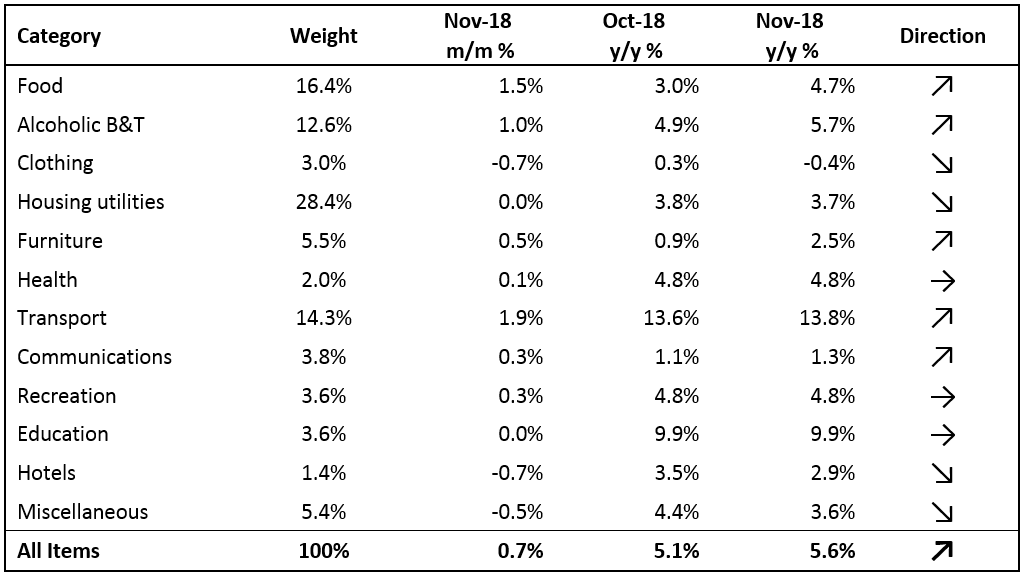

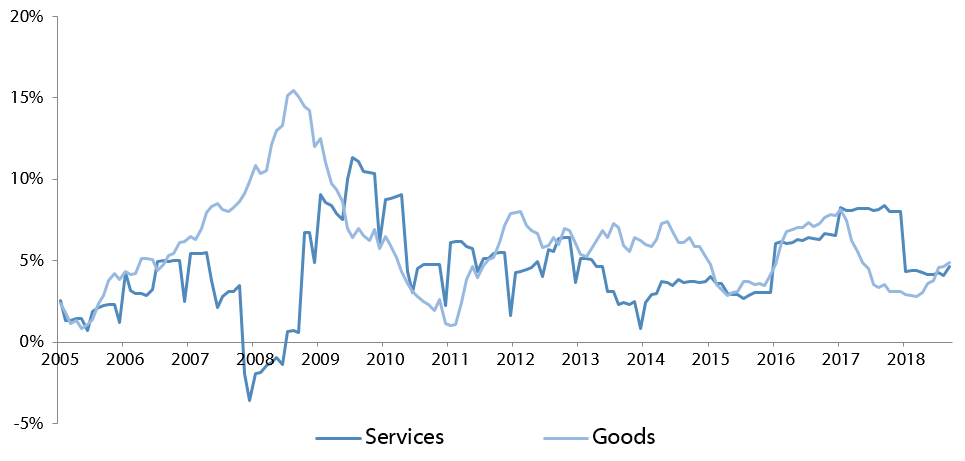

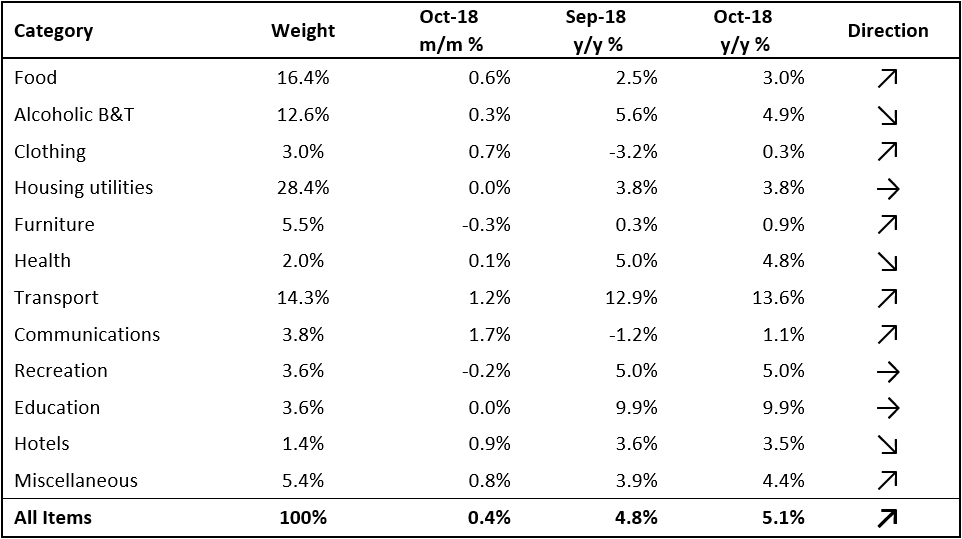

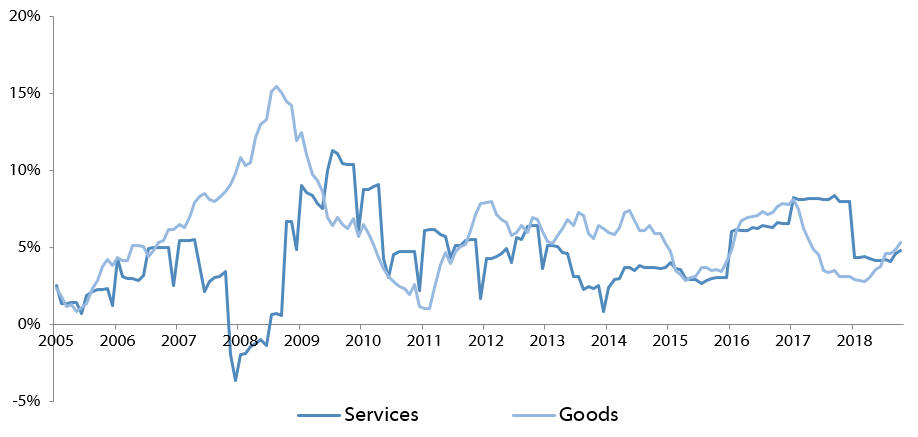

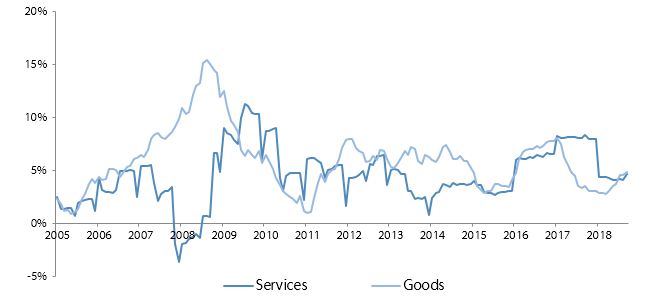

The Namibian annual inflation rate accelerated to 5.6% y/y in November, following the 5.1% y/y increase in prices recorded in October. Prices increased by 0.7% m/m, up from the 0.4% increase recorded in October. On an annual basis prices in five of the basket categories rose at a quicker rate in November than in October, three remained unchanged, while four categories saw lower rates of price increases. Prices for goods increased by 6.1% y/y while prices for services increased by 4.8% y/y. The increase in prices for services was unchanged from the increase recorded in October, while goods inflation accelerated on a monthly basis.

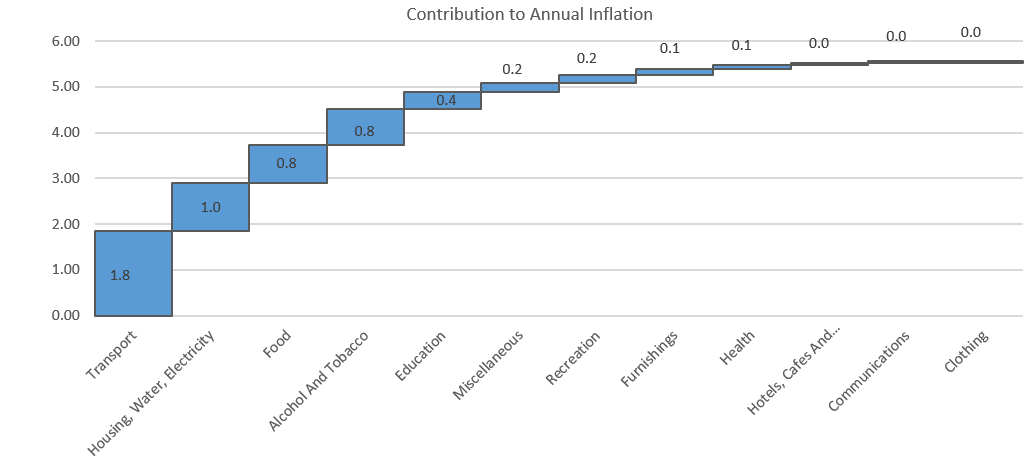

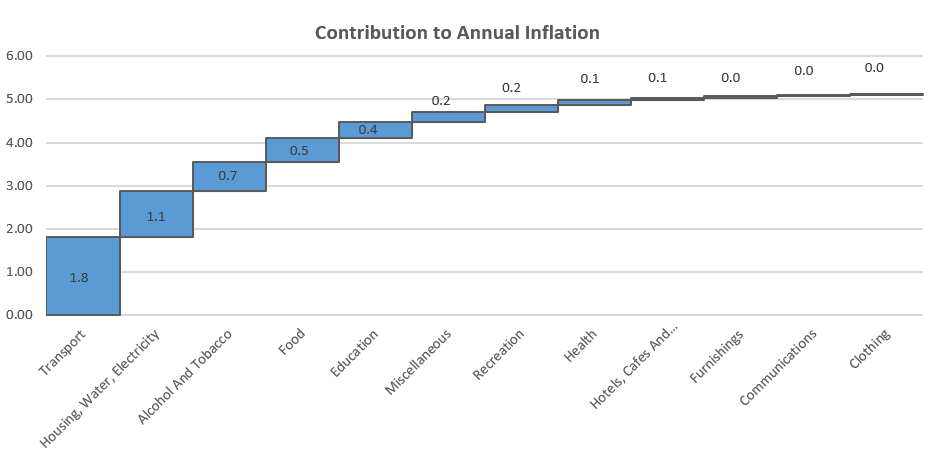

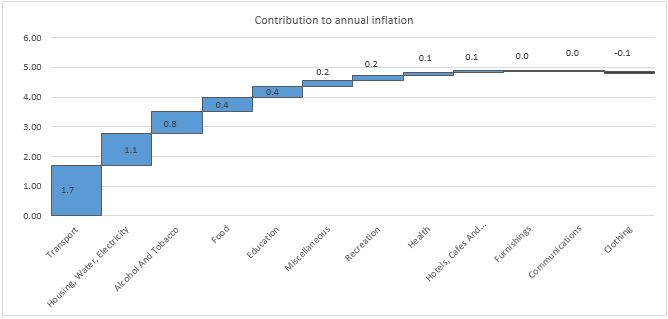

Transport, the third largest basket item, was once again the largest contributor to annual inflation, accounting for 1.8% of the total 5.6% annual inflation rate. Transport prices increased by 1.9% m/m and 13.8% y/y in November, up from the 1.2% m/m and 13.6% y/y increases seen in October. Prices in the three sub-categories all recorded increases on a year-on-year basis. Prices related to the operation of personal transport equipment increased by 15.4% y/y in November, compared to the 15.5% y/y increase recorded in the preceding month. The price of petrol increased by 50 cents per litre in November, while the price of diesel went up by 70 cents per litre, contributing to the jump in the overall category. Prices relating to the purchase of vehicles increased at a rate of 6.9% y/y, while prices related to public transportation services increased by 18.2% y/y.

The Ministry of Mines and Energy has since decreased fuel pump prices of unleaded and diesel by 100 cents per litre and 40 cents per litre, respectively. This should provide some relieve to consumers after a series of fuel price increases this year.

The Housing and utilities category was the second largest contributor to annual inflation due to its large weighting in the basket. Prices for this category remained flat m/m for a third month running and increased 3.7% y/y. Prices in the electricity, gas and other fuels subcategory increased 8.7% y/y, slightly slower than inflation of 9.0% recorded in October. The regular maintenance and repair of dwellings subcategory recorded an increase in prices of 3.5% y/y, which is a marginally slower rate of increase than the 3.7% y/y registered in the previous month. Month-on-month, prices of all the subcategories remained relatively unchanged.

Food and non-alcoholic beverages accounted for 0.8% of the total 5.6% annual inflation rate. Prices in this category rose by 4.7% y/y, faster than the 3.0% recorded in October. Prices for vegetables and fruit increased by 8.9% y/y and 7.9% y/y, respectively. Bread and cereal prices rose 6.0% y/y. Prices of food and non-alcoholic beverages accelerated at a faster pace on both monthly and annual basis. The second-round effects caused by the rampant and continuous increases in transport inflation seems to be filtering through to food prices. This is likely to persist in the very near-term, although recent fuel pump price cuts could moderate this slightly.

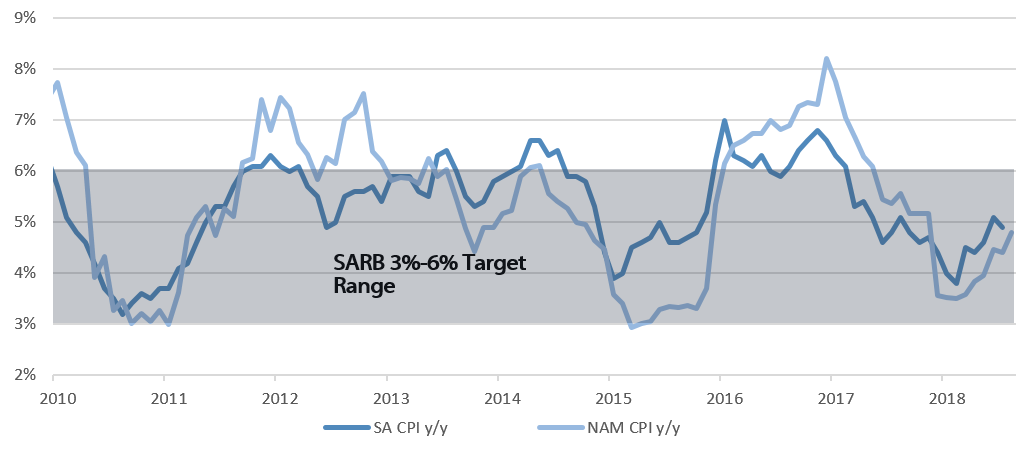

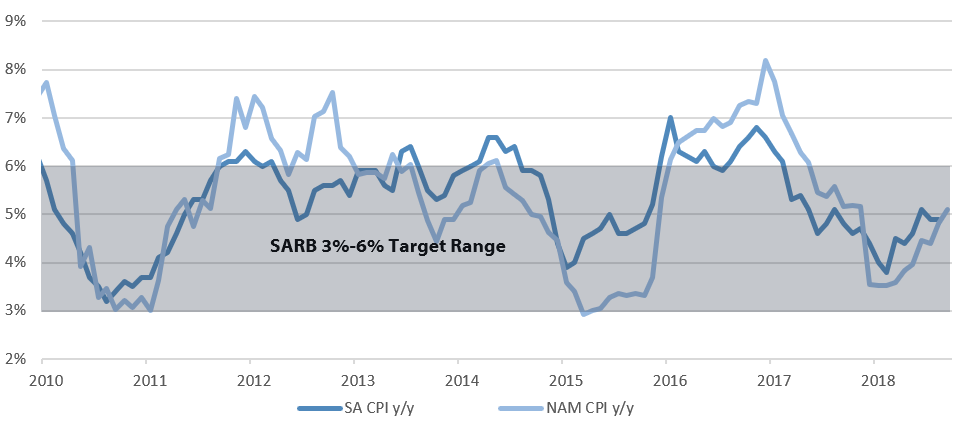

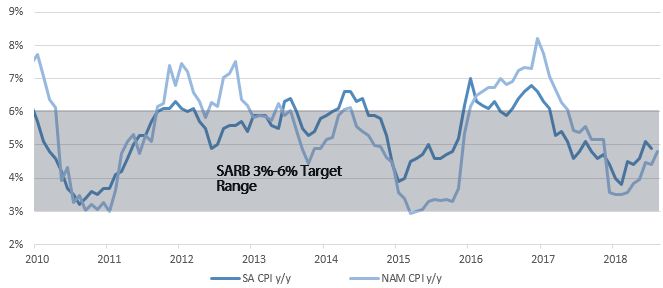

The Namibian annual inflation rate of 5.6% is currently trending somewhat higher than neighbouring South Africa’s November figure of 5.2%. The Bank of Namibia’s MPC decided to leave the repo rate unchanged at its meeting last week, deviating from the SARB’s decision last month to hike interest rates by 25 basis points. The BoN stated that the recent declines in fuel prices suggest that the risk of further upward pressure on inflation from this source has been reduced considerably. The BoN further mentioned that at the current level, the stock of international reserves is sufficient to protect the currency peg of the Namibian Dollar to the Rand.

As mentioned in our October 2018 PSCE review, our expectations are for interest rates to remain accommodative in the near-term. However, the BoN will be mindful of possible increases in SA rates and move to adjust local rates accordingly. Higher interest rates in SA will very likely lead to capital outflows from Namibia, which in turn jeopardises foreign reserve levels, and therefore the currency peg.