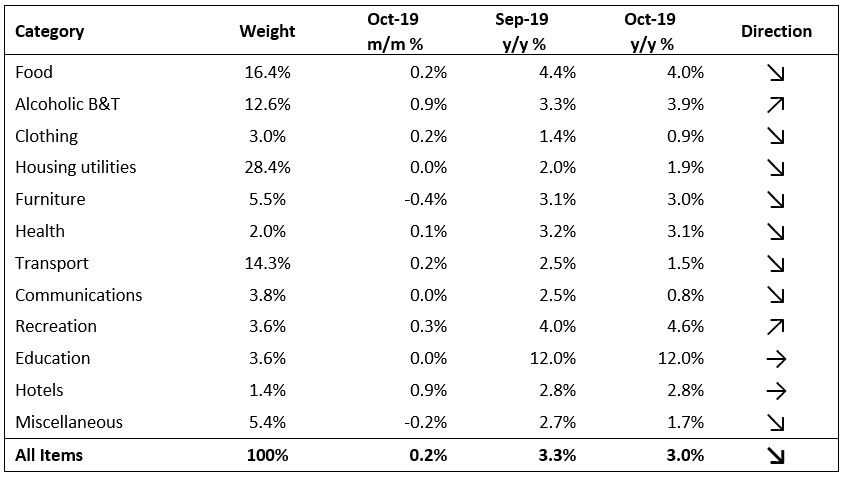

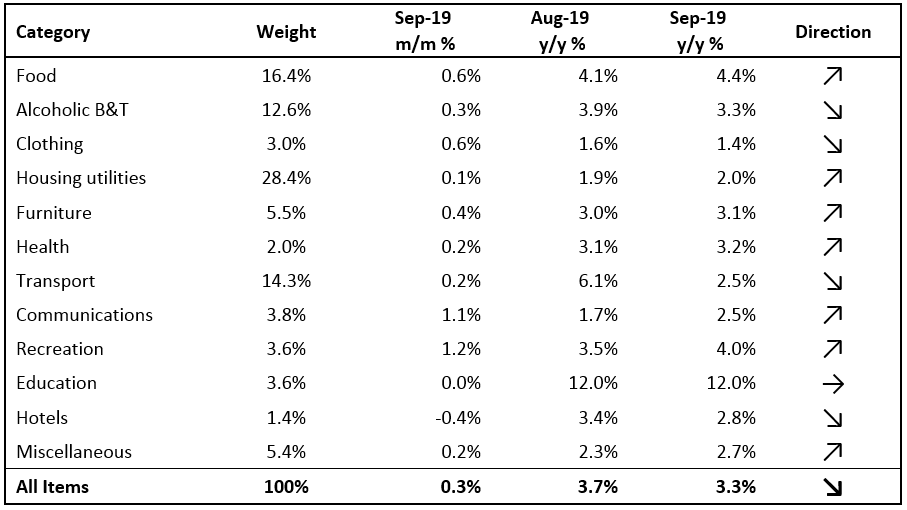

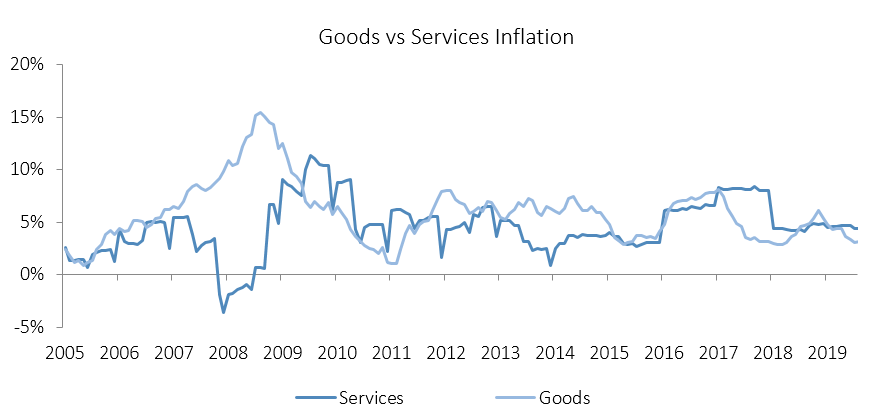

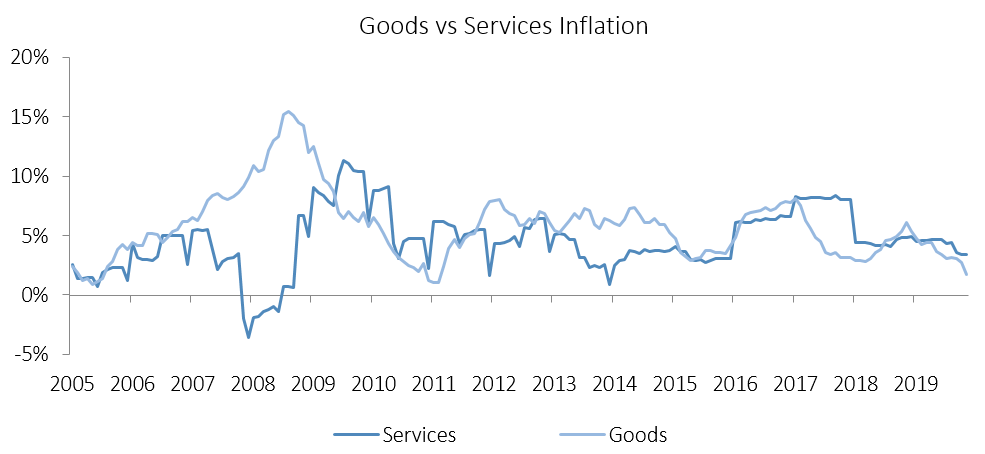

The Namibian annual inflation rate slowed for a third consecutive month, moderating to 2.5% y/y in November, hitting the lowest levels since August 2005. Prices increased by 0.1% m/m. On an annual basis prices in four of the twelve basket categories rose at a quicker rate in November than in October, two categories recorded increases consistent with the prior month, while the annual rate of price increases in six categories slowed during the month of November. Prices for goods rose by 1.7% y/y while prices for services rose 3.4% y/y.

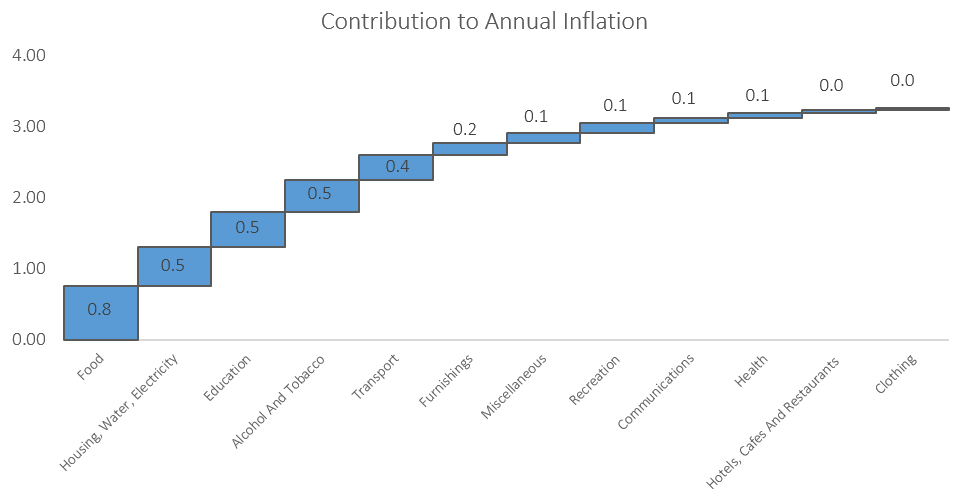

The housing and utilities category was the largest contributor to annual inflation in November due to its large weighting in the basket, accounting for 0.53 percentage points of the total 2.5% annual inflation rate. Price inflation for this category once again came in at 1.9% y/y but remained relatively flat month-on-month. The regular maintenance and repair of dwellings subcategory recorded an increase in prices of 5.0% y/y, which is a higher rate of increase than the 2.5% y/y registered the previous month. Month-on-month, prices in this subcategory increased by 2.2%. Prices in the electricity, gas and other fuels subcategory declined by 0.8% y/y. Annual inflation for rental payments remained unchanged at 2.3% y/y in November.

Food & non-alcoholic beverages, was the second largest contributor to annual inflation, accounting for 0.51 percentage points of the 2.5% annual inflation rate. Prices in this category increased by 0.4% m/m and 2.9% y/y. Prices in eleven of the thirteen sub-categories recorded increases on an annual basis, with the largest increases being observed in the prices of fruits and vegetables, recording price increases of 14.0% y/y and 14.4% y/y respectively. Meat prices decreased by 0.3% y/y, compared to the 1.9% y/y increase recorded in the previous month. Due to the ongoing drought there has been a large-scale slaughtering of cattle. This has reduced the number of livestock in the country and going forward meat prices will likely increase as restocking of farms will cause upward pressure on prices.

The education basket category recorded inflation of 12.0% y/y, with the cost of pre-primary and primary education growing at a rate of 12.6% y/y, while secondary- and tertiary education recorded price increases of 11.0% y/y and 12.7% y/y, respectively. All three subcategories printed no price increases on a month-on-month basis.

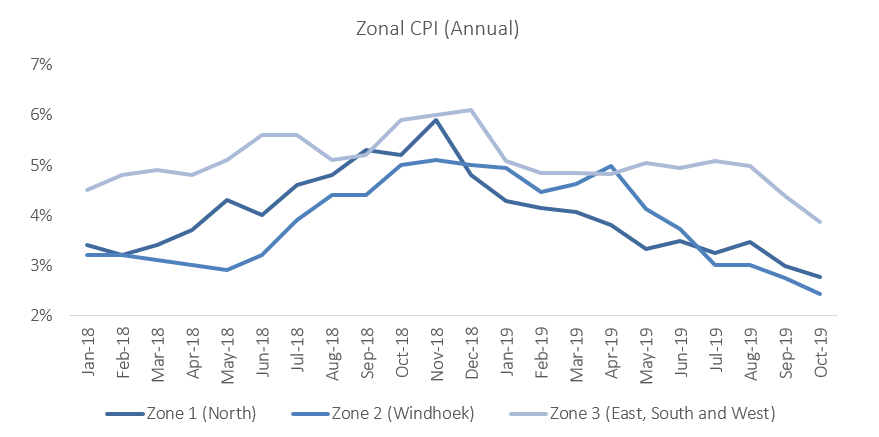

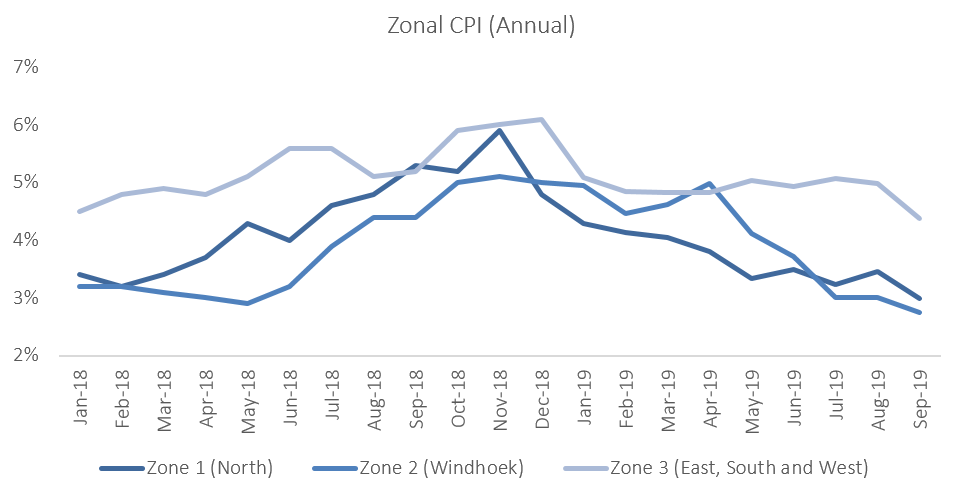

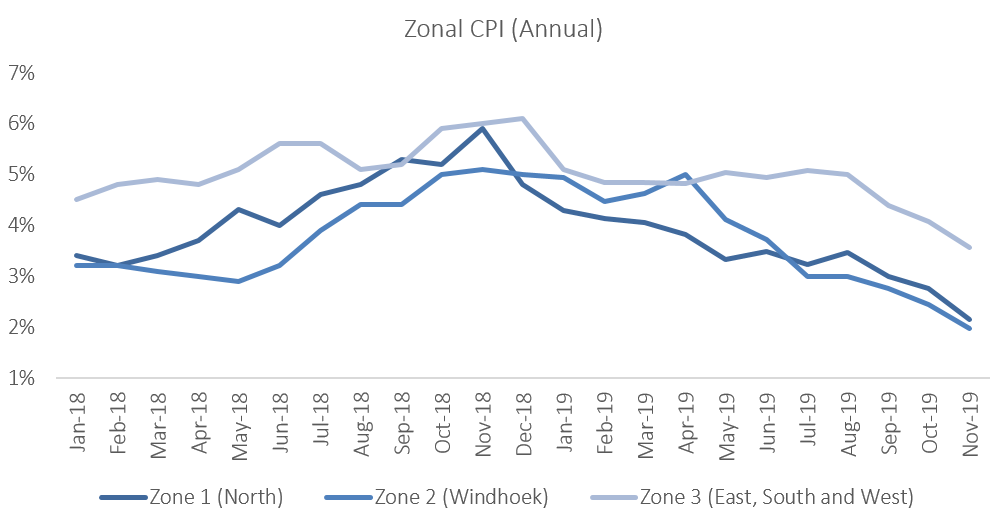

According to the zonal data, prices rose 0.5% m/m in the northern regions, but printed flat in the rest of the country on a monthly basis. On an annual basis, the Windhoek and surrounding area, recorded the lowest inflation rate at 2.0% in August, with the mixed zone 3 covering the south, east and west of the country recording the highest rate of inflation at 3.6% y/y. Inflation in the northern region of the country slowed to 2.1% y/y.

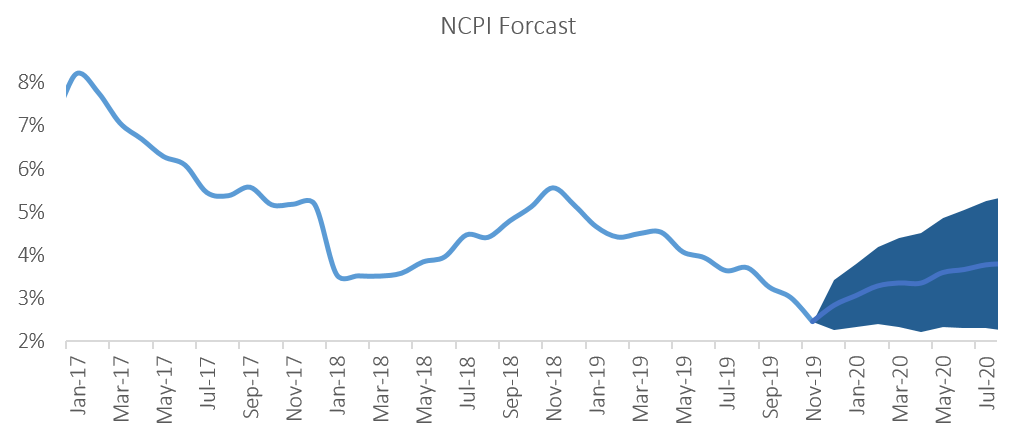

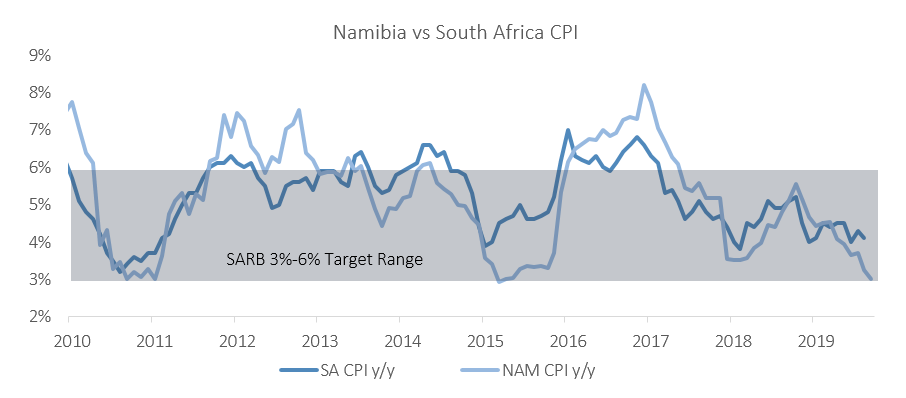

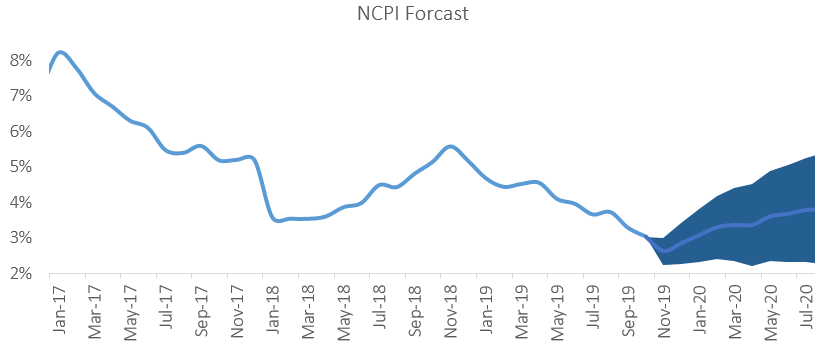

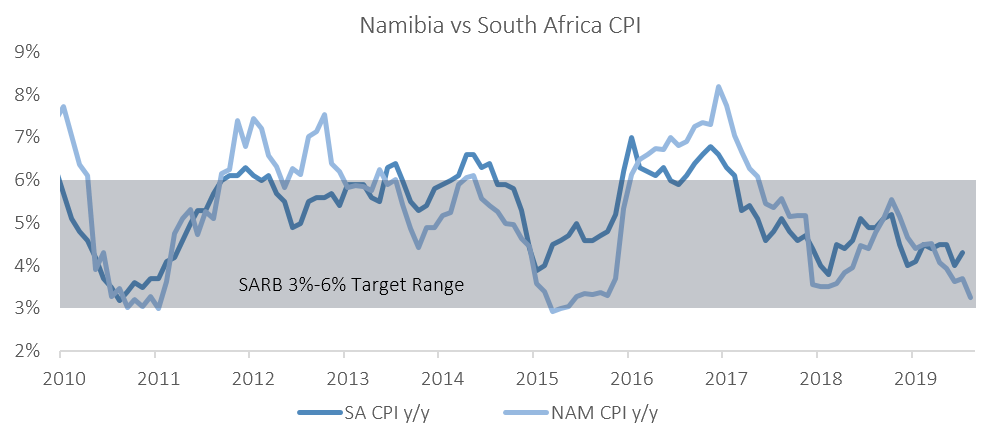

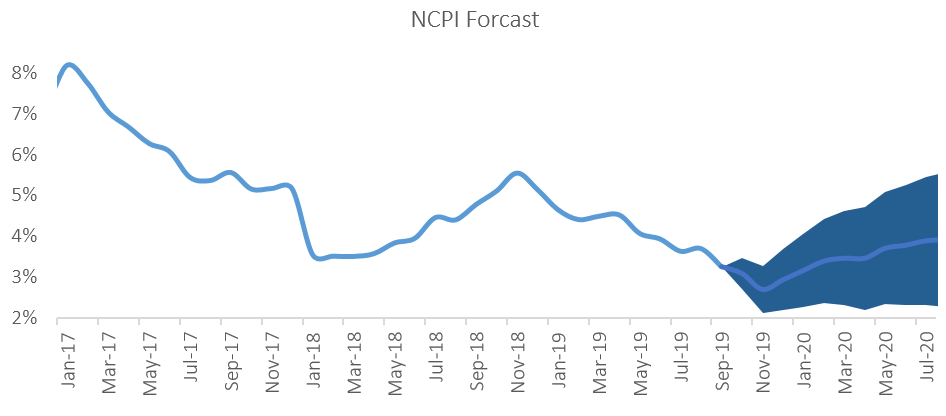

The Namibian annual inflation rate surprised further to the downside, slowing to 2.5% in November, and is trending well below South Africa’s November inflation figure of 3.6%. Inflationary pressure in Namibia remains low as gloomy domestic economic conditions translates to muted demand for both goods and services. IJG’s inflation model forecasts an average inflation rate of 3.8% y/y in 2019 and 3.5% y/y in 2020. The largest upside risk to this forecast is higher food costs as the drought affects local food production.