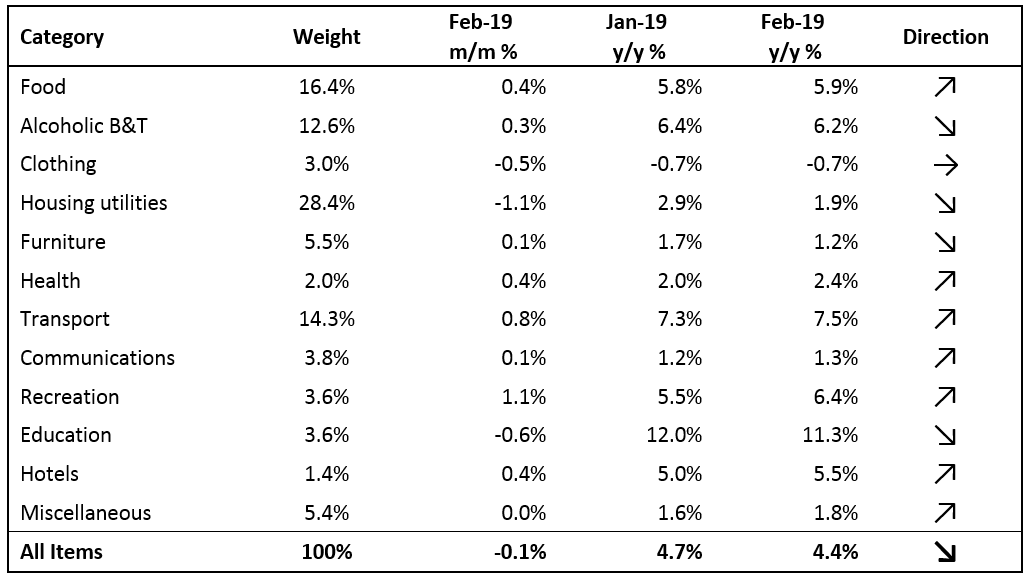

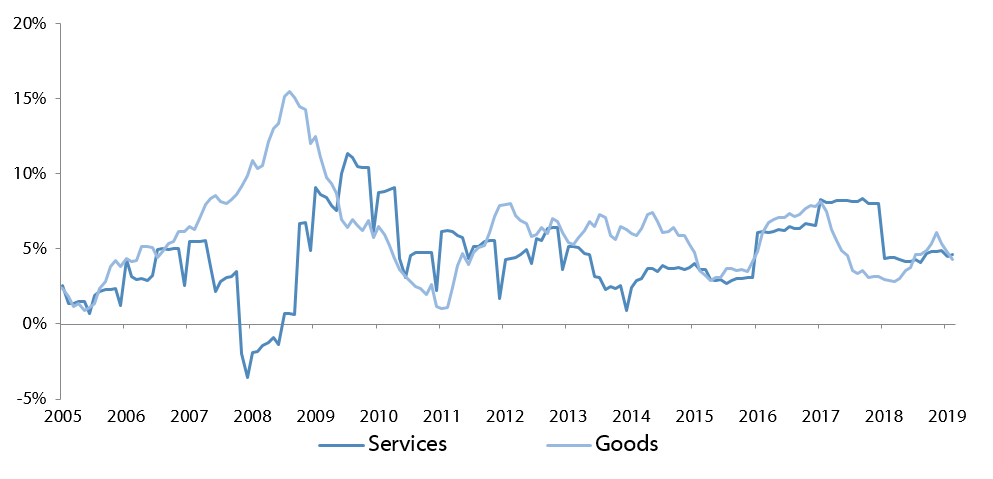

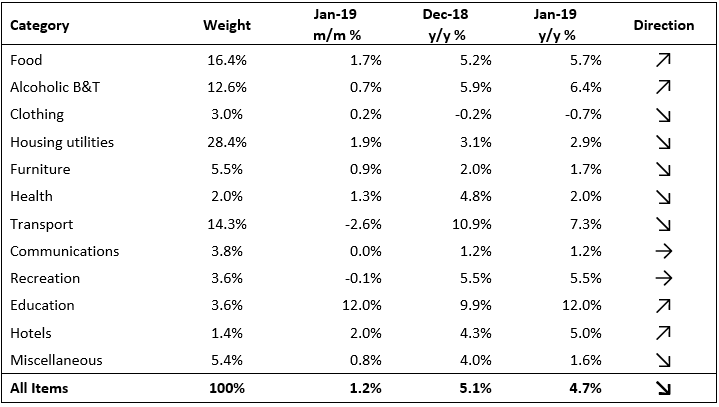

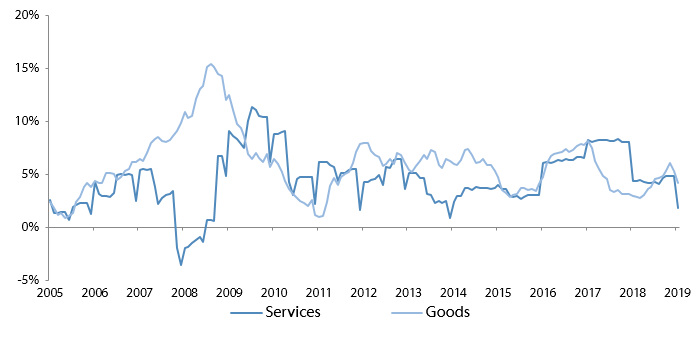

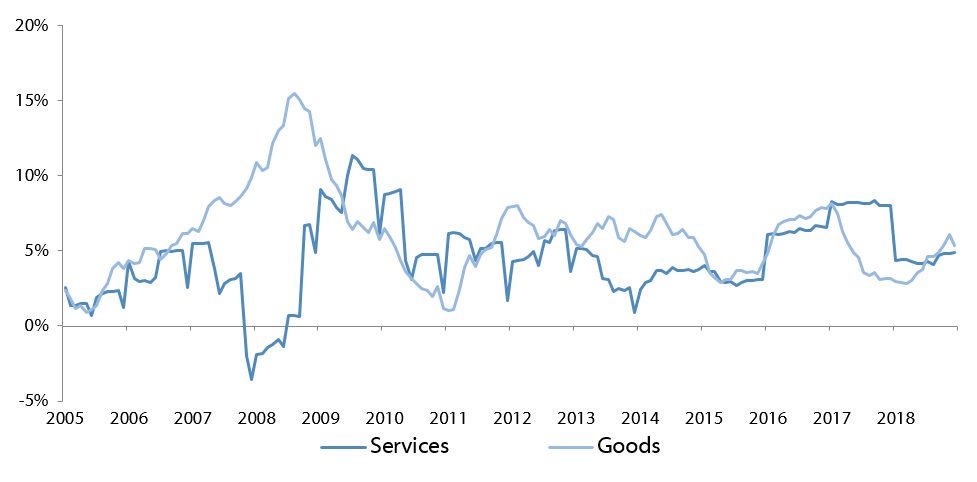

The Namibian annual inflation rate moderated slightly to 4.4% y/y in February, following the 4.7% y/y increase in prices recorded in January. Prices in the overall NCPI basket decreased 0.1% m/m. On a year-on-year basis, overall prices in seven of the twelve basket categories rose at a quicker rate in February, while four categories recorded slower rates of inflation and one category posted steady inflation. Prices for goods increased by 4.3% y/y while prices for services increased by 4.6% y/y.

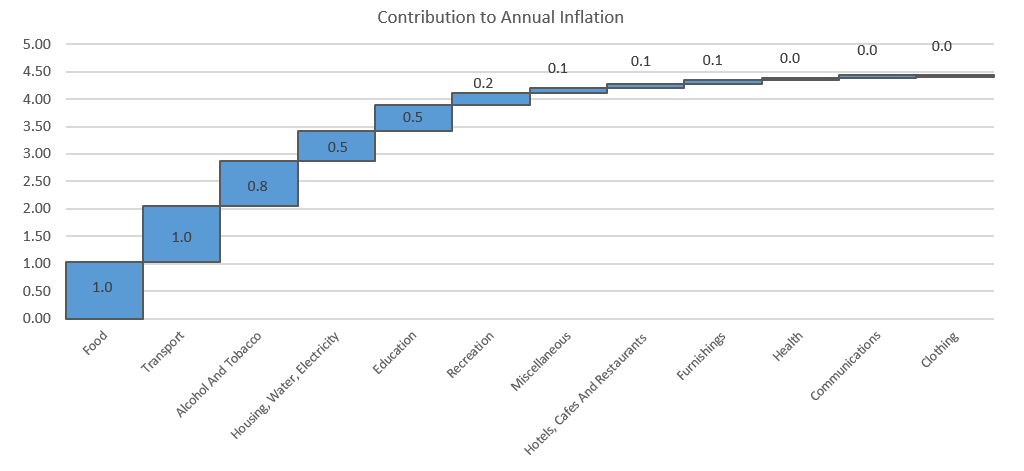

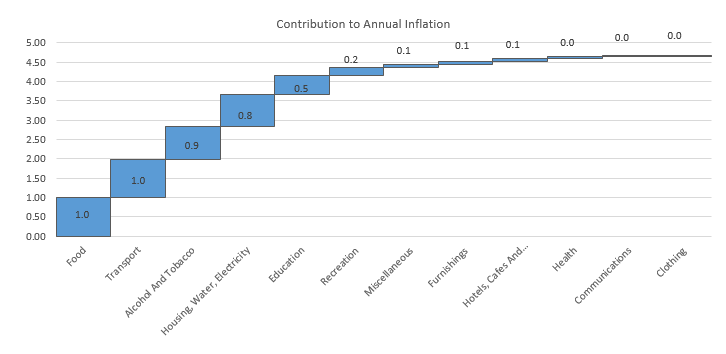

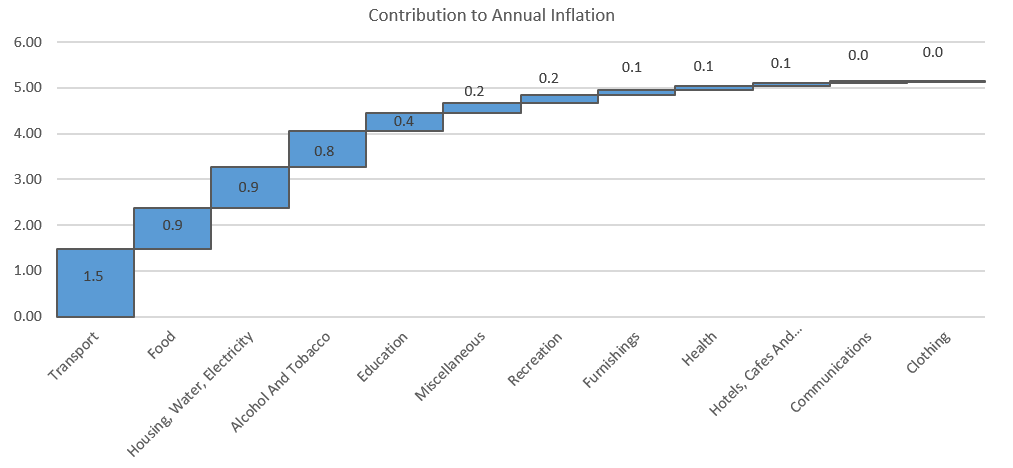

Food & non-alcoholic beverages, the second largest basket item by weighting, was once again the largest contributor to annual inflation, accounting for 1.0% of the 4.4% annual inflation rate. The basket category recorded price increases of 0.4% m/m and 5.9% y/y in February, versus the 1.7% m/m and 5.7% y/y increases recorded in January. Prices in all thirteen sub-categories recorded increases on a year-on-year basis with the largest increases being observed in the prices of vegetables, fruits, and bread and cereals.

Transport, the third largest basket item, was the second largest contributor to annual inflation. Prices for transport rose by 7.5% y/y in February, marginally faster than the increase of 7.3% y/y recorded in January. The purchase of vehicles subcategory saw price increases of 0.9% m/m and 5.0% y/y. The cost of operation of personal transport equipment recorded an increase of 5.2% y/y. Oil prices increased by 6.4% in February, reaching US$57 a barrel at the end of the month as OPEC cut its output to a nearly four-year low, according to a survey by S&P Global Platts. The Ministry of Mines and Energy however decided to keep fuel pump prices unchanged for the month.

Prices for the alcoholic beverages and tobacco category was the third highest contributor to the annual inflation rate in February, and increased at a rate of 0.3% m/m and 6.2% y/y. Prices of alcoholic beverages increased at a rate of 6.5% y/y while tobacco prices increased at a rate of 4.9% y/y.

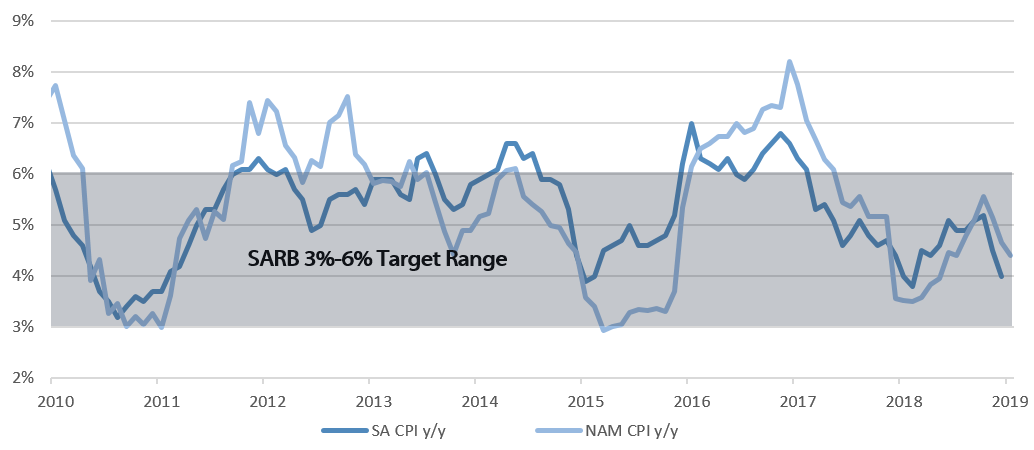

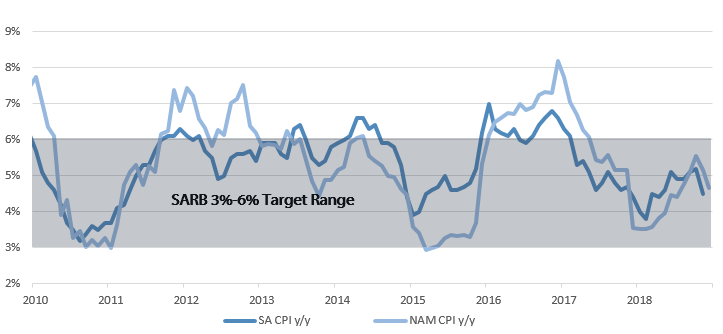

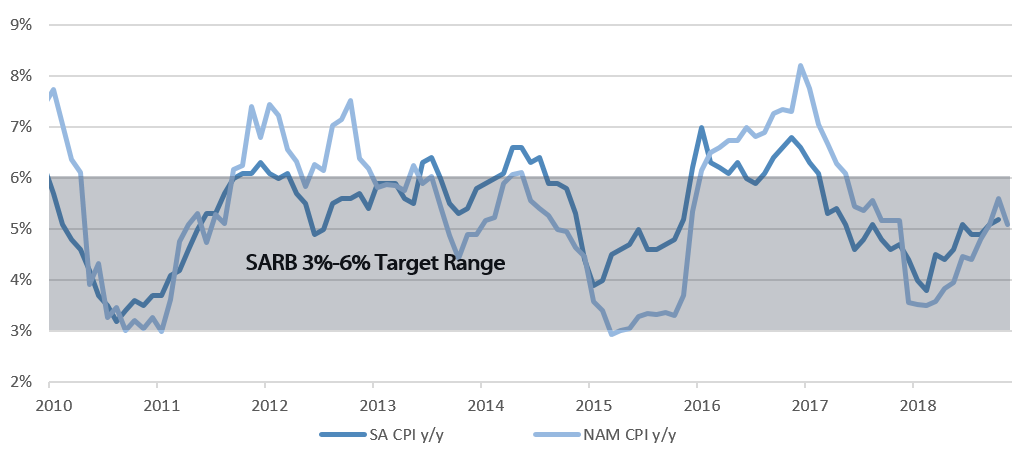

The Namibian annual inflation rate of 4.4% is currently trending somewhat higher than neighbouring South Africa’s January figure (latest available release) of 4.0%. Namibia’s inflation was mainly driven by food inflation, as the second-round effects caused by increases in transport inflation towards the end of last year and poor rainfall throughout the country during the first half of the 2019 rainfall season continue to push up food inflation.

Although the Ministry of Mines and Energy decided to keep fuel pump prices unchanged for March, we expect the Ministry to start hiking prices sometime in the coming months as oil prices have been picking up steadily since the beginning of the year. Inflation expectations will further be driven by exchange rates, with the rand having weakened since the beginning of February.