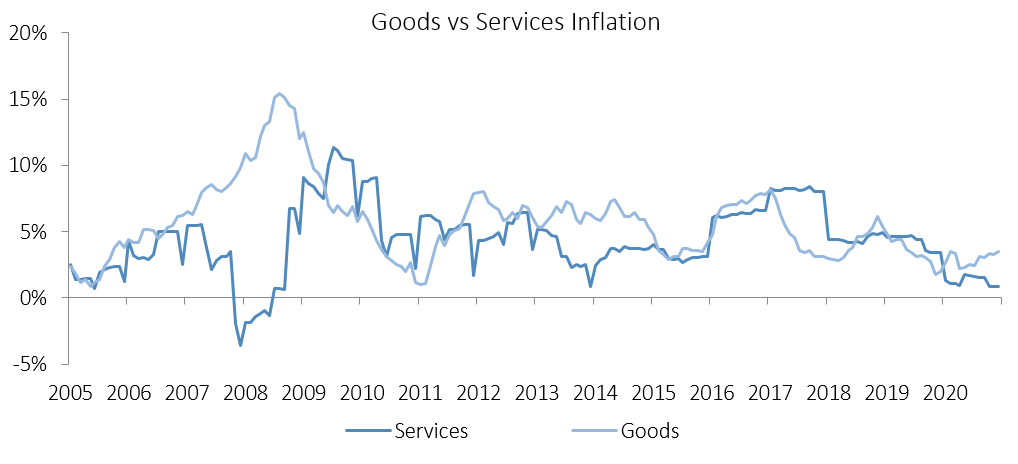

The Namibian annual inflation rate remained at 2.7% y/y in February, with prices in the overall NCPI basket increasing by 0.4% m/m. On a year-on-year basis, overall prices in six of the twelve basket categories rose at a quicker rate in February than in January and the other half of the basket categories recording slower rates of inflation. Prices for goods increased by 3.2% y/y while prices for services rose 2.0% y/y.

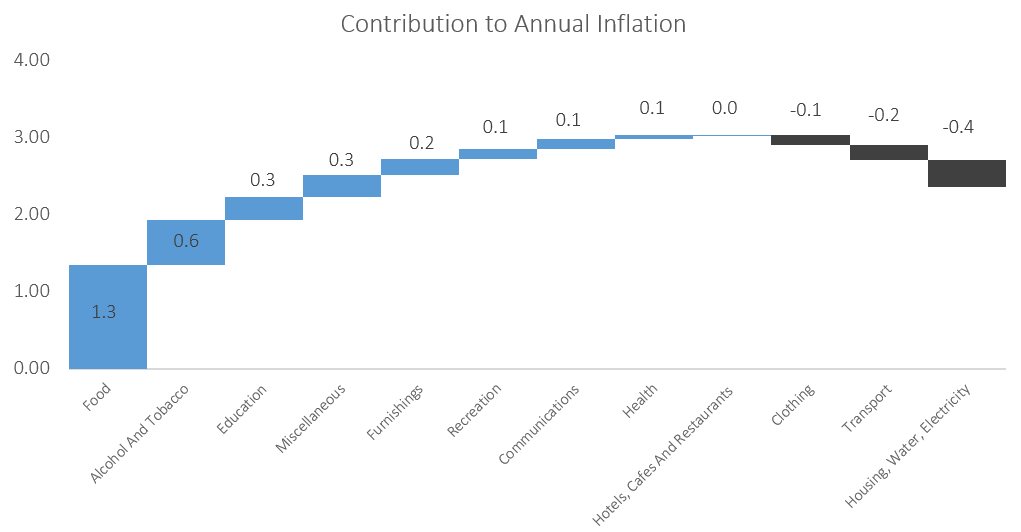

Food & non-alcoholic beverages, the second largest basket item by weighting, continued to be the largest contributor to annual inflation, accounting for 1.0 percentage point of the total 2.7% inflation rate. Prices in this category increased by 1.2% m/m and 5.5% y/y. Prices in twelve of the thirteen sub-categories recorded increases on an annual basis. The largest increases were observed in the prices of fruits which increased by 11.85% y/y and meat which increased by 11.84% y/y. The fish sub-category meanwhile saw a marginal price decrease of 0.6% y/y in February.

The alcoholic beverages and tobacco basket item was the second largest contributor to the annual inflation rate in February, with prices of the basket item increasing by 4.2% y/y. On a monthly basis, prices in this basket item fell by 0.4%. The alcoholic beverages sub-category recorded a price decrease of 0.4% m/m, but an increase of 3.0% y/y. Tobacco prices were down 0.2% m/m, but up 9.7% y/y.

The housing and utilities category accounted for 0.39 percentage points of the total annual inflation rate in February. Price inflation for this category remained steady on a monthly basis, but rose 1.5% y/y. The regular maintenance and repair of dwellings subcategory recorded an increase in prices of 3.1% y/y, which is a lower rate of increase than the 4.2% y/y registered the previous month. Prices in the electricity, gas and other fuels subcategory increased by 2.2% y/y, while the annual inflation for rental payments rose to 1.3% y/y. None of the four subcategories printed price increases on a month-on-month basis.

In the US inflation expectations have been heightened by the Fed’s prolonged loose monetary policy and President Joe Biden’s US$1.9 trillion stimulus package. These rising inflation expectations are putting pressure on central banks as they seek to ensure a smooth recovery.

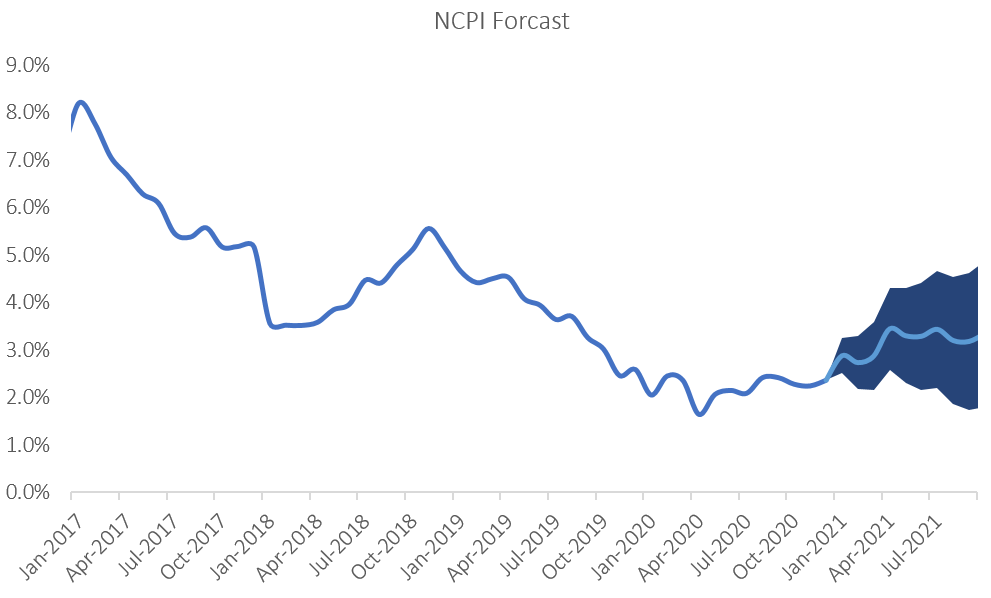

On the local front, however, IJG’s inflation model forecasts an average inflation rate of 3.2% y/y in 2021 and 4.3% in 2022, indicating a gradual increase in the inflation rate over the next two years and that inflation will likely remain relatively low over this period. This, coupled with high unemployment and struggling economic growth in both Namibia and South Africa, means that we currently see it as unlikely that interest rates will be raised in either country in the short-term.