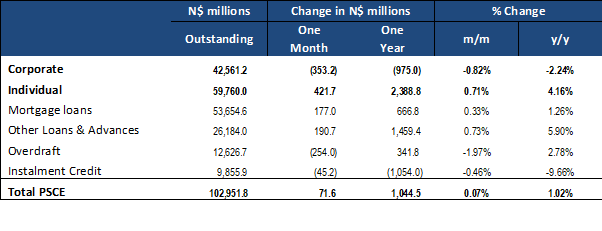

Overall

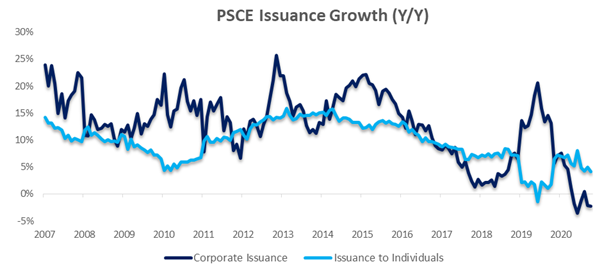

Total credit extended to the private sector (PSCE) increased by N$71.6 million or 0.1% m/m in October, bringing the cumulative credit outstanding to N$102.95 billion. On a year-on-year basis, private sector credit extension increased by only 1.0% y/y in October, compared to 1.5% growth recorded in September. This represents the lowest level of annual growth on our records dating back to 2002 as issuance continues to slow. N$2.39 billion worth of credit has been extended to individuals on a 12-month cumulative basis, while corporates and the non-resident private sector decreased their borrowings by N$975.0 million and N$369.4 million, respectively.

Credit Extension to Individuals

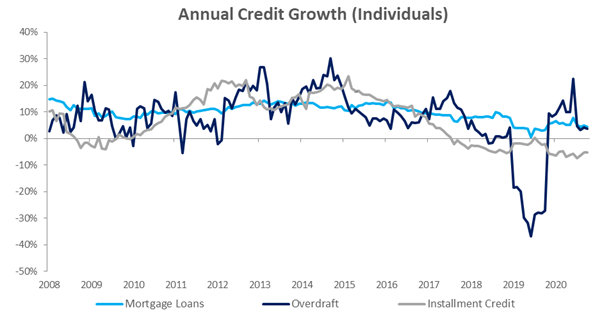

Credit extended to individuals increased by 0.7% m/m and 4.2% y/y in October. The month-on-month growth has mostly been driven by an increase in ‘other loans and advances’ (or OLA, which is made up of credit card debt, personal and term loans) which grew by 1.1% m/m and 11.0% y/y in October. Overdrafts grew by 1.1% m/m and 3.6% y/y indicating continued use of short-term credit by individuals. On the other hand, longer-term credit agreements like mortgages and instalment credit continued to slow. Mortgages declined by 0.8% m/m and increased by only 4.3% y/y as housing purchases continue to slow in value terms. Instalment credit grew by 0.1% m/m but was down 5.3% y/y as new vehicle sales continue to dwindle, declining 27.3% y/y.

Credit Extension to Corporates

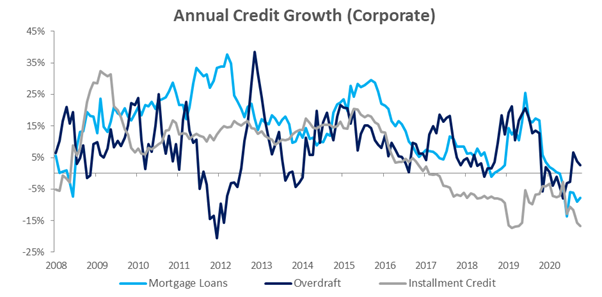

Credit extended to corporates contracted by 0.8% m/m and 2.2% y/y in October, following similar contractions in September. Except for the OLA category, all other segments contracted on a monthly basis. Mortgage loans to corporates declined by 0.8% m/m and 7.8% y/y. Instalment credit extended to corporates, which has been contracting since February 2017 on an annual basis, remained depressed, contracting by 1.5% m/m and 16.7% y/y in October the lowest level since early 2019. Overdrafts to corporates declined by 2.6% m/m but increased by 3.6% y/y.

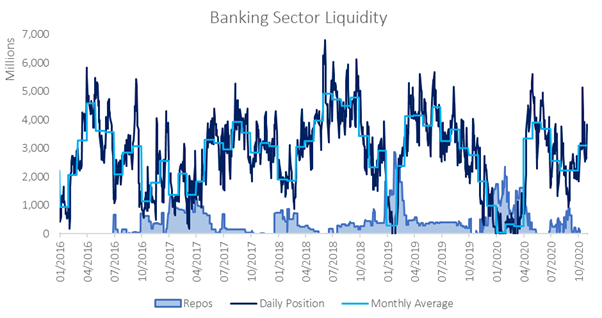

Banking Sector Liquidity

The overall liquidity position of commercial banks improved significantly in October, increasing by N$889.4 million to an average of N$3.10 billion during the month. According to the Bank of Namibia, the increase in liquidity is on the back of diamond sales, increased government expenditure and interest payment from the state during the period under review. Due to the increase in liquidity, The outstanding balance of repo’s fell from N$116.0 million to zero by month-end.

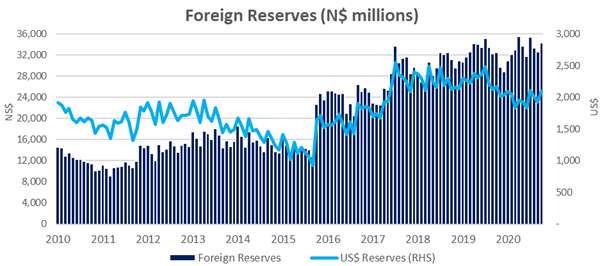

Reserves and Money Supply

Broad money supply rose by N$13.4 billion or 11.7% y/y in October, as per the BoN’s latest monetary statistics release. Foreign reserve balances increased by N$1.69 billion or 5.2% m/m to N$34.4 billion in September. The BoN attributes the rise in the official reserve stock to SACU inflows during the period under review.

Outlook

Private sector credit extension growth remains subdued at the end of October, slowing from 1.5% y/y to 1.0% y/y in October. Rolling 12-month issuance fell to N$1.04 billion and is down a rather staggering 82.3% from the N$5.89 billion figure as at October 2019. Although Namibian interest rates are at historical lows, so are business and consumer confidence. Economic activity, which was slow before the pandemic, has been hit hard by global lowdowns, and recovery may take years to materialise. As a result, credit uptake remains weak, as the base of growth, individual mortgages, continues to slow. Additionally, corporates continue to repay debt and de-lever their balance sheets. If these trends continue, we are likely to see private sector credit extension contract on an annual basis in the coming months.