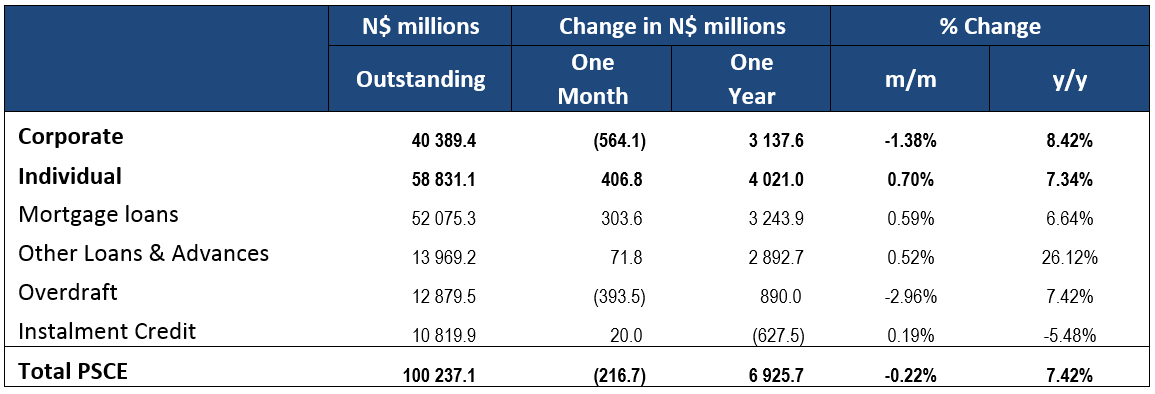

Overall

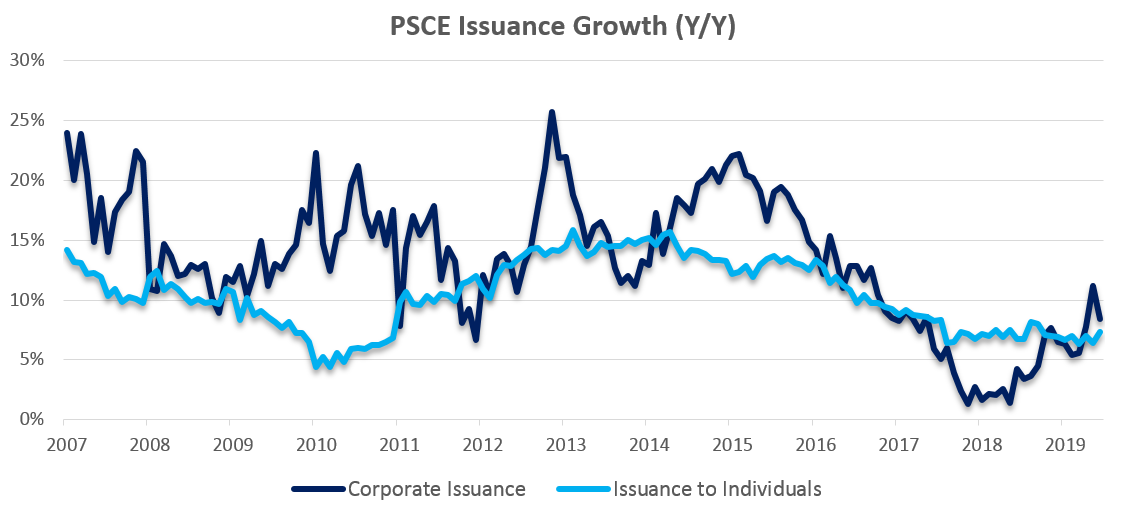

Private sector credit extension (PSCE) decreased by N$216.7 million or 0.22% m/m in June, bringing the cumulative credit outstanding to N$100.24 billion. On a year-on-year basis, private sector credit extension increased by 7.4% in June, compared to growth of 8.0% in May. On a rolling 12-month basis, N$6.9 billion worth of credit was extended to the private sector, with individuals taking up N$4.0 billion while N$3.1 billion was extended to corporates, and the non-resident private sector has decreased their borrowings by N$232.8 million.

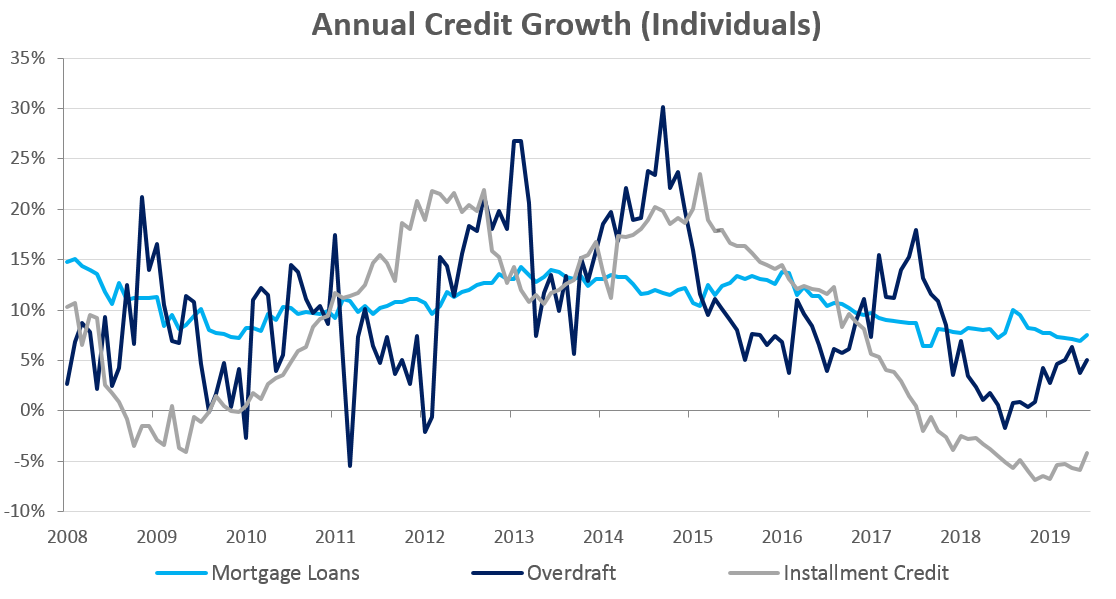

Credit Extension to Individuals

Growth in credit extension to individuals accelerated to 0.7% m/m and 7.3% y/y in June, compared to 0.4% m/m and 6.4% y/y growth recorded in May. Other loans and advances (which is made up of credit card debt, personal and term loans) grew by 1.4% m/m and 25.9% y/y in June. The rapid growth in short term debt uptake by individuals is very concerning as these loans bear high interest rates and have high default rates when compared to productive loans such as mortgages. Installment credit, which is quite often used to purchase new vehicles, contracted by 4.1% y/y. Mortgage loans to individuals grew by 0.6% m/m and 7.6% y/y, while overdraft facilities extended to individuals have increased by 0.1% m/m and 5.0% y/y.

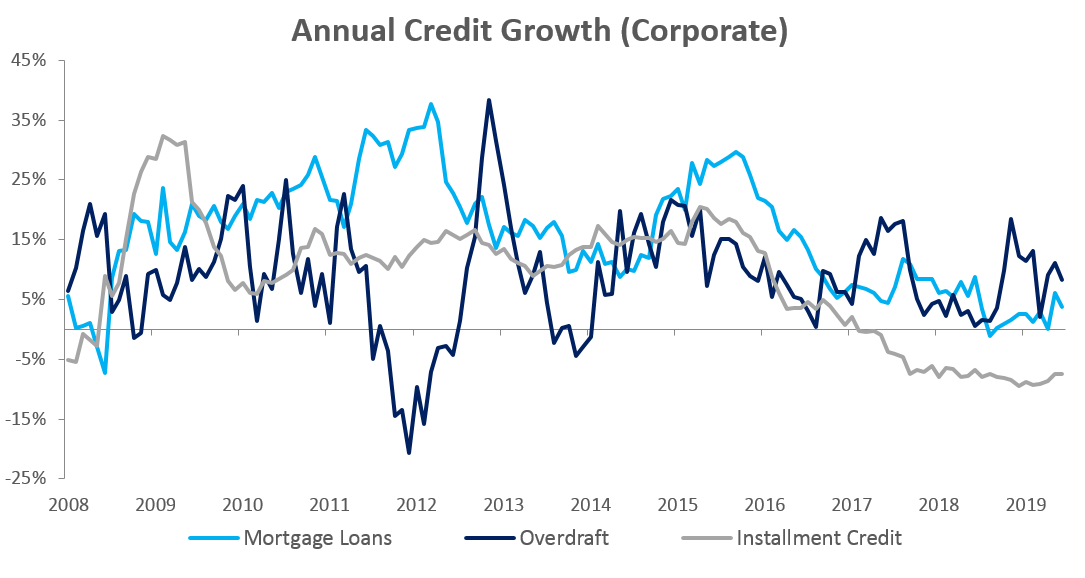

Credit Extension to Corporates

Credit extension to corporates contracted by 1.4% m/m after increasing by 2.8% m/m in May. On an annual basis, however, credit extension to corporates increased by 8.4% y/y in June, compared to the 11.2% y/y growth registered in May. The month-on-month contraction is mostly caused by businesses paying back overdrafts. Overdraft facilities extended to corporates decreased by 4.0% m/m, but are still up 8.3% y/y. Mortgage loans to corporates increased by 0.4% m/m and 3.7% y/y. Installment credit extended to corporates, which has been contracting since February 2017 on an annual basis, remained depressed, contracting by 0.4% m/m and 7.5% y/y in June.

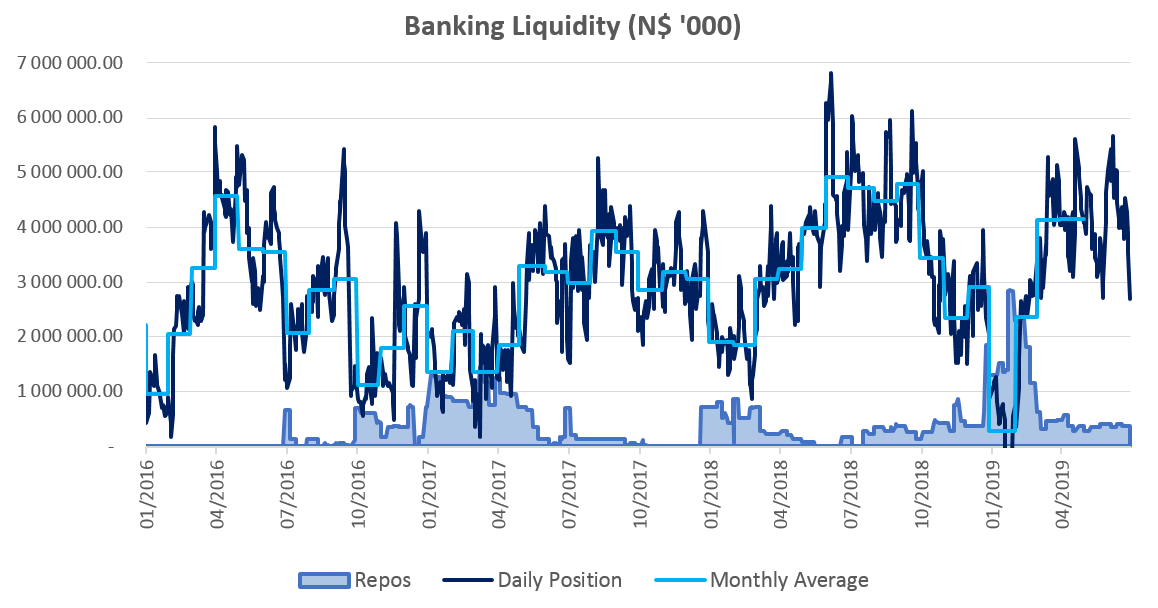

Banking Sector Liquidity

The overall liquidity position of commercial banks improved during June, increasing by N$648.0 million to reach an average of N$4.43 billion. According to the Bank of Namibia (BoN), the increase is attributable to the liquidation of funds, as companies were preparing for corporate tax payments during the period under review. The higher liquidity resulted in a decrease in use of the BoN’s repo facility by commercial banks, with the outstanding balance of repo’s decreasing from N$398.1 million at the start of June to N$388.7 million by month end.

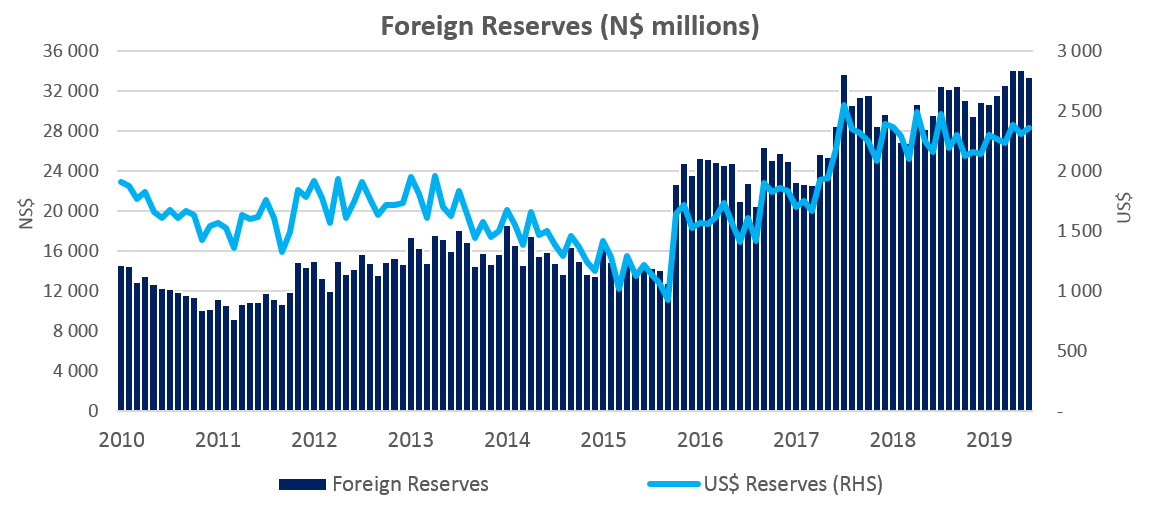

Reserves and Money Supply

As per the BoN’s latest money statistics release, broad money supply rose by N$7.38 billion or 7.3% y/y in June, following a 11.7% y/y increase in May. Foreign reserve balances fell by N$691.0 million to N$33.4 billion in June from N$34.1 billion in May. The BoN attributes the decrease to net capital outflow of foreign currencies through commercial banks, coupled with net government payments during the month under review.

Outlook

From a 12-month rolling perspective, credit issuance is up 19.5% from the N$5.79 billion issuance observed at the end of June 2018, with corporates taking up 45.3% of the credit extended over the past 12 months. The credit extended to corporates on a cumulative 12-month basis has increased from N$1.51 billion in June 2018 to N$3.14 billion, while credit extended to individuals increased from N$3.47 billion in June 2018 to N$4.02 billion at the end of June 2019.

Corporates have repaid overdraft facilities during the month, resulting in a 3.0% decrease in total overdrafts. The repayment of overdrafts is a positive sign in our view as the extension of overdraft facilities was unlikely to drive meaningful expansion of productive capacity. We do however believe that the repayment is a short-term phenomenon as both individuals and corporates remain under pressure.

We expect the BoN to follow the SARB’s MPC decision to cut the Repo rate by 25 basis points at its August MPC meeting, which should bring heavily indebted consumers and corporates some relief. However, interest rates remain accommodative by historical standards and further rate cuts are unlikely to result in a meaningful increase in the uptake of credit.