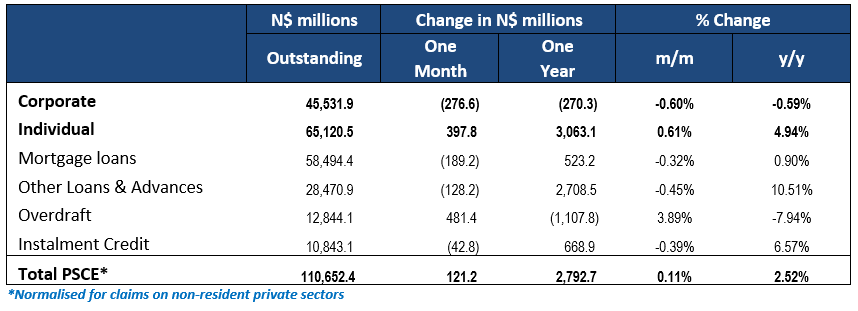

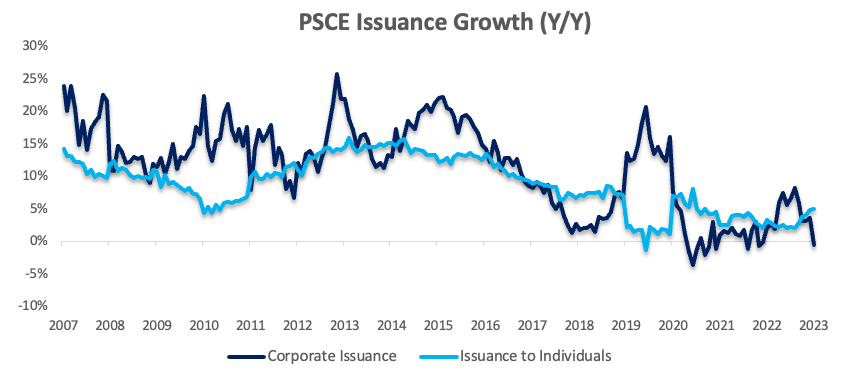

Private sector credit (PSCE) increased by N$121.2 million or 0.11% m/m in January, bringing the cumulative credit outstanding to N$110.7 billion on a normalised basis (removing the interbank swaps accounted in non-resident private sector claims). On a year-on-year basis, PSCE grew by 2.6%, compared to the 4.2% y/y growth recorded in December. Over the past 12 months, N$2.79 billion worth of credit was extended to the private sector, a 23.6% increase from the N$2.26 billion issued over the same period a year ago. Individuals took up N$3.06 billion worth of credit, while corporates decreased their borrowings by N$270.3 billion.

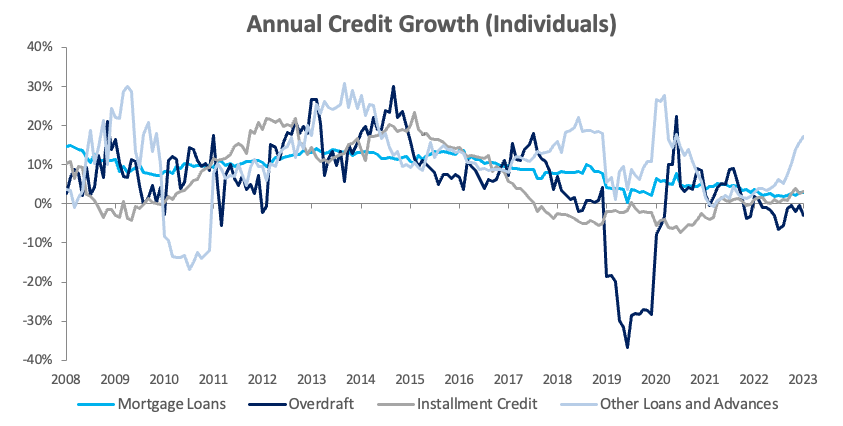

Credit Extension to Individuals

Credit extended to individuals rose by 0.6% m/m and 4.9% y/y in January. All sub-categories registered increases on a month-on-month basis, with the monthly growth again primarily driven by an increase in ‘Other loans and advances’ (which is made up of credit card debt and personal- and term loans). The sub-category grew by 1.8% m/m and 17.3%, the highest annual growth since June 2020. Overdraft facilities to individuals rose by 0.9% m/m but fell by 3.1% y/y. Mortgage loans posted 0.3% m/m growth for a third consecutive month, with year-on-year growth remaining steady at 2.8% y/y. Instalment credit grew by 0.2% m/m and 3.1% y/y.

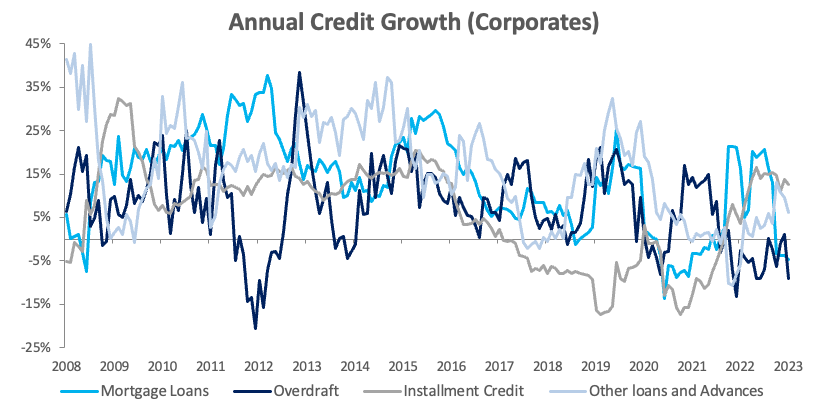

Credit Extension to Corporates

Credit extended to corporates contracted by 0.6% m/m and y/y, the first year-on-year contraction in this category since December 2021. Credit uptake by corporates has been very subdued over the past five months. Only overdraft facilities to corporates grew on a month-on-month basis. The sub-category grew by 4.6% m/m, but fell 9.0% y/y. Mortgage loans contracted on an annual basis for a fourth consecutive month, falling by 2.4% m/m and 4.7% y/y. Instalment credit fell by 1.3% m/m, but remains up by 12.7% y/y.

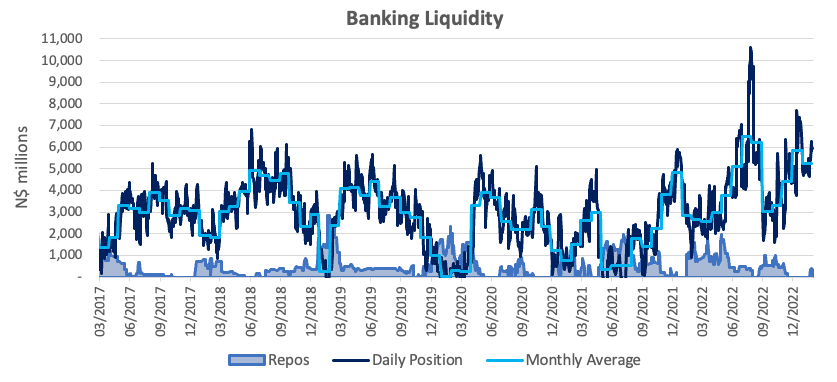

Banking Sector Liquidity

The overall liquidity position of Namibia’s commercial banks fell by N$585.1 million to an average of N$5.25 billion in January and ended the month at N$5.92 billion. Despite the strong liquidity position, some banks made use of the repo facility, with the balance coming in at N$380.0 million. The Bank of Namibia (BoN) noted that the decline is in line with historic trends of corporate tax payments and the “holiday season”, with declines usually observed in January to mid-March before accelerated government spending aids increases just before the end of the fiscal year.

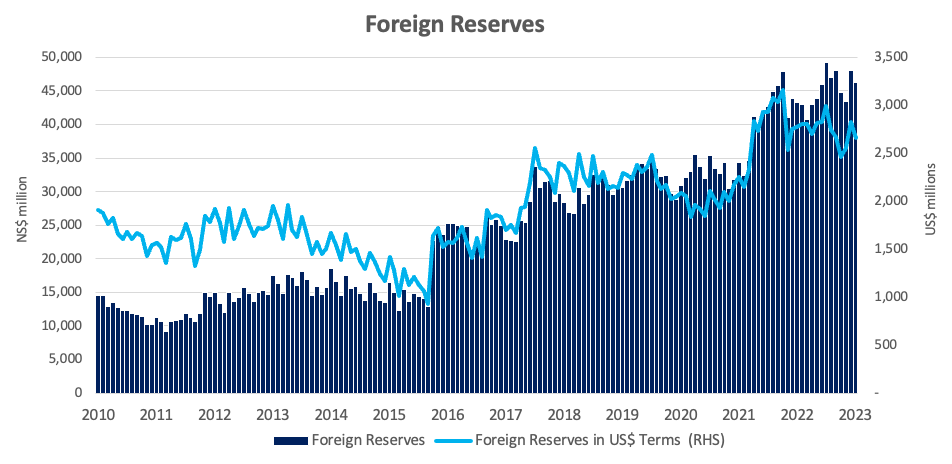

Money Supply and Reserves

Broad Money Supply (M2) rose by N$1.24 billion or 1.0% y/y in January, according to the BoN’s latest monetary statistics. The money supply decreased by 0.2% m/m and now stands at N$129.7 billion. The stock of international reserves fell by 3.5% m/m to N$46.3 billion in January. The BoN attributed the decline to net commercial bank outflows during the month.

Outlook

PSCE growth is off to a subdued start in 2023, with the year-on-year growth figure of 2.6% the slowest since March last year. The slow growth is largely due to low credit uptake by corporates, which has generally been lacklustre since June last year, and it is now starting to reflect in the year-on-year growth figures. This indicates that corporates are not borrowing money to invest in fixed capital projects to expand their operations, an indication of low business confidence.

In January and throughout the past year, individuals have shown a more encouraging uptake of credit compared to corporates, with growth being driven by both short-term ‘other loans and advances’ as well as mortgage loans.