Overall

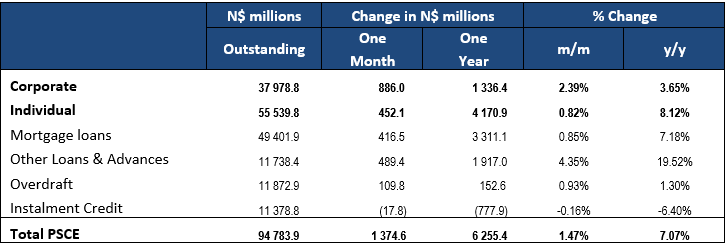

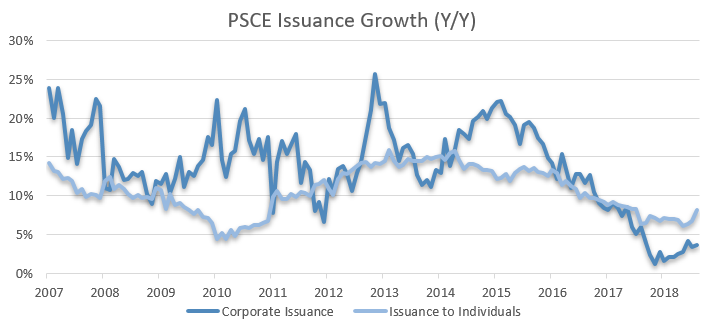

Private sector credit extension (PSCE) recorded it biggest monthly increase since November 2015, rising by N$1.37 billion or 1.5% m/m in August. Cumulative credit outstanding currently amounts to N$94.8 billion. PSCE growth accelerated to 7.1% y/y in August from 6.3% y/y in July. On an annual basis the growth in PSCE was driven largely by credit extended to households which increased at a quicker rate of 8.1% y/y in August compared to 6.7% y/y in July. Credit extended to corporates grew marginally quicker at 3.6% y/y in August versus the 3.4% y/y in July. On a rolling 12-month basis N$6.3 billion worth of credit was extended to the private sector with N$4.2 billion being taken up by individuals. Corporations took up only N$1.3 billion worth of credit while claims on non-residents totaled N$748 million.

Credit extension to individuals

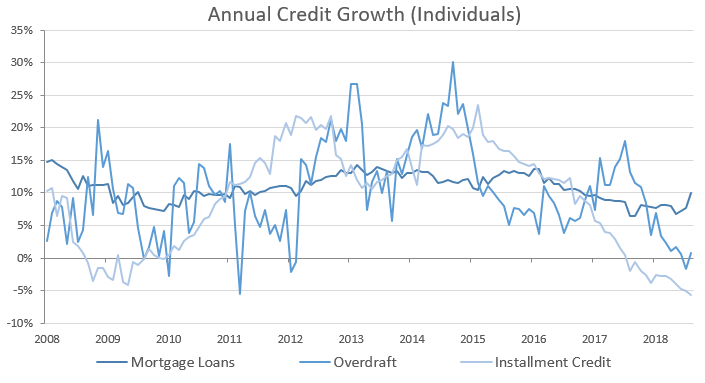

Household appetite for credit remains high judging by credit extended to individuals over the past 12 months. Credit extended to individuals increased by 8.1% y/y in August, a sharp acceleration from the 6.7% y/y growth recorded in July. Base effects saw mortgage loans extended to individual grow by 10% y/y in August compared to the 7.7% y/y increase recorded in July, resulting in the overall acceleration mentioned above. Individuals once again made very little use of overdraft facilities in August, with this increasing by 0.8% y/y following a 1.7% y/y contraction recorded in July. Household appetite for instalment credit remains subdued as reflected in the contractions of 5.6% y/y and 0.6% m/m in August. Other loans and advances grew by 17.2% y/y and 3.5% m/m in August.

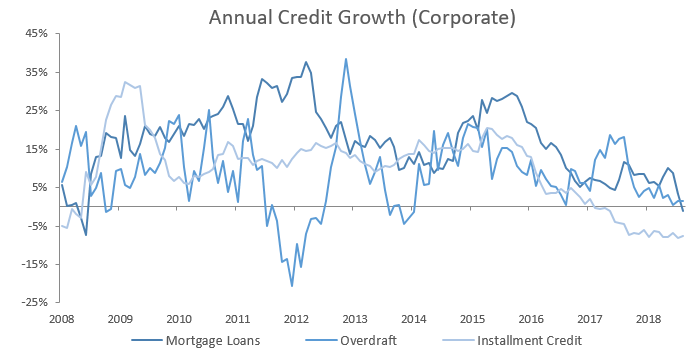

Credit extension to corporates

Credit extension to corporates grew by 3.6% y/y and 2.4% m/m. On a rolling 12-month basis N$1.3 billion was extended to corporates as at the end of August compared to N$1.2 billion as at the end of July. Instalment credit extended to corporates contracted by 7.5% y/y but increased marginally by 0.5% m/m in August. Leasing transactions to corporations also contracted in August, by 3.6% y/y and 3.1% m/m. The contraction in instalment credit and lease transactions points towards declining corporate investments of a capital nature. However, the uptick in loans and overdrafts of 22.1% y/y and 1.5% y/y, respectively, could suggest that businesses are lending simply to stay afloat.

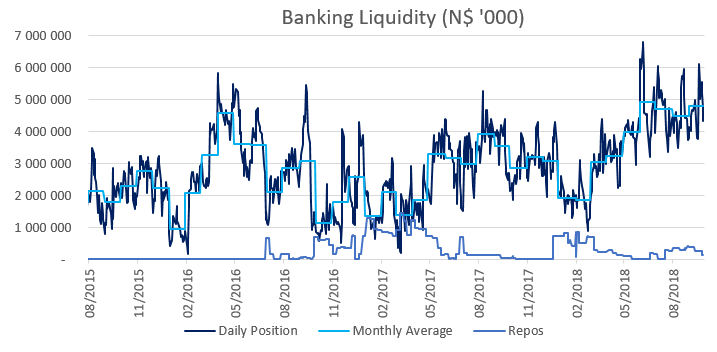

Banking Sector Liquidity

The overall liquidity position of commercial banks decreased by N$229.7 million to an average of N$4.5 billion during August from N$4.7 billion in July. The overall liquidity position continued to boast a healthy average monthly balance of above N$4 billion since June. The excess liquidity seems to have found some parking space with Bank of Namibia (BoN) attributing the decrease in overall liquidity to an uptick in the purchases of BoN bills over the month of August. At the same time commercial banks have continued to utilize BoN’s repo facility, with the balance of repo’s outstanding increasing from N$341 million at the start of August to N$386 million as at the end of August.

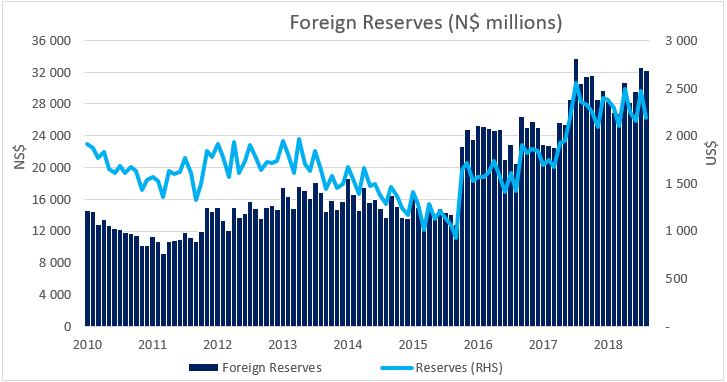

Reserves and money supply

Foreign reserve balances decreased by N$345 million to N$32.2 billion in August from N$32.5 billion in July. BoN had previously noted that the July balance of foreign reserves was N$30.8 billion, citing errors to March reserve figures. This has since been corrected along with the balances of the preceding three months. The N$345 million decline in reserves, however, BoN attributes to government disbursements over the month under review.

Outlook

Credit extension to individuals continues to outpace extension to corporates by most measures. However, the monthly uptick in PSCE registered in August was largely due to credit extension to corporates, which was almost double credit extension to individuals. The outlook for PSCE growth, for the time being, is rested on interest rate expectations with the SARB MPC keeping policy rates unchanged in September, with expectations for BoN’s MPC to follow suit. Rising oil prices and a weaker rand has seen a rampant increase to fuel pump prices, which will feed into the SARB’s inflation forecast. These factors will weigh on future interest rate decisions which in turn influences the rate of PSCE growth. Interest rates remain broadly accommodative at present but risks remain to the upside.

Notwithstanding global developments, local government fiscal shortages bear further risk to the outlook for PSCE. Local news media has reported that the Ministry of Finance (MoF) has engaged in consultations to discuss proposed increases to tax rates for individuals and various taxes affecting businesses. With individuals accounting for almost 70% of the credit issued from a 12-month cumulative perspective, any increase in tax impacts the ability of credit uptake by an already stretched consumer. This would mean less demand for consumer credit, and less disposable income to service debt. This will further supress consumer spending that in turn affects capital investment by local business, which at present is already heavily suppressed. An increase in corporate taxes (dividend withholding tax) further disincentivises credit uptake by corporates which could delay expansion of operations which further dampens the outlook for PSCE going forward.