Overall

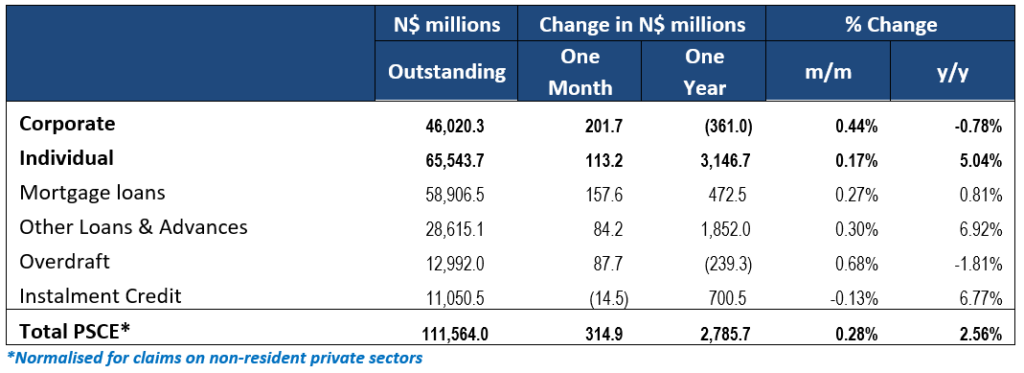

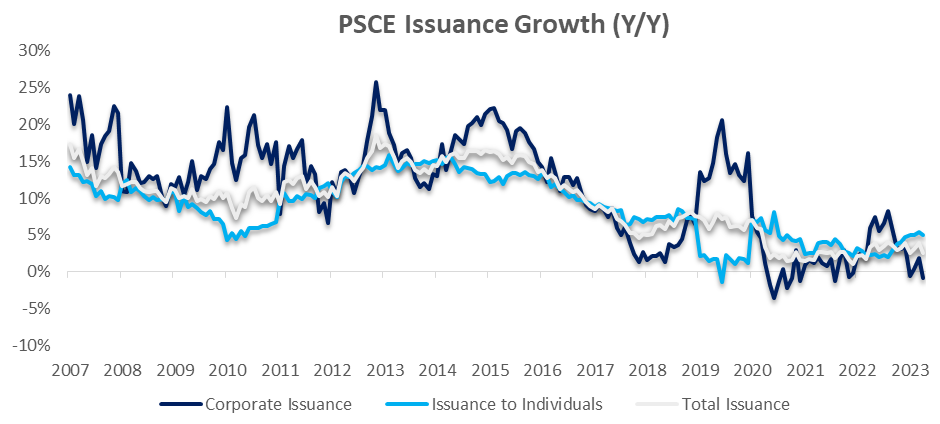

Private sector credit (PSCE) increased by N$314.9 million or 0.28% m/m in April, bringing the cumulative credit outstanding to N$111.6 billion on a normalised basis (removing the interbank swaps the Bank of Namibia (BoN) accounts for in non-resident private sector claims). On a year-on-year basis, PSCE grew by 2.56% in April, compared to a 3.9% y/y growth rate in March. Over the past 12 months, N$2.79 billion worth of credit was extended to the private sector, 21.6% less than the N$3.55 billion issued over the same period a year ago. Individuals took up N$3.15 billion worth of credit over this period, while corporates deleveraged by N$361.0 million.

Credit Extension to Individuals

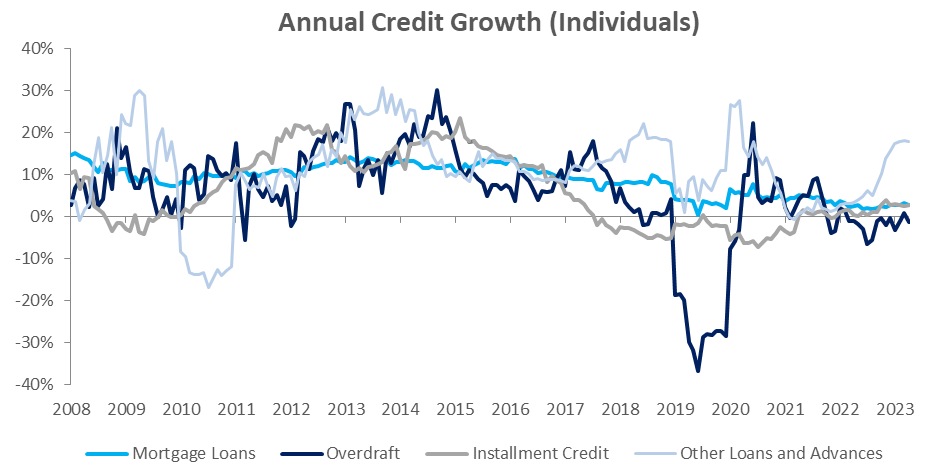

Credit extended to individuals rose by 0.2% m/m and 5.0% y/y. All four sub-categories, bar overdrafts, logged growth on a year-on-year basis. ‘Other loans and advances’ attributed to most of the annual credit uptake by individuals. The sub-category, consisting of credit card debt and personal- and term loans, increased by 0.3% m/m and 2.8% y/y in April. Mortgage loans came in second followed by Instalment credit. Mortgage loans to individuals increased by 0.2% m/m and 17.9% y/y in April, while instalment credit extended to individuals rose 2.8% y/y, despite dropping by 0.1% m/m. Overdraft facilities to individuals was the only sub-category that posted a decline on a year-on-year basis, recording a contraction of 0.3% m/m and 1.3% y/y in April.

Credit Extension to Corporates

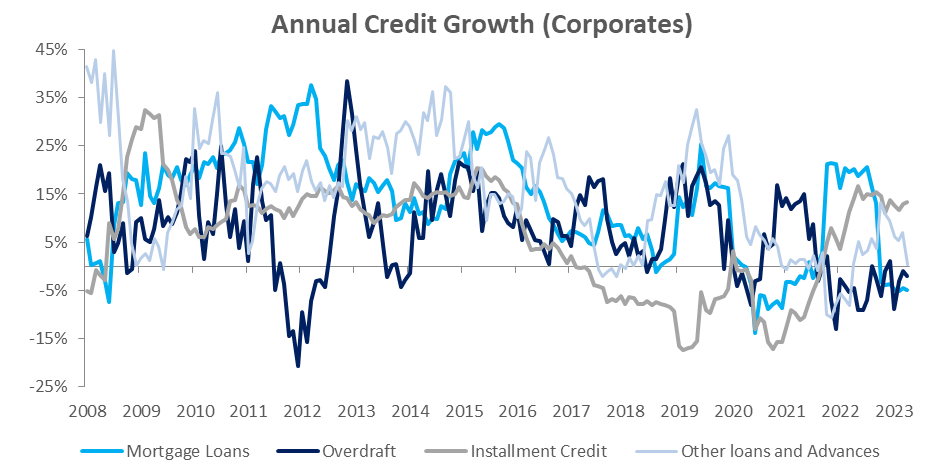

Credit extension to corporates rose by 0.4% m/m but fell 0.8% y/y after mortgage loan- and overdraft credit uptake by corporates slid over the preceding 12-month period ending in April. Mortgage loans and overdraft facilities to corporates declined by 4.9% y/y and 1.9% y/y, respectively, despite growing by 0.4% m/m and by 0.9% m/m, individually in April. Other loans and advances rose by 0.3% m/m and 0.4% y/y. Instalment credit to corporates came in slightly lower in April than in March but continue to bounce back strong on a year-on-year basis after instalment credit up by corporates grew by 13.4% y/y in May from a low base a year earlier.

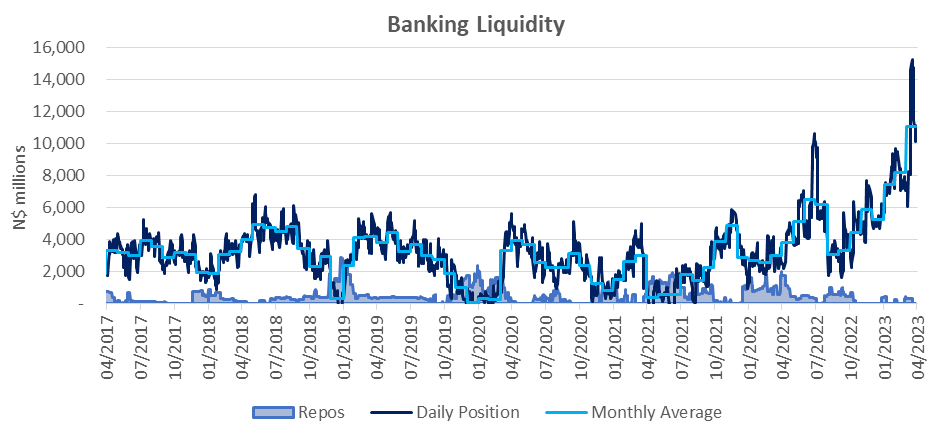

Banking Sector Liquidity

The commercial banks overall liquidity position strengthened further during April, rising by N$2.92 billion to an average of N$11.1 billion which is a record high. The Bank of Namibia (BoN) ascribed the increase to improved diamond sales, combined with Heineken’s acquisition of Namibia Breweries. The strong liquidity position resulted in the repo balance pulling back down to zero at the end of April from N$458.4 million at the start of the month.

Money Supply and Reserves

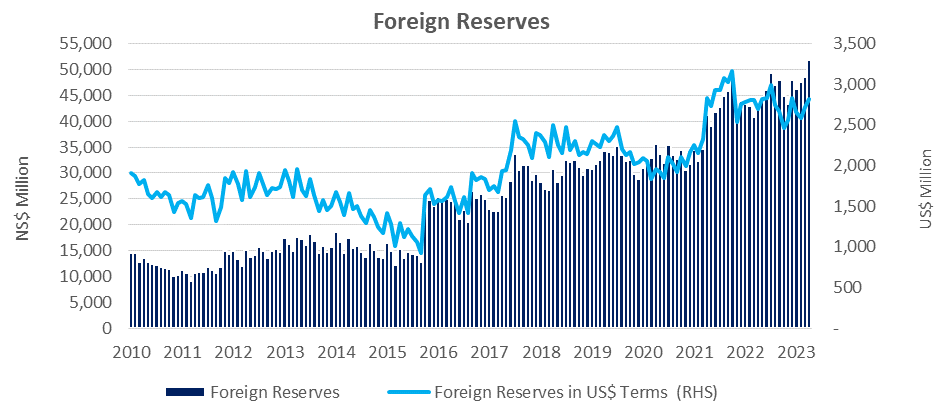

The BoN’s latest monetary statistics show that broad money supply (M2) rose by N$2.32 billion or 1.8% y/y in April. The stock of international reserves increased by 6.7% m/m or N$3.26 billion to N$51.8 billion – the highest level to date and translates to 5.4 months of import cover. The BoN attributed the increase to higher SACU receipts, diamond sales proceeds and FDI inflows in the manufacturing sector arising from the sale of Namibia Breweries Limited to Heineken as well as revaluation gains.

Outlook

Annual PSCE growth slowed in April to the slowest level in 14 months, which was in line with expectations considering the base effect mentioned in IJG’s March PSCE report. The cumulative credit issuance for the past 12 months reached N$2.79 billion in April, marking the lowest level this year.

Corporate credit uptake remains weak in comparison to credit uptake by individuals. This suggests that corporates are more reluctant to borrow under the current conditions, where both economic activity and interest rates are unfavourable for stimulating credit demand for businesses.

Looking ahead, we expect credit uptake to remain modest, as we see little support for increased demand. Considering the marginal impact of May’s base effect, we anticipate that annual PSCE growth figure will remain stable around 2.5% in May. Furthermore, we anticipate a significant boost in foreign reserves due to the sharp depreciation of the Namibian dollar against the US dollar in May. This improvement in the foreign reserve position may provide an opportunity for the BoN to stay on a less aggressive rate hike cycle compared to its counterpart in South Africa, as it seeks to maintain price stability.