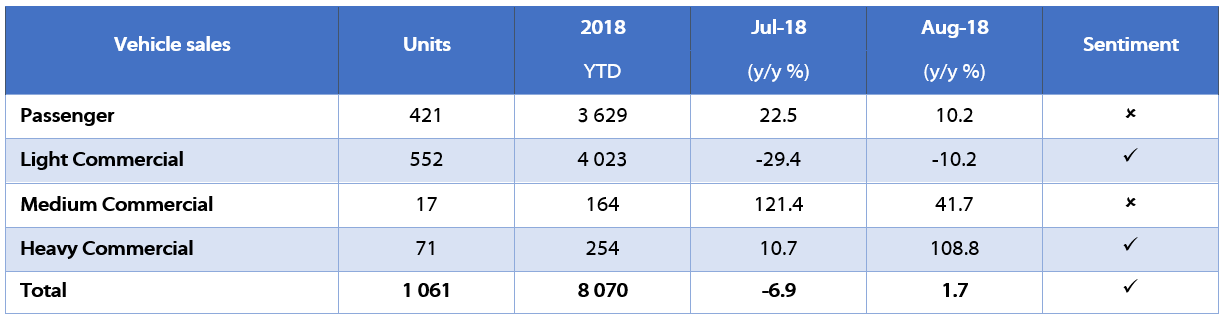

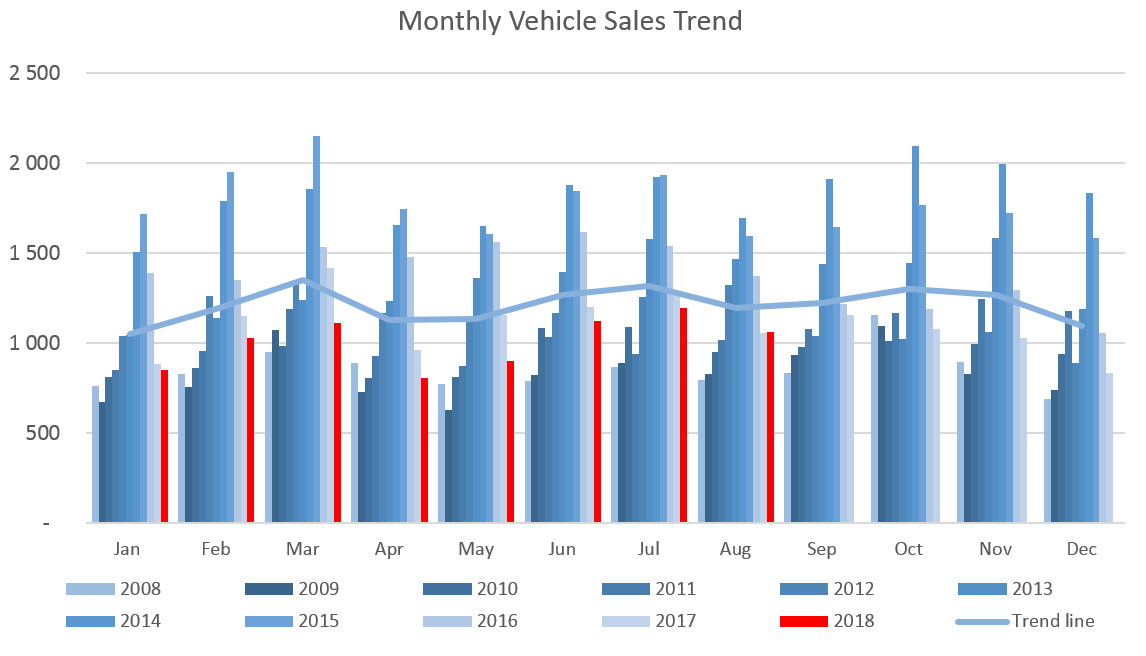

A total of 1,061 new vehicles were sold in August, representing an 11.0% m/m decrease from the 1,192 vehicles sold in July, but 1.7% more than in August 2017. Year-to-date 8,070 vehicles have been sold of which 3,629 were passenger vehicles, 4,023 light commercial vehicles, and 418 medium and heavy commercial vehicles. On a rolling 12-month basis, a total of 12,031 new vehicles were sold as at 31 August 2018, representing a contraction of 13.1% from the 13,848 sold over the comparable period a year ago.

A total of 421 new passenger vehicles were sold during August, decreasing by a hefty 30.4% m/m. From a year-on-year perspective however, 39 more units were sold in August 2018 (up 10.2%) than a year ago. Year-to-date passenger vehicle sales rose to 3,629 units, reflecting a 7.3% decline from August 2017.

640 New commercial vehicles were sold in August, representing a 9.0% m/m increase, but a 3.2% y/y contraction. 552 light commercial vehicles, 17 medium commercial vehicles, and 71 heavy commercial vehicles were sold during the month. On a year-on-year basis, light commercial vehicle sales have dropped by 10.2%, medium commercial sales increased 41.7% and heavy and extra heavy sales rose by 108.8%. On a twelve-month cumulative basis, commercial vehicle sales remain depressed with light commercial vehicle sales decreasing by 16.9% y/y, medium commercial vehicle sales declining by 0.8% y/y and heavy commercial vehicle sales dropping by 4.8% y/y.

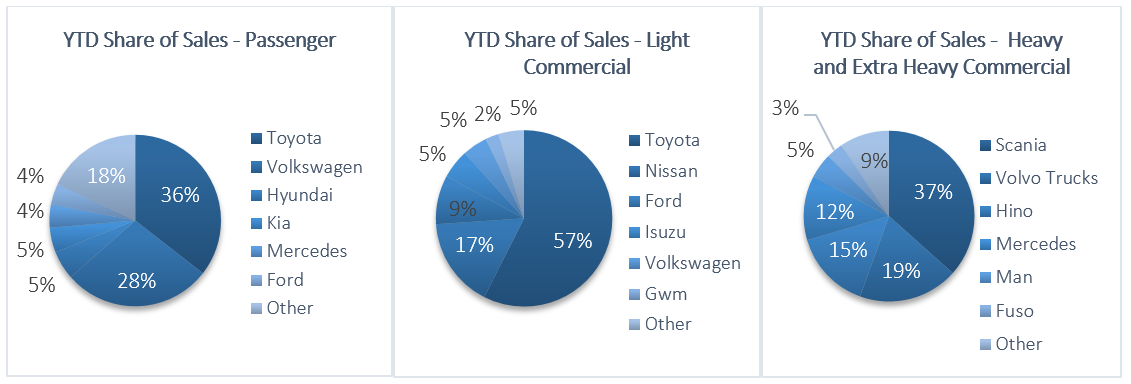

Toyota continues to lead the market for new passenger vehicles sales in 2018 based on the number of new vehicles sold, claiming 35.5% of the market, followed by Volkswagen with a 28.0% share. They were followed by Hyundai and Kia at 5.5% and 4.7% respectively.

Toyota also remained the leader in the light commercial vehicle space with 57.5% market share, with Nissan in second place with a 16.5% share. Ford and Isuzu claimed 9.0% and 5.3% respectively of the number of new light commercial vehicles sold for the year. Hino leads the medium commercial vehicle category with 42.7% of sales while Scania remains number one in the heavy and extra-heavy commercial vehicle segment with 36.6% of the market share year-to-date.

The Bottom Line

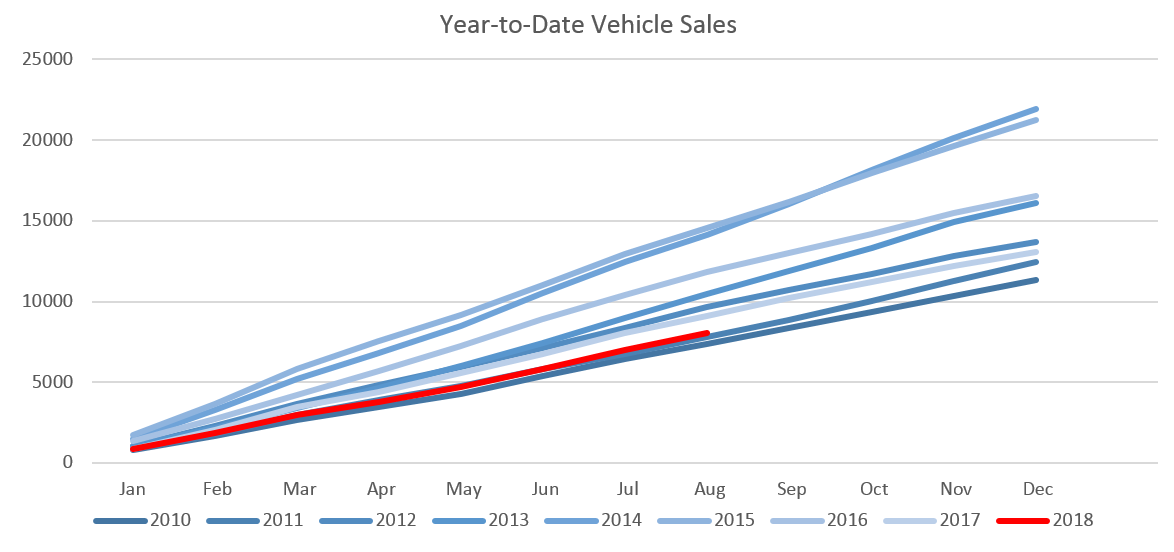

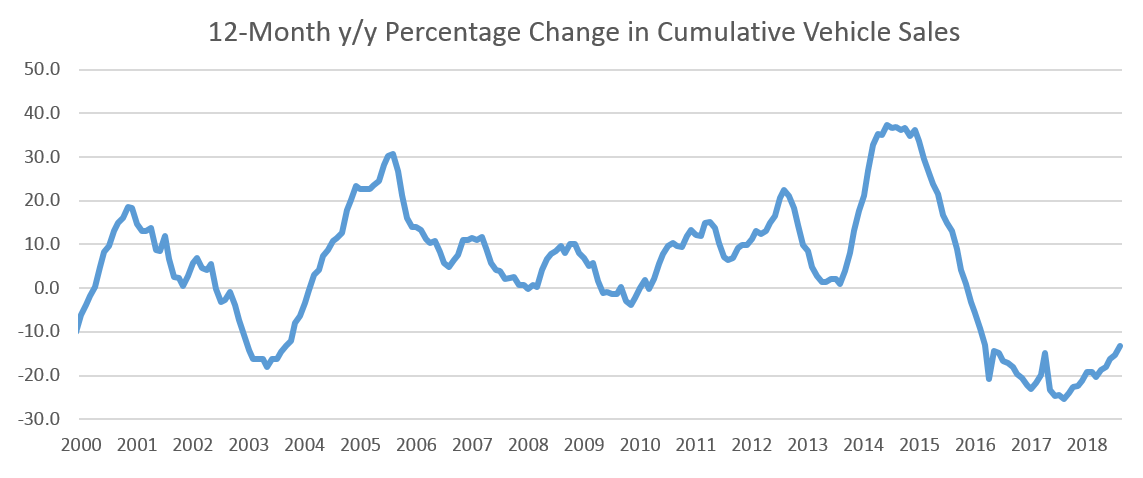

The outlook for new vehicle sales remains bleak with the cumulative number of new vehicle sales as at the end of August amounting to 12,031, a decline of 47.0% from the peak of 22,664 new vehicle sales recorded in April 2015. Year-on-year, the cumulative number of new vehicles sold has contracted by 13.1% from the 13,848 cumulative sales recorded in August 2017. Factors such as fiscal consolidation, low consumer and business confidence, expected fuel price increases, coupled with an increasing likelihood of interest hikes over the next 24 months, mean that no significant recovery in vehicle sales can be expected over the short to medium-term.