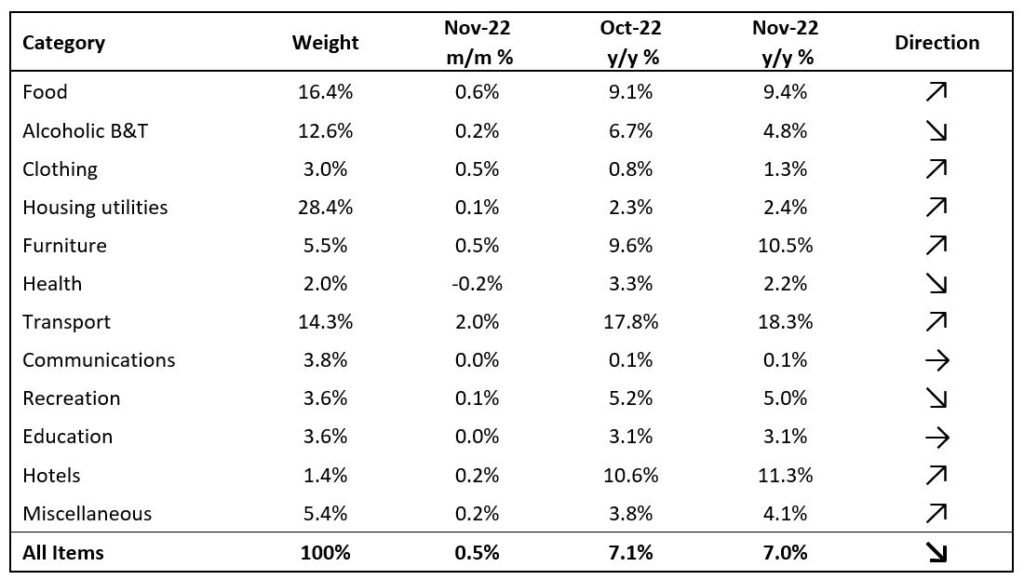

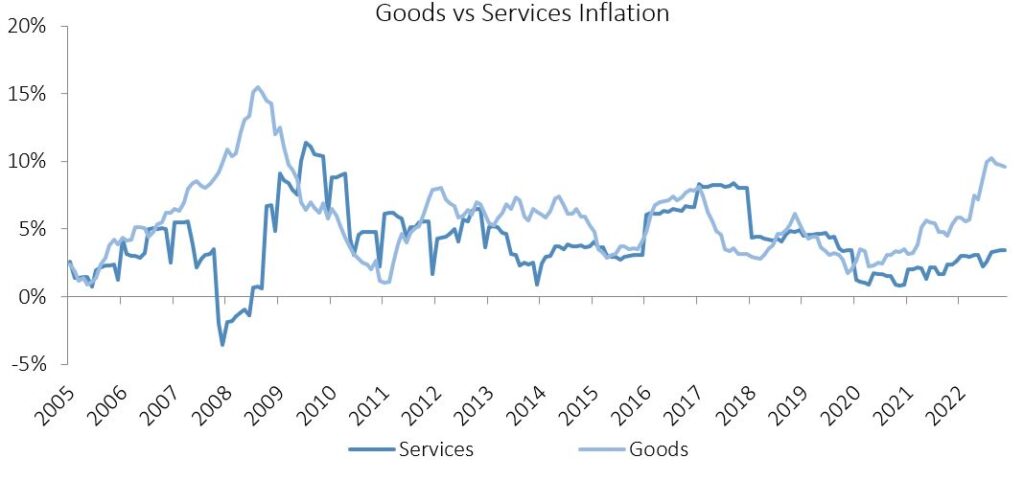

Namibia’s annual inflation rate slowed marginally to 7.0% y/y in November. Prices in the overall NCPI basket rose by 0.5% m/m, the quickest since July. Year-on-year, overall prices in seven of the twelve categories rose at a quicker rate in November than in October, three categories experienced slower rates of inflation and two categories posted inflation rates consistent with those in October. Goods inflation came in at 9.6% y/y, slowing for a third consecutive month. Services inflation, while fairly lower than goods inflation, rose for a fifth consecutive month to 3.4% y/y in November.

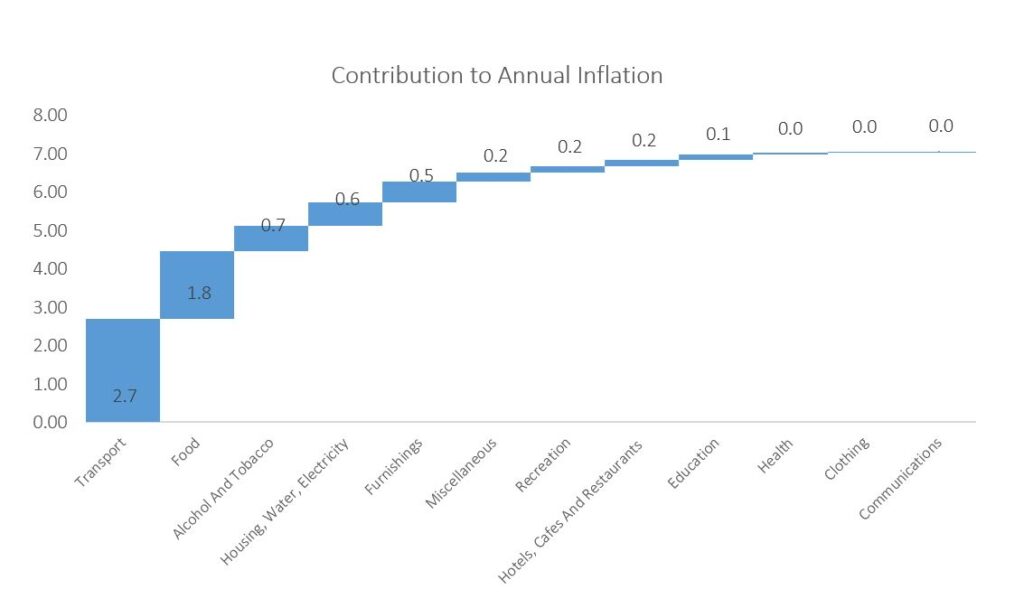

Contributions to the 7.0% y/y inflation print were relatively stable across the majority of the basket item categories. The largest movement was from the contribution of the alcohol and tobacco category dropping from 0.91ppt in October to 0.67ppt in November.

Transport inflation ticked up to 2.0% m/m and 18.3% y/y, following the 198c per litter increase in the price of Diesel that came into effect at the beginning of November. The basket item contributed 2.7ppt to the annual inflation rate. All three sub-categories recorded quicker inflation on an annual basis than in October. The purchase of vehicles sub-category recorded price increases of 0.8% m/m and 3.8% y/y. Prices in the operation of personal transport equipment sub-category rose by 2.8% m/m and 27.3% y/y. After recording an over-recovery of 125 cents per litre on diesel in November, the Ministry of Mines and Energy lowered diesel prices in-kind at the beginning of December while leaving petrol prices unchanged, which should ease inflation in this sub-category in December. The last two months have seen the brent crude price retrace to February levels in ZAR terms, which should lead to softer transport inflation in the coming months, should it remain at current levels. Prices in the public transportation services sub-category climbed by 0.2% m/m and 7.1% y/y.

Food & non-alcoholic beverages were the second largest contributor the annual inflation rate, contributing 1.8ppt to November’s print. Prices in this basket item rose by 0.6% m/m and 9.4% y/y. All thirteen sub-categories in this basket item recorded price increases on an annual basis for the 11th consecutive month. Fruit saw the largest prices increase on an annual basis, rising by 19.6% y/y, followed by the prices for oils and fats which rose by 18.3% y/y. Inflation for both sub-categories were however slower than the 21.6% and 24.6% respective annual rates recorded in October.

Alcohol & tobacco inflation eased from 6.7% y/y in October to 4.8% y/y in November. Prices of the basket item rose by 0.2% m/m. Alcoholic beverages posted inflation of 0.2% m/m and 5.0% y/y, driven primarily by price increases of 21.2% y/y on white spirits. Tobacco prices, meanwhile, rose by 0.3% m/m and 4.1% y/y, attributable of cigarette inflation of 5.7% y/y, compared to pipe tobacco prices which are down 0.4% y/y.

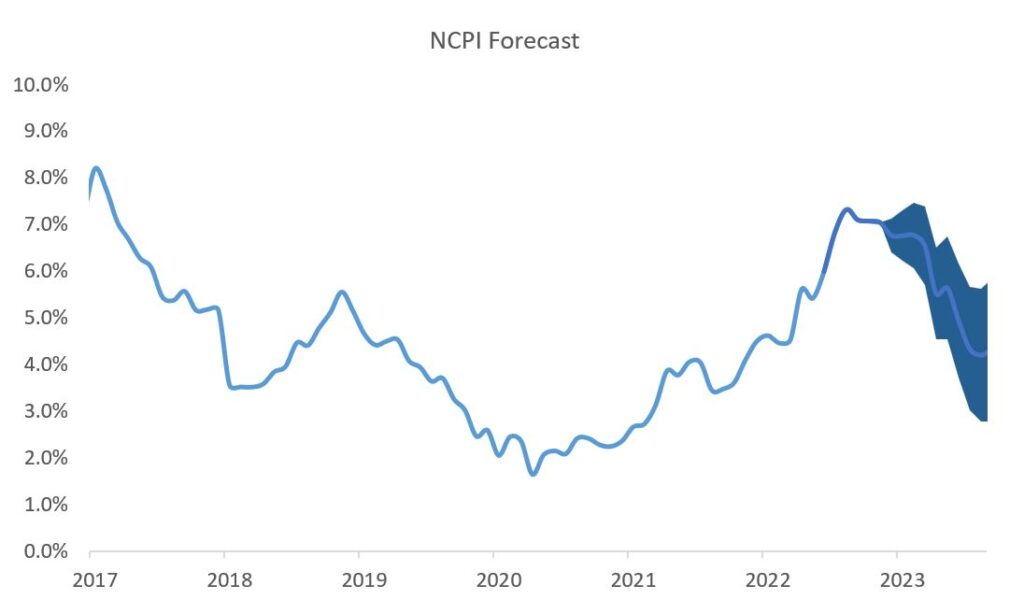

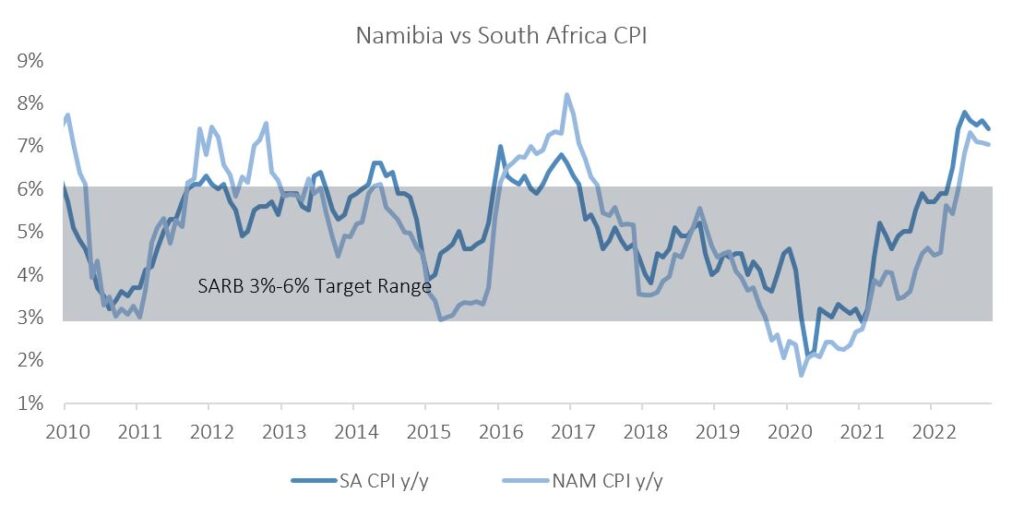

While easing somewhat, the Namibian annual inflation rate continues to trend above the SARB’s target ceiling of 6.0%. The Bank of Namibia’s MPC decision in November to not hike rates by as much as the SARB did (50bps compared to the SARB’s 75bps) came as somewhat of a surprise, but will be welcomed by indebted consumers and businesses as it softens the blow to some extent. After the rate announcement, the governor of the BoN explained that when the MPC were analysing the incoming monetary, financial and economic data at the last monetary policy review, the members had the benefit of seeing the forecasts for the forthcoming SACU receipts for 2023, which indicated that the total amount that Namibia will be receiving will be significantly higher in 2023.

He further added that the inflation rate seems to be levelling off and that forecasts are showing oil prices remaining relatively muted for at least the next six months. The governor specifically mentioned that they do not expect much changes from the 25bps differential between Namibia and South Africa’s repo rate in terms of capital outflows. We however do not foresee the BoN deviating from the SARB much going forward.

IJG’s inflation model currently forecasts Namibia’s annual inflation rate to further ease to around 6.8% next month, and for the rate to continue steadily slowing during the course of 2023, before reaching around 4.0% at the end of 2023.