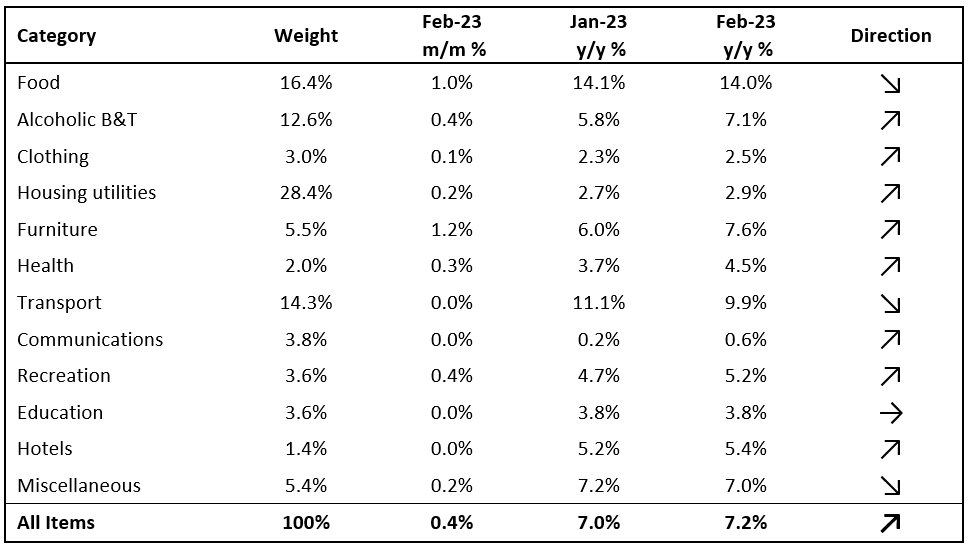

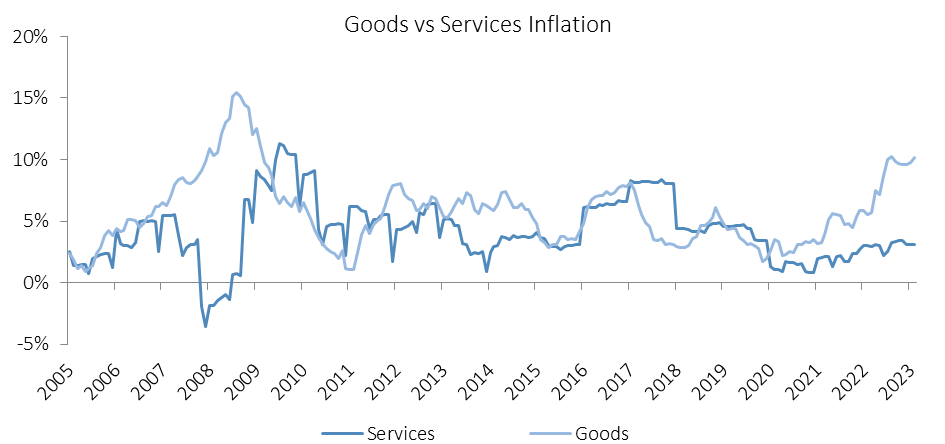

Namibia’s annual inflation rate soared to 7.2% y/y in February following a 7.0% y/y increase in prices recorded in January. Prices in the overall NCPI basket rose by 0.4% m/m, compared to a 1.1% m/m increase in January. On a year-on-year basis, overall prices in eight of the twelve basket categories rose at a quicker rate in February than in January, three categories recorded slower rates of inflation with education the lone category posting inflation in-line with January. Prices for goods increased by 10.1% y/y while prices for services rose by 3.1% y/y. This represents the greatest annual inflation margin recorded between goods and services inflation since December 2008.

Inflation Attribution

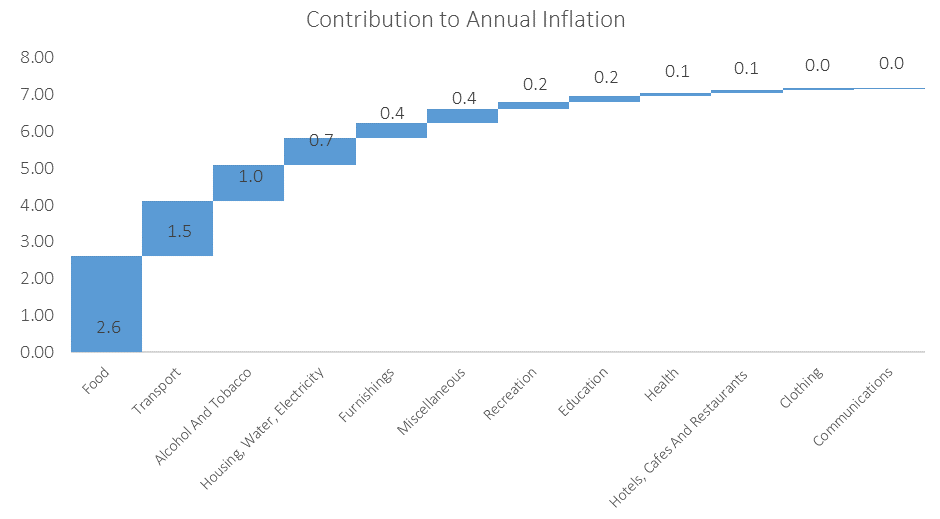

The food and non-alcoholic beverages basket category were again the biggest contributor to the annual inflation print after prices in this basket category rose 14.0% y/y in February. The basket category contributed 2.6 percentage points to the annual inflation rate in February. Month-on-month food and non-alcoholic beverage prices rose by 1.0%, slowing from the 2.3% recorded on average over the past 2 months. Fruit price inflation accelerated for a third consecutive month to 26.8% y/y, with citrus prices rising by 27.4% y/y and avocados by 75.7% y/y. The prices of breads and cereals rose by 0.7% m/m and 22.0% y/y with prices of all of the food items in this sub-category rising by double digits percentages year-on-year except for Mahangu meal which rose by a mere 0.3% y/y. Overall, most of the sub-categories in this basket posted higher inflation compared to January while bread, cereals, fish, vegetables and non-alcoholic beverages including coffee, tea and mineral waters showed signs of slowing inflation.

As the graph below depicts, transport was the second largest contributor to February’s annual inflation print, contributing 1.5 percentage points. Prices in this basket category was unchanged from last month but rose 9.9% when compared to the prices a year ago. Operation of personal transport equipment inflation continued to slow with prices in this sub-category rising 14.2% y/y compared to 15.9% y/y a month earlier. The Ministry of Mines and Energy’s decision to increase the price of petrol by 150c per litre from the beginning of March means we may see prolonged periods of elevated inflation for this category. Purchase of vehicles inflation also slowed in February. Prices in this subcategory fell 0.5% m/m while annual inflation decelerated to 5.3% from 6.2% a month earlier. Public transportation services inflation accelerated to 1.1% y/y from 0.9% in January while prices remained stable from last month.

The alcohol and tobacco basket category saw prices increase by 0.4% m/m and 7.1% y/y. The prices of alcoholic beverages climbed by 0.4% m/m and 7.6% y/y. The acceleration from January’s 6.5% y/y rate was largely driven by steep increases in prices of white spirits and brandies which rose 26.0% y/y and 8.1% y/y respectively. We expect more price pressures to come from this sub-category following the steep increase in ‘sin taxes’ on alcoholic beverages with effect from 23 February as was announced by the Minister of Finance during the FY2023/2024 budget speech last month. Tobacco products recorded price increases of 0.2% m/m and 5.1% y/y, with cigarette prices up 5.8% y/y while pipe tobacco prices increased by 2.9% y/y. Similarly, more price pressures are expected from the increased ‘sin taxes’ on tobacco products.

Outlook

The acceleration of Namibia’s annual inflation rate to 7.2% in February marks the second consecutive month of higher annual inflation and comes as prices of items in most of the basket categories continue to soar. This shows that we have yet to enter a disinflationary cycle and that a prolonged restrictive monetary policy stance may be required to bring inflation down to desired levels.

Namibia is not alone in this predicament. We continue to see relatively high and ‘sticky’ inflation prints from numerous countries. Most notable are the US and the Eurozone, where their central banks are considering further interest rate hikes to push inflation down to target levels faster which in turn heightens fears of a possible recession in those economies.

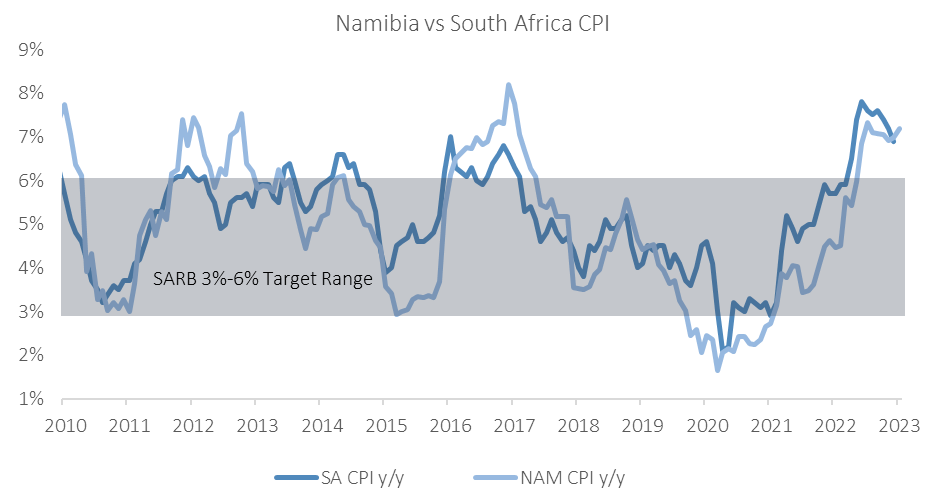

Whether Namibia will be spared from further rate hikes will be largely dependent on the SARB’s assessment of the necessity to hike rates even further to bring South Africa’s inflation back within the target range of between 3-6%. South Africa’s annual inflation print stood at 6.9% in January. February’s inflation print is expected to be announced this week and will be followed by the SARB’s MPC announcement scheduled for 30 March. Both announcements should provide insight into the scope and duration of further interest rate hikes needed to curb inflation not only for South Africa but for our economy given the close economic ties with our southern neighbour.

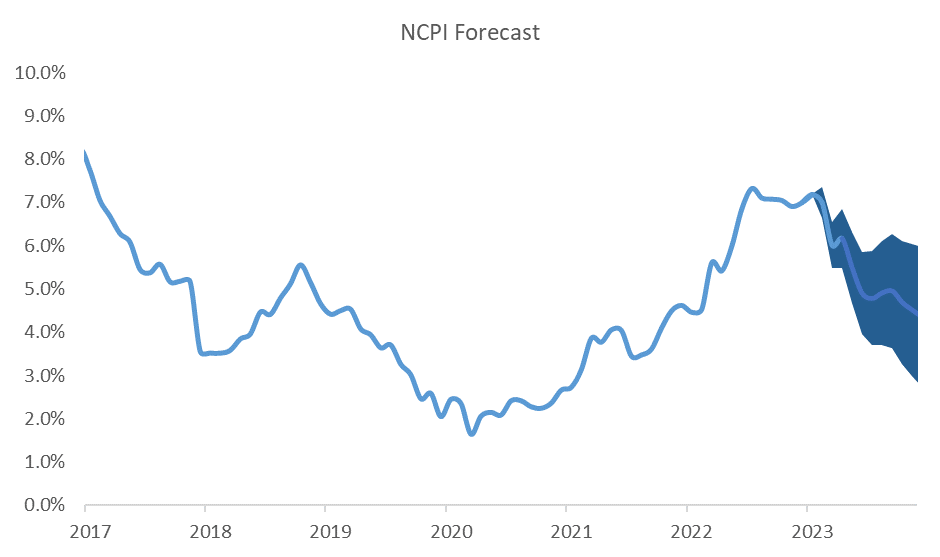

Despite seeing inflation accelerating during the first two months of the year, IJG’s inflation model predicts a gradual slowdown in Namibia’s annual inflation rate over the remainder of year, before ending the year at around 4.5%.