Namibia’s annual inflation rate softened to 6.1% y/y in April. On a month-on-month basis, prices in the overall NCPI basket rose by 0.4% m/m, following the 0.6% m/m increase in March. On an annual basis, overall prices in three of the twelve basket categories rose at a quicker rate in April than in March, eight categories recorded slower rates of inflation while inflation in the education category remained steady over the period. Inflation on services ticked up to 3.2% y/y while inflation on goods edged lower to 8.2% y/y.

Inflation Attribution

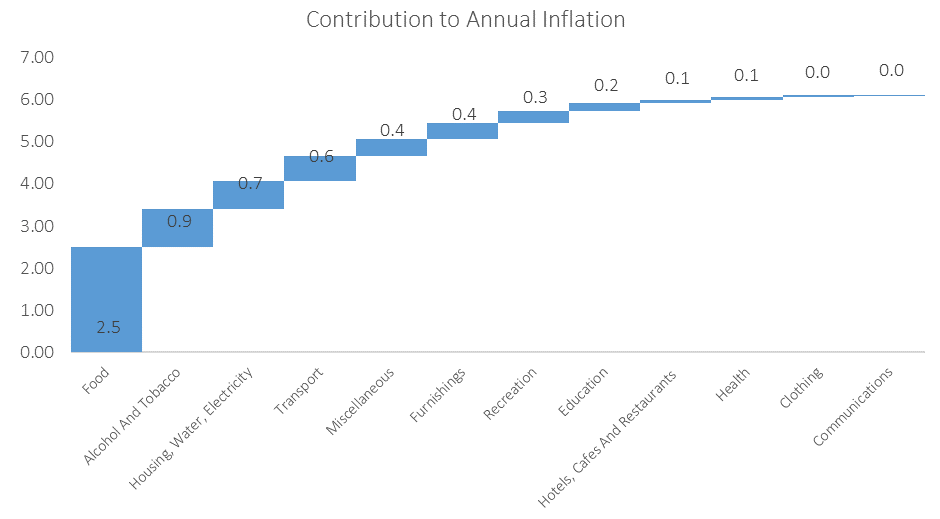

The Food and Non-Alcoholic beverages basket item was once again the largest contributor to Namibia’s annual inflation rate, contributing 2.5 percentage points in April. Prices of this basket item increased by 0.5% m/m and 13.5% y/y. The year-on-year inflation rates for most of the sub-categories in this basket category slowed from March but remain relatively elevated. Fruits posted the highest year-on-year inflation followed by Breads and Cereals. Fruit prices increased by 1.2% m/m and 28.5% y/y, marginally slower than the 29.1% y/y increase recorded a month earlier. Prices of the Breads and Cereals sub-category fell by 0.1% m/m but remain high considering that prices of this sub-category are 19.8% higher than they were a year ago. Vegetables and Fish were the only sub-categories which recorded quicker inflation compared to March on a year-on-year basis. Prices of the Vegetables sub-category rose by 2.5% m/m and 15.2% y/y, while prices of the Fish sub-category increased by 0.5% m/m and 8.8% y/y.

The Alcohol and Tobacco basket item was the second largest contributor to April’s inflation print, contributing 0.9 percentage points. Prices in this category rose by 0.6% m/m and 6.7% y/y. Inflation on alcohol products came in at 7.6% y/y, a slight uptick from the 7.4% y/y reported in March. Tobacco product inflation came in at 2.6% y/y, down from 4.8% y/y a month ago. Six of the nine sub-categories in this basket item posted either slowing or steady inflation. Pipe Tobacco, Brandies and Beers/Ales/Ciders were the only sub-categories which saw prices grow faster in April than in March.

Housing, Water and Electricity, which has the heaviest weighting in the inflation basket at 28.4%, was the largest contributor to inflation among the remaining categories and replaced Transport as one of the top three contributors to Namibia’s annual inflation print. Inflation in this category came in at 2.6% y/y in April, down from 3.0% y/y in March. All four sub-categories in this basket item recorded slowing inflation compared to March on a year-on-year basis. Prices of Electricity, Gas and Other Fuels fell by 0.4% m/m, while annual inflation in this subcategory slowed to 4.9%. Prices in the Regular Maintenance and Repair of Dwelling sub-category decreased by 0.4% m/m with annual inflation coming in at 4.8%. Rental inflation and prices of Water Supply, Sewerage Service and Refuse remained steady month-on-month with annual inflation at 2.1% and 2.5%, respectively.

Outlook

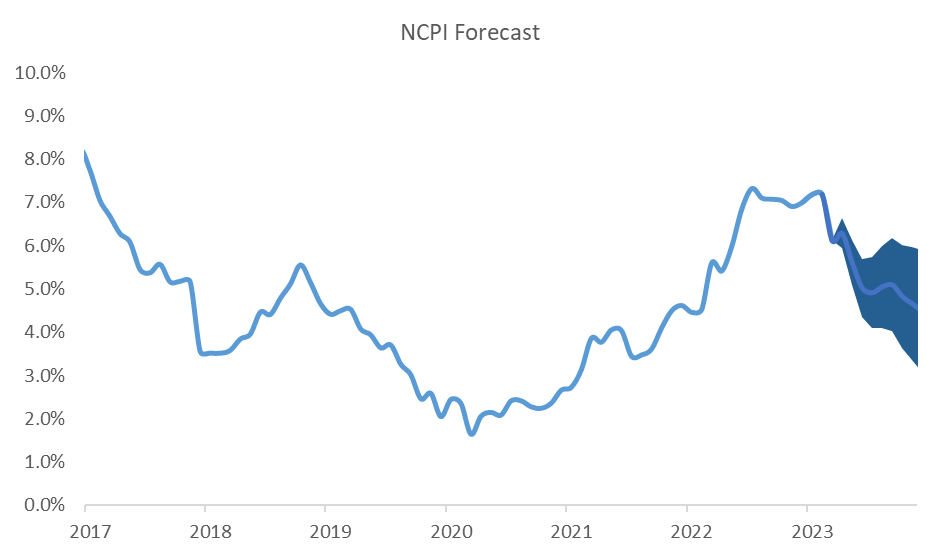

The steep drop in April’s inflation print to 6.1% is primarily due to base effects in the Transport category with fuel prices now only marginally higher than they were a year ago. Still, the slowdown should be a welcome development for the Bank of Namibia (BoN) and its quest to temper inflationary pressure. The drop in April’s inflation print, coupled with the fact that we see inflation starting to ease in other parts of the world, may signal the start of a much-anticipated disinflationary cycle which in turn could see the end of the BoN’s tightening of the belt. The BoN raised lending rates by a further 25bps last month, again deciding to not hike as aggressively as the South African Reserve Bank (SARB) last time round and now lags the SARB’s lending rate by 50bps. Elevated food prices and a weak currency do however pose risks to the BoN’s inflation fight.

IJG’s inflation model continue to predict a gradual slowdown in Namibia’s annual inflation rate over the remainder of year, before ending the year at around 4.8%.