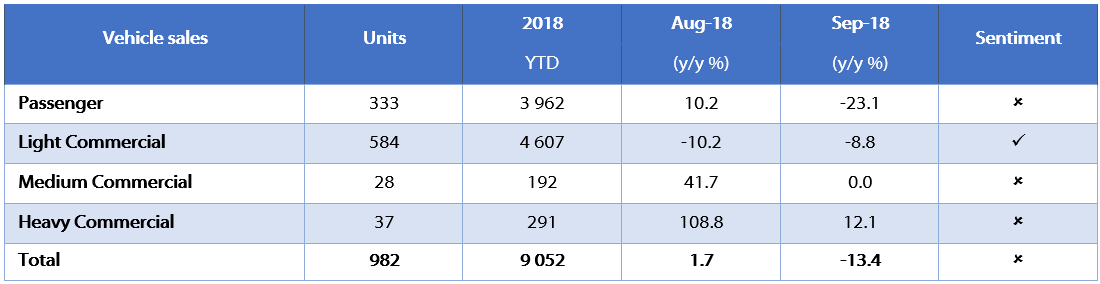

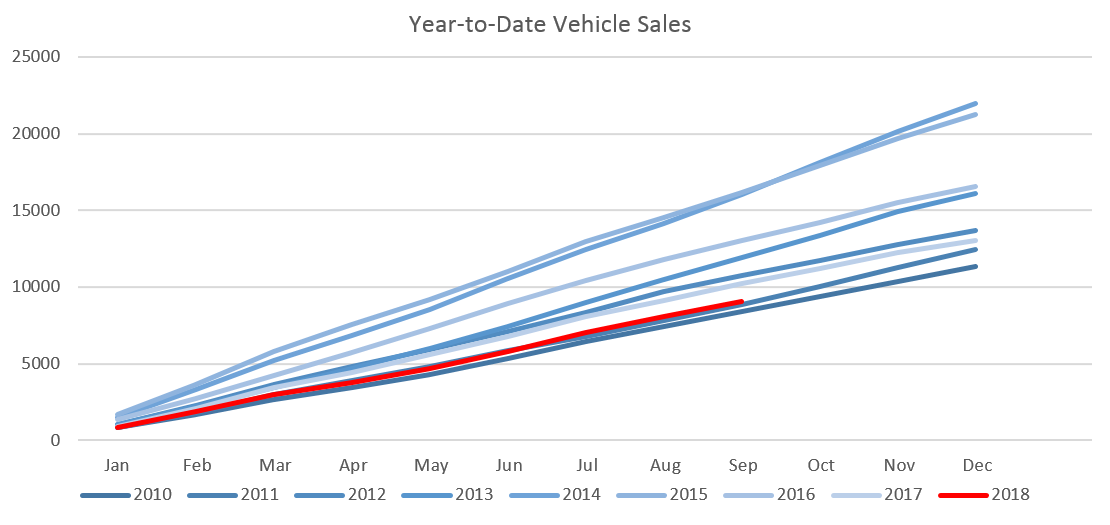

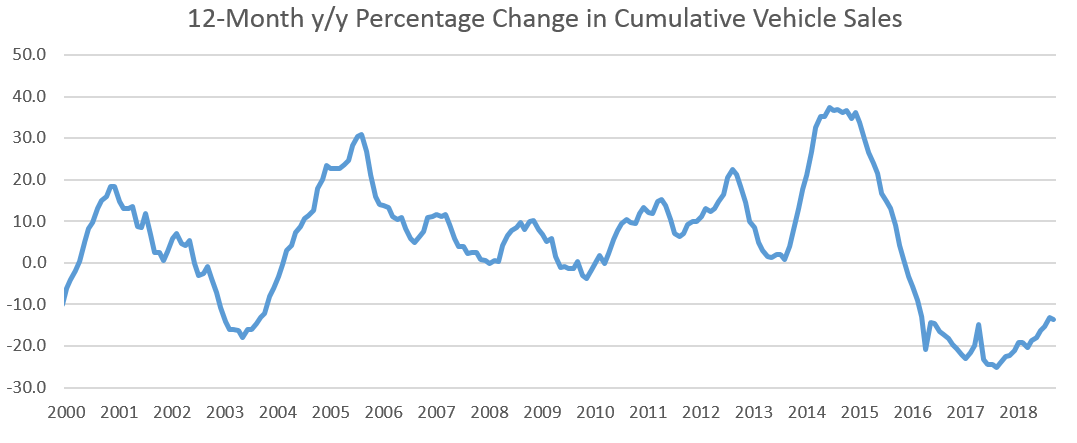

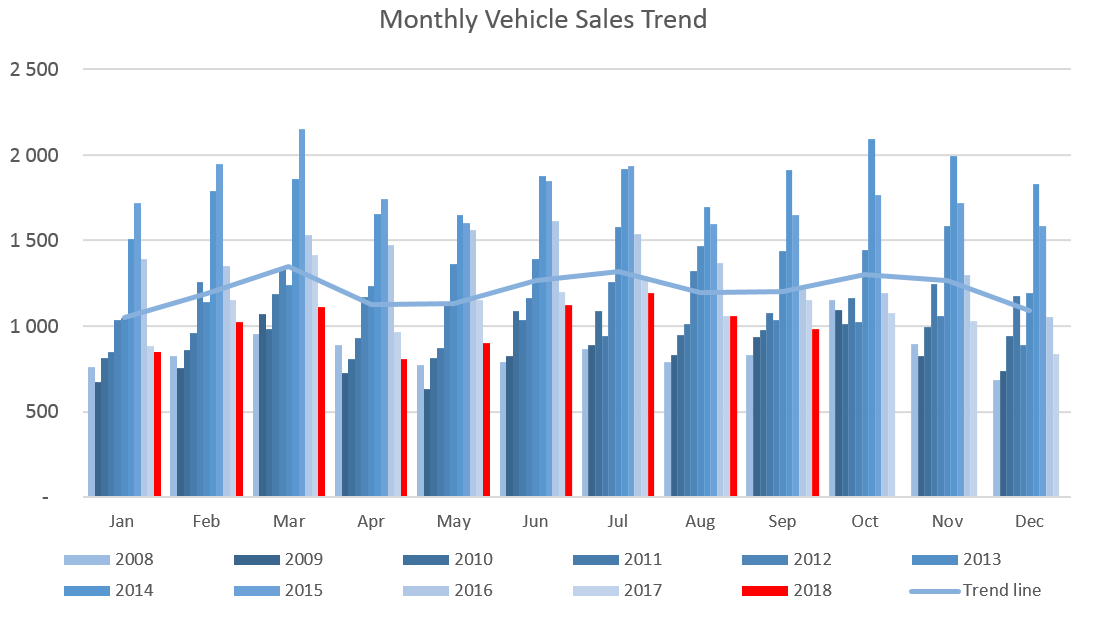

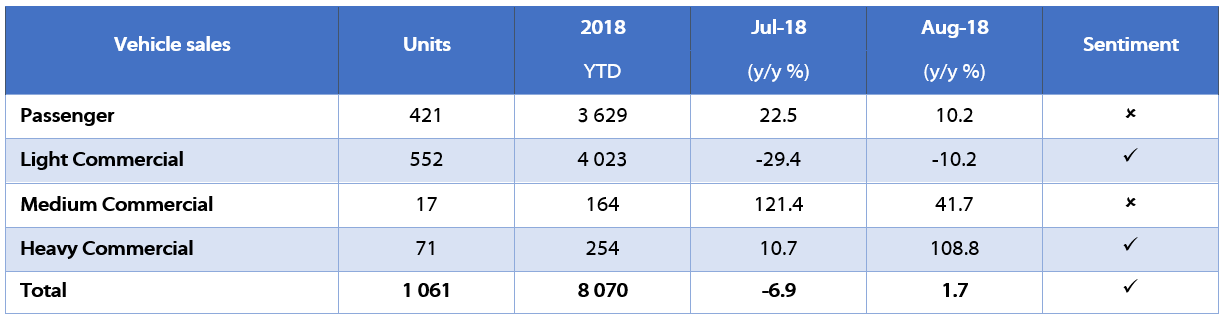

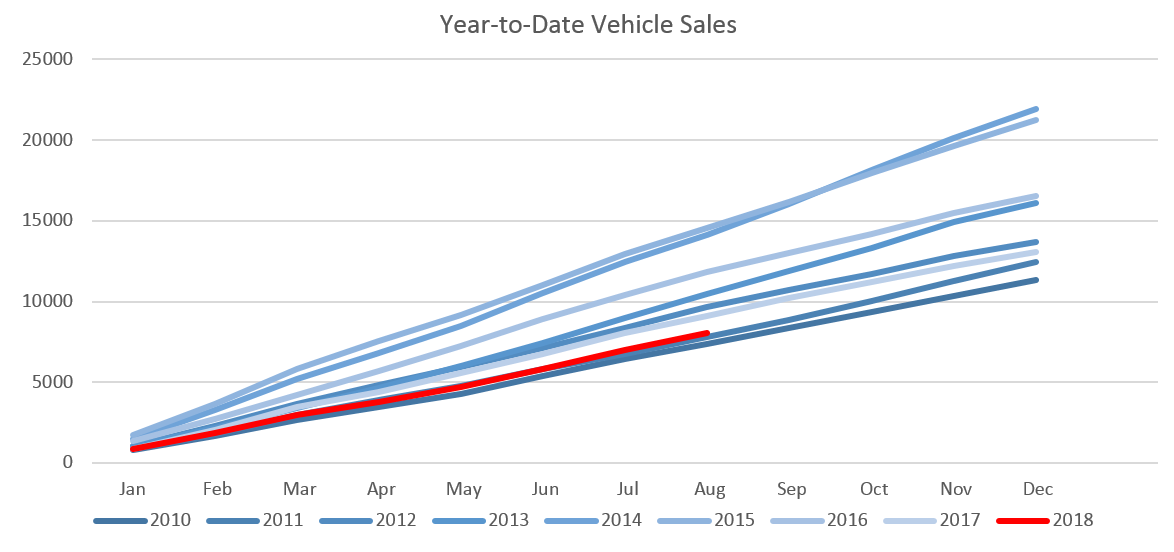

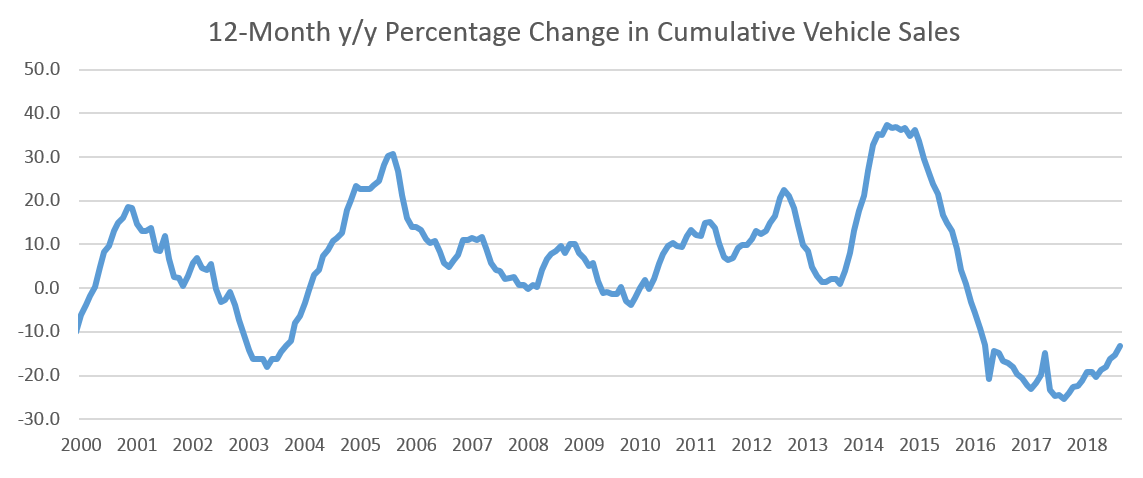

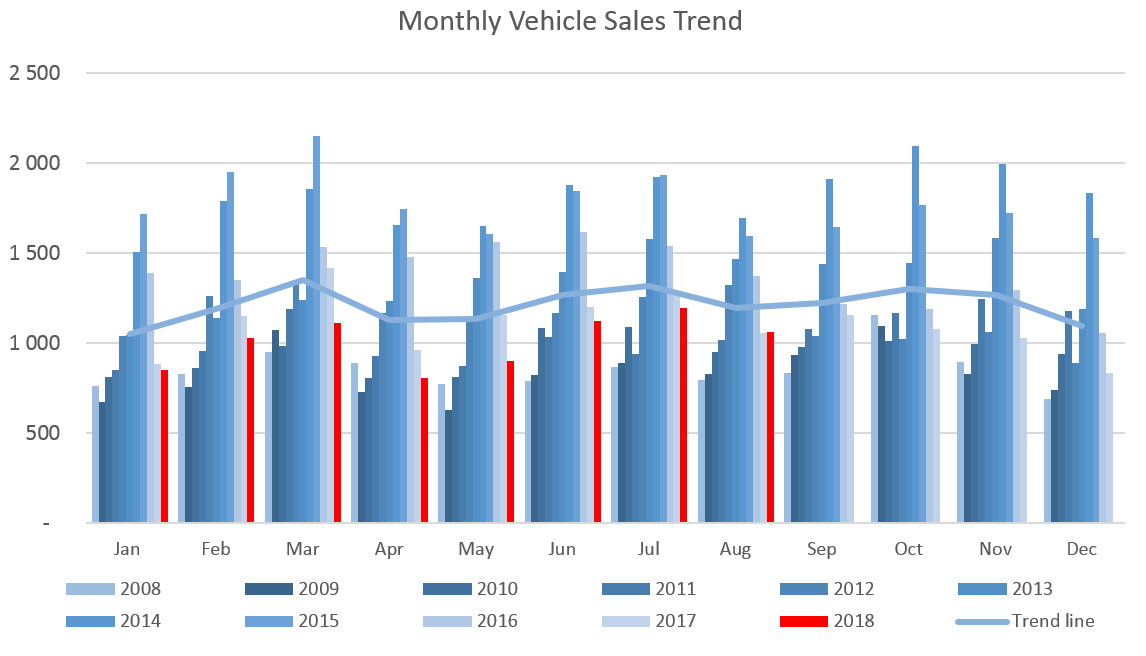

982 New vehicles were sold in September, which represents a 7.4% m/m decrease from the 1,061 vehicles sold in August, and a 13.4% y/y decrease from September 2017. Year-to-date 9,052 vehicles have been sold of which 3,962 were passenger vehicles, 4,607 light commercial vehicles, and 483 medium and heavy commercial vehicles. On a twelve-month cumulative basis, a total of 11,879 new vehicles were sold as at 30 September 2018, representing a contraction of 13.7% from the 13,765 sold over the comparable period a year ago.

A total of 333 new passenger vehicles were sold during September, declining by 20.9% m/m and 23.1% y/y. Year-to-date passenger vehicle sales rose to 3,962, down 8.9% when compared to the number sold by September last year. For the past three quarters, passenger vehicles have, on average, made up 43.7% of the total number of new vehicles sold.

649 New commercial vehicles were sold in September, representing a 1.4% m/m increase, but a 7.4% y/y contraction. 584 light commercial vehicles, 28 medium commercial vehicles, and 37 heavy commercial vehicles were sold during the month. On a year-on-year basis, light commercial vehicle sales have dropped by 8.8%, medium commercial sales were flat, and heavy and extra heavy sales rose by 12.1%. On a twelve-month cumulative basis, light commercial vehicle sales dropped 17.2% y/y, medium commercial vehicle sales declined by 1.6% y/y, and heavy commercial vehicle sales dropped 2.1% y/y.

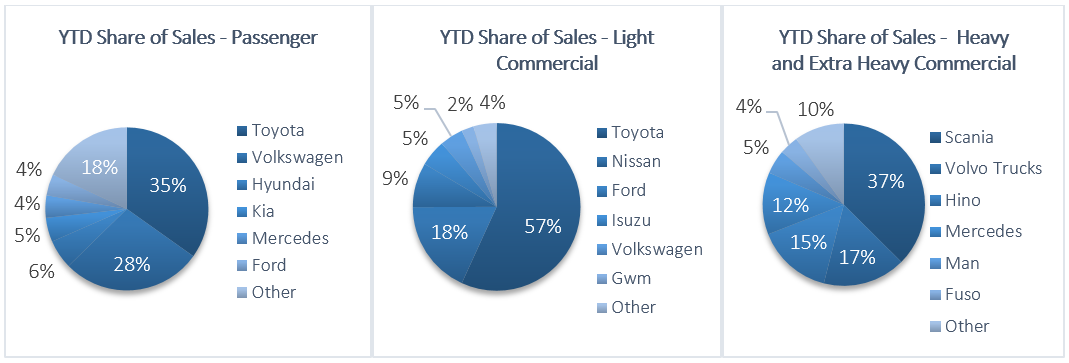

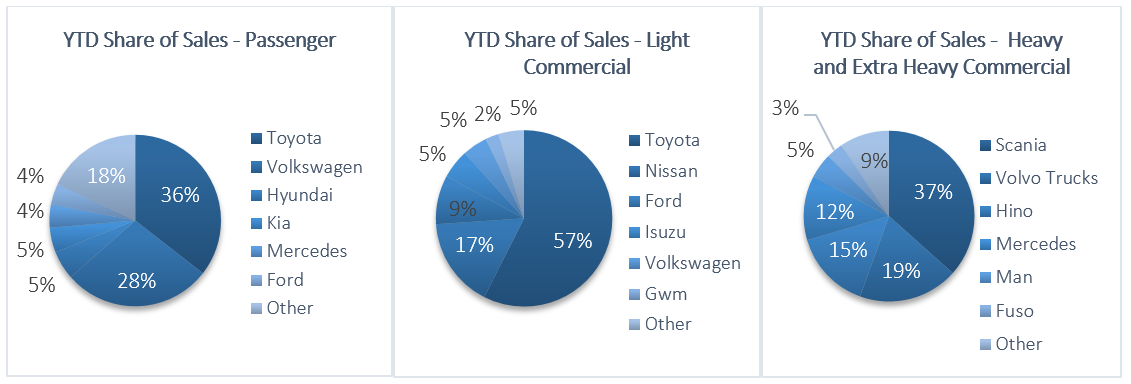

Year-to-date, Toyota and Volkswagen continue to hold their market share in the passenger vehicle market based on the number of new vehicles sold, claiming 34.8% and 27.8% of the market respectively. They were followed by Hyundai at 5.8% and Kia at 4.8%, while the rest of the passenger vehicle market was shared by several competitors.

Toyota also remained the leader in the light commercial vehicles space with a robust 56.8% market share, with Nissan in second place with a 18.1% share. Ford and Isuzu claimed 8.6% and 5.1%, respectively, of the number of light commercial vehicles sold year-to-date. Hino leads the medium commercial vehicle category with 44.3% of sales while Scania remains number one in the heavy and extra-heavy commercial vehicle segment with 37.5% of the market share year-to-date.

The Bottom Line

The cumulative number of new vehicle sales continued to contract on a 12-month basis, amounting to 11,879 at the end of September. Year-on-year, the 12-month cumulative number of new vehicles sold has contracted by 13.7% from the 13,765 cumulative sales recorded in September 2017. If implemented, the proposed changes to the income tax legislation is very likely to have a negative impact on economic growth, and put additional pressure on both individuals and corporates. This means that lower spending on capital assets will reduce the demand which is already under pressure for both passenger and commercial vehicles.