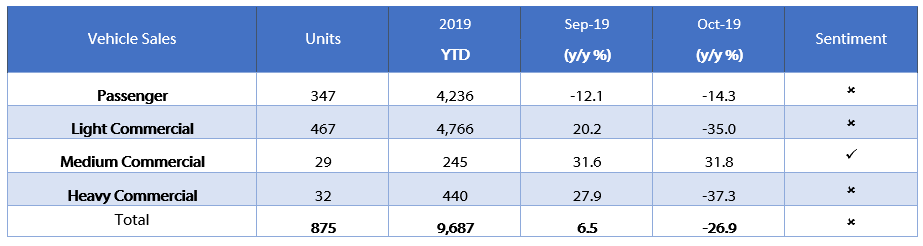

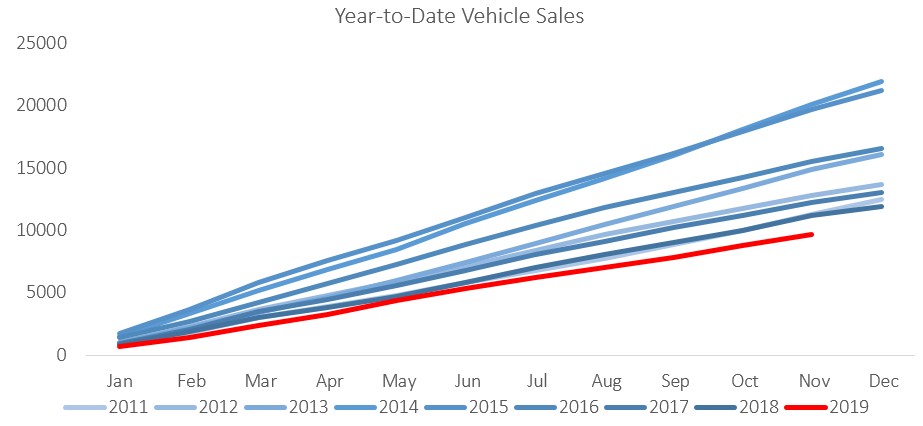

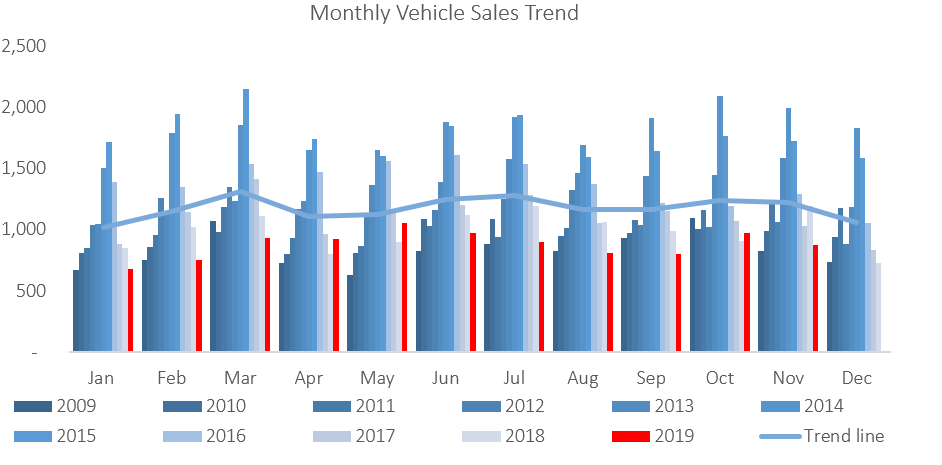

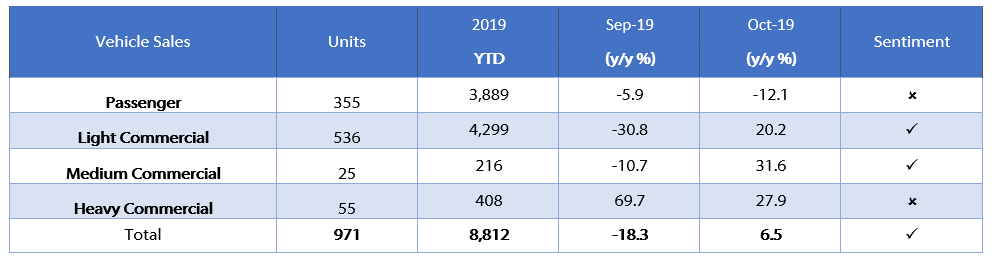

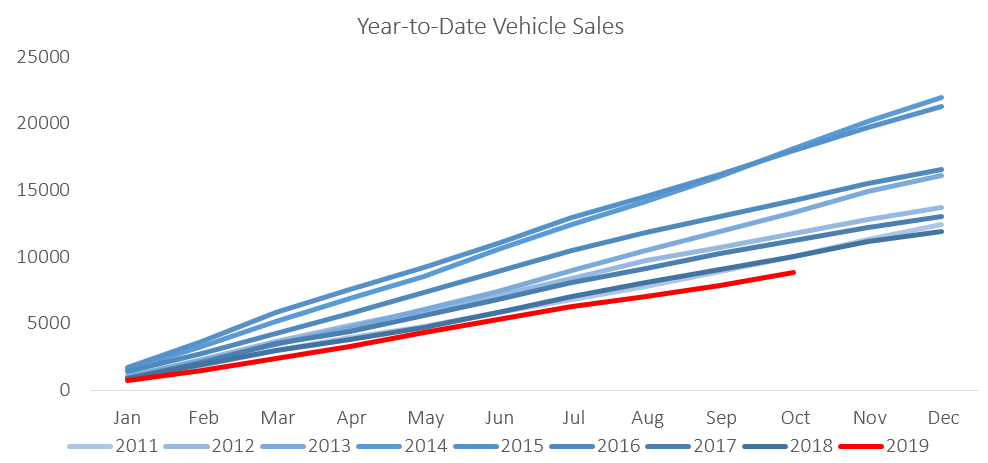

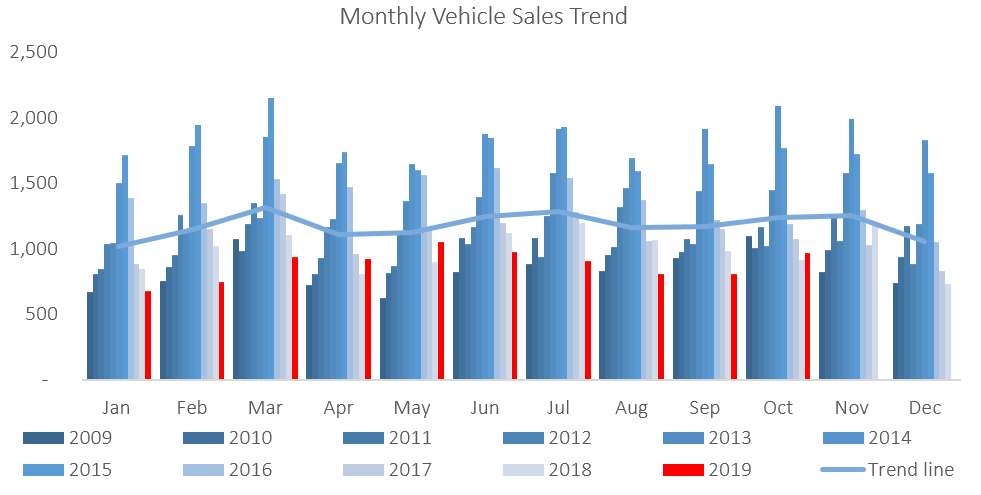

714 New vehicles were sold in December, down 18.4% m/m from the 875 vehicles sold in November, and a decrease of 2.2% y/y from the 730 new vehicles sold in December 2018. Year-to-date 10,401 vehicles have been sold, a 12.6% contraction from December last year and the lowest annual vehicle sales figure since 2009. Of the 10,401 new vehicles sold during the year, 4,550 were passenger vehicles, 5,101 were light commercial vehicles, and were 750 medium and heavy commercial vehicles.

A total of 314 new passenger vehicles were sold during December, representing a 9.5% m/m contraction, but a 1.3% y/y increase. 4,550 passenger vehicles were sold in 2019, a 10.7% decline from 2018 and lower annual sales than the preceding nine years. Passenger vehicle sales made up 43.7% of the total number of new vehicles sold during 2019, broadly in line with the trend over the last 5 years.

Commercial vehicle sales declined to 400 units in December, a 24.2% m/m, and 4.8% y/y contraction. During the month 335 light commercial vehicles, 21 medium commercial vehicles, and 44 heavy commercial vehicles were sold. On a year-on-year basis, light commercial sales have declined by 12.3%, medium commercial vehicles rose by 90.9%, and heavy and extra heavy vehicle sales rose 37.5% y/y. On a twelve-month cumulative basis, light commercial vehicle sales dropped 17.1% y/y, while medium commercial vehicle sales rose 9.0% y/y, and heavy commercial vehicle sales rose 17.5% y/y.

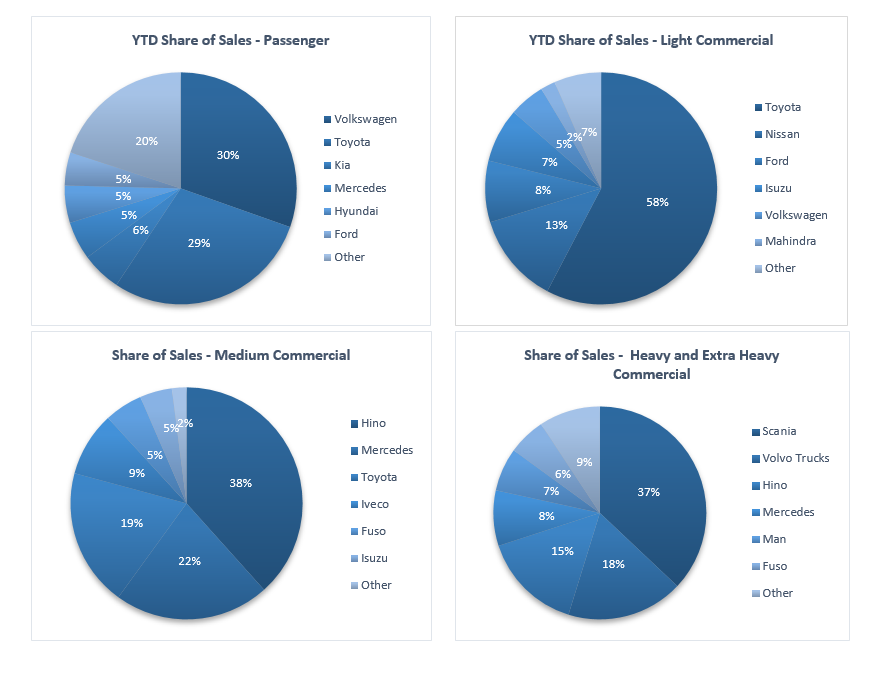

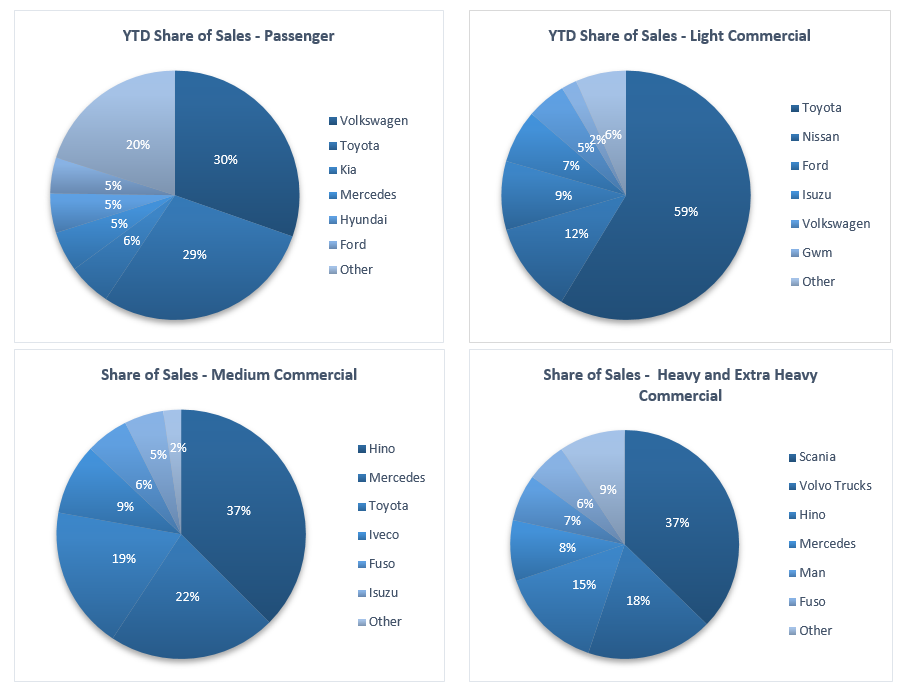

Volkswagen lead the market for new passenger vehicle sales in 2019, claiming 30.5% of the market, followed by Toyota with a 28.3% share. They were followed by Kia and Mercedes at 5.8% and 5.5% respectively, while the rest of the passenger vehicle market was shared by several other competitors.

Toyota remained the leader in the commercial vehicle space in 2019 with 57.3% market share, with Nissan in second place with a 12.4% share. Ford and Isuzu claimed 9.3% and 7.6% respectively of the number of new light commercial vehicles sold for the year. Hino lead the medium commercial vehicle category with 39.8% of sales while Scania was number one in the heavy and extra-heavy commercial vehicle segment with 35.5% of the market share during the year.

The Bottom Line

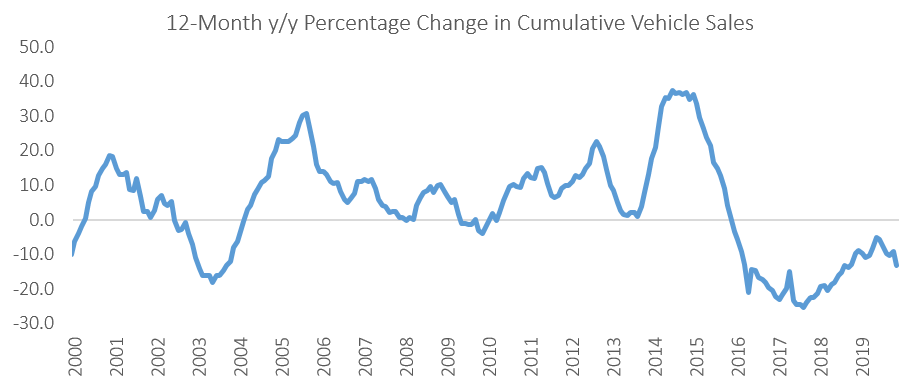

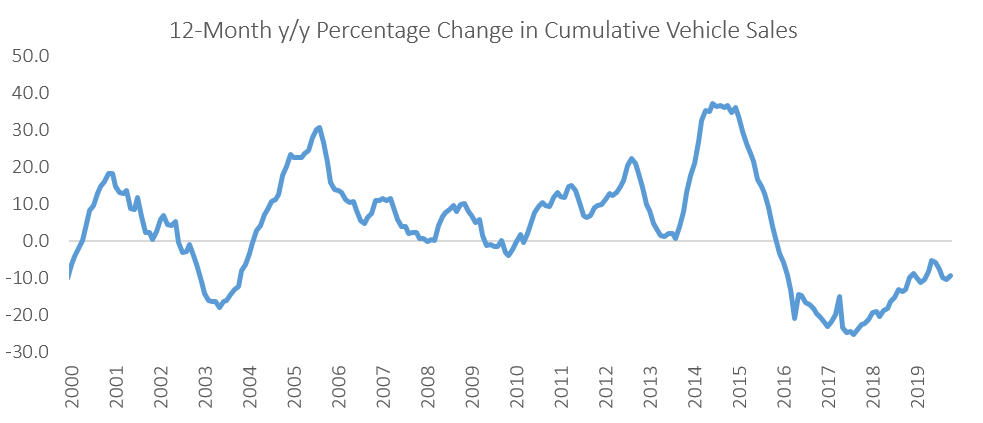

New vehicle sales figures were quite dismal in 2019 with the cumulative number of new vehicles sales for the year amounting to 10,401, a decline of 12.6% from the cumulative number of vehicles sold in 2018 and a 54.1% contraction from the peak, on a cumulative 12-month basis, of 22,664 new vehicle sales recorded in April 2015. We expect new vehicle sales to remain under pressure in 2020 as there is little sign that the economy will show any meaningful growth. December new vehicle sales have historically been low when compared to most other months, but 2019’s December figure was the lowest since 2008, showing just how badly the ongoing recession has impacted demand and investment.