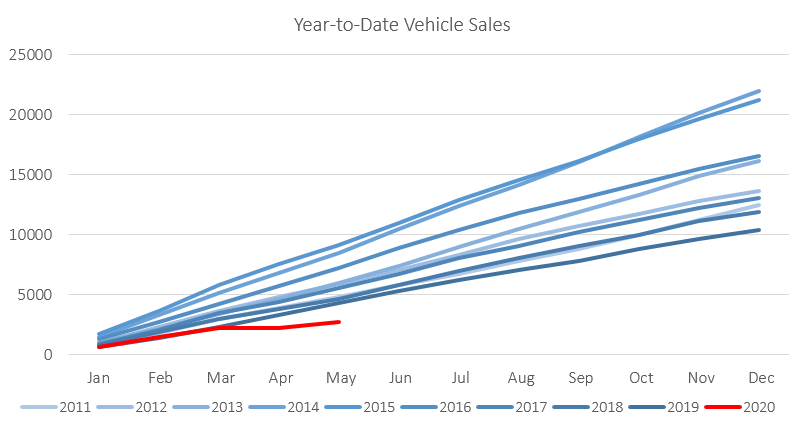

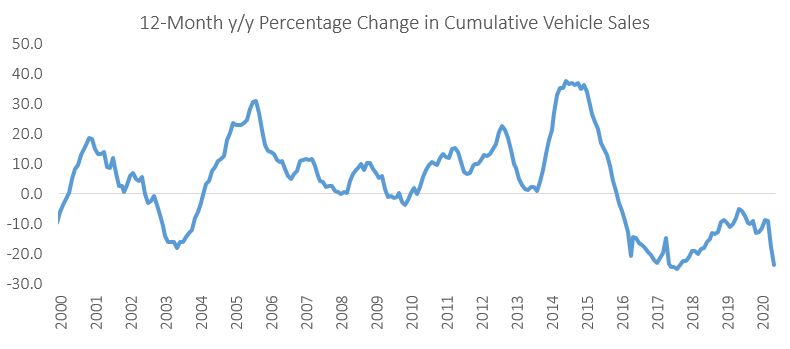

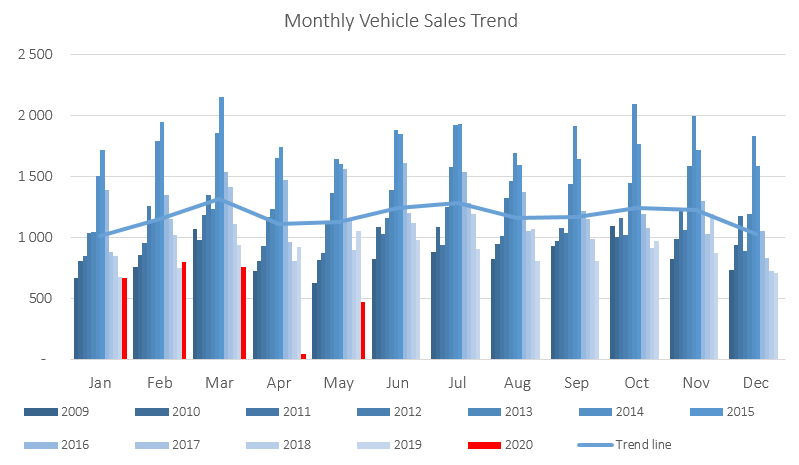

767 New vehicles were sold in June, an increase of 62.8% m/m from the 471 new vehicles sold in May. However, this is a decrease of 21.5% y/y from the 977 new vehicles sold in June 2019. Year-to-date 3,517 vehicles have been sold, of which 1,530 were passenger vehicles, 1,766 were light commercial vehicles, and 221 were medium and heavy commercial vehicles. On a rolling 12-month basis, a total of 8,595 new vehicles were sold as at June 2020, representing a contraction of 24.7% from the 11,412 sold over the comparable period a year ago.

345 New passenger vehicles were sold during June, increasing by 56.8% m/m, although this increase is from a low base. On a year-on-year basis, June’s new passenger vehicle sales were 8.7% lower than the 378 vehicles sold a year ago. Year-to-date passenger vehicle sales rose to 1,530 units, down 38.1% when compared to the number sold in the first half of last year. Twelve-month cumulative passenger vehicle sales fell 0.9% m/m and 27.3% y/y. Passenger vehicles have made up 43.5% of the total number of new vehicles sold in the first six months of 2020, compared to 46.4% in the same period last year.

A total of 422 new commercial vehicles were sold in June, representing a 68.1% m/m increase, but a 29.5% y/y contraction. The monthly increase is again from a low base. Of the 422 commercial vehicles sold in June, 386 were classified as light commercial vehicles, 12 as medium commercial vehicles and 24 as heavy or extra heavy commercial vehicles. On a twelve-month cumulative basis, light commercial vehicle sales dropped 24.6% y/y, while medium commercial vehicle sales rose 6.1% y/y, and heavy commercial vehicle sales fell by 13.7% y/y. While medium- and heavy commercial vehicles continue to record growth on a twelve-month cumulative basis, the light segment of the market continues to see lower volumes sold than in 2019.

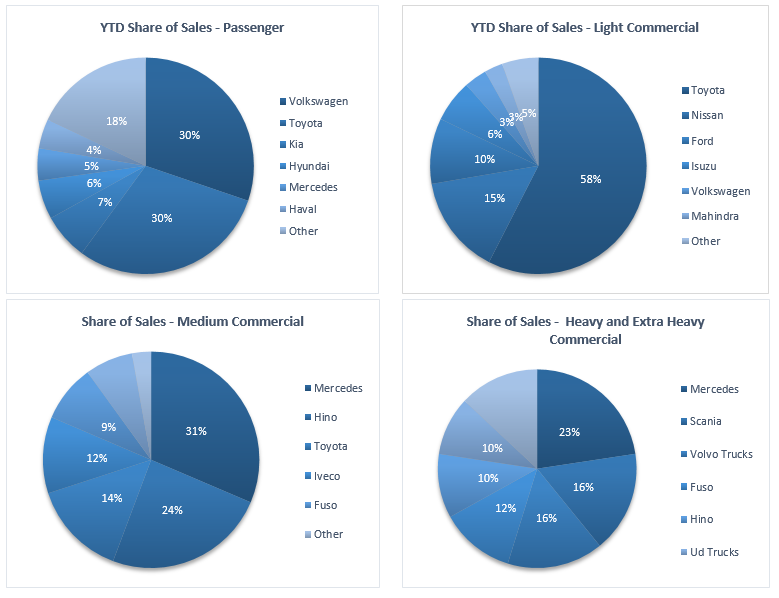

Volkswagen narrowly leads the passenger vehicle sales segment with 30.4% of the segment sales year-to-date. Toyota retained second place with 29.5% of the market share as at the end of June. They were followed by Kia and Hyundai with 6.5% and 5.6% of the market respectively, while the rest of the passenger vehicle market was shared by several other competitors.

Toyota, with a strong market share of 56.4% year-to-date commands the light commercial vehicle sales segment. Nissan remains in the second position in the segment with 13.7% of the market, while Ford makes up third place with 10.3% of the year-to-date sales. Mercedes leads the medium commercial vehicle segment with 31.7% of sales year-to-date and remains number one in the heavy and extra-heavy commercial vehicle segment with 22.3% of the market share year-to-date.

The Bottom Line

June saw the number of new vehicles sales increasing quite substantially on a monthly basis. However, as pointed out earlier in this report, this increase is from a relatively low base as vehicle sales are merely recovering after very low activity during lockdown. In the first half of this year, new vehicle sales are down 33.9% y/y compared to the same period in 2019. We expect new vehicle sales to remain under pressure and do not foresee any substantial increases in the number sold for at least the rest of the year, as economic conditions are expected to remain weak.