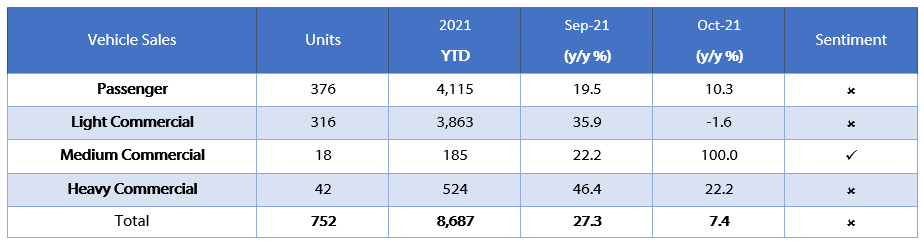

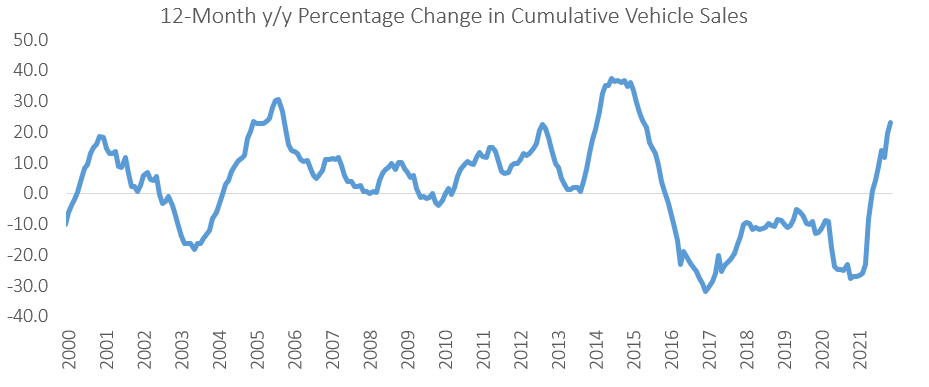

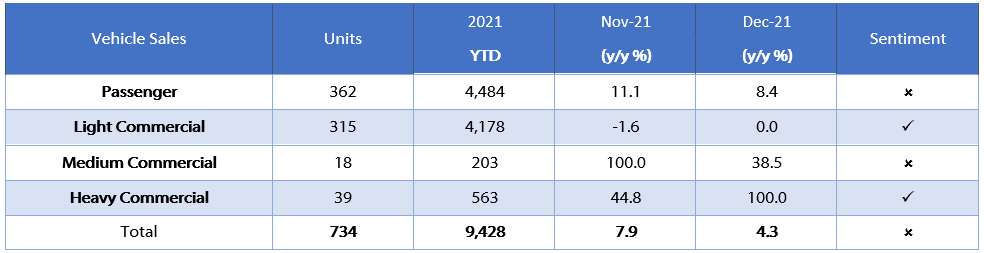

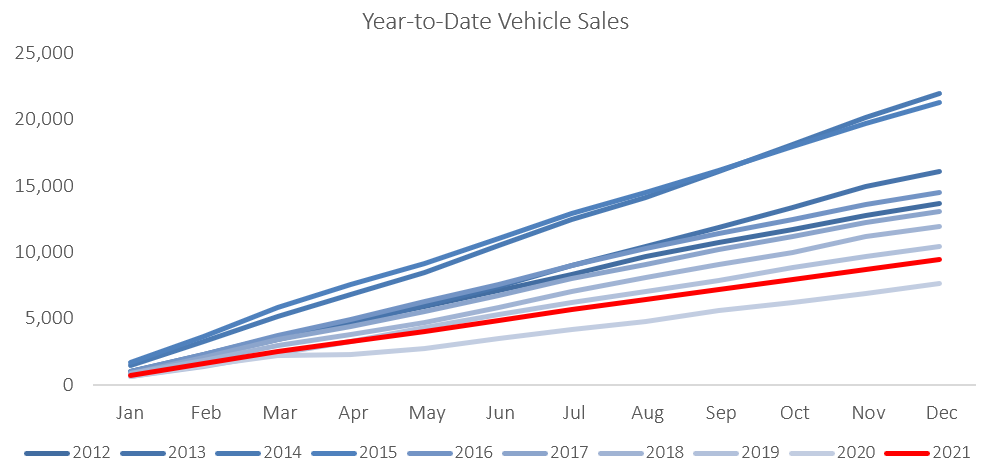

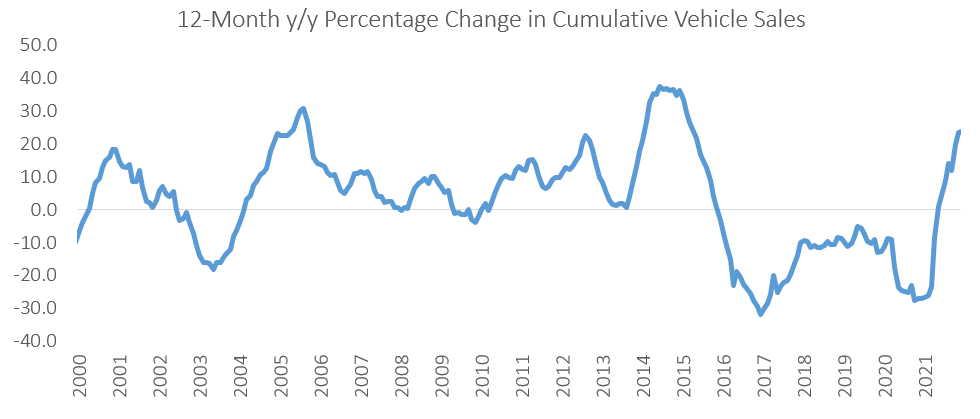

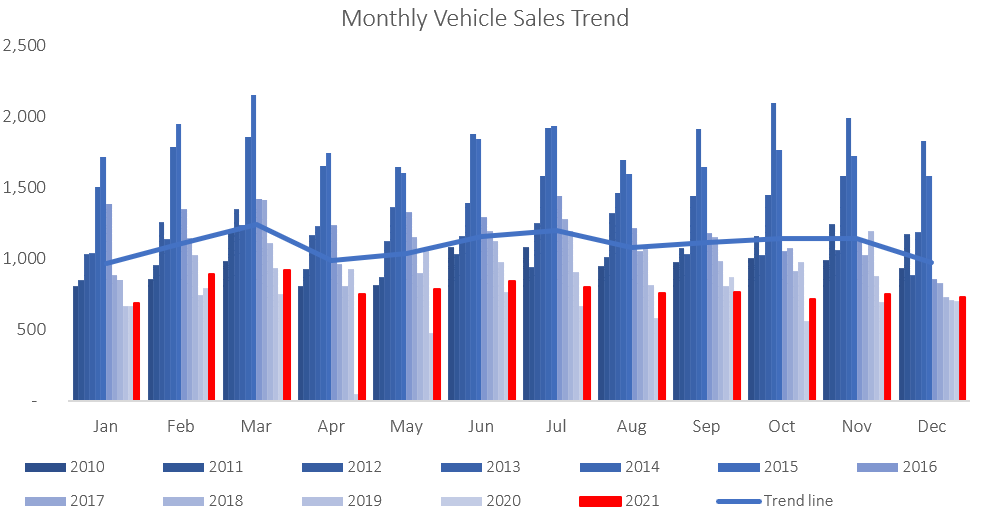

A total of 734 new vehicles were sold in December, which is 21 vehicles fewer than were sold in November but represents a 4.3% y/y increase from the 704 new vehicles sold in December 2020. Year-to-date 9,428 new vehicles have been sold, which is 23.9% higher than during 2020, but 9.5% lower than in 2019. As the chart below indicates, this makes 2021 the second-worst year for new vehicle sales in the past decade. Of the 9,428 new vehicles sold during the year, 4,484 were passenger vehicles, 4,178 were light commercial vehicles, and 766 were medium and heavy commercial vehicles.

362 new passenger vehicles were sold during December, representing a 4.5% m/m contraction, but an 8.4% y/y increase. 4,484 new passenger vehicles were sold in 2021, a significant increase of 39.7% from 2020. Encouragingly, new passenger vehicle sales for the year were just 1.8% lower than in 2019, indicating that passenger vehicle sales have more or less rebounded to their pre-pandemic level, although this is still a far cry from the sales figures seen during 2013-2015.

A total of 372 commercial vehicles were sold in December, five fewer than in November but two more than in December 2020. During the month, 315 light commercial vehicles, 18 medium and 39 heavy commercial vehicles were sold. For the year, light commercial vehicle sales rose by 8.0% y/y, medium commercial vehicle sales increased by 18.0% y/y and heavy commercial vehicle sales climbed by 56.0% y/y. Thus, while all three commercial vehicle sales categories have rebounded from the low sales figures recorded in 2020, heavy commercial vehicle sales have encouragingly recorded the best annual sales since 2015.

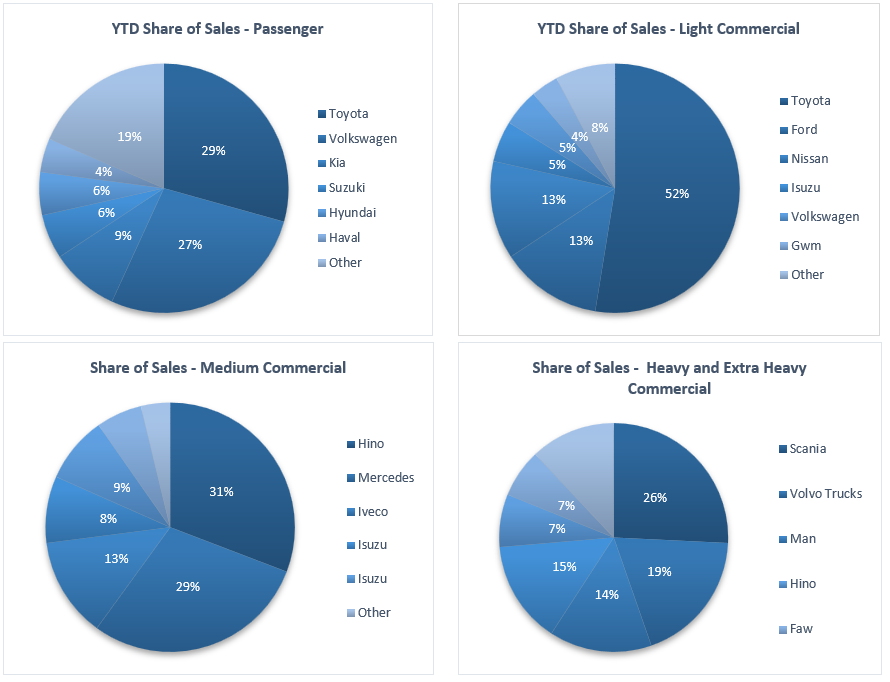

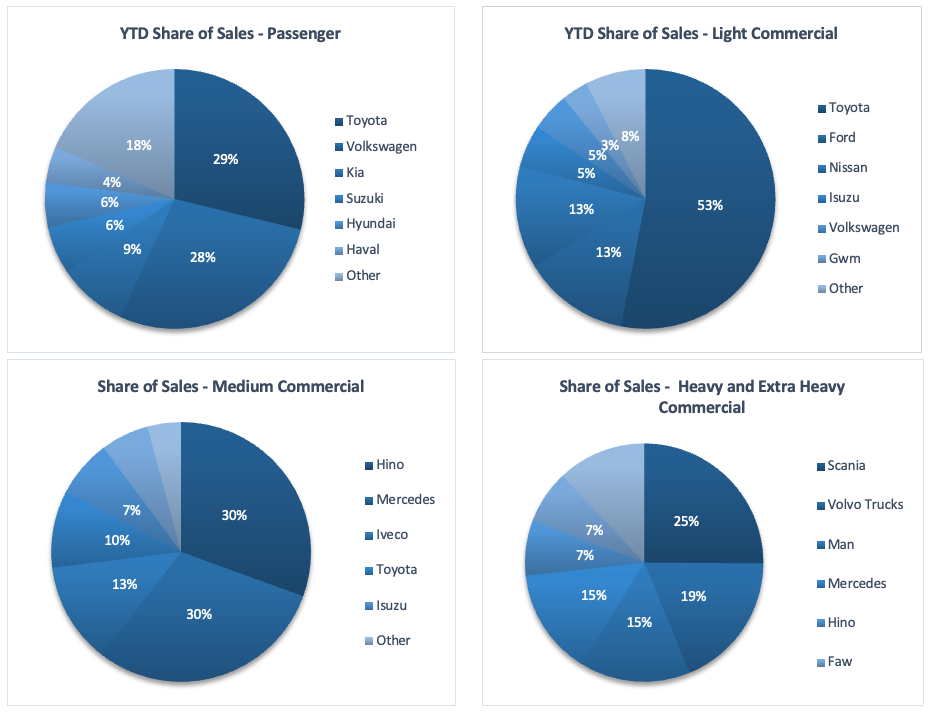

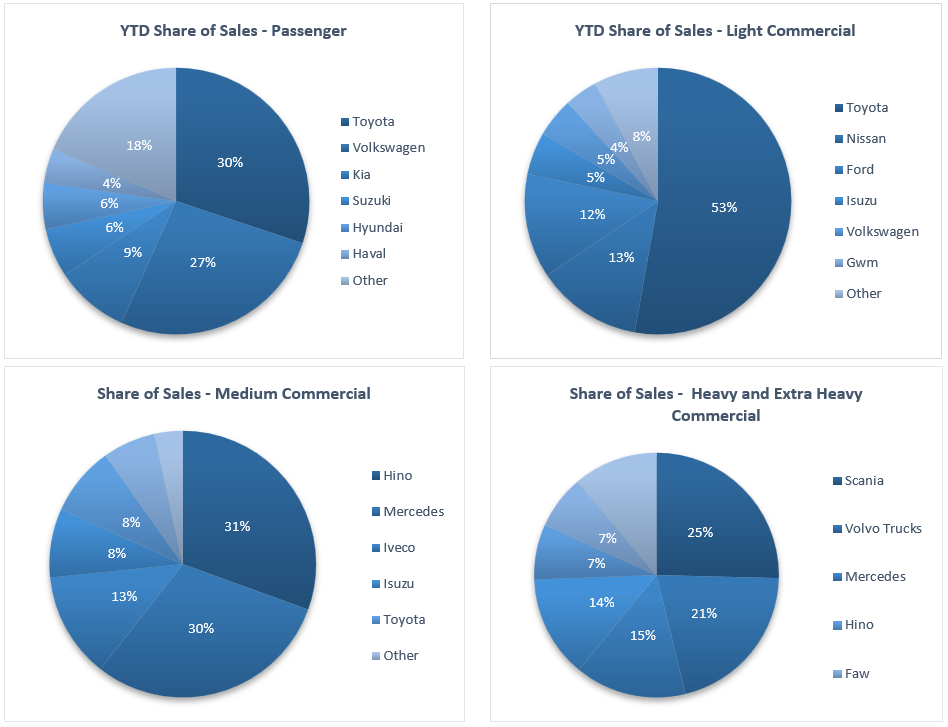

Toyota led the market for new passenger vehicle sales in 2021, claiming 30.1% of the market, followed by Volkswagen with a 26.6% share. They were followed by Kia and Suzuki at 9.0% and 5.9%, respectively. The only other manufacturer that managed to breach the 5% market share mark was Hyundai with 5.6% of the market, leaving the remaining 22.8% of the market to other brands.

Toyota dominated the light commercial vehicle space in 2021 with a 52.8% market share, with Nissan in second place with a 12.8% market share. Ford and Isuzu claimed 12.6% and 5.1%, respectively, of the number of new light commercial vehicles sold for the year. Hino led the medium commercial category with 30.5% of sales while Scania was number one in the heavy and extra-heavy commercial vehicle segment with 25.4% of the market share during the year.

The Bottom Line

While new vehicle sales for the year have rebounded from the dismal figures seen in 2020, 2021 was still the second-worst year for vehicle sales in the past decade. The recovery has predominantly been driven by a rebound in passenger vehicle sales, with total commercial vehicle sales still lagging well behind 2019 levels. The strong increase in heavy commercial vehicle sales is however welcome news as it suggests that a few companies and mines upgraded their fleets indicating business optimism. With there being few signs that 2022 will see significant economic growth, we expect new vehicle sales figures to remain more or less in line with 2021’s.