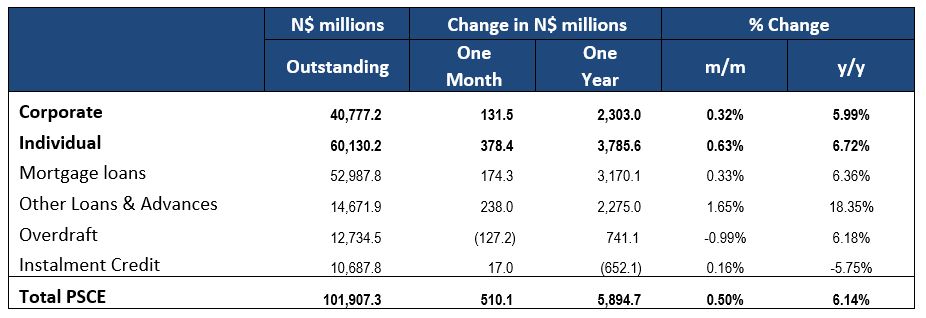

Overall

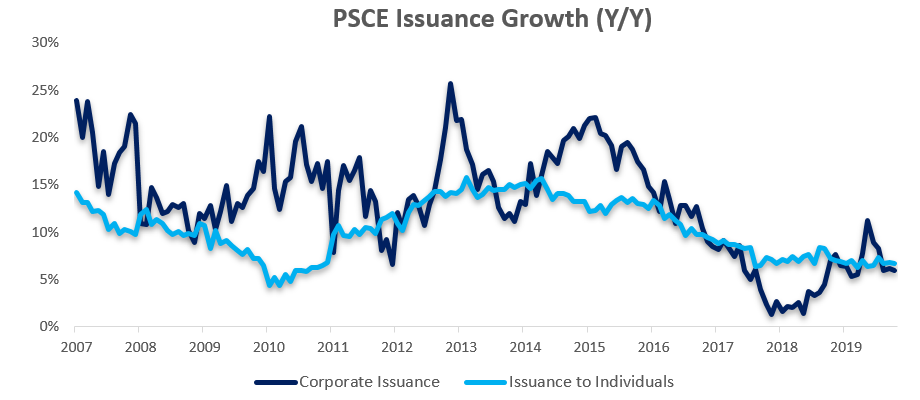

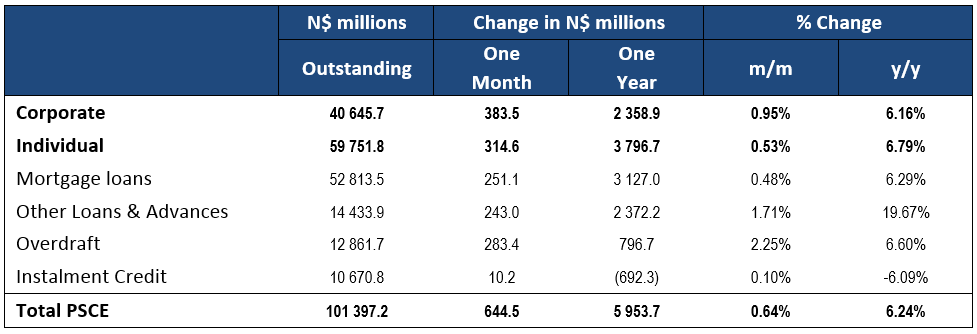

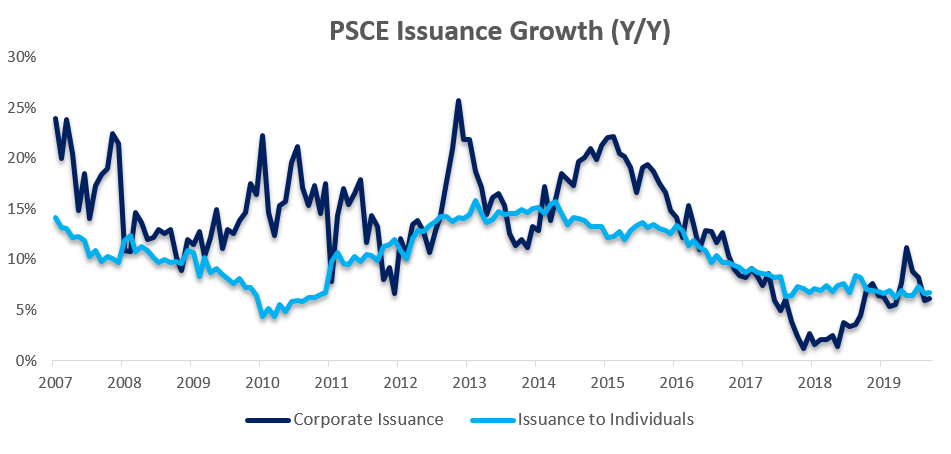

Private sector credit (PSCE) increased by N$586.8 million or 0.58% m/m in November, bringing the cumulative credit outstanding to N$102.5 billion. On a year-on-year basis, private sector credit increased by 5.92% in November, somewhat slower than the 6.14% growth rate recorded in October. On a rolling 12-month basis, N$5.7 billion worth of credit was extended to the private sector, with individuals taking up N$3.7 billion while N$2.2 billion was extended to corporates, and the non-resident private sector has decreased their borrowings by N$205.0 million.

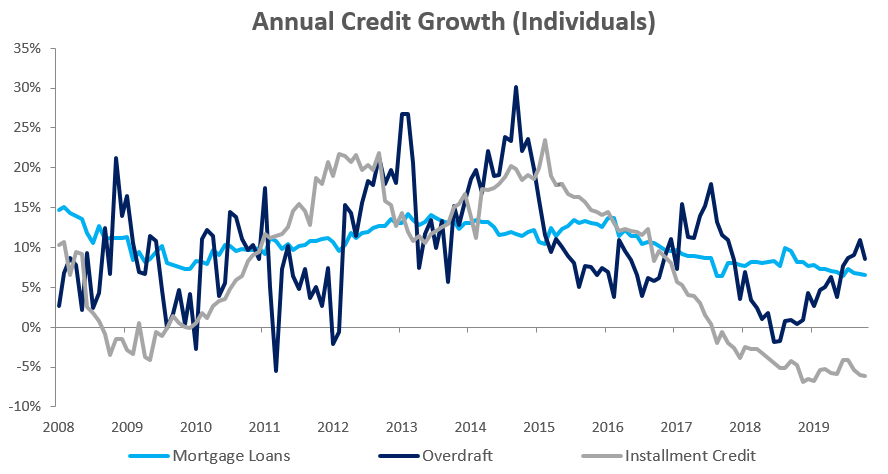

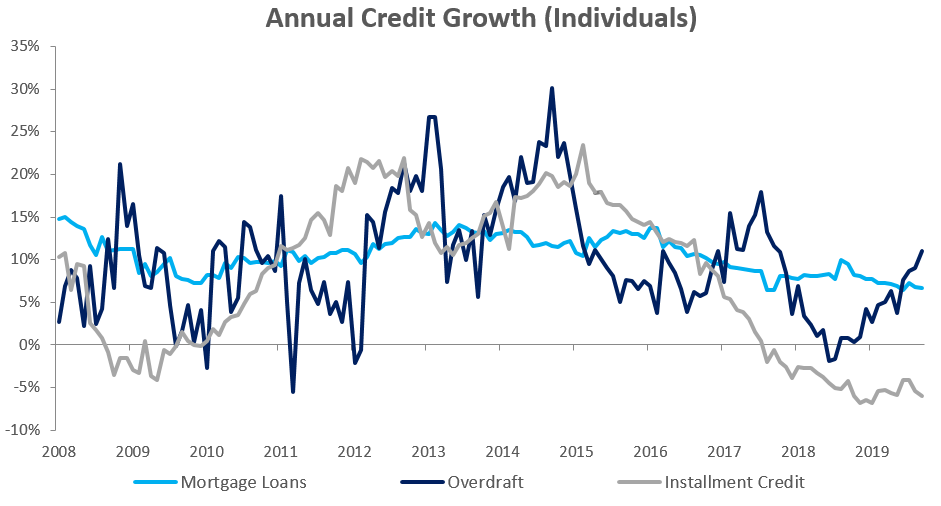

Credit Extension to Individuals

Credit extended to individuals increased by 6.6% y/y in November, almost unchanged from the 6.7% y/y growth recorded in October. On a monthly basis household credit increased by 0.6%, once again a similar pace to the 0.5% growth registered in October. Mortgage loans extended to individuals grew by 0.2% m/m and 5.7% y/y, compared to 0.6% m/m and 6.5% y/y in October. Household appetite for instalment credit remains subdued as reflected in the contractions of 0.4% m/m and 5.8% y/y in November. Other loans and advances grew at a relatively quick pace of 4.3% m/m and 27.3% y/y during the month, indicating that consumers remain stretched as they are taking on more credit card debt, personal, and term loans.

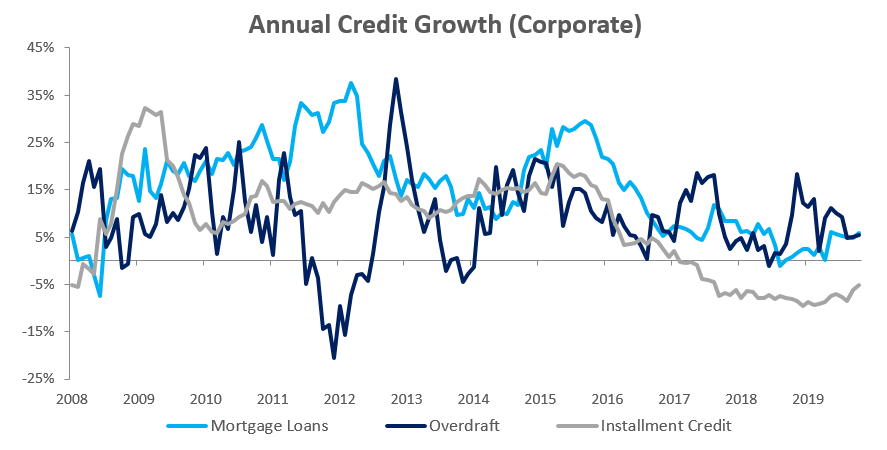

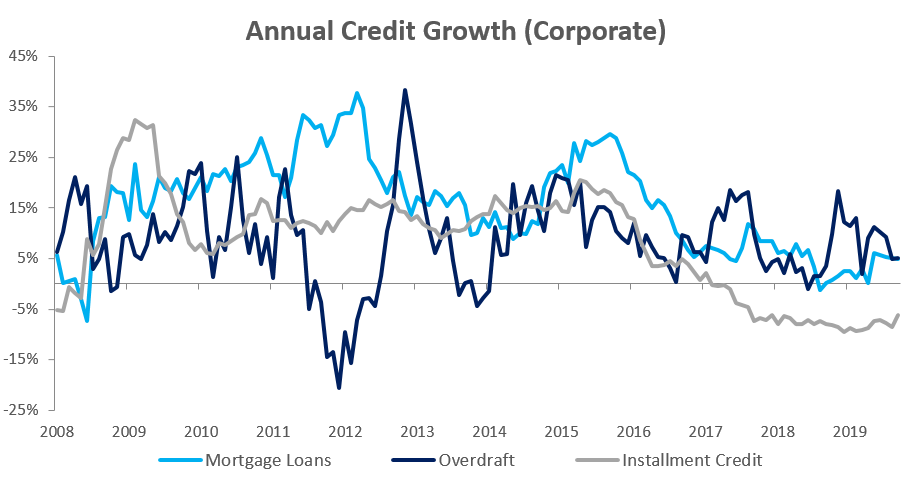

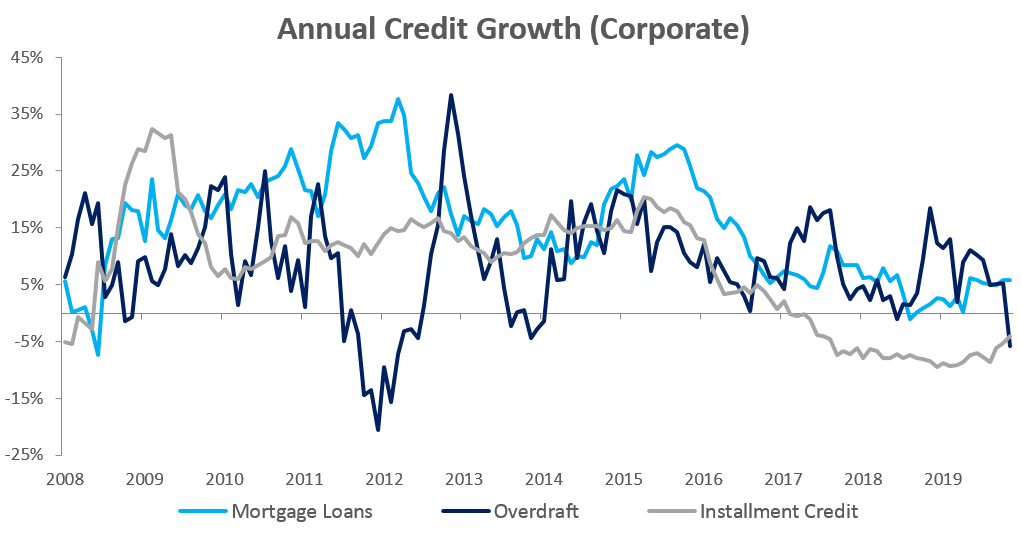

Credit Extension to Corporates

Credit extension to corporates grew by 0.4% m/m and 5.7% y/y in November, compared to the growth of 0.3% m/m and 6.0% y/y recorded in October. On a rolling 12-month basis N$2.2 billion was extended to corporates, a far cry from the highs of over N$5.3 billion recorded for the 12 months ending in February 2015. Installment credit extended to corporates printed flat m/m, but contracted by 4.1% y/y in November. Leasing transactions to corporations declined by 2.4% m/m and 34.2% y/y. Overdraft facilities extended to corporates contracted by 2.6% m/m and 5.8% y/y, making it the first contraction on an annual basis since June 2018. Whether corporates will continue to pay back overdraft facilities going forward remains to be seen, although it seems unlikely as economic conditions remain challenging. Mortgage loans extended to corporates grew by 0.5% m/m and 5.9% y/y, while other loans and advances grew by 2.9% m/m and 15.8% y/y.

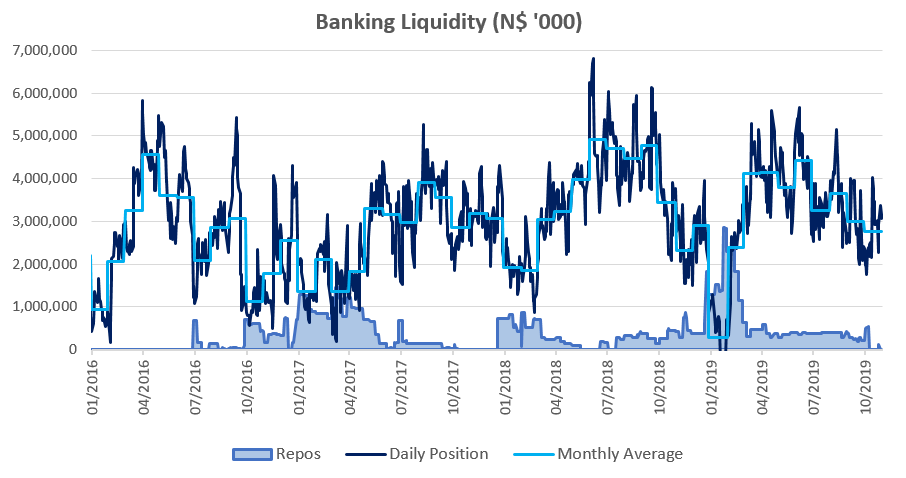

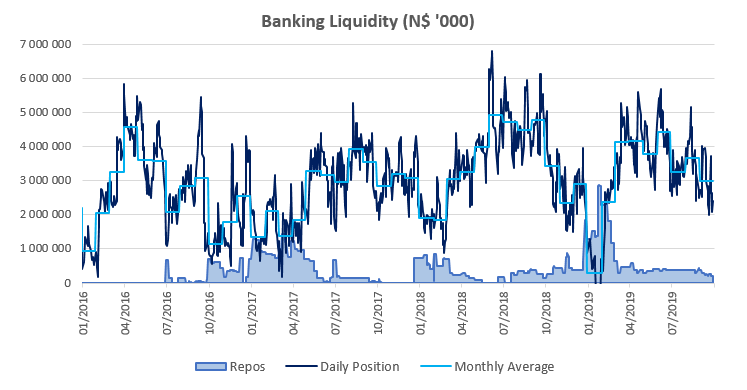

Banking Sector Liquidity

The overall liquidity position of commercial banks deteriorated during November, declining by N$925.3 million to reach an average of N$1.84 billion. Bank of Namibia attributed the decline in liquidity to higher issuance of BoN bills and the issuance of a new Treasury Bill, coupled with cross border payments made during November.

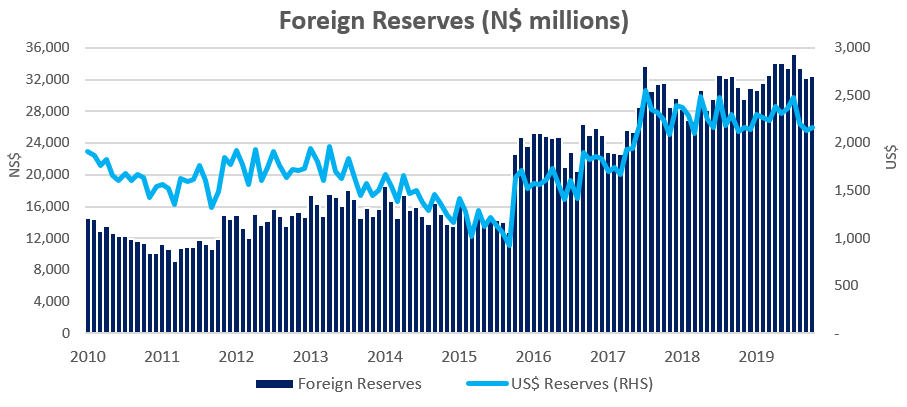

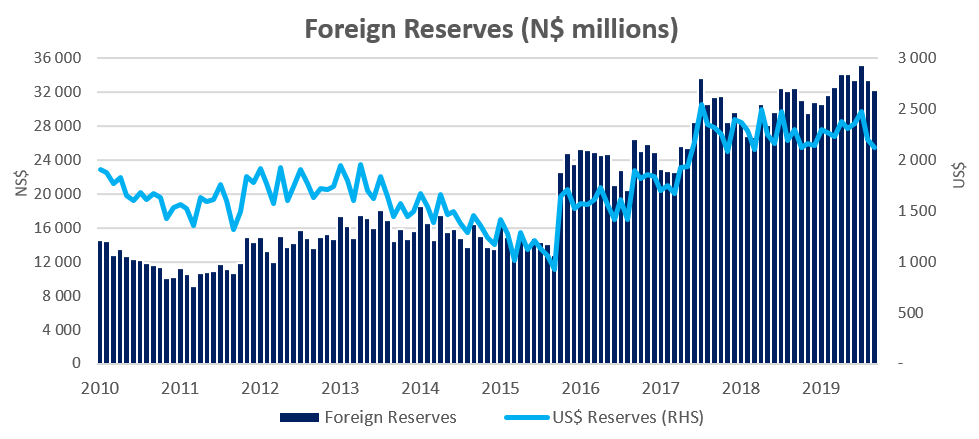

Reserves and Money Supply

Broad money supply rose by 9.3% y/y in November, following a 6.7% y/y increase in October, as per the BoN’s latest money statistics release. Foreign reserve balances fell by 8.4% m/m to N$29.8 billion in November. The BoN stated that the decline was due to the net purchases of South African Rands by commercial banks for import payments coupled with increasing government foreign payments during the month under review.

Outlook

Overall PSCE growth in November moderated for a third consecutive month on a year-on-year basis, increasing by 5.9%. Rolling 12-month private sector credit issuance is down 21.0% from the N$7.2 billion issuance observed at the end of November 2018, with individuals taking up most (65.2%) of the credit extended over the past 12 months.

Low economic activity and a lack of demand means that growth opportunities for businesses remain limited. Consumer confidence will first need to improve before corporate demand for credit will increase. Increased consumer demand results in more business production that must satisfy this demand, thus incentivising businesses to borrow in order to fund capital and expansionary projects. Until such a time that consumer confidence increase, we do not expect to see any significant growth in PSCE. It is unlikely that monetary policy will drive PSCE growth in the coming year, as interest rates are not far off historically low levels.