Overall

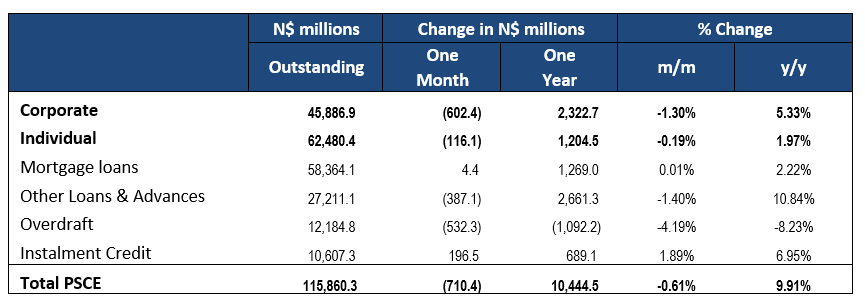

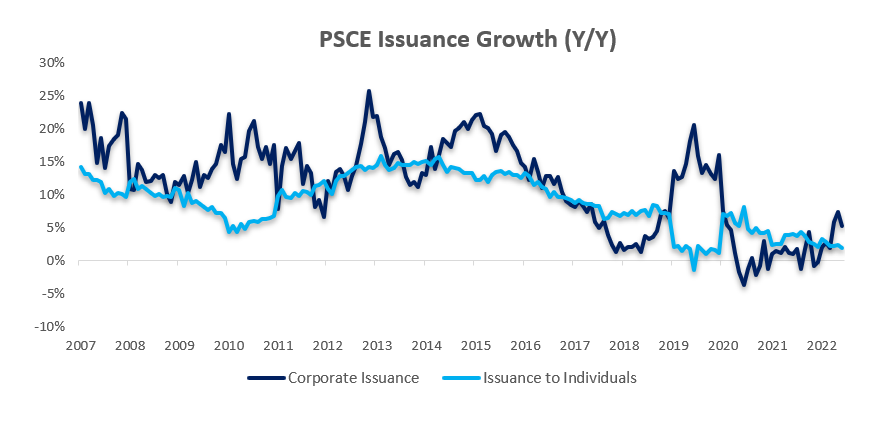

Private sector credit (PSCE) increased by N$505.3 million or 0.43% m/m in August, bringing the cumulative credit outstanding to N$116.7 billion. On a year-on-year basis, private credit sector credit grew by 11.2% y/y from a relatively low base a year ago. Normalising for the steep rise in claims on non-resident private sectors over the past 8 months which mainly relates to interbank swaps sees annual PSCE grow by only 4.4% y/y. We view this as a more accurate picture of credit extension and thus exclude the swap transactions from our analysis going forward. On a 12-month cumulative basis N$4.79 billion worth of credit was extended to the private sector. Corporates and individuals took up N$3.52 billion and N$1.26 billion respectively.

Credit Extension to Individuals

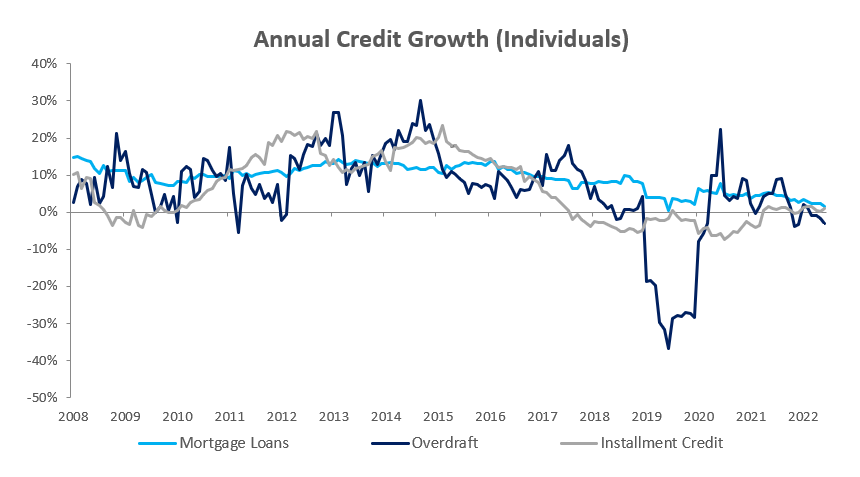

Credit extended to individuals grew by 0.5% m/m and 2.1% y/y to N$62.91 billion in August from N$61.65 billion a year ago. Overall, annual growth in credit extensions to individuals slowed in August when compared to the revised 2.2% y/y growth rate reported for July. The Bank of Namibia (BoN) attribute the decline to lower demand in all the credit categories but instalment and leasing sales. Mortgage loans to individuals rose by 0.3% m/m and 1.9% y/y. Overdraft facilities increased by 1.1% m/m, but contracted by 5.6% y/y. Other loans and advances (consisting of credit card debt, personal- and term loans) climbed by 1.1% m/m and 5.1% y/y. Instalment and leasing sales rose by 0.9% m/m and 1.2% y/y.

Credit Extension to Corporates

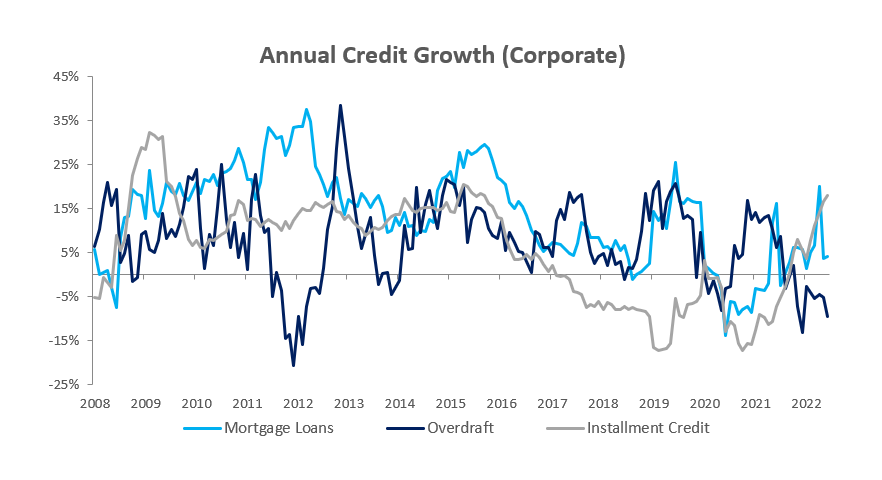

Credit extension to corporates grew by 0.3% m/m and 8.3% y/y in August, bringing the cumulative corporate credit outstanding to N$46.23 billion. Overall, annual growth in credit extensions to businesses accelerated in August when compared to the revised 6.4% y/y growth rate observed last month. The BoN ascribed the increase to rising demand for overdraft credit and other loans and advances by corporations in the mining and services sector. Overdraft facilities to corporates grew by 2.1% m/m and 0.1% y/y, following a 9-month consecutive year-over-year decline. Other loans and advances climbed by 0.8% m/m and 19.4% y/y. Mortgage Loans declined by 1.7% m/m but rose by 1.2% y/y. Instalment and leasing sales increased by 1.4% m/m while annual growth for this credit category remained steady at 14.9% y/y.

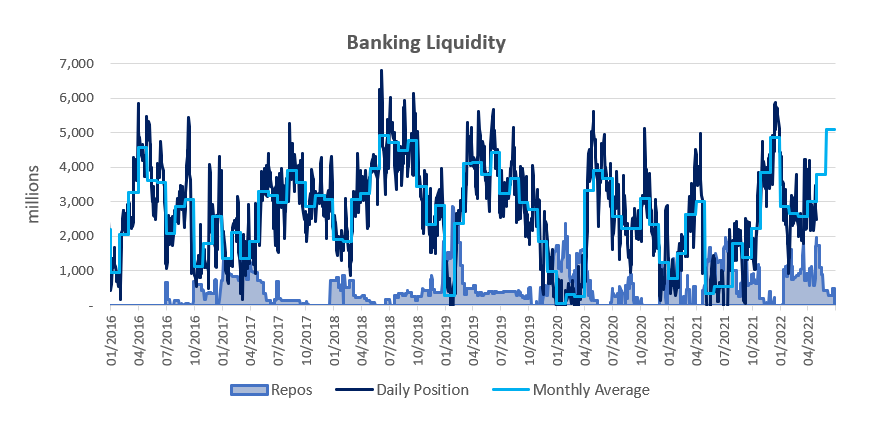

Banking Sector Liquidity

The overall liquidity position of the commercial banks saw a continued decline in August, dropping by N$6.35 billion to an average of N$6.21 billion, and ended the month at N$3.86 billion. The decline in the market cash positions is partly attributed to other financial corporations’ withdrawals, according to the BoN. The repo balance in contrast rose to N$529.7 million in August from N$293.0 at the end of July.

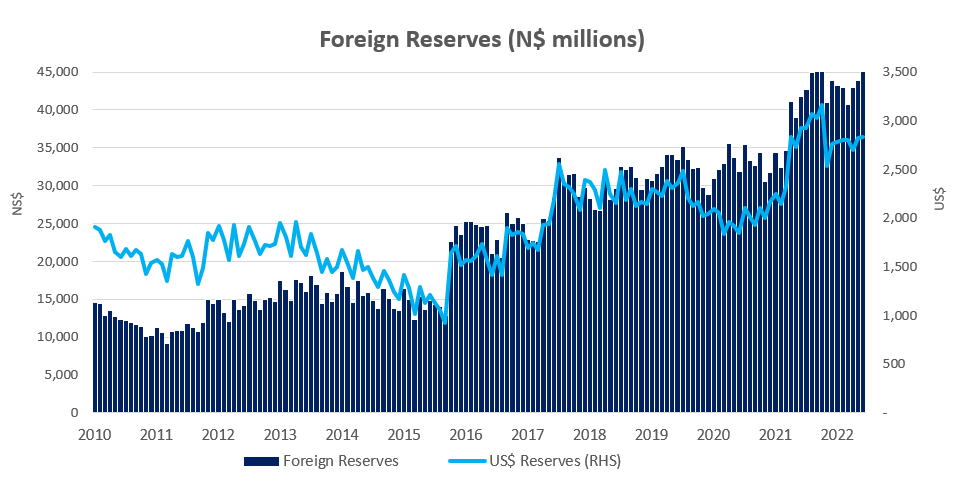

Reserves and Money Supply

The BoN’s latest figures show broad money supply (M2) increased by N$4.97 billion or 4.0% y/y to N$128.0 billion but slowed on an annual basis compared to the 11% y/y growth rate recorded in July. According to the BoN, the decrease in M2 growth was due to a decline in both the net foreign assets and domestic claims of the depository corporations. The drop was further attributed to a decline in transferable deposits coupled with a contraction in other deposits over the review period. The BoN’s official reserve stock contracted by 4.6% m/m or N$2.24 billion to N$47.0 billion. The BoN ascribed the decline in the international reserves stock to increased foreign currency outflows for import payments during the review period.

Outlook

Despite seeing PSCE growing at its fastest rate since the pandemic on a normalised basis, growth remains well below the levels observed prior to the pandemic. We expect PSCE growth to remain subdued over the short to medium term while the central bank maintains a restrictive monetary policy and continues to raise interest rates to fight rising inflation. We expect the BoN to hike interest rates by a further 75 basis points at its next MPC meeting scheduled for 26 October to stay at pace with the interest rate hikes by the SARB. The SARB hiked its repo lending rate by 75 basis points last month. While we should see commercial banks become more willing to extend credit in the rising interest rate environment, as they experience margin expansion, demand for credit would not necessarily follow suit. The private sector has endured a lot of financial hardship over the past couple of years and there are probably fewer households and entities with the ability to take up new credit from Banks despite debt remaining relatively inexpensive by historic standards. The private sector may also be unwilling to commit to long-term expensive debt under the current lackluster economic circumstances. Therefore, we expect demand for credit to remain low while the supply of credit is set to improve.