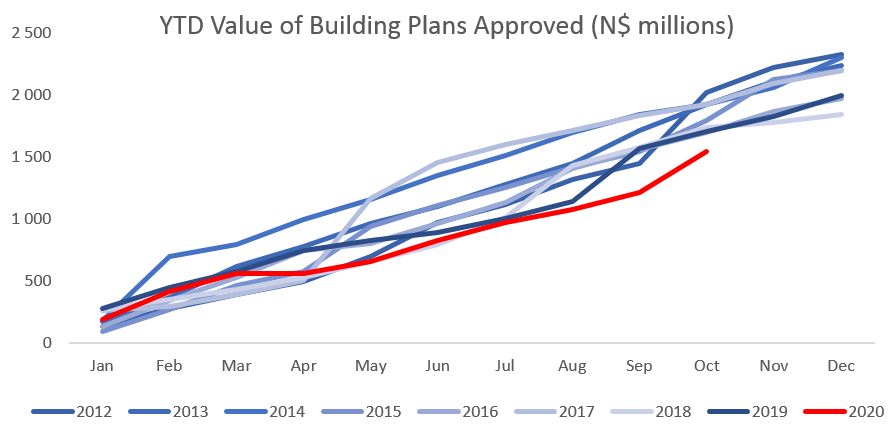

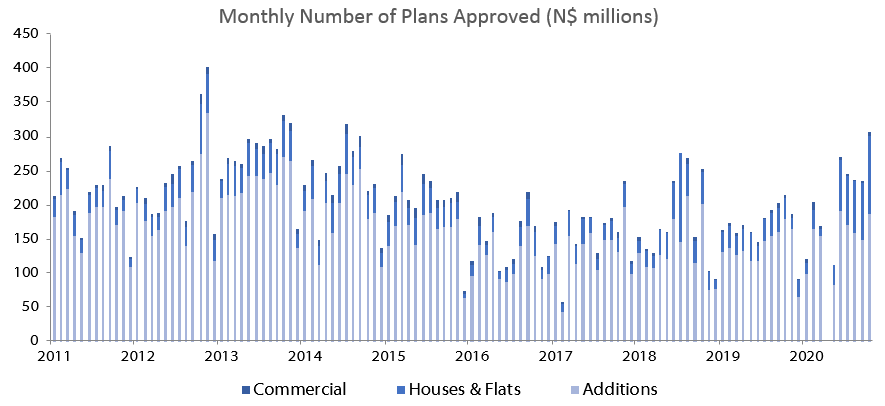

A total of 306 building plans were approved by the City of Windhoek in October, 72 more than in September. In value terms, approvals rose by N$194.1 million to N$327.7 million in October from N$133.6 million worth of approvals in September. A total of 65 building plans were completed at a value of N$54.8 million in October, a decrease of 73.4% y/y in number and 50.1% y/y in value of completions. Year-to-date, N$1.54 billion worth of building plans have been approved, 9.6% lower than the comparative period a year ago. On a twelve-month cumulative basis, 2,173 building plans were approved worth approximately N$1.83 billion, 1.2% higher in value terms than approvals at the end of October 2019.

The largest number of building plan approvals in October was made up of additions to properties. 186 additions to properties were approved with a value of N$67.0 million, 25.7% higher in number and 15.5% more in value terms than in September. Year-to-date 1,352 additions to properties have been approved with a total value of N$578.4 million, a 3.4% decline in number and 11.9% y/y decrease in value. 17 additions worth N$15.1 million were completed during the month. Year-to-date 856 additions have been completed with a combined value of N$439.3 million, down 16.7% y/y in number and 8.0% y/y in value terms.

New residential units were the second largest contributor to the number of building plans approved with 115 approvals registered in October, 30 more than in September. In value terms, N$242.9 million worth of residential units were approved in October, an increase of 35.3% m/m and 224.9% y/y. Year-to-date 506 new residential units have been approved worth N$666.2 million, an increase of 60.1% and 36.0% compared to the same time last year. 47 Residential units valued at N$39.3 million were completed in October bringing the year-to-date number to 639, up 151.6% y/y. In value terms this is an increase of 183.0% y/y to N$992.5 million.

5 New commercial units, valued at N$18.0 million, were approved in October, bringing the year-to-date number of commercial and industrial approvals to 38, worth a total of N$295.0 million. Bar one month, the number of approvals for commercial and industrial properties has been languishing in single-digit territory since September 2016 and has an average approval rate of fewer than 4 approvals per month over the last 12 months. On a rolling 12-month basis, the number of commercial and industrial approvals increased to 46 units, worth approximately N$314.8 million, a decrease of 43.6% in value terms from the period ending October 2019. One commercial building plan was recorded as completed in October, valued at N$400,000.

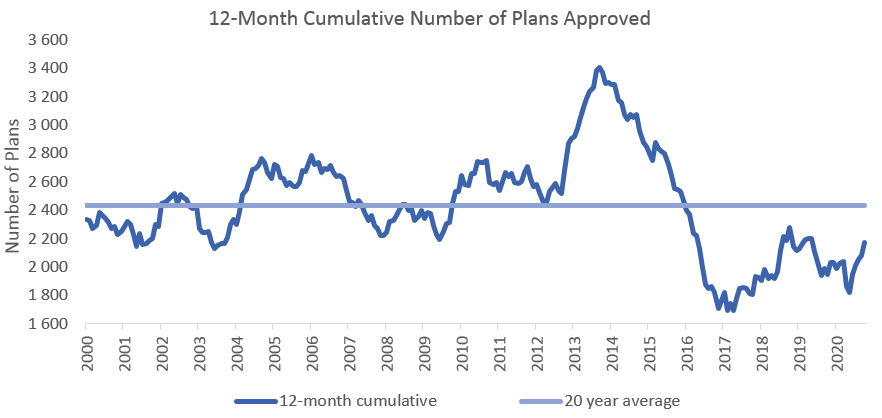

During the last 12 months, 2,173 building plans have been approved, increasing by 11.6% y/y. These approvals were worth a combined N$1.83 billion, an increase in value of 1.2% y/y. The last 3 months have seen a steady uptick in the 12-month cumulative number of plans approved in the capital, but the growth in the cumulative value of plans approved have been lagging, for the most part, indicating that the planned construction activity will mostly consist of smaller building projects. The cumulative value of plans approved is still trending downward from a longer-term perspective, as the graph above indicates.

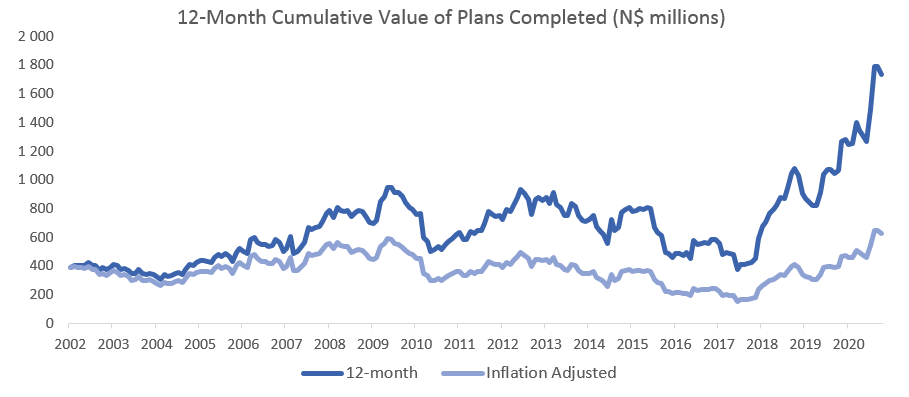

The value of plans completed has however recovered more significantly as can be seen in the below figure, although as we have cautioned in the past, this could simply be due to a completions backlog (paperwork backlog) which is now being processed by the City of Windhoek, making it difficult to say when the actual construction activity took place.